Insider trading? Isn’t that a bad thing? Well, turns out that it’s not always a bad thing and that tracking insider trading can actually lead to some great buying opportunities!

This is a topic that stemmed from a listener question that Andrew and Dave addressed on the podcast and I think it would be good to expand a bit on it and maybe even do a quick example!

But first, what is insider trading? Investopedia says that “insider trading involves trading in a public company’s stock by someone who has non-public, material information about that stock for any reason.”

You might think of insider trading of being only a bad thing but that’s definitely not the case.

But in essence, people are taking information that the public doesn’t know about and then selling their shares, or buying more, to capitalize on the swings in the share price once that data become public.

Personally, I think about a recent case with Moderna (MRNA). MRNA is a biotech company that is actively chasing a vaccine for the coronavirus and they’ve recently reported some really optimistic news on a small test that they have done with 45 people that show positive results. At first, they reported positive initial data on an even smaller sample size (like 10 people or less) and there were also some insider trades done in that same time period, so people thought that it seemed very fishy.

Now that the full report has come out as being positive, and that MRNA has said that their management all follows a very strict procedure of planned stock transactions, it has helped alleviate some of the concerns that MRNA might have been falsifying information and then trading against it, but it was a very real concern at that time.

But the thing is, insider trading is actually perfectly normal! Management is allowed to buy and sell shares of the company as long as they’re not using this non-public information and are obeying all laws that they need to follow. Just as when you see a stock selling off hard it might be a bad sign and when you see a lot of demand for a stock it could be a good thing, it is not different with management!

Management buying stock can be a GREAT sign that positive things are on the way for the company and likely the share price, but you just need to make sure that you’re really understanding the true relative importance of that purchase. A few important things to think about are:

- Who is making the transaction?

- How much is that transaction relative to the employees’ salary?

- Is it a strict buy/sell or is it a stock option being executed?

These three pieces of information are vital to know because it can really help show the true importance of an insider trade! Let me explain further:

First, let’s go to GuruFocus and type in ALDX (Aldeyra) into the search bar:

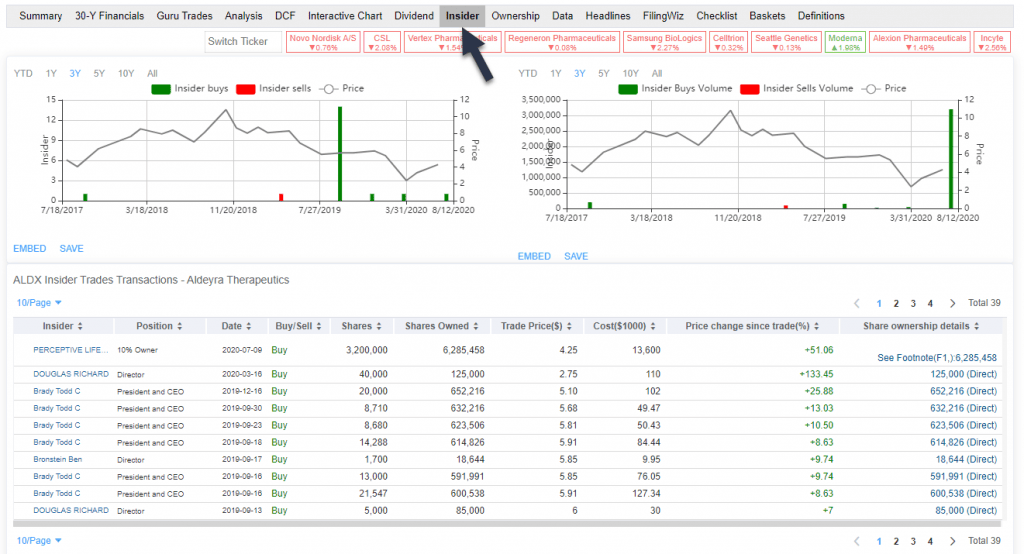

Then you’ll click on the ‘Insider’ tab and you can see a couple graphs and data about all the transactions:

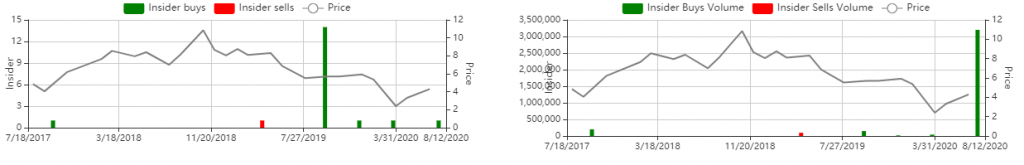

First, I like to see the graphs to see if the buys or sells have been trending at all. In this case, it looks like the buys have been trending quite a bit since mid-2019 and the volume has really picked up strong as there are some major planned buys on 8/12/20:

Now that we see the trend, we can look at the exact details in the chart of who is making the decision, which kicks off the three important questions to ask!

Who is making the transaction?

The most common name here is Todd Brady, CEO at ALDX. He has made a lot of purchases but all for relatively small volumes. The largest purchase has been by Perceptive Life Sciences which is a fund and a 10%+ owner of ALDX. Other than that, there have been some purchases by Doug Richard, who is a director and has the second largest purchase recently with 40,000 shares.

How much is that transaction relative to the employees’ salary?

Per Wallmine, Richard Douglas made $169,675 as a Director at Aldeyra and his recent purchase was $110,000, meaning he simply bought shares worth about 65% of his salary – that is a monster amount!

To me, this means that he really has some major faith in the company and is putting his money where his mouth is.

Is it a strict buy/sell or is it a stock option being executed?

Looking at this data, it doesn’t seem like it was a stock option purchase because when stock options are being executed it will say something like ‘401k’ or something else similar in the column titled ‘share ownership details’.

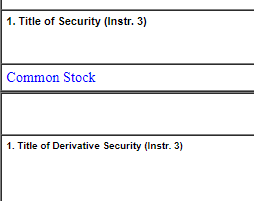

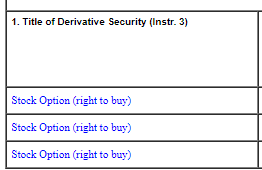

Then, you can click on the link and it’ll take you to the SEX website where you can see if it was common stock or options. The first image is the ALDX purchase noting common stock and the second would be a stock option example:

So, a director of the company bought a massive amount of shares worth about 65% of his annual salary, and he wasn’t executing stock options but rather just purchasing common stock. Does that seem like a bullish piece of qualititiave data? I mean, it absolutely does to me.

But, at the end of the day, I am going to invest in companies that are undervalued vs. their intrinsic value because I think that’s where I will get the most value and also maintain a margin of safety.

Related posts:

- The Roles, Levels, and Salaries of C Level Management Explained C level management, or the C-suite, includes all the top managers of any company such as Microsoft, Berkshire Hathaway, and Tesla. The C level management...

- Stock Repurchases: How They Work and Their Effect on Earnings Updated 3/6/2024 In today’s market, share repurchases are the choice that most public companies use to return value to their shareholders. Investing giants such as...

- What is a Stock Proxy? What’s a Voting Proxy? | Simple Guide for Beginners A stock proxy is a document that public companies have to release every year. In it, investors will find details about management, the board of...

- What Buybacks King, Henry Singleton, Can Teach Us About Capital Allocation Before Warren Buffett and his special conglomerate, the compounding machine Berkshire Hathaway, there was a CEO of Teledyne called Henry Singleton—who pioneered prudent capital allocation...