The crypto world can seem endlessly confusing, but it isn’t that bad. There are tokens, coins, blockchains, deFi, dApps, and ‘doh (kidding)—but there is a basic hierarchy to it all.

Think of the difference of a token vs coin like roads vs interstate highways. Every highway is also a road, but not every road is a highway. Likewise, every coin is its own blockchain, but not every token (road) is a highway (its own blockchain).

The basic hierarchy in this space is something like this:

- Cryptocurrency

- Coins

- Tokens

Where cryptocurrency can refer to coins or tokens, but where tokens and coins are two separate things; tokens can be built on other coins but coins can’t be built on other tokens.

It goes back to highways and roads where every coin is its own blockchain (every highway is a road), but every token is built on a different blockchain (not every road is a highway).

If you don’t understand blockchains, I’d recommend reading my Crypto and Blockchain for Beginners guide. After you have that background, you’re more likely to follow these concepts easily, as we cover the following:

- The Basics of Coins and Tokens

- Pros/Cons of Tokens

- Pros/Cons of Coins

- Types of Tokens

- Types of Coins

- How to Look up If a Crypto is a Coin or Token

- So Should You Invest in Tokens or Coins?

Regardless of how you feel about the idea of cryptocurrency, it is the future of the internet. Bitcoin might go to zero someday (it’s just one of many coins), but blockchains are in wide use already; thousands of applications have been built and many more are likely to come.

The Basics of Coins and Tokens

In a nutshell, a blockchain is the technology which allows special “web3” (decentralized/ democratized) websites or apps to exist.

These web3 applications are unique because they transfer ownership of data (and profits) from a centralized controller (Facebook, YouTube, Activision Blizzard, etc) to decentralized controllers (which can be the users/content creators/cryptoholders of the website or app).

Every blockchain has its own cryptocurrency—this is called a coin.

What makes blockchains interesting is that they are generally open source and decentralized, which means anyone can build on the blockchain, to improve it, or build their own blockchain on top of another blockchain.

Anyone can also build a website or app using a blockchain already in place instead of its own—the cryptocurrency for that would be a token.

Pros of Tokens

The benefit of building on a blockchain which already exists (thus creating a token) is that the barriers to entry are very small. You just need to write some code.

By leveraging a blockchain which is already in place (like Ethereum, Solana, or Cardano), you can shortcut much of the hard work needed to build a blockchain, since it’s already freely out there. You also can leverage the network of other web3 apps built on that same blockchain (in theory), by seamlessly “plugging in” to them.

Where web2.0 and web1.0 needed expensive servers to work as the infrastructure for highly data intensive applications, web3.0 can simply run on the blockchain as the infrastructure is crowd sourced to the blockchain.

To build the infrastructure and the network of users themselves (by heavy marketing expense or other means), companies traditionally had to raise a lot of capital just to make it possible.

With web3.0, a good idea and a token, anyone can quickly scale an application through the power of crowd sourcing, decentralization, and democratization, all made possible by blockchain.

Cons of Tokens

The downsides to building on somebody else’s platform is the loss of control to that platform. You are bound to that blockchain, for better or for worse.

The holders and users of tokens could be affected by what happens to the blockchain it runs on; Ethereum and its high gas fees are a great example of this.

Because Ethereum has become so popular, with so many applications/platforms built on it, its blockchain has become very congested. As a result, transaction times have become longer and the fees for transactions (“gas fees”) have become greater (and are relatively higher than other major blockchains).

Of course the usage of a blockchain also goes hand-in-hand; if users of applications prefer different “wallets” (places to hold coins and tokens) than Ethereum’s, there may be a smaller pool of users to market to and provide a solution for.

Pros of Coins

If tokens cede control to coins, then of course coins have more control and their own ecosystem.

The vast potential of scalability with web3.0 is really amplified for coins, since network effects can boost these infrastructure highways, as more and more tokens connect to their network.

Because of this, the success of a coin can be self-perpetuating, as the expanding size of a network makes it attractive to other token or coin creators.

That’s a true compounding form of growth right there.

Cons of Coins

There’s no such thing as a free lunch, and this is true in the “meta” cryptoland just like in the real world.

Really building an attractive network that all the other blockchains and tokens want to build on-top of means having really excellent code, and one that is adaptable enough to handle the increasing demands of a growing network.

This could become prohibitively expensive, and start to mirror the kinds of expenses you might’ve seen with traditional web2.0 scaled applications.

The success of a coin could attract attention from the masses, and could attract the type of money that seeks control, a change of control which may or may not be able to be prevented.

Types of Tokens

The cryptocurrency space is still in a very chaotic infancy stage, which means lots of things are still in flux.

Many developers are experimenting with the ideas of tokens and coins, and there doesn’t seem to be a Standard Operating Procedure for widely accepted practices of the usage of these cryptos.

For example, you could have a wide range of use cases utilizing the attractive features of web3.0, but there doesn’t seem to be a rulebook for which governance or which blockchain design works best for one utility or the other.

Because everybody is figuring this out on the fly, and experimenting, innovating, and inventing, the best or most widely used types of tokens could be fluid as time goes on.

I found 3 different articles which defined crypto tokens as having 3, 4, or 5 major types. Here’s the list, which includes all types discussed in those:

- Platform tokens

- Payment (or transactional) tokens

- Utility tokens

- Governance tokens

- Security tokens

- Commodity tokens

- Non-fungible tokens

I don’t profess to be an expert in any of these, but I can offer some example use cases based on my basic understanding of the technology thus far.

Remember that tokens are built on a different blockchain which will also have its own cryptocurrency (coin).

Platform tokens: deliver dApps, or decentralized applications. This could vary from gaming to finance to digital collectibles, to really a wide range of uses. Types of tokens described below can also be “platform tokens”, think major blockchains like Ethereum or Solana.

Payment (or transactional) tokens: blockchains which might connect to many other blockchains, providing easy transfer or conversion from one cryptocurrency to another (Uniswap, PancakeSwap are some current examples).

Utility tokens: could be similar to (or the same as) transactional tokens in that their utility could include easy transfer or conversion between digital assets.

Security tokens: not security as in safety but as in assets; think common securities today such as stocks and bonds.

Governance tokens: could be similar to security tokens, in that they represent the benefits of owning securities, such as the ability to vote on key decisions for the token.

Commodity tokens: tokens backed by real assets, such as “stablecoins” or others.

Non-fungible tokens (or NFTs): data that can’t be duplicated or altered in order to preserve original authenticity and ownership rights. Use cases could include art or music, where the original artist would retain royalty rights (instead of a record label, for example).

Types of Coins (Crypto)

I’m not going to do into the specifics around categories of crypto coins, as these could be as endless as the number of tokens built on the major coin blockchains.

Since a blockchain (and subsequent coin) can literally be created out of thin air, instead of a token which must build on-top of a blockchain, you could argue the types of coins could be unlimited.

We don’t know what new type of coin will revolutionize our future…

So here’s the top 5 coins, according to Coin Market Cap, as categorized by market capitalization today:

- Bitcoin

- Ethereum

- Binance Coin

- Solana

- Cardano

How to Look up If a Crypto is a Coin or Token

You can also quickly look up for yourself whether the cryptocurrency you are investigating is indeed a token or a coin.

Sifting through the whitepapers of all the cryptos would really be time consuming; here’s a quick and easy way to look up if a crypto is a token or coin.

Go to coinmarketcap.com.

In the search bar in the upper right, type in the name or symbol of the crypto you are wanting to investigate.

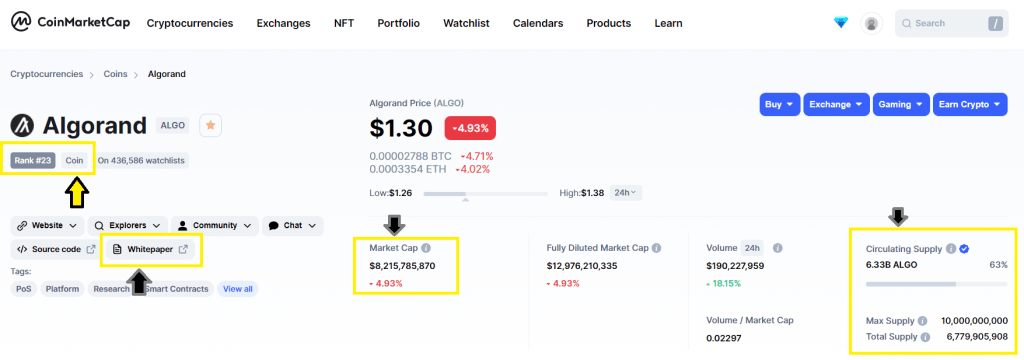

For this example, I’m going to look up one called Algorand, with the symbol “ALGO”.

Right at the upper part of the screen, we see several pieces of information which greatly inform us about some of the key aspects of the crypto:

You can see how popular this coin is based on its Market Cap; today Algorand is the #23 cryptocurrency in the world.

Right next to the crypto’s rank, you will see either “Coin” or “Token”. This is the magical information that tells us much about the structure of the crypto, and what tools we will need (wallets, etc) to interface, trade, transfer, and buy or withdraw the cryptocurrency.

The Market Cap is prevalent on the screen as well.

Circulating Supply is extremely interesting to me, as most popular cryptos will also have their Max Supply and Total Supply reported in this section. This should give you a good sense of how much future dilution has been planned and confirmed, which could help estimate the future price of the crypto assuming the Market Cap stays relatively constant.

Finally, you have a link to the Whitepaper (bottom left), similar to a prospectus page or annual report for investments in traditional finance.

If you are putting any serious money into a crypto, I’d consider reading the Whitepaper a must-do. Even after that, be extremely careful!

These are NOT your SEC-regulated stocks and bonds! (Not yet, anyway).

So Should You Invest in Tokens or Coins?

At this point, I really see putting money into crypto as a speculation, not an investment.

Compared to other investment options out there, such as stocks and bonds, there’s very little required disclosure (and recourse to lost funds from fraud or a breach of fiduciary duty).

Consider that companies in the U.S. are required to post their financials every quarter and have them officially audited by a firm every year.

From what I’ve seen, most cryptos don’t even disclose the number of holders of a particular coin or token; at least it’s not easily accessible and certainly not in an organized database such as SEC’s EDGAR. For all we know, many of these web3 applications could be losing money hand and fist, even after their great utility.

I’m not saying some people won’t make huge fortunes from crypto.

Not saying that crypto isn’t here to stay.

I’m just saying that there’s a difference between prudent investment and speculation, and I’d find it hard to believe that you can adequately value many of these blockchains with the information that is publicly available today (If you have a credible source of freely available information to prove me wrong, please leave it in the comments for all to access).

That said, I find the web3/crypto space incredibly fascinating, and I think there’s nothing wrong with throwing a few bucks into some of these great applications, particularly if they provide you tangible utility for buying their tokens or coins.

What’s utility?

As defined in economics—the usefulness or enjoyment a consumer can get from a service or good (source).

Get tangible utility and potentially make money if the cryptocurrency goes higher over time? Well, that’s the potential win-win power of web3.0.

Related posts:

- Crypto Pt3: Hidden Disadvantages of Crypto (Fees, Wait Times, Complexity…) Many people can intuitively grasp the obvious disadvantages of cryptocurrency—it’s risky, volatile, unregulated, and (currently) unwieldy. However, there’s additional disadvantages of using cryptocurrency you’ll only...

- Crypto and Blockchain for Beginners – It’s All About Democracy! I’m not a crypto or blockchain expert. In fact I barely know what I’m talking about, and maybe because I’m such a crypto beginner I...