What is theta gang? Simply put, these are options trading strategies that capitalize on the fact that the prices of options decay over time. Instead of trying to predict if a stock will go up or down, you simply play the time game– collecting premium which turns to profit as time goes by, then rinsing and repeating.

The strategies you could employ to take advantage of theta can really be endless, but I’m going to focus on 4 popular ones that have a high probability of closing in the green and are relatively simple to understand.

This guide will assume you at least know the basics of calls and puts, which should be the bare minimum requirement of anyone trying theta gang strategies. If you need help with that I created an Options for Beginners guide that really breaks down the basics of options contracts without getting too overly technical.

Here are the 4 popular theta gang strategies I’ll cover [Click to Skip Ahead]:

The first two theta strategies are great for Beginners and seasoned traders alike because your max loss is limited and you know exactly what that max loss would be. Yet at the same time, you can profit from these trades if either A) the stock moves in the direction you like, or B) enough time has passed and time decay has worked its magic.

These strategies are called the put credit spread and call credit spread. I’ll start with the put credit spread first because that’s generally preferred if you are bullish on the market or stock.

Put Credit Spread

The concept behind a put credit spread, or even a credit spread in general, is that you are selling an option with added protection.

The nuts and bolts for this strategy:

- Sell a naked put

- Buy a cheaper put

So for a put credit spread, you are just selling a put while also buying a protective put to limit your downside. You are selling 1 put while also buying 1 cheaper put… and your profit is the difference between these two. The extra premium that is left after buying your cheaper protective put is your maximum profit.

You’d generally sell a put if you think the stock is going to go up, and because the put you are selling is at a higher premium (because of the higher strike price) than the put you are buying, this is a strategy you’d implement if you are bullish.

What makes this so appealing is that—while your upside is obviously lower—your downside is greatly reduced. It goes from being a 100% downside (if selling a cash covered put), to having a limit, and one that you can set depending on how aggressive you want to be for your profit target.

If you’re selling a naked put on margin your potential downside is huge (way more than 100% of what you’d have to put down), and so a put credit spread should be a requirement if you’re selling theta on margin… and let me show you a quick example why.

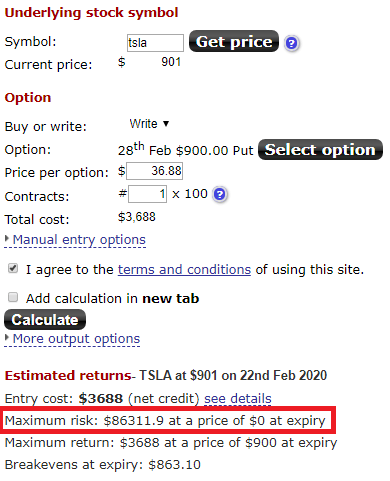

Here’s a quick profit/ loss calculation on selling a naked put, using a favorite meme stock like Tesla (I would NEVER recommend selling any options on an overvalued stock like Tesla, unless you’re a masochist or think “stonks always go up”).

A website like this one is a really great tool for visualizing your profit and loss potential on all strategies involving selling theta, and I highly recommend using it at least when you’re starting out.

Now that you can see why a put credit spread can be such a great theta gang strategy, let’s go over some of the logistics behind setting one up.

How to Set Up a Put Credit Spread

Circling back to the beginning, remember that we want to sell a put and buy a cheaper put, and pocket the difference in premium. That’s pretty much it.

You want to pick the same expiration on both puts, and make sure the protective put is cheaper than the put you are selling. In order for that to happen, you’ll have to pick a higher strike price for the put you’re selling and a lower strike price for the put you are buying. Due to the way puts are priced, that’s how you’ll always maintain a credit spread.

Here’s an example of a put credit spread that ended up how you’d like it, from the “Theta Gang spokesperson” himself, Joonie:

Notice his profit on this trade, and the strike prices of these puts. Playing theta like Joonie does also means picking further out expiration dates, to let time decay do its job. The stock price could jump up or down and yet the trade can end up profitable as long as the stock didn’t trend too drastically one way or the other (while also staying there).

Of course, there’s always the potential of a loss with any options trading strategy, theta based or not, and you’ll need to keep that in mind as well. Going back to Joonie’s trades again, (and I don’t mean to single him out but as of writing this he has a lot more winners than losers, so keep that in mind) here’s one that turned the other way against him:

The underlying stock AMZN moved from $1,988.30 to $1,964.32 at expiration, creating a small loss on his position.

While a put credit spread style should have a higher win percentage (in general), this needs to be balanced with the overall profit and loss averages on your trades, as well as the risks you’re taking with the individual stocks. If you’re too skewed one way or the other, your overall return could really suffer—so please be cognizant of those factors.

Potential Theta Gang Mistakes

Here’s some mistakes that could be made with a put credit spread (and with all theta gang plays):

1. Making the spread too small

If you pick strike prices on the puts that are too close together, you’ll get hardly any profit for the capital you are risking. To avoid this, I’d recommend estimating the yield of your credit spread based on how much capital you’re risking AND how long your capital is tied up (the expiry date). If it’s too small a yield, either don’t take the trade, buy a cheaper put, or sell a more expensive put.

2. Setting your protective put too low

If you pick a protective put that is so far out of the money that only a “black swan” event would provide you any sort of protection, well you’re risking a lot more downside risk and getting yourself into selling a naked put territory. In fact, I’d argue at that point you’re just throwing your money away on the protection (like if the underlying stock needs to drop 20% or something ridiculous). You can be aggressive when it comes to setting your credit spread, but don’t be too greedy.

Just remember the old adage: Bulls make money, bears make money, (theta gang makes money), but pigs get slaughtered…

3. Not setting a profit target

This is something I’ve picked up from the Theta Gang spokesperson himself and am starting to implement more with all of my options trading. When you have a profit target of say, 50%, you’re able to capitalize on either the swings of the stock and/or time decay—and once that profit is realized you can free up capital for another trade.

As shared from another member from the Theta Gang website, and I don’t want to get too detailed here, but essentially there’s gamma risk and tail end risk that can increase after you’ve hit your profit target… and so why greatly increase risk to double your money (from 50% to 100%) when you can just take the 50% and start anew without those risks.

I think as it relates to put credit spreads in particular the 50% profit target seems to be a really good one, and one that’s been working for some of the members on the Theta Gang site throughout the “tail end” of 2019.

4. Not doing Due Diligence on the stock

This should go without saying, but I’m shocked by how little emphasis is put on the analysis on the underlying stock throughout many options guides online (or even published books on the subject!). It’s almost thought as an after thought, but should be the 1st step in the analysis.

If you don’t have a fundamental reason to be bullish on a stock based on real, financial numbers found in the income statement and balance sheet, then you have no business selling options on any of those stocks.

5. Not checking volume

Liquidity is always something you should consider when trading options, and especially when trading theta gang spreads. If you’re setting profit targets but trading options with low volume, then don’t expect your trades to be filled when trying to exit. Option chains post the volume for a contract that day, and so check to make sure that there is decent activity before entering the trade if you’re expecting to get out to take profits off the table later.

Moving On (and more quickly…)

That about sums up a basic explanation on the put credit spread, and the call credit spread is basically the same thing but on the call side, with a few minor important details. I hope you’re not too intimated by the breadth of this section to continue on to the rest of the 3 theta gang strategies, but I promise they’re not as intensive.

This one had a lot to cover because it’s such a common strategy for trading theta, and it’s very powerful if used correctly. You’ll find that the 5 mistakes I listed above really apply to all 5 of the strategies on this post, and so I won’t have to harp on them too much again.

Call Credit Spread

This is a spread where you are bearish instead of bullish, and so you sell a call instead of a put. Selling a naked call can be very dangerous because your potential downside is infinite if the stock runs up, and so that’s why this call credit spread includes a protective call to limit that downside risk.

The nuts and bolts of the strategy:

- Sell a naked call

- Buy a cheaper call

Similar to the put credit spread, the trader here wins if the stock remains flat. Being a bearish strategy, you also win if the stock goes down. In either case (down or even), you essentially keep your premium and that’s your max gain (if the sold call expires worthless).

Like the put credit spread, you can choose your downside limit by where you set your protective call– too much protection means small profits, and too little protection allows you to keep more of the short call premium.

Also like the put credit spread, this strategy has 2 additional potential pitfalls: getting greedy and not setting a profit target (and getting wiped out by gamma), or not doing due diligence on a stock and getting crushed the wrong way (in this case, thinking bearish on a stock that’s actually a great company with great catalysts moving forward).

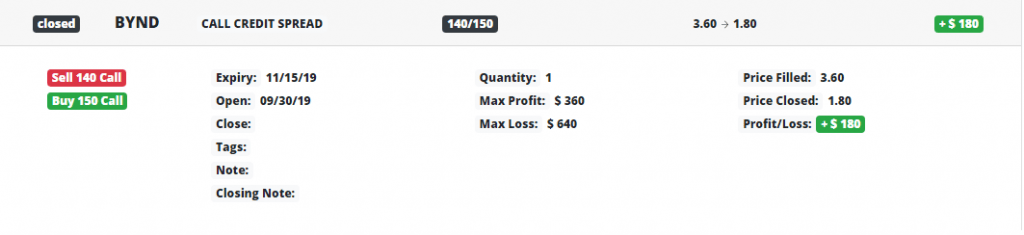

Quick example:

Short Put / “The Wheel”

This one is my favorite theta gang strategy, and especially because I put on these trades on stocks I’m willing to buy and hold anyways. which takes out much of the downside risk– because I’m willing to hold even through a bearish period (remember stocks go up over the long term).

I’ve talked before about how selling puts (aka doing a short put), especially when selling cash covered puts, doesn’t have to be a risky trade, but in this section I’ll specially cover how the wheel makes short puts even better.

The nuts and bolts:

- Sell an OTM put (cash covered preferred)

- Sell covered calls if assigned

Let’s be clear here. Selling naked puts all on its own can be a very risky endeavor depending on how you’re managing the position. Selling a put exposes you to 100% downside risk. In theory, a stock could crash 15% and you’d experience that entire loss. It’s somewhat padded from the premium you receive, but other after that point you take all that loss.

Since most traders (good ones too, I’ll add) tend to limit losses as a principle, that means that losses like these will be locked in. And while you might be thinking that this is a once in a while type of thing, it’s the stocks that are more prone to these moves that will have all of the great premiums to collect anyways (in general).

What makes this strategy not as risky, and much more appealing, is the “wheel” part of the trade.

Remember the key that I mentioned at the top: you employ the wheel on stocks you’re willing to own for the long term. So if you sell a put that gets assigned, you have to buy that stock, often at a loss. Where the wheel comes in is that after assignment, you turn around and sell a covered call to get out without a loss.

As long as your strike price for the covered call you sell is the same as the short put you got assigned on, then the combination of those two trades is essentially zero. But you collected premium on both sides, and that would be your profit.

Remember that we’re talking about the “worst case” scenario here, where your short put gets assigned. What you’ll probably experience instead are short puts that expire worthless or can be bought back later at a profit, and probably can expect at least 70% win rate with this (especially in a bull market).

OTM options, statistically, expire more than they don’t (about 90% according to this post), and so that plus a wheel management strategy makes this theta gang trade very, very appealing.

One more point about downside risk, since I’m a risk-averse value investor at heart:

What can tend to happen when you get assigned on a short put is that the stock will have fallen very far, and so the premiums for covered calls to “break even” could be smaller than normal (since the price fell already).

I have 2 strategies that I use to combat this:

(1) I’ll wait for a decent “up” day before I sell my covered call [note: remember that the ratio for up/down days in the stock market is close to 50-50, so that down day(s) that caused your put to be assigned will likely bounce back at some point (at least a little)]

(2) The more the stock has fallen, the longer the duration of the covered call that I’ll sell. [note: remember that option prices increase the more days there are to expiration, and that’s called options time decay].

All in all, there’s many things that can work in your favor to make the wheel a profitable thing for you.

I want to highlight my latest successful experience with the wheel, because it shows you exactly how a stock could go completely in the wrong direction, but you can still profit nicely– thanks to theta gang…

Read about my fun experiences selling premium here. Summary:

“Even though my 600 shares are down -$609.67 as of writing this, the profits from my option writing on it equal a total net +$73.20, even as the stock has decreased -5.4% since I started.

I’m calculating about a return of 3.5% CAGR on that money, again… even as I was wrong on the stock and it’s decreased -5.4% over the last 3 months.”

Short Iron Condor

This one is simple because it’s a combination of two strategies we just covered: the put credit spread and call credit spread.

Remember that a put credit spread is a strategy to use when you want to profit from theta and are also bullish on a stock, and a call credit spread also takes advantage of theta but is used when you are bearish on the stock.

So, a short iron condor is a neutral position. Your position is net bullish from the puts and net bearish from the calls. This type of neutral strategy profits the most when a stock stays flat, not closing too much higher or lower than your strike prices depending on where you set them.

You can make this strategy as complicated and calculated as you want, and so your profit potentials will vary depending on where you buy and sell your 2 calls and 2 puts.

If you really want to use the short iron condor heavily I’d recommend really studying up on your profit/ loss potential for the various strike prices you set, and how current prices for those options are lining up and how that compares to where you think the stock price will go (and its volatility or where it has been).

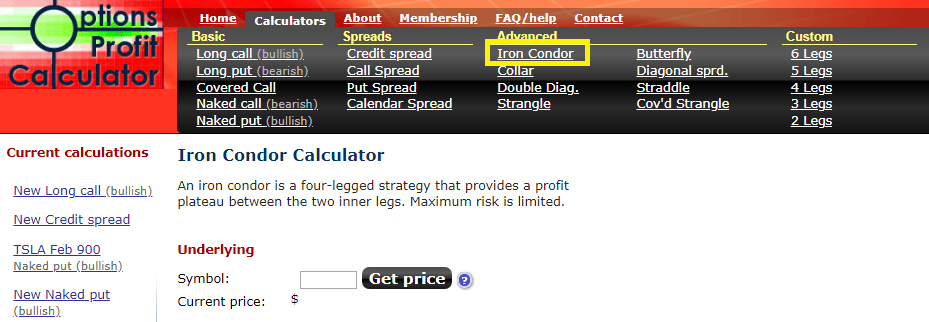

Using the tool I recommend frequently, Options Profit Calculator, can really help you make those decisions and exactly know your maximum profit and loss. That online tool is great because there’s a link for setting up an Iron Condor right at the top (see screenshot below).

Just remember to set it up as a short iron condor, making sure you’re getting a net credit on the trade (from both the put spread and call spread).

Conclusion

In all of these strategies, you are selling theta. That’s what makes them “theta gang”.

As long as the stock doesn’t have extreme moves over the duration that you sell these options, you’ll generally make a profit on them.

This is true whenever you sell options, but what makes these theta strategies so appealing is that the protective puts and calls limit your exposure to really extreme moves (for the credit spreads), while the wheel strategy limits your downside risk when you are willing to hold for the long term anyway.

When you remember that option prices tend to decline over time due to time decay, you really put time on your side and generally increase your chance for a profit the farther to expiration the options you sell are.

By the way, looking for some cool merch?

I managed to score a 10% from the founder of Thetagang Merch, use offer code EINVEST10 for 10% off all orders! (Store link)

Whatever you do, just remember this one thing:

These strategies can be optimized to limit risk and maximize reward, but at the end of the day there are stocks (and companies) underneath this complexity of options. You could have the smartest options strategy in the world and still have losing trades because you are wrong on the stocks you trade.

So really concentrate on analyzing these businesses, and really hone your ability to identify when a business is in trouble, and when its financials are healthy.

If you do a great job at that, then you should do fine with any theta gang strategy, regardless of which one you decide to choose.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- An In-depth Guide to the Theta Gang Wheel Strategy Not long ago this blog featured different trading strategies that utilize the Theta Gang mindset of selling options for premium. One strategy in particular that...

- How Options Time Decay Destroys the Prices of Calls and Puts Options time decay can be one of the most insidious forces to lose you money as you buy call and put options. As I mentioned...

- How to Trade Options: A Beginner’s Guide to the Risks (and Rewards) Table of Contents [Click to Skip Ahead] Intro to Options The Two Most Basic Options Contracts The Options Killer: Time (Theta) How to Create a...

- Selling Covered Puts for Great Premiums: It Doesn’t Have to Be Risky Getting down to the basics of selling covered puts really helps the options trader conceptualize the risks and reward profile behind the trade. The big...