Understanding the concept of pre-tax and post-tax investment income is an imperative part of the investing and financial planning roadmap. Different assets (ie. stocks, bonds, REITs) have different types of income that will be taxed in different ways from annual taxes, to deferred taxes, to wealth taxes.

The difference in after-tax income adds up to significant amounts over time as the powerful compounding effect of returns is involved. After-tax return analysis is an important part of financial planning and is commonly taught at colleges, universities and professional courses such as the CFA. It is important to understand when and how taxes will be charged in order to start to determine which registered accounts types might be preferred for specific investments.

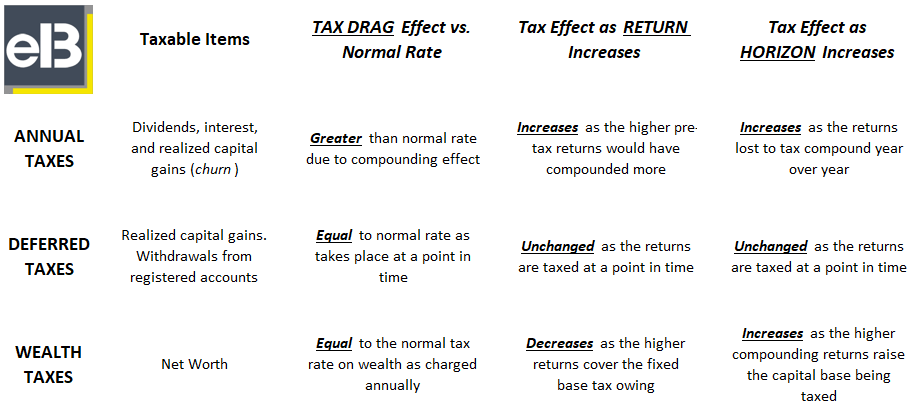

Tax drag refers to the negative effect taxes have on gross investment returns. Knowing which type of investment return to target in taxable accounts, tax-deferred accounts, or tax-free accounts is an important part to the financial planning roadmap that we will discuss first.

Account Types to Know for Tax Purposes

Many registered retirement accounts across the world have contributions based off pre- or post-tax income so understanding tax concepts are important to all investors. Understanding the return characteristics of an asset or investing strategy will help decide which type of account the investment should be held in. Income types and investing strategies need to be matched with the appropriate account in order to minimize taxes and maximize overall returns.

Registered accounts in the U.S. are available to help avoid annual taxes and create deferred tax scenarios for taxpayers. In the U.S. the most popular registered accounts for retirement are the 401K and Roth IRA, while up in Canada, the Registered Retirement Savings Plan (RRSP) and Tax Free Savings Account (TFSA) offer investors savings on annual taxes, deferred taxes, and potentially even future wealth taxes.

Knowing whether an investment return will be generated through realized capital gains, unrealized gains, dividend income, or interest income will help you decide which type of account the investment should be held in. Everyone’s situation will be different but investors should be sure to take advantage of registered accounts in their tax jurisdiction.

Generally, long-term equity investments generating growth and capital gains are best sheltered in a tax-free account that will never have to pay tax when the funds are withdrawn. This allows the long-term compounding effect to do its work best. The tax-free accounts that avoid future deferred taxes are the Roth IRA in the U.S. and the TFSA in Canada.

For investments such a GICs or bonds that will generate interest income (generally the highest tax item!) but little capital gains, it may feel important to shelter this income as well but, compared to higher return equity investments, their contribution in a registered account may best be placed elsewhere. As with diligent capital allocation in operating a business, investors need to think of the highest and best long-term use for their precious contribution room in their registered accounts.

Side Note: In addition, investors could consider their conviction on the investment (strong, weak) as not to waste precious tax deferred or tax-free contribution room by wrongly incurring capital losses in a sheltered account!

Annual Taxes

Annual taxes are what we normally think of day to day because income taxes would fall into this category and they are such an important aspect of life. In regards to investments, annual taxes would apply to items such as dividends and interest income. In addition, realized capital gains can be considered a type of annual tax as portfolio churn is a natural part of the portfolio management process.

Annual taxes on dividends and interest lead to a tax drag that is greater than the nominal/normal tax rate as the negative effect from taxes is compounded over time. For annual taxes, as the investment return increases, the tax drag increases as annual taxes are diminishing the compounding effect of returns. As the investment horizon increases, the tax drag will also increase as these compounding effects take place year to year.

There are registered accounts in many countries where investors can shelter investments from annual taxes. Even though annual taxes may be sheltered in registered accounts though, taxes may still be paid at a later date in what are called deferred taxes which we will talk about next.

Deferred Taxes

Investors will have to pay deferred tax when realizing capital gains in unregistered accounts or when making withdrawals during retirement from registered accounts such as a 401K or RRSP contributed to decades earlier with beneficial pre-taxed income.

As capital gains are taxed at one point in time, there is no compounding effect to the tax drag. This means that whether the investment is sold and taxed in year 3 or year 10, the tax drag will remain unchanged. Deferred taxes lead to a tax drag that is equal to the nominal tax rate for that type of income. As investment return increases, the tax drag from deferred taxes are unchanged. Similarly, as investment horizon increases, tax drag is unchanged for deferred taxes.

However, this only holds in isolation not considering potentially high reinvestment churn from actively buying and selling stocks each year. For investors that are very active with multiple purchases and sales in their portfolio, say 100% of the portfolio churn over every year, then capital gains can become a significant annual tax item that has a negative compounding effect on returns!

Deferred tax status is also relevant for certain accounts like a 401K in the U.S. or RRSP in Canada. In both the 401K and RRSP, taxes are deferred until funds are withdrawn at a later date in retirement. The benefit of this is that investment contributions can grow tax free until that later date when they are withdrawn. This pre-taxed contribution has amazing compounding effects! While the Roth IRA and TFSA still save you on the annual taxes, you are initially investing after-tax earnings in the portfolio on income that has already been taxed.

Side Thought: A good deal of the tax deferral benefit can be removed if tax rates move significantly higher in the future. In our world of indebted governments across the world, higher tax rates in the future are a real possibility…

Wealth Taxes

The wealth tax is an emerging political idea across OECD countries and the U.S. has started discussions on its implementation as well. There are currently five OECD countries which charge wealth taxes on its citizens based off their net worth.

The first thing that comes to many people’s minds when they think of wealth taxes is economist Thomas Pickety’s best selling book Capital in the Twenty-First Century. His book discusses with great economics support that when the return of equity capital is greater than economic growth, what is mathematically happening is that there is a concentration of wealth and increase in inequality. He goes on to argue that the solution is a progressive tax on wealth to offset the compounding effect.

When I say wealth taxes are an emerging idea, it is interesting to know that governments charging wealth taxes is nothing new and has actually fallen in and out of favor across OECD countries over the past century from a peak of 12 countries charging them in 1996. As such, investors and analysts should get familiar with the effect wealth taxes can have on the accumulation of wealth as it very well could affect them or their clients. Luckily for many retail investors, their modest portfolio should hopefully fall under the progressive wealth ranges targeted by these taxes.

The result of wealth taxes on a portfolio is a tax drag that is equal to the nominal tax rate which would be charged annually on net wealth. This means that as investment return increases, tax drag decreases as assets recover their value. For example, if taxes are charged at a fixed 2% of assets and return 4%, they are recovering their value and still have a net return of 2%. As investment horizon increases, tax drag created by wealth taxes increases as the compounding effect of those taxes charged takes hold with the growing capital base being taxed.

Takeaway for Investors

The compounding effect builds wealth over time but taxes can have a limiting effect on after-tax investment returns. Investors should be taking advantage of the tax deferred and tax free accounts in their jurisdictions and should be thinking about the after-tax return figures for retirement planning purposes. As with diligent capital allocation in operating a business, investors need to think of the highest and best long-term use for their precious contribution room in their registered accounts. Everyone’s situation will be different but investors should be sure to take advantage of registered accounts in their tax jurisdiction.

Related posts:

- Are You Tax Efficient Investing? If Not, You’re Losing Tons of Money! One thing that I often see among newer investors is that they’re extremely inefficient in their investing process. They’ll have absolutely zero tax strategy and...

- 10 Reasons Why Compounding Interest is the 8th Wonder of the World The words compounding interest are two of the most powerful in the investing world. Today, I’m going to show you 10 reasons why. Albert Einstein...

- Taxable Brokerage Account: Full Implications “Hey Andrew, I read your recent article on why people should consider Roth IRAs for investments. Regarding taxes, when would an independent brokerage account (taxable...

- Average 401K Return: What to Expect from your 401K A 401K is a powerful investment account, but what is the average 401K return? Let's cover this return and how you should invest to maximize...