Visa is arguably one of the world’s most recognizable logos and brands. Fun fact: they took the name because it is simple enough to sound the same in every language.

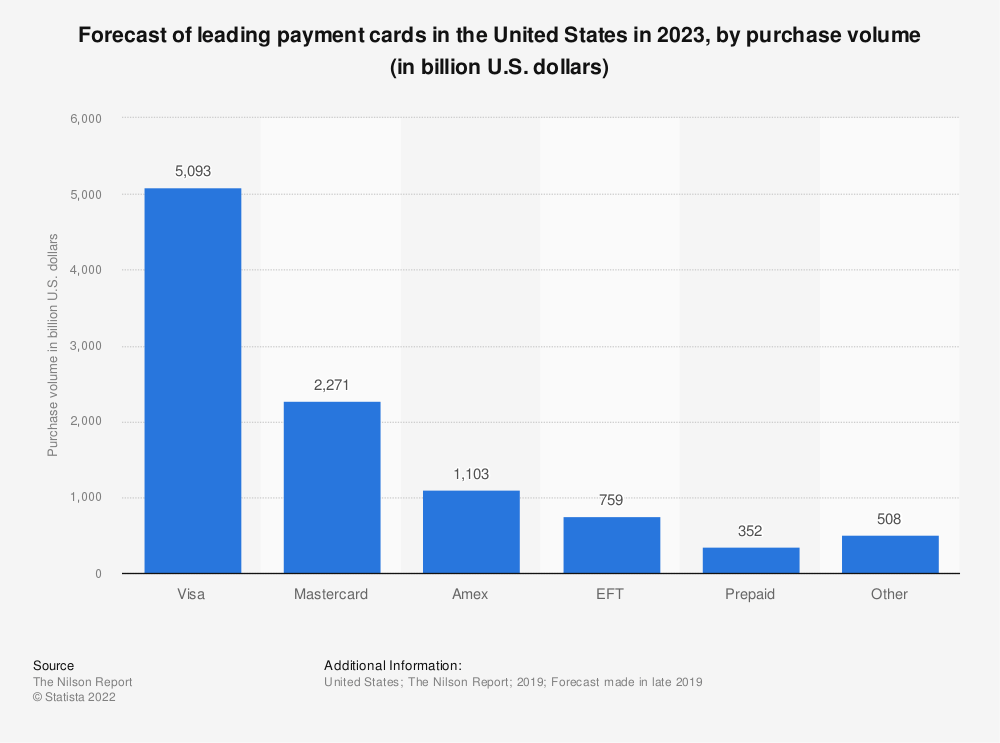

Visa enables electronic fund transfers worldwide, processing upwards of 1,700 transactions per second. It is the world’s second-largest payment organization, behind China Union Pay, which is local, giving Visa the largest global reach.

Unlike American Express and Discover competitors, Visa does not issue cards, extend credit, or set rates or fees for consumers, separating it and its cousin, Mastercard, from other payment facilitators.

Most of us are familiar with Visa and probably hold three or more of our cards in our wallets, physical or virtual, but how many know the company’s history or how it came into existence? It’s a cool story and helps shed some light on how we make payments today, plus in the future.

In today’s post, we will learn:

- Short History of Credit Cards

- How Did Visa Start?

- Important Dates in Visa’s History

- How Does Visa Work?

- Investor Takeaway

Okay, let’s dive in and learn more about the history of Visa.

Short History of Credit Cards

Today, using debit or credit plastic is synonymous with paying for things. We can’t imagine a world without these features, and when we leave our house, we all grab the essentials: keys, cell phones, and wallets.

Paying for items with cash, debit card, or credit card has become a way of life, with plastic forms of payment rising in usage. The use of plastic is replacing cash as a form of payment. In 2019, debit cards passed cash as the number one form of payment in the U.S., and that habit is only accelerating even more since the pandemic began.

We think of credit as this new invention, but economies thrived on credit far before creating money. During the Bronze Age, almost all transactions took place as a form of credit.

“The first recorded transaction that laid a foundation for our modern credit card system occurred over 5,000 years ago when the ancient civilization of Mesopotamia used clay tablets to trade with the neighboring Harappan civilization.”

As early as the 1800s in the U.S., there were examples of early credit cards as credit coins and charge plates issued to farmers by merchants in the Wild West to give them credit until the harvesting of their crops.

The next evolution in credit cards came from Western Union offering metal plates to their best customers to delay payment.

In 1946, the Brooklyn banker John Higgins created the “Charge-it-card,” which used Higgins bank as the go-between between customers and merchants. They worked in this fashion: the bank would pay the merchant for the customer’s transaction and later collect the money from the customer. Their system was the first example of the closed-loop payment system.

The first modern credit card as we know it today was born in 1949. Frank McNamara and his partner, Ralph Schneider, created the “Diner’s Club” in 1949. The story goes, McNamara got the idea from negotiating with a restaurant manager to come back the next day to pay his bill after he had forgotten his wallet.

The Diner’s Club began with cardboard cards chosen men could use at 27 area restaurants. It began as a friends network of 200 members, men only; yes, it was a different time as women weren’t allowed to have credit products at the time.

Original courtesy of dinersclub.com

The Diner’s Club would go on to become the first credit card accepted outside the local area and, over the next two years, would grow to 42,000 members across the U.S.

And in 1959, American Express created the plastic credit card we know today, quickly adopted by Bank of America, Carte Blanche, and Diner’s Club.

The final evolution of today’s credit card was the creation of revolving credit by Bank of America with their BankAmericard. It was the first revolving credit, meaning when you use the card and pay the bill, you get the credit back to use in the future. BankAmericard, created in 1966, was the precursor to Visa.

How Did Visa Start?

The date September 18, 1958, is important in Visa’s history. That was when Bank of America launched their aforementioned BankAmericard credit card in Fresno, California.

The BankAmericard was the invention of Joseph P. Williams, the leader of Bank of America’s in-house development think-tank, Customer Services Research Group. Williams’ main success was implementing the first all-purpose credit card.

In the 1950s, the typical middle-class American carried multiple revolving credit accounts with multiple merchants. That system was clearly inefficient and cumbersome for both the merchant and consumer. The need to carry so many accounts or cards and keep track of individual bills each month for both parties drove a need for consolidation.

At that time, no unified financial instrument was available to the public. It was evident to the financial industry, but no one has solved the problem.

There was the Diner’s Club card nationwide, but the bills were due in full each month and, after many attempts to unify credit cards, ended in failure, mostly by small, local banks without the resources to make them work.

Williams and his team studied these failures, along with the success of Sears and Mobil Oil in their ability to make revolving credit cards work for their businesses.

After studying these results, Williams and Bank of America decided to conduct a test. They selected Fresno, California, as a test site for their idea; with 250,000 residents, it was big enough to make a credit card work but small enough to control startup costs. At that time, Bank of America had Fresno’s 45% market share.

The test began with Bank of America stuffing Fresno’s mailboxes with a mass mailing of 65,000 unsolicited BankAmericard offers. And at first, the test went well, and by March 1959, the test expanded to San Francisco and Sacramento, and by June, they were dropping offers in Los Angeles.

By the end of October that year, BankAmericard had 2 million offers mailed, and the BankAmericard was accepted at 20,000 merchants statewide.

Picture courtesy of americanhistory

Despite the success in developing demand for the card and acceptance by merchants, there were problems. Soon, over 22% of the accounts were delinquent, higher than the projected 4%, along with numerous credit card fraud claims.

The launch of BankAmericard cost the bank over $8.8 million; after including advertising and overhead, that figure rose to approximately $20 million.

The company launched a public relations campaign to salvage the reputation of BankAmericard, and by 1961 it was profitable for the first time.

Much of the early problems stemmed from fraud and the initial credit card agreement, which included language that held cardholders liable for all charges, including fraud. Once they cleared up that language, it was off to the races.

The company kept the reputation a little on the shady side to ward off competitors, which worked until 1966, when the truth about how profitable the BankAmericard was became public knowledge.

Then Bank of America expanded beyond California; its original goal was to begin competing with another up-and-comer in Master Charge, later Mastercard.

Important Dates in Visa’s History

The origins of Visa are a fascinating story, and one that shows how the humble origins of some products expand into something global. One good idea can sprout into a world-changing idea.

Visa has had several notable moments in its history; some are critical to developing the beast today that is Visa.

1958: Birth of BankAmericard

As we discussed above, 1958 was a critical year in the birth of the BankAmericard which morphed into the company Visa that we know today.

The original BankAmericard came printed on paper with a $300 limit.

1970: Dee Hock Enters the Picture

By the late 1960s, Bank of America began licensing the BankAmericard program abroad, with local banks issuing cards in different names. For example:

- In Canada, a conglomeration of banks, including Royal Bank of Canada, Toronto-Dominion, and Bank of Nova Scotia, offered the card named Chargex

- France was known as Carte Bleue

- In Japan, Sumitomo Bank issued a card

- In the U.K., the card was Barclaycard.

- In Spain, the Banco de Bilbao issued the BankAmericard

In 1968, Dee Hock, an important name in Visa history, entered the picture. In 1968 Hock was the National Bank of Commerce manager when asked to supervise the rollout of the BankAmericard in the Pacific Northwest.

Hock quickly realized that the rollout of the BankAmericard had been haphazard, and there were problems with the “interchange fees” because Bank of America had grown quickly without thought to how banks handled the charging of fees between merchants and consumers with the bank in the middle.

It wasn’t an issue when only Bank of America offered the product, but it started to create issues when offering licenses outside their network.

Hock recognized these problems and created a committee of other banks that persuaded Bank of America that the BankAmericard had a future outside the bank.

In 1970, Bank of America gave up control of the BankAmericard program. The various issuer banks of BankAmericards took control of the program. They created the National BankAmericard. These actions created an alliance or jointly controlled consortium with Hock as NBI’s first president and CEO.

1973: Precursor to VisaNet

In 1973, National BankAmericard launched the precursor to VisaNet. The company launched the protocol language that established the first electronic authorization system. They followed that release with the first electronic clearing and settlement system.

1975: First Debit Card

The first debit card debuted in the First National Bank of Seattle, which would drive Visa’s revenues for decades.

1976: Visa Is Born

Visa as we know it is born. After expanding abroad, the company realized combining the international and national banks would be in the best interests of both companies.

However, there was a lot of resistance to releasing an international card like BankAmericard. For this reason, Hock created the “Visa” name as a coalition of international companies, including the blue, white, and gold flag, which included the colors of the international flags.

Hock believed the name “Visa” was easy to say in any language, recognizable and denoted international acceptance.

2007: Visa Goes Public

On October 11, 2005, Visa announced it would merge some of its business and become a public company, Visa, Inc. Under the IPO reorganization, Visa Canada, Visa International, and Visa USA would merge into the new company.

On November 9, 2007, Visa submitted its $10 billion IPO, and on March 18, 2008, the company went public. The initial offering sold 406 million shares at $44 per share, which raised $17.9 billion and was the largest IPO in U.S. history.

After the IPO, Visa traded on the New York Stock Exchange with the ticker symbol “V.”

How Does Visa Work?

Visa’s main profit comes from fees generated from payment flow on its VisaNet network. That protocol which Visa created in 1973, allows the transfers of payments between merchants and consumers.

That system includes technology, services, products, and other programs that ease the electronic exchange of funds information between financial institutions, merchants, consumers, and governments.

Visa and Mastercard set the rules that allow these financial transactions to occur over their payment rails, with Visa providing reliability and security.

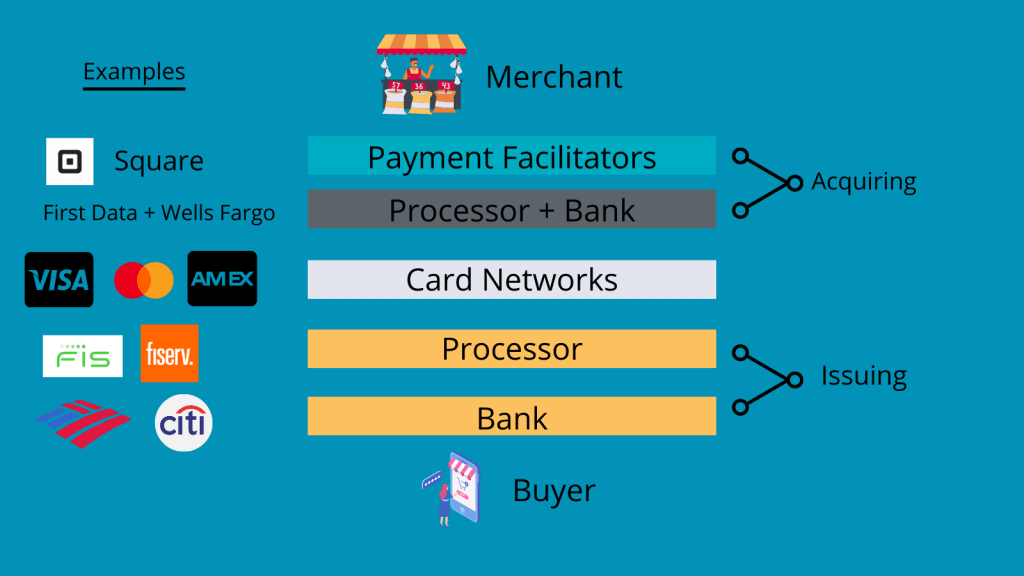

As mentioned, Visa enables payments between merchants (stores) and consumers (buyers). Below is an example of the payment flow:

- “The cardholder presents the merchant with a card for payment. The card data are read directly from the card by a point-of-sale (POS) device, key-entered into it by the merchant or provided by the cardholder on the merchant’s website or over the phone.

- The merchant transmits the transaction information to the acquirer.

- The acquirer sends a transaction authorization request to Visa.

- Visa sends the authorization request on to the issuer or, in certain circumstances, it may perform “stand-in processing” on behalf of the issuer and approve or decline the transaction.

- The issuer sends back to Visa an authorization response, either approving or rejecting the transaction.

- Visa sends the authorization response on to the acquirer.

- The acquirer routes the authorization response to the merchant.”

Visa’s payment process occurs in three steps:

- Authorization: the process of accepting or declining the transaction

- Clearing: the process that transmits the final transaction information from the acquirers to issuers for settlement.

- Settlement: the actual exchange of funds from the acquirers to issuers once clearing the transaction.

Here’s what is so amazing about the whole process: it all takes seconds to go from Walmart to the processor, Visa, bank, and back to Walmart. All of that occurs over Visa’s payment rails and allows Walmart to determine that you have the money to pay for your groceries, and the transaction will clear after you leave the store.

The average fees that Visa charges merchants, of which they take a small portion, are 1.43% to 2.4%, depending on the type of transaction.

Visa and Mastercard charge different fees depending on the presence of the card. For example, there is one rate for the consumer presenting the card in person instead of buying the product online. The reason for the difference is possible fraud remains higher if the transaction occurs online versus in person.

The total processing fees comprise three parts:

- Interchange: goes to the issuing banks and is non-negotiable

- Assessments: goes to the card schemes – Visa, Mastercard, American Express, for example – and are non-negotiable

- Markup: goes to the merchant acquirer and is negotiable

Visa and Mastercard set the interchange rates and assessment fees for payments to go over their payment rails, but they only take the assessment fee, with the majority of the fees going to the issuing bank, 80%.

For example, Visa takes 0.13% of each debit card transaction, equating to $0.13 of a $100 transaction. That might not sound like a lot, but when Visa processes 24,000 transactions a second, those pennies add up to $21.8 billion in revenues for 2020.

Investor Takeaway

Visa is one of the best-known brands globally, with millions of people walking around with cards in their pockets with the Visa logo.

The company started with humble beginnings and only intended for use in California to become one of the most important financial companies globally.

I think history is fascinating, and seeing how Visa’s history unfolded is interesting and gives you some insight into how the company operates and its history of enabling payments for customers.

The company started to make credit card transactions easier by consolidating revolving credit to one account, making keeping track of spending and payments much simpler.

Those ideas spread like wildfire, as there was a need for that solution nationwide, which then spread to the rest of the world.

To dig deeper into Visa’s fascinating history, check out these additional resources:

Dee Hock, the Father of Fintech

One From Many: Visa and the Rise of Chaordic Organization

Understanding history helps us predict the future because, as Mark Twain supposedly stated, “history may not repeat, but it certainly rhymes.” And learning about different companies can give us insight into how they operate today and what possible decisions they might make in the future.

And with that, we will wrap up our discussion on the history of Visa.

As always, thank you for taking the time to read today’s post, and I hope you found some value in the information. If I can be of any further assistance, please don’t hesitate to reach out.

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- How Visa Makes Money: A Business Model Breakdown Updated 10/12/2023 Visa Inc (V) is one of the leading payment brands globally and its cousin Mastercard (MA). Visa provides payment services to over 200...

- The Future of Debit Card Processing, What It Is and How It Works Updated 10/27/2023 In 2020, the Federal Reserve Bank of Atlanta conducted a Survey of Consumer Choice, which reported that: Evidence also shows that increasing debit...

- The Amazing Story of Mastercard: History and Making Money Updated 10/27/2023 Mastercard, along with Visa, is one of the card processing network giants that help enable money transfer between consumers and merchants. Whether it...

- The History of American Express and their Business Model Updated 11/24/2023 American Express’s history helped shape the finance structure, along with its unique business model. Warren Buffett thinks so highly of American Express that...