401k’s are OLD NEWS! Kidding…kinda…not really. Personally, I am a huge fan of the IRA and think that everyone should be utilizing them whenever they can. But even if you are, are you on track for your retirement? Only one way to tell – a Traditional IRA Calculator!

First, let’s talk about what an IRA even is. IRA stands for Individual Retirement Account and you can invest money into this account, for the purposes of retirement, as long as you meet a few different requirements. It’s almost like an individual 401k.

You don’t have a company match, obviously, or anything like that, but you can save some money and the government gives you some tax advantages for it. Taking advantage of these tax advantages are the difference between a novice and a pro, or someone that retires early and someone that will retire late!

Per NerdWallet, you need to meet the following:

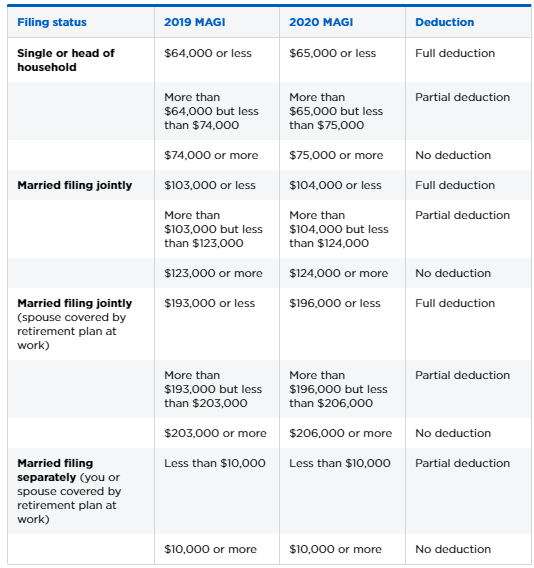

- Stay under the income limits. Those limits, in 2020, are below:

- Keep your money in the IRA until you’re 59.5, or you will face a 10% withdrawal penalty

- You have to take your money out, or at least start taking it out, by age 72

- Max annual contribution of $6000 (as of 2020) for most people while catchup contributions allow you to put in $7000

That’s it! Really, the only main hurdle is the income limits, which admittedly are hard to hit and if you are hitting them on a regular basis, then good on you – you probably don’t need to worry about this measly retirement account!

One thing that I love about the IRA is that you can contribute to last year’s IRA contribution limit up until Tax Day of that year. So, you could’ve contributed $6000 on 4/15/19 for your 2018 IRA contribution, and then contributed another $6000 that same day for your 2019 contribution!

You get an extra 3.5 months to try to build up that money and it’s a huge help to get some money stashed away.

I’m writing this in the middle of the coronavirus, which the jury is still out if this will be the worst stock market crash of all time, but since the tax due date was extended, you can still contribute money into your 2019 IRA until 7/15/20! That means you have an extra half year to get that money into the 2019 IRA. I know that many people are in major financial times, but you also got stimulus packages.

If you need to use that money for day-to-day life, do that and don’t look back. If you don’t have an emergency fund then you need to build that up. But if you have both of those covered and don’t have some crazy high interest debt like a credit card, put that money into an IRA! You can get an IRA with most great brokerage firms.

Unfortunately, this does not include Robinhood. They’re excluded because I said “great”. But they also just don’t offer it. I used to be a Robinhood user but then the site LITERALLY SHUT DOWN and I said “gimme my money, I’m walking” and now I’m 100% at fidelity and I love it!

But IRA’s are truly awesome, and you have two great options between a Roth and a Traditional.

A Roth IRA is used with after-tax income and a Traditional IRA is used with pre-tax income.

Both have major benefits and while I know that it can be a heated topic if you should invest in a Roth or a Traditional IRA, the simple answer is that neither is wrong because you’re saving EXTRA for your retirement!

Benefits of a Traditional IRA

- Money goes in tax free and gets put to work faster

- If you think your tax rate will be lower when you need it, then you will be taxed at a lower rate in the future than you are now, meaning you’ll have more money than if you put it in a Roth.

- Reduces your taxable income

Benefits of a Roth IRA

- Money goes in after tax but so you know exactly what you have. Every penny in there is yours because you don’t ever have to pay tax again

- If you think that you’ll be taxed at a higher rate in the future then this will be better off

- Your contributions can be withdrawn at any time, tax and penalty free, because you already paid tax on that money when it was going into the IRA.

- You can actually put more money into a Roth IRA than a Traditional IRA. While this factually is inaccurate (lol), you can put in $6000 of after-tax money. $6000 of after-tax money vs. $6000 of money that will be taxed in the future is absolutely a major benefit for you to consider. Simple math is that if you’re taxed at 25%, then putting $6K into your Roth would be like putting $8K into your Traditional IRA, which as I said, you cannot do.

The last reason is the main one that I like a Roth IRA. I think it motivates me to save even more money and just get that much closer to my goals but I do have some money in traditional accounts as well. There’s been a lot of talk the last few years that the government might take away the tax advantage of the Roth IRA and make you pay taxes anyways, and while that would be a load of crap and legitimately stealing, I guess it could happen, so that’s also another major benefit of a Traditional IRA and it’s part of the reason why I diversify where I put my money.

Again, as I mentioned, there is no right or wrong. Both are great! I think the Roth is better but I also don’t trust the government to honor things honestly, so I put a little bit in my Traditional. I think it’s a good time to note that the total limit is $6000 and that doesn’t apply to each account – $6000 total in IRA’s each year, as of 2020.

So, I think you probably have a good grasp on the IRA and it’s benefits now, but how can you tell if you’re actually on track? Well, Handy Andy recommends that you download this Handy Dandy Traditional IRA Calculator!

I made this specifically with the intent of allowing you to be able to see how investing in an IRA can save you monster amounts of money if you take advantage. All that you need to know is a few key pieces of information:

- Annual Contribution – this is simply the amount that you want to put in each year. The limit is $6,000 as of 2020 so you cannot go over that unless you’re in a catchup contribution period.

- Growth Rate – the Compound Annual Growth Rate, or CAGR, since 1950 has been 11%. I like to use 8% to be conservative but you can input any number that you might like.

- Current tax rate – If you’re unsure, take a look here for the 2020 tax brackets (https://www.kiplinger.com/article/taxes/t056-c000-s001-what-are-the-income-tax-brackets-for-2020-vs-2019.html) or simply just google it to find your bracket.

- Future Tax Rate – you can put whatever you want here. I put a few percent higher than current just because I really like to be conservative and this helps me make sure that I am running an analysis with a margin of safety!

- Years Investing – how long do you plan to invest before needing this IRA money? 10 years? 20? 50? No matter what it is, just input the number you think is right. Again, be conservative!

Once you know all of this information you can see how your future balance might look with a Traditional IRA – check it out!

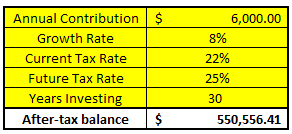

I am assuming that I am going to max out my contribution of $6,000 at an 8% return, am currently in a 22% tax bracket and will be in a 25% bracket in the future, and that I intend to invest for 30 years. That means that my after-tax balance will be over $550K! Not bad for only putting in $180K ($6K/year * 30 years).

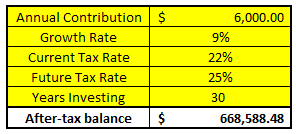

Pretty dang cool, right? You can change up the numbers as you please to see how things might look if you were to up the interest rate to 9%:

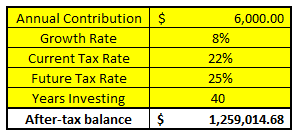

Or, maybe you think that you will only get an 8% return in the market but instead you plan to not touch your money for 40 years…how would that make things look? Spoiler – the answer is AMAZING!

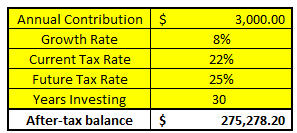

Of course, not every scenario is a great one. What if you could only put in $3K?

It’s not fully capped out but still an amazing accomplishment for you! That’s $275K at retirement when you really will want it for health, family visits, spoiling those sweet grandkids, and many other reasons, so I tip my hat to you for starting early and planning ahead!

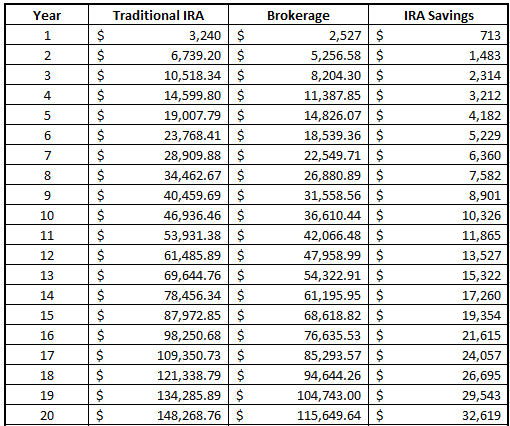

In addition to this summary that I have shown above in the screenshots, I also breakdown the balance on an annual basis, and along with that, I show how the balance might’ve changed if you were to simply invest your money into a brokerage account.

If you put your money into a brokerage account then you’re going to pay your current tax rate now and the also pay taxes later! It very well could be a long-term capital gains tax but who knows what that rate will be in 30 years – the thing is that you’re paying taxes TWICE!

Take a look below if you were to do this:

My chart goes all the way through 75 years which is way in excess of what you will actually need but you can see that even just twenty years will save you nearly $33K. And you’re doing almost nothing different – you just had to open a different account!

That’s the main thing with personal finance that I have learned – sure, becoming financially autonomous does take a little bit of time, effort and education, but for the most part, a lot of this is things that we’re already doing now!

If you’re currently investing, whether it’s in stocks or in ETFs or anything else, and it’s in a brokerage account, then you’re just flat out wasting money. If you had simply taken a little bit of time to learn about an IRA, then you could literally save tens of thousands of dollars for your retirement!

It’s such a simple change that can go such a long way and the only thing keeping you from taking advantage is a lack or awareness/education.

That’s why I love writing about these kinds of things – I feel like I can spread the word about some great ways to make us all better off financially to help us reach our goals just a little bit faster.

So, with that in mind, I’d be remiss if I didn’t say that the main reason that I love the Roth IRA is because I can actually sneak extra money into my account!

No, I’m not defrauding the government, but the main difference between a Traditional and a Roth IRA is that a traditional is pre-tax income and the Roth is after tax. Well, they both have a $6,000 cap but $6,000 of pre-tax isn’t the same as $6,000 after tax.

For instance, if your tax rate is 22% as I had used in the example above, then $6000 of pre-tax money is worth $4,680 ($6,000*.78%) in after-tax money.

So, in other words, even if you maxed out your Traditional IRA, you’re going to have less than you would if you maxed your Roth because you can put in after-tax money up to $6,000 into that Roth!

Of course, that means you’re going to have less to live on because you’re choosing to save more, but the entire point of this blog is to show you how to maximize your tax savings with an IRA and by using a Roth, you can get a tax savings on MORE AFTER-TAX money than you can with a traditional IRA.

It might seem like a ton, but if I have taught you anything, I hope it’s that little changes can add up quickly.

If you have that extra cash at the end of the month and are debating between putting money into your IRA or your 401k, don’t worry – we have you covered there too!

Related posts:

- Optimize Your Retirement With This Roth vs. Traditional 401k Calculator! To many people, the terms “Roth” and “Traditional” only apply to their IRA, but I am here to tell you that this is not the...

- Hey Andy – Does HSA Roll Over My Savings from Year to Year? Recently I was having a conversation with a friend and they told me that they didn’t use an HSA because they didn’t want to lose...

- IRA vs 401k, Roth vs Traditional – Retirement Accounts Made Simple You decided to open a 401k. Finally! A smart decision today. But now they want to stump you with some investing jargon. Do you want traditional?...

- CD vs. Savings Account: Which will make you wealthier? There is a time and a place for a Certificate of Deposit (CD) and there is a time and a place for a high-yield savings...