On a recent episode of the Investing for Beginners Podcast Andrew and Dave had a guest, Scott Chapman, join the show. During the podcast, Scott talks about his book, Empower Your Investing, and goes in depth with how and why he decided to write the book. Listening to the podcast really sparked my interest with John Templeton so I wanted to dig a little deeper into the Templeton Growth Fund.

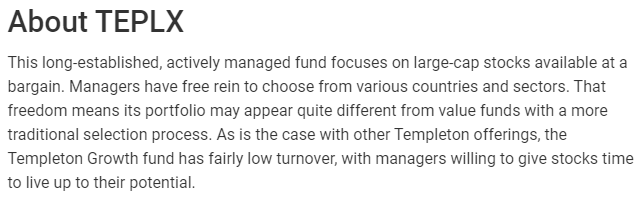

The Templeton Growth Fund (TEPLX) was founded in November of 1954 and essentially tries to focus on finding large-cap stocks that are currently undervalued. Sounds very similar to what we’re all trying to do, right?

Unfortunately, that really is the end of the good news…

Since 1986, the returns for the fund have only average 2.65% while the S&P 500 has returned an annual average of 9.08%.

My first thought was that there likely was simply a few bad years in there but that’s also not the case. Breaking it up into 5-year periods doesn’t make the data look any better as the S&P outperformed TEPLX every time except for once.

And a large majority of those periods of outperformance were by an amount greater than 5%.

If you had invested $1000 at the beginning of 2014 in both the S&P 500 and TEPLX, your TEPLX shares would now be worth $1044.33 not including dividends while your S&P 500 shares would be worth $1,736.77, also not including dividends.

“But Andy, that’s such a short timeframe!” Ok, let’s keep going then!

If you invested $1000 in 2009, your TEPLX shares are now worth $868.82 while your S&P 500 shares are worth $1,687.37.

How about 15 Years ago in 2004? Your $1000 of shares are now worth $1,278.84 in TEPLX and $2,815.30.

How about since that 1986 date that I threw out…$1,000 is now worth $1,512.04 in TEPLX and $11,723.60 in the S&P!

This really isn’t supposed to be a bash fest on the fund, but I think this is a great learning lesson on investing in general. Normally I am one to give you all of the details and then conclude at the end but in this case, I wanted to do things in reverse.

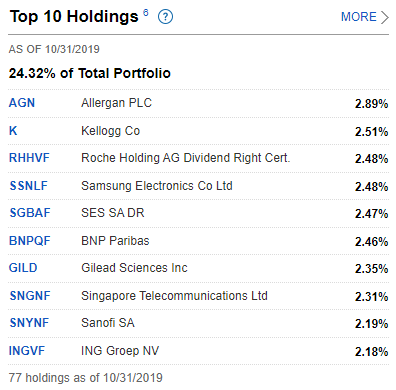

So, you know the results – let’s take a look at the fund. We know that the fund likes to target undervalued funds that are mid-caps and try to invest in them until they become overvalued. So, what are some of the current stocks that make up TEPLX?

There are quite a few big names in there that likely ring a bell. Note that the fund is made up of 77 different stocks meaning that the average stock accounts for 1.03% of the fund.

Also, interesting to see that these top 10 holdings account for 24.32% of the fund, meaning that on average the Top 10 Holdings each account for 2.43% of the fund, nearly double the average. Nothing out of the ordinary here, but just things that I like to consider when investing.

Ok, so let’s now look at the dividend yield – current yield is 1.79% – that is right in line with the S&P 500 ETFs.

Next, let’s move on to the expense ratio. Typically, when you buy a fund like this, you’re going to pay some sort of expense ratio. The more hands off that the fund is, the lower that expense ratio should be…theoretically. For comparison purposes, a lot of ETFs are typically in the .05% – .4% range, meaning that you’re paying $.50 – $4 for every $1000 that you have in the fund on an annual basis.

TEPLX, on the other hand, has an expense ratio of 1.3%.

That is not very good, my friends – especially when the returns underperform the market at such an awful rate.

One of the last things that I will do when looking at a fund like this is I will check the Morningstar rating.

While Morningstar will likely require for you to signup to see their rating and information, you can check out other websites like Seeking Alpha, MarketWatch or even going to the actual website for the fund like I did with TEPLX.

All in all, is this a stock that you would invest in? If I was to buy this fund, I would be paying a high expense ratio for a stock that has a much worse than average return while only receiving the average dividend yield… this is the definition of running way! But I think this really is an important lesson.

So many people will invest in this fund thinking that it’s going to have a great record of performance for them as John Templeton was truly one of the great investors that would seek to find under-valued companies.

But they’re only looking at the name on the front page and not the actual content!

If there’s one thing that I want you to take away from this post, it’s that you need to dig a little bit deeper and do some research on your own.

I mean, let’s be real – how good does this sound?

I would love to invest in a fund like that! That is a direct quote from U.S. News and while I do not at all disagree with their description of the fund, what they don’t say is that it also has a very long period of underperformance – like forever.

So, like I mentioned, don’t simply just listen to someone else’s review of a stock or a fund. Take the time to dig a little bit deeper and make sure that you understand the numbers before investing in anything at all!

Investing in a stock that you’re not knowledgeable about isn’t going to hurt anyone other than yourself! You need to make sure that you know exactly what you’re getting into before putting your money in someone else’s hands.

If someone came up to you and said “I have an awesome sports game that I want to take you to – do you want to go? It only costs $100.” Would you say yes? Sounds like you and your buddy will have a good time at the game!

What your friend didn’t tell you is that the “awesome sports game” was actually the homecoming football game at your biggest rival and by “I want to take you” your friend meant physically – like you were going to get a ride, but you were totally going by yourself.

Is this extreme?

Heck yeah it is.

But paying 1.03% to invest in a stock that underperforms the market by more than 6% is also pretty dang extreme if you ask me.

Related posts:

- What are the Different Types of Mutual Funds, and What do They Mean? Mutual funds are a great vehicle for growing your money. Keep reading to find out more about them and what types of mutual funds may...

- How to Choose the Right ETF Updated 10/27/2023 With more than 2,000 ETFs or exchange-traded funds available in the U.S. alone, choosing the right ETF might seem like picking out the...

- Traditional Overdiversification Wisdom is Bunk. 15-20 Stocks= Not Enough. Everything you’ve ever heard about diversification, and overdiversification, is wrong! The conventional wisdom is that any portfolio over 20- 30 stocks is overdiversified. This is...

- What is a Good Number of Stocks to Own? The number of stocks in a portfolio can have a major influence on your ultimate results as an investor. Because of this, every investor must...