Updated 3/26/2024

When I first started investing, trying to understand all of the lingo and complicated methods was simply overwhelming. Many of us have likely heard of retirement accounts, but chances are, we have no idea what they do or why they’re there.

That’s the exact reason why I want to dive into Individual Retirement Accounts (IRAs) and answer the question, “What Types of IRA Best Fit My Life?”

Even if you are an investor and are pretty well-versed in personal finance, I’d be willing to bet that you wouldn’t be able to list all of the different types of IRAs that exist. I know that I wasn’t.

Most of you would know the Roth and Traditional IRA, and maybe a couple would be familiar with a SEP IRA or a Spousal IRA, but there are still three more lesser-known, but still worth considering, accounts.

Yes, there are seven different IRAs!

That might sound a bit overwhelming, so let’s start with some of the basics.

Click to jump to a section:

- What Even Is an IRA?

- Traditional IRA

- Roth IRA

- SEP IRA

- Nondeductible IRA

- Spousal IRA

- SIMPLE IRA

- Self-Directed IRA

What Even Is an IRA?

As I mentioned before, an IRA is an Individual Retirement Account. You might be familiar with a 401k sponsored through your employer, which is similar, except an IRA is independent of your employer.

You can open an IRA with almost any brokerage firm you want, and they will offer you this option as an account.

You would want to open an IRA because it gives you a pretty significant tax advantage, either when your money goes into the account or when you pull it out, depending on the IRA that you choose.

In return for this tax advantage, your money has to stay in the IRA until you’re at least 59.5 or older. You cannot pull out any more funds than you’ve contributed unless you want to pay taxes and a 10% penalty. Hard pass on that!

For the most part, that’s an IRA for you. Of course, with seven different versions, there are intricacies to them all, so let me touch on those quickly.

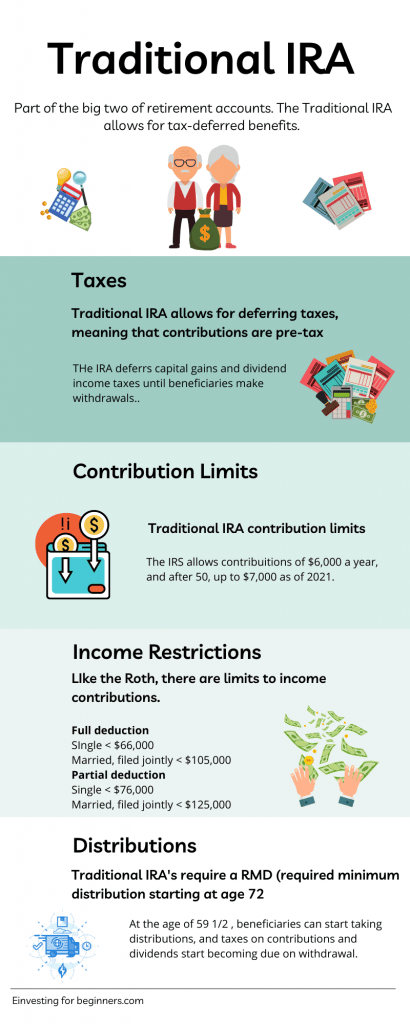

Traditional IRA

A traditional IRA is funded with pretax money, meaning that your money will go into the account tax-free. On the flip side, that means that when you decide to withdraw money from your account, you’re going to have to pay taxes on it at your current income tax rate.

In 2024, the contribution limit is $7K for Traditional IRAs, meaning that’s the maximum that any person can put into their IRA for that year. Now, if you’re over 50, there is a thing called “catch up” contributions where you can put in an additional $1K each year for a total of $8K.

To contribute to a Traditional IRA, your income has to be under $77K if you’re single/Head of Household or $116K if you’re married and filing jointly. These incomes are relatively low compared to some of the other IRA options which might seem surprising, but you have to take a step back and think about it from the government’s perspective.

The government, like anyone else, wants its money now. When you pick a pretax IRA like the Traditional IRA, you’re choosing to pay taxes later rather than now, aka delaying when the government gets its tax money.

To deter this from happening, the IRS puts lower income limits so you can phase out faster, and this is no longer a viable option for you. At that point, you will likely make a move to an after-tax IRA.

Who is this best for?

At the end of the day, the debate of Roth vs. Traditional comes down to one question – do you think your taxes will be higher now or when you need the money in retirement?

The Traditional IRA is best for people who think their taxes are higher now. For example, maybe you’re in the 32% tax bracket now and think you’ll be in the 22% tax bracket in retirement. If so, it makes sense to save 32% in taxes now and then pay 22% later, a net gain of 10%.

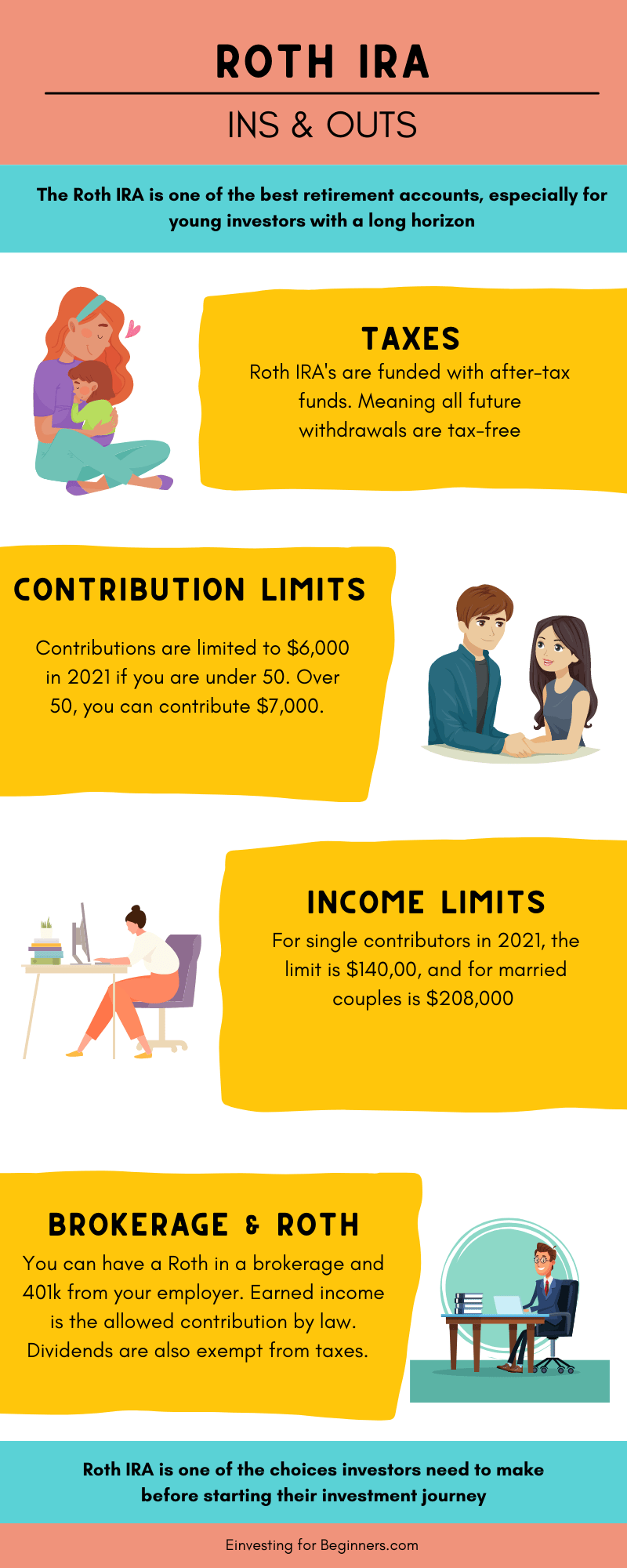

Roth IRA

The Roth IRA is the exact opposite of the Traditional IRA. You’re going to pay taxes now and then when you withdraw money from your IRA, that money will be completely tax-free. In other words, whatever your account balance is at that moment in time is exactly the amount of money that you’ll be able to pull out and not pay a penny of taxes.

The contribution limits are the same at $7K and an additional $1K for catch-up contributions as of 2024.

The income limits, however, are much different. To make the full contribution, single filers and heads of Households must make under $161K in 2024, but they can still contribute a smaller amount up to $144K.

If married filing jointly, the income limit is $153K and becomes completely phased out at $240K.

If you’re unsure if you’ll be over the Roth IRA max or not, I recommend setting aside money in a brokerage account until you can determine your annual income. If you’ll be under the limit, simply transfer that money from your brokerage into the Roth. If you’re over the income limit, then you can let it sit or maybe check out another option I’ll discuss later.

Additionally, you can withdraw any contributions that you’ve made at any time for any reason and not pay taxes or fees. This can give you some ultra flexibility if you were to ever need it.

Who is this best for?

The Roth IRA is the opposite of the Traditional IRA and is best for people who think their taxes will be higher in retirement.

Additionally, the Roth IRA is best for those who want a bit more flexibility to withdraw funds if a crisis occurs and treat the contributions like a pseudo-emergency fund.

The Roth IRA is also great for those who just want peace of mind. Once you’ve paid taxes, you’re done. Your future tax rate doesn’t matter. Your account balance is what you get. It’s very beneficial to have some tax-free income in retirement.

SEP IRA

A SEP IRA, or Self-Employed Pension IRA, is funded by an employer for its employees. It is a type of Traditional IRA in the sense that money goes in pretax and is taxed when the account holder withdraws it.

Most people likely will not qualify for a SEP IRA because of their employment status, but those that do can find it to be extremely beneficial. There are some specific rules for having a SEP IRA, though, so I highly encourage you to do some major investigation before opening.

Who is this best for?

The SEP IRA is best for self-employed people because it has minimal administration and setup costs. Additionally, the contribution limits are much higher, at $69K in 2024.

Nondeductible IRA

This is my least favorite kind of IRA. If your income is above the IRA income limits, you can contribute after-tax dollars, similar to a Roth IRA, but those funds will be put into a Traditional IRA. The benefit of doing this is these funds will grow on a tax-deferred basis, meaning you won’t pay any taxes while your money is still in the IRA, but when you withdraw it, you’ll pay taxes on all of your growth.

As I mentioned, I hate this option. You don’t avoid taxes on either the pretax or after-tax side, and your money is tied up in the IRA until you’re 59.5 at a minimum. So, no tax advantage and no flexibility to pull this money out if you need it at any point in time.

Pretty awful, right? It’s a lose-lose. If you’re over the income limit, you might as well just put your money into a brokerage account so you have the ability to tax-loss harvest and also withdraw the funds if/when you need them.

Now, believe it or not, there is one scenario where I LOVE the Nondeductible IRA. You can perform something called a Backdoor Roth conversion, where basically you put money into the nondeductible IRA and then immediately transfer it into a Roth IRA. Once in the Roth IRA, your money can grow tax-free in perpetuity.

It’s simply just a workaround for the income limits that the IRS has put in place. Sounds too good to be true, right? Well, it might be. The Backdoor Roth has been in recent conversations to be disallowed but as of February 2022, we’re still in business!

If you’re thinking about doing the Backdoor Roth, just do a little bit of research before execution to save yourself some time, money, and a massive headache.

Who is this best for?

The Non-Deductible IRA is best for those who are over the Roth IRA contribution limits but still want to save more for your retirement plan via the backdoor Roth.

If the Backdoor Roth were to ever disappear, I’d struggle to find a scenario in which it would be more beneficial than investing in a brokerage account.

Spousal IRA

Spousal IRAs are an amazing hack for people to take advantage of. Normally, to qualify to contribute to an IRA, you have to have earned income in that tax year, but with a spousal IRA, you can contribute funds for your spouse if they are not employed or have very little income and you file your taxes jointly.

The contribution limits are the same as they are for a working person, so for 2024, you could theoretically contribute $7K to your IRA and $7K to the Spousal IRA.

In theory, this is an excellent option to have one spouse work at home and still have some sort of retirement option because they won’t have a 401k, 403b, or another employer-sponsored retirement plan. On the other hand, I imagine that those families that only have one income likely might be in a pinch to be able to max out one IRA, let alone an additional spousal IRA.

And guess what – that’s completely okay!

The beauty of personal finance is that it has to fit into your life. Hell, with daycare costs the way that they are lately, anyone with a couple of kids in daycare must have a very high income even to sustain any sort of savings for retirement. Maybe a family can choose to have one parent stay at home to remove those daycare costs and then try to fund some of the spousal IRA.

The beauty of this is that you can be flexible in your decision-making and retirement-planning process. You have options out there that fit the life that you want, so figure out what you want, and then have your retirement planning evolve around that.

I have a friend whose wife stays home with their kids three days/week and works the other two days. When she goes to work, they make a minimal amount more than if she would stay home, but it’s simply good for her to have adult interaction.

I also have friends who both make $100K+, and when the first kid comes around, one of them is going to stay home with their child. Daycare is about $20K/year so they’re giving up, let’s say, $50K or so of after-tax money.

That’s an awful financial decision, but it’s an A+ personal decision. The spousal IRA is literally for this scenario. Figure out your home life and if it’s one parent staying at home, know that you have the Spousal IRA set for your use!

Who is this best for?

A Spousal IRA is best for a married couple with one spouse having a zero-to-low income. It allows you to lean on the majority of the “breadwinners” income to fully max out two separate IRAs.

SIMPLE IRA

A SIMPLE IRA, short for Savings Incentive Match Plan for Employees, is an excellent option for those who are self-employed or in a small company. Often, a SIMPLE IRA will be offered to employees instead of a 401k because it’s a cheaper, more flexible option with many of the same benefits.

Employers are required to offer their employees a match, typically up to 3%, as you would commonly see in a 401k.

One of the main differences between a SIMPLE IRA vs. a 401k is that the SIMPLE IRA contribution limit is much lower, sitting at $16K in 2024 vs. the 401k contribution limit of $23,000.

Who is this best for?

The SIMPLE IRA is best for small businesses that aren’t able to contribute more than the contribution limit, or those that have their own business as a side hustle and can use this SIMPLE IRA in addition to their 401k with their full-time employer.

Self-Directed IRA

A Self-Directed IRA operates under the same rules and contribution limits as Traditional and Roth IRAs, but the critical difference is that your investment options are much more vast.

In addition to the standard options that most IRAs let you invest in like stocks and bonds, a Self-Directed IRA allows you to invest in things like crypto, real estate, small businesses & startups.

There are some intricacies to having a self-directed IRA that you need to understand, so please make sure you do some further due diligence before opening one.

Who is this best for?

A self-directed IRA is best for the well-experienced investor that wants to find a tax-advantaged way to invest in some high-risk, high reward options. A bit like Peter Thiel!

Summary

Many people think of IRAs in black and white.

- Pretax or after-tax?

- If I’m over the income limit I’m out of options.

- If only one spouse has earned income you can only contribute to one IRA.

- $6K each year and that’s it.

I urge you to think outside the box because there are other options for you. Just because you don’t fit the criteria of the common Roth IRA doesn’t mean you’re done. Be creative!

Maybe it’s by taking a look at one of these other great IRA options. Or maybe it’s by maxing out your HSA instead (which I prefer over an IRA).

At the end of the day, do what you can to have your money work for you in the most effective way possible, and once you’ve figured out the best account, it’s time you look at the Sather Research eLetter!

Related posts:

- Everything you Need to Know: Traditional IRA Pros and Cons Traditional IRA accounts don’t have to be utilized just for retirement funds. Check out Traditional IRA pros and cons to see if an account makes...

- There are Several 401k Alternatives Available to You Are you stressed about your company not offering a 401K retirement plan? Don’t worry, there are tons of 401k alternatives for you to choose from....

- Sure I Save Taxes, but is the 401k Worth It? Updated 3/28/2024 The 401k is one of the most popular tools for investing for retirement because so many employers offer it. But, believe it or...

- Why You Should Start an HSA Investment Strategy if You Haven’t Already When you talk about retirement, you typically hear words like 401K or IRA. What you should be thinking about is an HSA investment strategy, and...