One thing that I often see among newer investors is that they’re extremely inefficient in their investing process. They’ll have absolutely zero tax strategy and it costs them a ton of money in the end. If this is you, don’t worry – you’re going to leave this post with some great tax efficient investing strategies that you can immediately implement!

Chances are, you’ve heard about how massive fees can absolutely kill your returns, but why don’t people care at all about taxes? Or, I should say, that so many people don’t care about taxes; because I know some are in the loop.

For me, when I was first getting started investing, I always had the strategy that I didn’t care if I was paying taxes because I was making money!

The way that taxing works with investing is basically two different scenarios:

1 – You hold your equities for shorter than one year

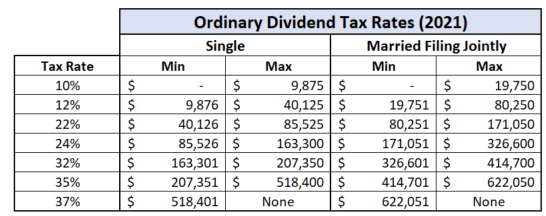

In this case, you’re going to pay your normal income tax on all gains that you make as these gains will be referred to as “short-term capital gains”. So, if you were to purchase a stock at $1000 and sell it for $1500, then you would pay taxes on the $500 in gains that you made. Below is a chart that shows the tax brackets that you would fall into during 2021:

If you’re in the 22% tax bracket, that would mean that your $500 gains just were reduced by $110 and now you’re down to $390. But this isn’t the only potential with taxes!

2 – You hold your equities for longer than one year

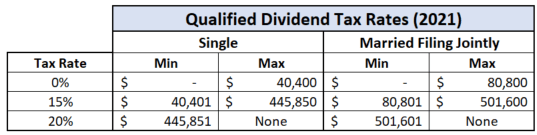

In this case, you’re still going to pay taxes, but you’re going to pay less taxes because you held them for over a year and they’ll be referred to as “long-term capital gains”. Below shows how those taxes look in 2020:

Using the same example above where you made $500, your effective tax bracket would be 15%, meaning that your gains after taxes would be $425. While this means that you still paid $75 in taxes and that’s absolutely not ideal, you were able to at least shrink your tax bill by $35 over the alternative of holding your stocks for under a year.

Taxes can absolutely kill your investments if you’re not comfortable but seriously, don’t worry. Back to my original point, the good thing is that you’re truly only going to pay tax if you make money, so I personally take solace in that. But the opportunity cost of not being an efficient investor can really, really hinder your performance.

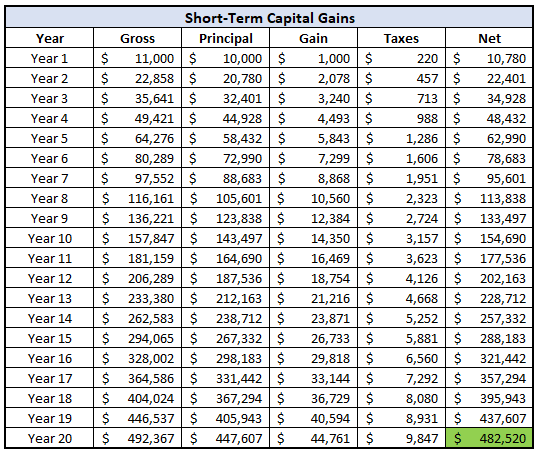

To help illustrate this a little bit better, let’s walk through an example. Let’s pretend that you’re able to invest $10K each year for the next 20 years and every year you make a 10% return, which might sound crazy, but it’s actually spot on with how the S&P 500 has performed over the last century!

Additionally, you just can’t help yourself and every year you’re going to sell your stocks so they’re always getting the short-term capital gains tax of your normal income tax, which I will consider to be 22%.

Over the course of that 20 years, you’ve invested $200K and now have nearly $483K after paying taxes which is a pretty nice chunk of change! Over that time period, you will have paid a total of $79,685 in taxes…ouch!

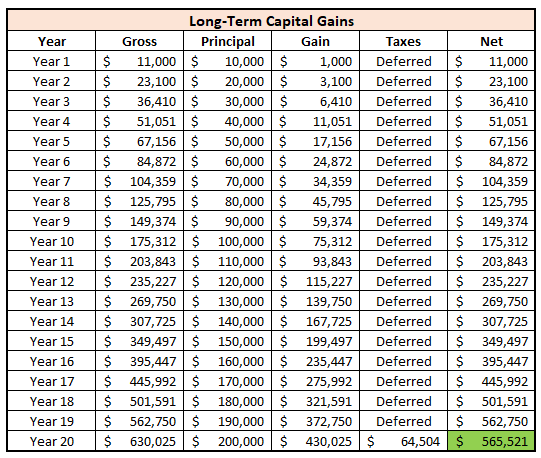

But, if you had simply just let that money compound in the market and defer those taxes until later in life because you’re not selling anything, then you could really capitalize on those long-term capital gain tax rules of only paying 15%. In fact, your net account would be $565,521 instead of the $483K that you were going to have by selling each year!

And the crazy thing is that even if you had changed the tax rate to 22% to keep it a truly apples-to-apples comparison, your balance would still be $535,419. So, you’re still paying the same exact tax rate, but you’re simply deferring those taxes to later in life rather than paying them throughout time.

This is a major concept of investing in general by not interrupting compound interest unnecessarily, and by paying taxes throughout time, you’re literally doing that. You’re drawing down your balance way earlier than you need to be and that’s negatively affecting your performance over time as I just proved.

Now, I know some of you might be saying, “But Andy, this is nonsense because the stock market doesn’t always go up and I take advantage of stock loss harvesting!”

And guess what – I agree with you on this. This is right when we start to talk about some of these tax efficient investing strategies that I teased you with earlier.

Tax loss harvesting is when you’ll sell some of your investments at a loss to offset some investments that you have sold that you’ve realized gains that year.

Now, as of 2021, the key is that these gains and losses have to be realized gains and realized losses, meaning that you have to have actually sold those equities. If you owned Tesla and it went from $200 to $2000, you don’t owe taxes until you sell those shares. So, you could hold them for 100 years and not pay taxes until that point.

This is something that’s extremely important to understand when trying to implement a strategy like this. It’s also very important to understand that you are not taxed on the performance of each stock that you buy and sell but rather the total amount at the end of the year that you have made.

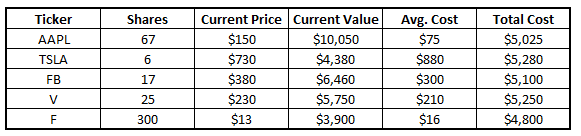

Let me explain better with an example – let’s imagine that it’s getting towards the end of the year and your portfolio is made up of the following five stocks – what would you do?

Now, that’s obviously an extremely loaded question and you should never make an investment decision based on taxes alone, but they do play a part in your portfolio.

If this was my portfolio and I LOVED all five of these companies, do you know what I would do? Absolutely nothing. I wouldn’t touch it.

But what if I really didn’t like Ford (F) or Tesla (TSLA) anymore? What would I do then?

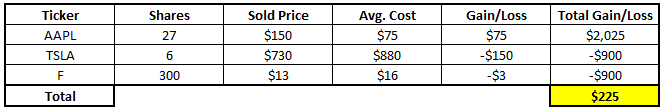

Well, one thing that I could do is sell all of those shares. When I did that, I would be locking in a realized loss of $900 for both companies.

- TSLA: $880 avg. cost – $730 current share price = $150 loss/share. $150*6 shares = $900

- F: $16 avg. cost – $13 current share price = $3 loss/share. $3*300 shares = $900

By selling these shares I have effectively created an $1800 “credit” on taxes that I can get back. My portfolio would show this year that I lost $1800 in my investing so I wouldn’t owe any taxes.

But, I view this as an opportunity. Maybe I think that Apple (AAPL) has had too much of a runup over the last year and my position has gotten too large. When you look at the screenshot, you can see that the “Total Cost” for each stock was ~ $5K as I had targeted (in this theoretical example) for each company to be about 20% of my portfolio.

Well, AAPL is now about ⅓ larger than my second largest holding and has doubled up TSLA and F. Just to be safe, I might decide to rebalance my portfolio and lock-in some of those gains.

If I were to sell AAPL without doing any tax loss harvesting at all, I would owe taxes on those gains – either long-term capital gains if I held the shares for over a year or short-term capital gains if under one year of holding.

But, because I have sold F and TSLA and created this $1800 deficit, I can sell $1800 of gains and they wipe each other out. So, let’s pretend that I want to sell 27 shares of AAPL to get back to a more normal level in my portfolio.

- AAPL: $75 avg. cost – $150 current share price = $75 gain/share. $75*27 shares = $2025

By selling these three companies, I have neutralized some of my gains and now will show that I only made $225 from my investments this year:

My taxes will now be based on $225 of profit instead of the $2,025 if I had only sold AAPL and done nothing else.

But what if F were to take a massive dip shortly after I sold and I wanted to buy back in? That would then trigger a “wash sale”, which effectively means that the tax savings that I received will be completely wiped out meaning that I’m going to pay higher taxes.

Wash sales can be a complicated topic so I will cover that in more depth in a future post to help show the intricacies of them. In short, when you sell your shares, you have to wait at least 30 days before you can buy back into that company or else this wash sale is going to occur, so if you’re going to sell – you need to be ok with sitting on the sidelines for at least a month.

“Andy, this seems like it would be a major hassle to track all of this information”.

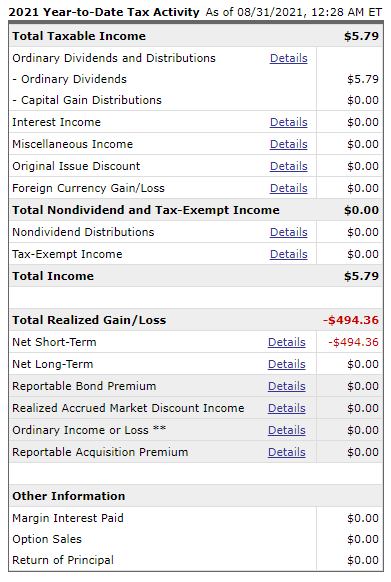

You’re right – it would be, and that’s why I love Fidelity as my brokerage firm. Fidelity automatically tracks all of this info for me so I don’t have to do a single thing! All that you have to do is login, click on the account that you want to view, and then select the “Tax Info (Year-to-Date)” section, shown below:

At that point they will show you a nice chart of your tax implications for this year and years prior as well:

At this point in 2021, my total tax liability is actually a negative $494.36 as the shares that I had sold in this account were at losses. This doesn’t mean that I have lost money, it just means that the shares that I have sold were at a loss. I could have a billion in unrealized gains (I don’t) but this chart is purely for tax purposes.

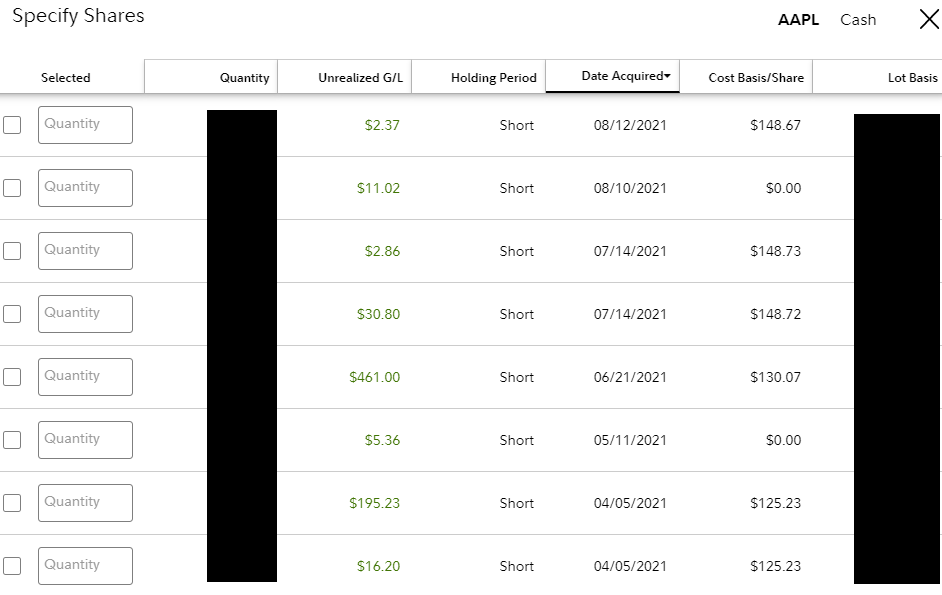

If you’re a fan of consistently putting money into your account like Andrew, Dave and myself all are, then you’re likely going to have purchased the same stock many different times. Fidelity will let you sell specific shares that will help you with tax loss harvesting so you can pick and choose exactly what you want to sell to maximize the value you’re getting from this tax loss harvesting process.

You just have to go into Fidelity and click “Sell Specific” on the shares you want to sell. You’ll then get a screen like this:

All of these columns are important because you can see the date acquired for long/short term capital gains purposes and then the total gain or loss. This is very relevant when you’re making decisions to tax loss harvest.

Anytime that I am selling shares that are “winners”, I try to decide what my ideal position size is for that company and then look at the specific shares. If I want to maybe only cut 10%, then I’ll sell the shares that have had the biggest increase so I don’t have to sell as many. If I want to sell more shares, I’ll sell those with the smallest increase.

And finally, an amazing thing about tax loss harvesting is that you can write off $3K in losses each year off your ordinary income. So you don’t have to find that perfect balance of $0 for a gain/loss but you can even drop $3K below!

It might not be realistic to do this at all, or maybe just not all the way to $0, but it’s a strategy to be mindful of when it gets closer to the end of the year as it definitely can save you from sending money to the tax man.

It’s imperative to remember that you should NEVER make an investing decision, regardless of buying or selling, only because of tax purposes. Taxes might help sway the timing of selling a stock but do not ever do it just for taxes with the hopes to buy back in 30 days later at a similar price because I bet you’ll regret it as the stock soars higher.

DOn’t let the tail wag the dog. Ever.

Instead, focus on finding great companies at great prices. And if you want to completely avoid even having to worry about this tax loss harvesting nonsense, start with maxing out your retirement accounts that are all tax-advantaged such as an IRA, 401k, and my personal favorite – the Health Savings Account!

Related posts:

- Taxable Brokerage Account: Full Implications “Hey Andrew, I read your recent article on why people should consider Roth IRAs for investments. Regarding taxes, when would an independent brokerage account (taxable...

- “I Don’t Get It – Why is Investing Important?” So many people will ask me “why is investing important” and at the end of the day, it really boils down to one thing –...

- What Should I Do With My Employee Stock Options? On a recent episode of the Investing for Beginners Podcast, Andrew and Dave answered some pressing listener questions in what ALWAYS is my favorite episode...

- 4 Money-Saving Hacks to Ring in the New Year! As we roll into the New Year, it is time to get started with some great money-saving hacks to help you retire rich. While smart...