Updated 11/9/2023

According to McKinsey, the global TAM (total addressable market) for the payments industry is $4.6 trillion. The U.S. payments market expects to reach $236.1 billion by 2028 from the current level of $68 billion.

Many investors or analysts estimate or calculate the total addressable market of the industry they analyze to understand better the market opportunity for a company like Visa or Paypal.

The TAM, or total addressable market, offers a potential revenue target for a company looking to expand its market or expand into other markets. These estimates help companies develop strategies and plan to capture those additional revenues or market shares.

The two best examples of these expansions and competition are the payments space, especially in B2B and online retail. During the pandemic, both industries have seen explosions in their TAMs, and the estimates available for Amazon, Walmart, Shopify, Square, and Paypal to expand into or capture.

With the increased enthusiasm around the total addressable markets expanding, the enthusiasm for those stocks increases, helping drive up prices. Any discussion about growth centers around the possible total addressable market and how much each company can capture.

In today’s post, we will learn:

- What is the Total Addressable Market?

- What is the Importance of a Total Addressable Market?

- The Differences Between TAM, SAM, and SOM

- How Do You Calculate the TAM (Total Addressable Market)?

Let’s dive in and learn more about the total addressable market.

What is the Total Addressable Market?

The ability of any analyst or investor to calculate the total addressable market or TAM is a major part of forecasting value creation.

According to Michael Mauboussin, since 1960, approximately one-third of the value of the S&P 500 stems from the anticipation of payoffs from future investments. To assess value creation, investors must understand how much Visa can invest and what returns those investments will earn.

The definition of total addressable market or TAM:

“TAM as the revenue a company would realize if it had 100 percent share of a market it could serve while creating shareholder value. TAM is a concept that executives and investors use frequently but that few define properly or thoughtfully. You should recognize upfront that TAM is not about how large a firm can grow to be but rather how much it can expand while adding value.”

The TAM helps businesses and investors determine what level of effort and funding Visa should invest to capture more of their market.

The TAM is also important for startups and existing businesses because those estimates help them prioritize new products or services, customer segments, or other opportunities to offer bigger opportunities.

For newer or younger businesses, creating a possible value creation proposition involves estimating the overall market size, competition, expected growth, and overall investment needed.

Estimating the TAM helps all parties determine possible market size and the effort and investment needed to acquire as big a piece of the pie as possible. It also helps these parties determine which service or product will best fit.

Despite the focus on TAM, especially among growth investors or V.C. firms, almost zero companies can capture 100% of a TAM unless they become a monopoly. Typically, there is room for more than one or two competitors in a particular space. In many cases, there is room for multiple competitors to exist in the same space as long as they occupy a particular niche.

The payments industry is a perfect example of this, with Visa and Mastercard dominating the payment schemes, but other players are fighting for other parts of the payment pie. For example, Square focuses on small-to-small businesses, Paypal focuses on medium-sized businesses, and Adyen focuses on enterprise-level businesses.

Most companies can’t capture the TAM for their product or service unless they are a monopoly. Convincing consumers to use their product or service is tough, even if they have only one competitor.

That is why most companies measure their serviceable available market or SAM to determine how many consumers they can reach with their marketing or sales channels.

What is the Importance of a Total Addressable Market?

The TAM, or total addressable market, is not about how large a company like Apple can grow but how much it can grow while adding value to its customers.

Below is an exchange between Aswath Damodaran, an NYU professor and a leading valuation expert, and Bill Gurley, a venture capitalist with Benchmark Capital, that occurred in 2014 over the prospects of Uber, the transportation company.

The following is an excerpt that highlights the importance of determining a TAM and some of the difficulties:

“Damodaran suggested the company was worth about $6 billion, a fraction of the $17 billion value implied by a round of financing the company had completed.2 (A round in the summer of 2015 valued the business in excess of $50 billion ).

Gurley responded with an article called “How to Miss By a Mile: An Alternative Look at Uber’s Potential Market Size,” in which he argued that Damodaran’s valuation grossly underestimated the magnitude of Uber’s potential TAM. Both men believe in using discounted cash flow to value the business, so the crux of their disagreement, which was refreshingly civil, sat squarely on the perceived size of Uber’s opportunities.

Damodaran calculates Uber’s TAM based on the taxi and car service business, which he estimates to be $100 billion. He then assumes the company can reach a market share of 10 percent and proceeds to calculate the value of the business. Gurley suggests that Uber’s TAM is in the range of $450 billion to $1.3 trillion and argues the company can capture a market share of up to 25 percent.

Gurley comes to a wildly different conclusion about value because the high end of his estimate for addressable TAM is more than 25 times larger than what Damodaran assumes. To buttress his case, Gurley notes that Uber’s revenue in San Francisco, one of its early markets, is already “multiples bigger” than the $140 million of total revenue from the taxi and car service industry. And business is still growing rapidly in that region.”

The above exchange is the perfect example of how to think about a company’s TAM and that there are multiple avenues to determining a company’s total addressable market.

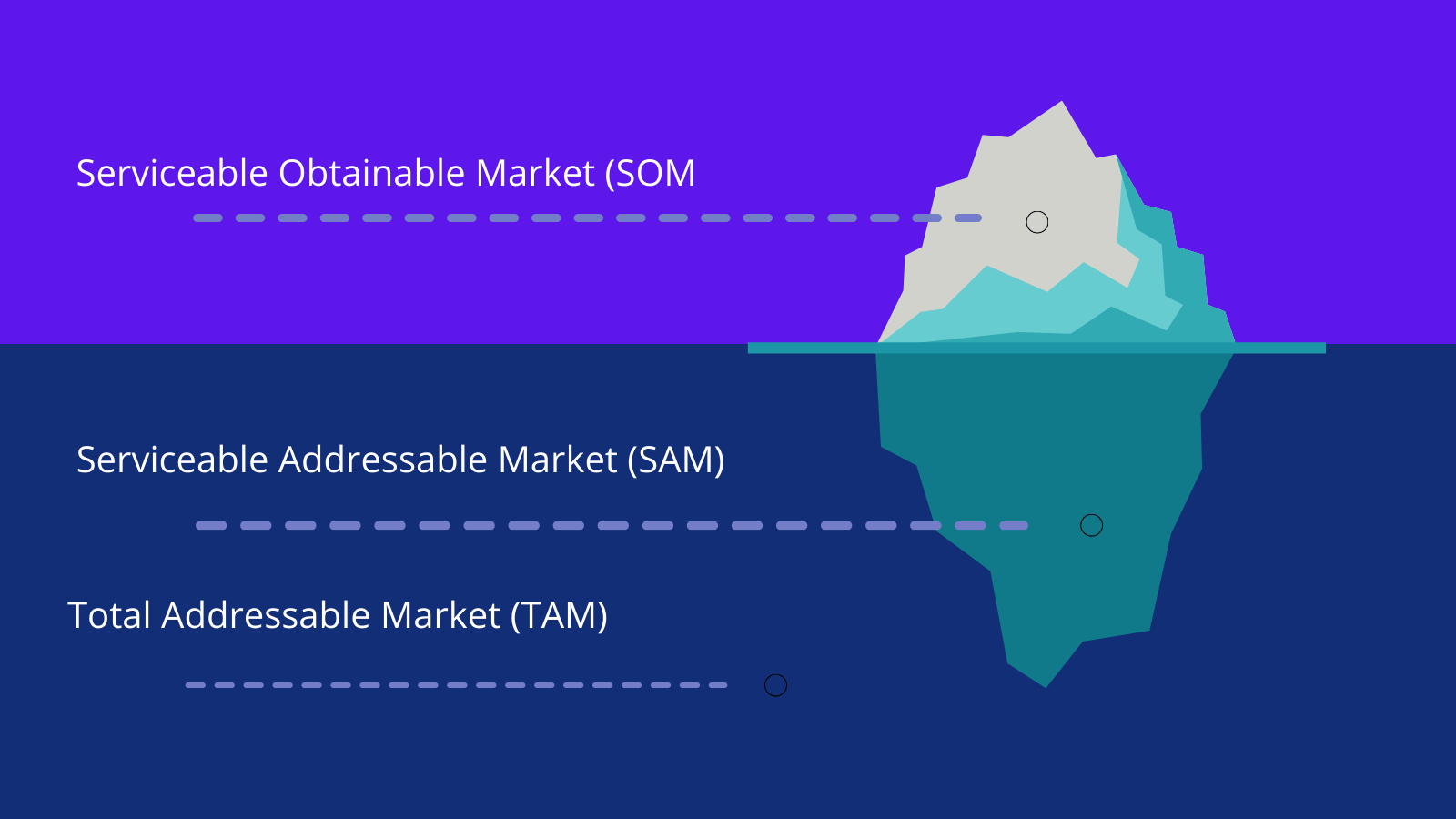

The Differences between TAM, SAM, and SOM

TAM, SAM, and SOM represent the various subgroups of a different market. The TAM, or total addressable market, represents the total demand for a product or service represented by annual revenues.

SAM or serviceable available market is the targetable addressable market that a company can serve with its product or service. SOM or serviceable obtainable market is the percentage of SAM a company can realistically achieve with its marketing or sales channels.

Identifying and analyzing an industry helps you identify the subsets of each industry, and market research helps investors identify opportunities for companies.

Consider that the TAM spits out a BIG number, attracting eyeballs and generating attention. But the devil is always in the details, and focus on the latter two, SAM and SOM, in your analysis.

The SOM or serviceable obtainable market is arguably the most important. It shows PayPal’s realistic target and the revenue it can capture in the B2B market.

A great example of breaking down the industry into different addressable markets would be to look deeper at consumer food expenditures.

The U.S. retail food industry in 2019 totaled $6.2 trillion, encompassing retail and food sales and including alcoholic and non-alcoholic beverages. Therefore, the total addressable market is $6.2 trillion, but not the whole market for Constellation Brands, a liquor distributor.

Instead, they would focus on the alcoholic market, totaling $252.2 billion in 2019. If we look deeper, we can see that there were $120 billion in beer sales in 2019, leaving $132.2 billion in wine and alcohol, which is the focus of Constellation Brands.

The company’s SOM would be $132.2 billion, which is the available market to try to either grow or take from competitors.

It makes zero sense for Constellation Brands to target $6.2 trillion as their market when they sell zero food, and why would they compete with Kroger or Walmart?

Instead, their focus would be on those companies that sell alcohol or wine and determining marketing and sales that would allow them to capture more of their market.

How Do You Calculate the TAM (Total Addressable Market)?

Calculating TAM from a high level expresses TAM for the annual revenue expectations for that market.

The formula from a high level would be:

TAM = average revenue x number of customers for the entire segment of the target market

To calculate the total addressable market, below are three primary methods to determine the TAM:

- Top-down

- Bottom-up

- Value Theory

There is another method of determining the market TAM using outside sources, such as third-party research, which we will discuss first.

Outside Research

Using outside or external research is a quick and easy way to find a TAM from professional services and data.

Private research is expensive, but sometimes the headlines make it public via press releases or a simple Google search. There are advantages to using these reports, as they are easy to obtain and are typically compiled by skilled professionals with access to data we can’t access.

Some of the leading providers of these reports are Gartner, Forrester, IDC, and McKinsey. These companies research and publish industry reports on deep dives into particular sectors. These reports usually contain revenue opportunities and future potential for competitors in those sectors.

For example, Gartner forecasts that the global cybersecurity market will grow to $345.4 billion by 2026.

The main disadvantage of using these services is the black box approach to calculating the numbers. There is little transparency in how these companies calculate their estimates. Therefore, our only defense to a challenge to using their estimates is, “Well, McKinsey published the number, so it must be valid.”

Unfortunately, that is not always a defensible rationale, and there are additional ways to measure a sector’s TAM.

Top-Down Approach

The top-down approach follows the process of elimination, which starts with taking a large population of a known size and then chipping away to narrow it down to a more specific sector.

Thinking of an inverted pyramid is a good way to envision this approach. The large population at the top of the pyramid narrowed down to the smaller segment at the bottom.

The top-down approach uses industry research and reports to get estimates of the large population.

A great example would be a startup tech company offering an app targeting small businesses that can’t afford to process payments. The company uses industry research that estimates over 1 billion small businesses globally, of which 30% lack the resources to process payments. Therefore, the estimated potential customers for the app would be:

30% x 1 billion customers = 300 million potential customers.

Further research shows that 90% of these businesses do not have a system to ring up customers. Thus, the potential customers for the payment app would be:

10% x 300,000,000 = 30 million potential customers

Now, say the company offers free downloads of the app but offers a subscription for the service of $100 annually. That would give the payment app company an estimated total addressable market of:

30,000,000 x 100 = $3 billion

Bottom-Up

The bottom-up analysis is trustier because it uses primary research to determine TAM estimates.

The bottom-up analysis uses more reliable data for the current usage and prices of the product. For example, in our example of the payment app above, we can find a more reasonable estimate of the number of businesses to target to achieve the possible TAM.

The advantage of using this method is that it allows more insight into which data it uses and why, allowing for better clarification. Using more reliable data gives the company a more defensible position for its estimate of potential TAM.

Value Theory

Value theory uses an estimate of value provided to customers by the product or service and how much that value reflects from the product pricing.

Companies estimate how much value they add to their products and services and why they capture that value through product pricing.

For example, Amazon captures a lot of value with its Prime subscription. Many consumers use it because it allows them to easily purchase products and other add-on services Amazon offers.

Amazon predicts that the price of Prime offers additional value to consumers, and the company can use that estimate to predict additional TAM targets with other products or services. As Amazon looks to expand markets or offer other services, Amazon can estimate additional TAM based on the value Prime offers subscribers.

Additionally, suppose Amazon decides to increase the price of Prime. In that case, the company can see what pricing power it retains for that service and what other cross-selling services might be available.

Investor Takeaway

The total addressable market is among the most important metrics for startups and established companies.

The TAM allows companies to estimate the potential scale of a particular market for their product or service. TAM estimates come in the form of total sales and revenues that the company can capture.

When any company is releasing a new product or service, moving into a new customer segment, or planning on cross-selling existing products to existing consumers, the TAM helps those companies estimate the potential revenue growth.

As investors, we need to be objective about potential TAMs in a company’s projections because excessive numbers can lead to extremes in pricing. If a company estimates it will grow cell phone sales of 40 million new customers when only 30 million total customers are available, that is impossible.

Using a combination of top-down, bottom-up, and outside research will help you determine realistic total addressable markets for any industry, sector, or company you are analyzing.

Try to be as pragmatic as possible, and try not to buy into the hype because Wall Street’s job is to sell, and they can be quite persuasive.

Use your judgment and those you trust to help you estimate pragmatic TAMs.

For a deeper dive into estimating TAMs, please check out this article:

Total Addressable Market – Michael Mauboussin

And with that, we will wrap up our discussion on total addressable markets.

As always, thank you for taking the time to read today’s post, and I hope you find something of value.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Competitive Advantage: How to Find Sustainable Moats in the Stock Market “If you build a better mousetrap, the world will beat a path to your door.” Ralph Waldo Emerson As investors, searching for companies with a...

- Beginner’s Guide to the Yahoo Finance Numbers (Updated) Updated 7/12/2023 Let’s assume you are an absolute beginner when it comes to using ticker systems like Yahoo Finance. The world of stock investments might...

- What are the Stock Market Sectors? – Global Industry Classification Standards One of the most common ways investors think about a company and analyze their portfolio diversification is by sector. There are 11 main sectors used...

- The Tyranny of Stock Market Bubbles: History Repeats Itself As the saying goes, “history repeats itself.” Smart investors are willing to learn from the lessons of history’s mistakes. Other investors have lost money in...