You can use total current assets to assess a company’s financial standing. Today’s post will teach us the formulas to use and what to do with the results.

The balance sheet of a business, usually referred to as a “statement of financial position,” lists the company’s assets, liabilities, and equity (net worth). The income statement, cash flow statement, and balance sheet combined form the foundation of any company’s financial statements.

It’s crucial to comprehend the form of a balance sheet, how to read one, and the fundamentals of balance sheet analysis, whether you’re a corporate shareholder or a prospective investor.

Buffett evaluates the balance sheet the same way as he does the income statement to look for businesses with a sustainable moat or competitive edge.

The total current assets represent the most liquid assets for any company, and understanding those assets will give you a better sense of the company’s financial position.

In today’s post, we will learn:

- What are Total Current Assets?

- Understanding Total Current Assets

- Defining Total Current Assets

- How Do We Calculate Total Current Assets?

- Some Examples of Total Current Assets

- What Are Total Current Assets vs. Total Assets

- How Can Investors Use Total Current Assets?

- Investor Takeaway

Okay, let’s dive in and learn more about total current assets.

What Are Total Current Assets?

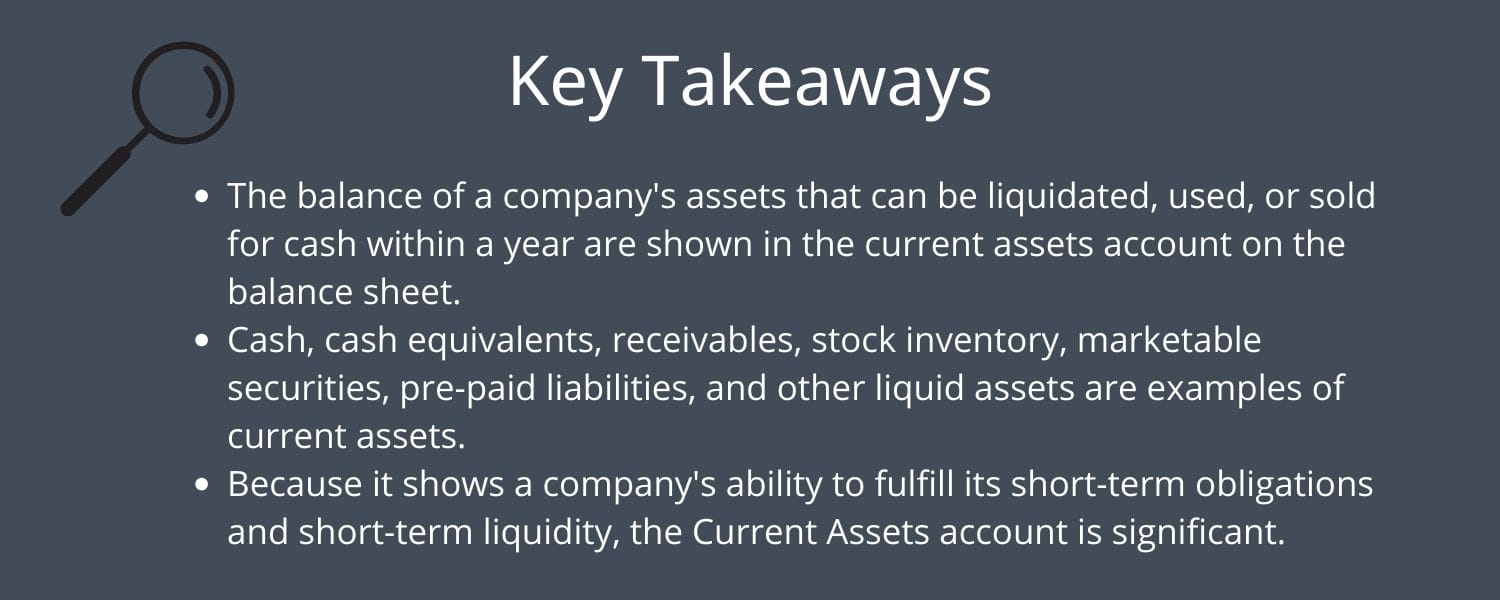

On a company’s balance statement, total current assets are the sum of all cash, receivables, prepaid expenses, and inventory. If companies anticipate these assets will convert into cash within a year, they categorize them as current assets.

Companies compare the total current assets to the total current liabilities to determine whether there are enough assets available to pay for a business’s commitments.

Current assets include:

- Cash

- Cash equivalents

- Accounts receivable

- Stock inventory

- Pre-paid liabilities

- Other liquid assets

Total current assets represent the above all added up, typically listed as a specific line item on the balance sheet.

Because it shows a company’s ability to fulfill its short-term obligations and short-term liquidity, the Total Current Assets account offers significance.

Notably, cash is the most liquid form of the current asset. It is readily convertible to cash and finds its place on the company’s balance sheet in descending order of liquidity. Therefore, cash lists at the top. We can find the essential elements of a company’s short-term liquidity and net working capital requirements in these short-term assets.

Not all of these will convert into cash within a year; that is crucial to remember. For instance, prepaid expenses are a current asset since they save money by eliminating the need to pay for items within the next year, and not all of the inventory will turn over in a calendar year.

Understanding Total Current Assets

Publicly traded companies must follow widely accepted accounting principles and reporting guidelines (GAAP). Companies need to produce financial statements with specified line items that offer transparency for interested parties following these principles and practices. The balance sheet, which lists a company’s assets, liabilities, and shareholders’ equity, is one of these statements.

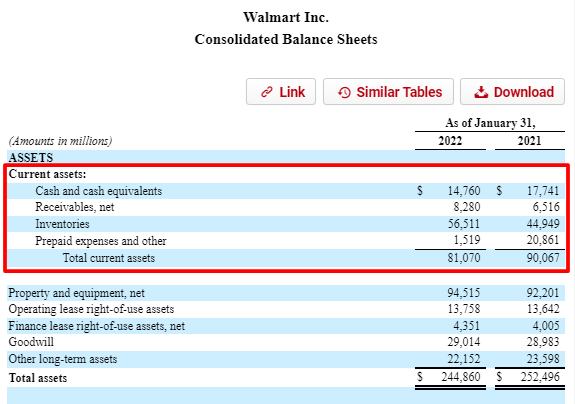

The first account mentioned in the Assets section of a company’s balance sheet is always Current Assets. The Current Assets account consists of various subaccounts. For instance, Walmart includes many current assets sub-accounts that add up to total current assets, which is the sum of the current assets sub-accounts.

Investors should pay close attention to this area because it displays the company’s current liquidity. Apple’s balance sheet showed that it had $81 billion in current assets that it might turn into cash in a year. Short-term liquidity is essential because if Walmart were to have trouble meeting its short-term obligations, it could sell these assets to pay them off.

Current assets can be anything from barrels of crude oil, manufactured items, work-in-progress inventory, raw materials, or foreign cash, depending on the nature of the firm and the products it markets.

Defining Total Current Assets

Numerous assets can be regarded as current by numerous businesses across all industries. These sub-accounts are typically how most sectors organize their current assets; however, you might see others:

- Cash and Cash Equivalents

- Marketable Securities

- Accounts Receivable

- Inventory

- Prepaid liabilities/Expenses

- Other Short-term Investments

Due to the different ways businesses might account for the included assets, the sequence in which these accounts appear may vary. For example, Berkshire Hathaway lists total current assets differently from Apple.

Cash and Cash Equivalents

Assets in the Current Assets account must be cash or have a quick cash conversion rate by definition. Certificates of deposit, money market funds, short-term government bonds, and treasury bills are examples of cash equivalents.

These assets must not be subject to restrictions limiting their ability to be liquidated quickly to qualify as current assets.

Marketable Securities

The total value of liquid investments that can change quickly to cash without losing their market value will enter into the marketable securities account.

For instance, it might not be viable to convert shares of a corporation into cash if they trade in extremely low volumes without affecting their market value. Since companies don’t regard these shares as liquid, they don’t record the value in the current assets account.

Accounts Receivable

As long as the companies anticipate accounts paid within a year, the value of all money owed to a company for goods or services delivered or utilized but not yet paid for by consumers will list in current assets.

Some of a company’s receivables might not record in the current assets account if it generates sales by giving its clients longer credit periods.

Inventory

Current assets include inventory, which consist of raw materials, components, and finished goods. But depending on the product and the industry sector, different accounting standards can change inventory, which occasionally could not be as liquid as other eligible current assets.

For instance, there is little to no assurance that a dozen expensive pieces of heavy earthmoving equipment will sell in the upcoming year. Still, there is a large likelihood that 1,000 umbrellas will sell successfully during the impending rainy season.

Because of these factors, you ought to approach inventory with caution. To find out what is happening with a company’s inventory, read the company reports or surf the internet. It may just be a regular procedure or an industry trend for inventory to be at certain levels.

Additionally, inventory limits working capital. Inventory can back up if demand changes abruptly, which happens more frequently in some industries than others.

Prepaid Liabilities

A company’s prepaid expenses, which represent payments made in advance for future goods and services, will categorize as current assets. They are payments already made even though companies can’t redeem them for cash. As a result, companies can use the money for other purposes. Payments to contractors or insurance firms are examples of prepaid expenses.

Other Short-term Investments

Although some liquid investments will list in the Other Short-Term Investments account, many businesses classify liquid investments into the marketable securities account. An illustration would be extra money invested in short-term security, putting it to use while retaining the ability to access it in an emergency.

How Do We Calculate Total Current Assets?

The calculation for total current assets simply adds up all the assets that can convert into cash within a year. If the formula does not have a current asset subcategory, you can add one to Other Liquid Assets.

You compile and add the details of current assets from a balance sheet. On the balance sheet, it is typically already added up for you under Total Current Assets:

Total current assets = Cash and Cash Equivalents + Accounts Receivable + Inventory + Marketable Securities + Prepaid Expenses + Other Liquid Assets

As noted above, we can find the total current assets at the top of the balance sheet. Most companies do us the favor of adding them up for us, but on rare occasions, it is good to understand how to add them up ourselves.

A bigger-picture overview gives us a summary of how the company funds daily operations. For example, companies utilizing inventory and turning it over quickly can lead to growing revenues for the company, and companies use accounts receivable collections as a means of generating cash flow to fund operations.

The cash flow statement and balance sheet connect between total current assets. We can see changes in assets and liabilities in the cash flow from the operations section of the cash flow statement. These connections tell us how the company turns those items — inventory — into cash.

Some Examples of Total Current Assets

Let’s look at several real-world examples and compare their total current assets.

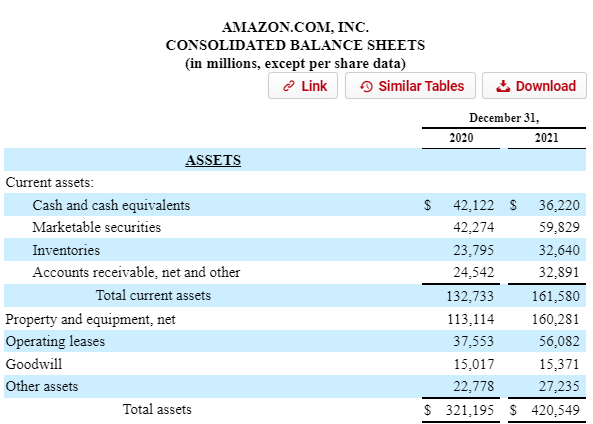

Leading retailer and cloud provider Amazon (AMZN) carries $132,733 million of total current assets on its balance sheet.

- Cash and cash equivalents = $42,122 million

- Marketable securities = $42,274 million

- Inventories = $23,795 million

- Accounts receivable = $24,542 million

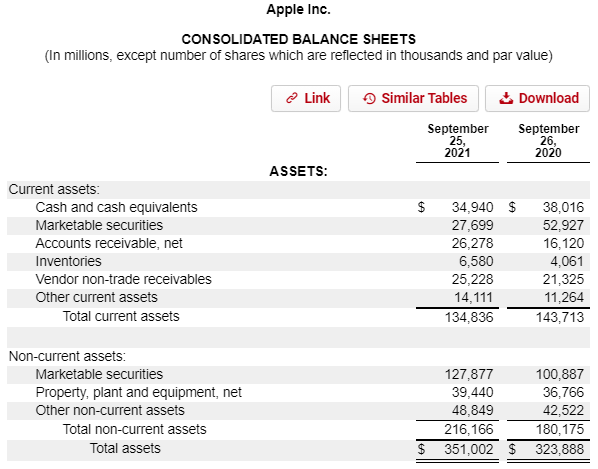

In comparison, Apple (AAPL) carries $134,836 million of total current assets on its balance sheet:

- Cash and cash equivalents = $34,940 million

- Marketable securities = $27,699 million

- Accounts receivable = $26,278 million

- Inventories = $6,580 million

- Vendor non-trade receivables = $25,228 million

- Other current assets = $14,111 million

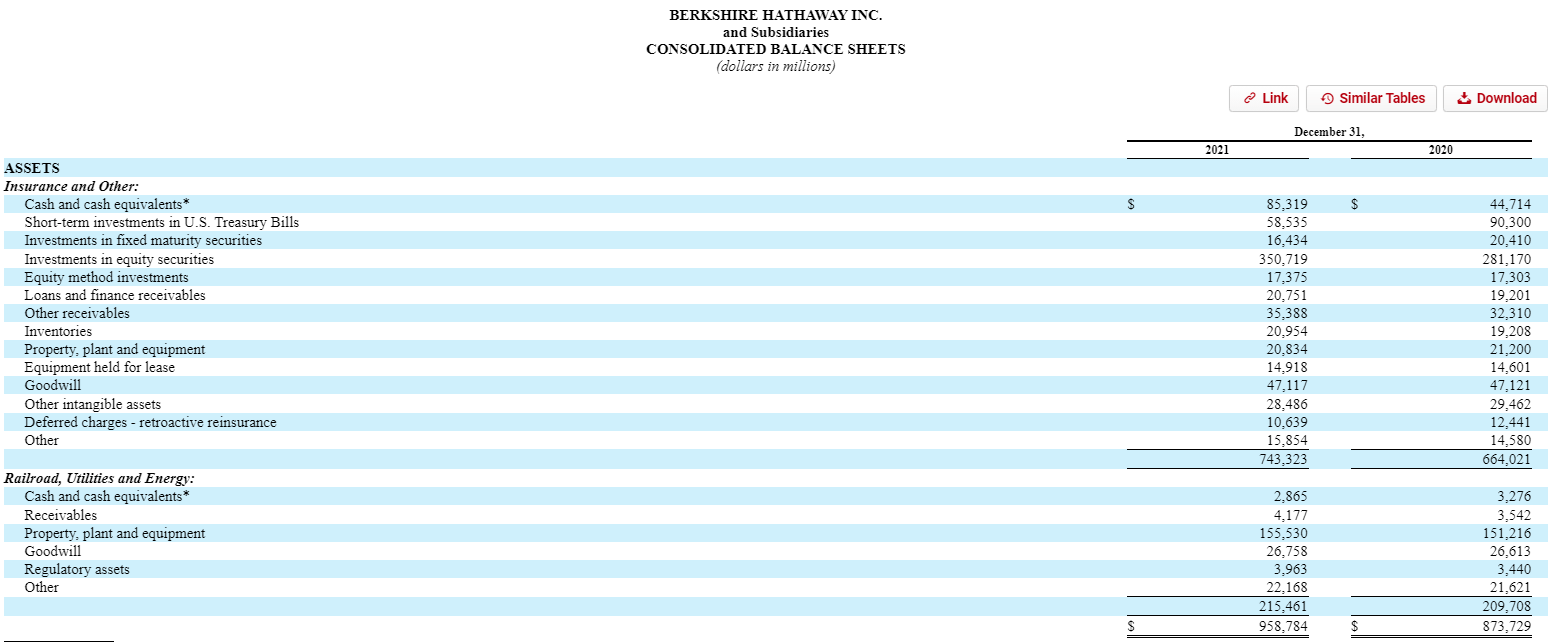

To see how different companies list their total current assets or assets in general, I present Berkshire Hathaway’s balance sheet.

As we can see, Berkshire presents their financials in a bit of a different format from Amazon and Apple. Buffett and his team present the financials so investors can understand the different components of their business.

For example, because Berkshire operates as a conglomerate containing diverse businesses such as insurance companies and railroads, they need to break the balance sheet into different sections.

We can also see that cash, marketable securities, and equities make up a large portion of Berkshire’s assets. Those categories comprise over $531 billion of Berkshire’s $958 billion worth of assets.

What Are Total Current Assets vs. Total Assets?

Any asset that will generate economic value for or within a year is considered a current asset. In addition to long-term fixed assets, intangible assets, and other non-current assets, total assets include all current assets.

As a result, a company’s current assets only make up a small portion of its overall assets.

Total assets refer to all of a business’s assets or valuable possessions. Cash accounts receivable (money owed to you), inventory, equipment, tools, etc. are all included in total assets.

To determine a company’s total assets, sum together all of the values of its assets.

Common line items outside of total current assets include:

- Goodwill

- Intangible assets

- Net Property, Plant, and Equipment (Net PPE)

- Other non-current assets

The big difference between total current assets and total assets remains liquidity. Total current assets represent cash or near cash in their ability to liquidate those assets to cash in a quick manner.

For example, they need to generate cash to fund a project and turn the inventory into a sale. Or reach out to vendors to receive payments sooner for better terms or a discount on outstanding balances.

How Can Investors Use Total Current Assets?

When it comes to running a corporation daily, company management places a high priority on the total current assets figure. Management must have the money available when invoices and loans are due.

The total current assets amount shows the company’s cash and liquidity in terms of dollar value. If necessary, it enables management to reallocate and sell assets to maintain business operations.

We can use financial or liquidity ratios to measure a company’s liquidity position.

The following ratios can help us determine Amazon’s liquidity.

The current ratio compares a company’s total current assets to its current liabilities, or the value of debts due within a year, to assess its capacity to meet short-term obligations.

The quick ratio evaluates a company’s capacity to cover its most liquid liabilities in the short term.

It subtracts the amount of the Current Liabilities account from the value of the Cash and Cash Equivalents, Marketable Securities, and Accounts Receivable accounts.

We don’t include Inventories in this computation due to the variable liquidity of inventory.

Cash ratio

The cash ratio represents the amount of the Cash and Cash Equivalents account divided by the value of the Current Commitments account to determine a company’s ability to pay down all of its short-term liabilities using cash quickly.

Investor Takeaway

Understanding the current asset formula is essential because it is a crucial sign of a company’s near-term financial stability. Understanding the terms associated with the line items will give us a better understanding of the company.

We can use the above ratios to help us analyze the company’s liquidity. The appropriate range for the company’s current asset to current liability ratio is between 1.25 and 2.00. If the ratio is less than 1, then the current liabilities are more than the current assets.

It indicates that the company’s current assets are insufficient to effectively cover its current financial obligations.

Understanding balance sheets and how to analyze them will help you find strong, financially fit companies. During times of stress, a company with a strong balance sheet has a better chance of surviving and even thriving during a hard time.

Buffett uses his understanding of balance sheets to help him identify companies with moats and how well those companies use their assets to generate sales.

The liquidity represented by total current assets will give you a quick snapshot of the financial stability of any given business.

And with that, we will wrap up our discussion for today.

Thank you for taking the time to read today’s post, and I hope you find something of value. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- What are Cost of Goods Sold and What’s Included in it? Controlling costs remains one of the more important jobs of management. They must control the costs of producing revenues, which reflect their profits. One of...

- Commercial Paper For Beginners “The commercial paper, when that dries up, you know, that’s just like sucking the blood out of the economic body of the United States.” Howard...

- Investment Terms Everyone Should Know Updated 9/3/2023 If you are new to investing, all the terms and jargon might seem overwhelming. But today’s post will help you learn some of...

- What is Minority Interest and How Do I Find It? Acquisitions, as a part of growth, continue to play a role in the markets. Many companies use this strategy. Berkshire Hathaway, Google, and Constellation Software...