Have you ever had a stock jump massively after there was a merger and acquisition announced? Or, maybe the opposite happened and the share price dropped significantly. Either of these can happen for many reasons, so I think it’s fitting for us to take a deep dive into the various types or mergers and acquisitions!

Mergers and acquisitions, or M&A, happen all the time in business. Oftentimes you will see them happen so that a company can grow an area of their business faster than if they had grown it organically, but that is not always the sole reason. Maybe the company truly just sees an opportunity for cost cutting and “synergy” value, which is certainly a trendy word anytime you see M&A occurring.

Before we get too much into the impact on your investments, I think it’s very important for us to understand the 5 different types of mergers and acquisitions:

Horizontal Merger

A horizontal merger is between two companies that you might normally think of as being in direct competition with each other. You’ll typically see a horizontal merger take place so that those companies can lower costs, by becoming more efficient by maximizing economies of scale.

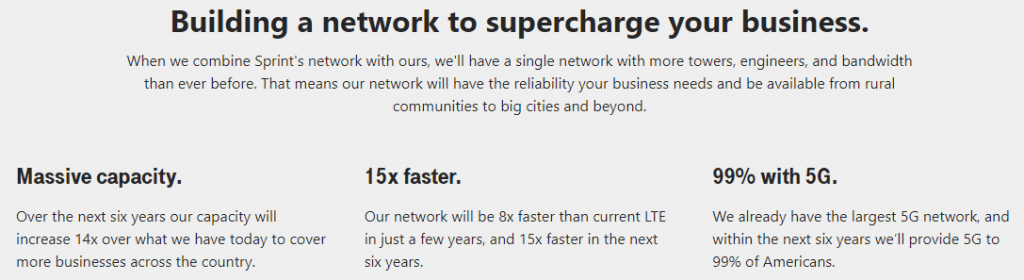

An example of a horizontal merger is when T-Mobile & Sprint merged together in 2018. The two companies merged (T-Mobile really acquired Sprint for $26 billion) bringing down the legitimate cell phone carriers to three from four.

Per the T-Mobile website, they really had three main goals:

- increase their customer base

- partner to become a faster supplier

- speed up the transition to 5G

They felt that rather than competing with one another, they would be advantaged to combine together and join forces to conquer. Oftentimes in horizontal mergers you might see some pushback from the FCC and in this case, that certainly was true as the merger was only approved by a 3-2 vote.

From my experience seeing these types of mergers and acquisitions, the question of approval really has two arguments:

- The companies merging say that they’re doing so to drive costs even lower by becoming more efficient

- Outsiders think that the companies are eliminating competition and will inevitably raise prices because there is no competition left

Which argument is right? I think it depends on a case-by-case basis – I’m just happy I’m not the one deciding!

Vertical Merger

Another type of merger and acquisition is the vertical merger. A vertical merger is one that applies along the same supply chain but is not in direct competition with each other. The reason that companies would want to partake in this sort of merger is because they might feel that they’d be better off simply combining efforts or buying someone that already specializes in a certain field, rather than starting from ground zero.

For instance, an example of a vertical merger is when Disney acquired Pixar. Disney hadn’t had great luck producing quality animated films so rather than continuing to try and fail, they decided to acquire Pixar because they already had a great track record of success. Some of their well-known films that you might be aware of include Toy Story (first one in my mind), A Bug’s life, Monsters Inc., Finding Nemo, Cars and many others.

This merger happened in 2006 and since then, they have continued to make more great films. Disney thought they’d be better off to acquire a company that already was an all-star rather than spending time and resources to continue to try and get it right.

Another theoretical example would be with a company like Apple. Apple recently announced that their Mac computers are going to be created with their own manufactured chips buy what if they had chosen to just acquire a company that was already making chips for the Mac?

That could’ve saved them time and money but maybe Apple simply prefers the ratability and consistency of keeping it in house, along with the fact that they will just have more controls in place to make updates as needed. In this case, Apple chose to keep it in house rather than taking part in a vertical merger.

Was this the right decision? Only time will tell!

Market-Extension Merger

The third type of merger that we will discuss is the market-extension merger. In this case, it’s exactly what you think – companies are merging together to be able to pursue markets that they haven’t previously been able to expand into.

Quite simply, they are choosing to buy their way into more markets with a company that’s already established there rather than growing organically.

One thing that’s great about this is that you have two different companies with theoretically no overlap that likely do not do things the same way. This allows for an opportunity for fresh perspectives and ideas to challenge the status quo and likely drive more synergistic value to the companies.

An example of this would be if a bank was wanting to grow their regional presence into a more national focused presence. For instance, in 2002, RBC Centura merged with Eagle Bancshares to help expedite the growth into North America.

Another example that I can think of is with a company that I used to frequent that was on Shark Tank in the past – Tom & Chee. Tom & Chee is a grilled cheese restaurant in Cincinnati, OH, and they have the most amazing grilled cheese you can ever imagine. They initially were only in Cincinnati but have started to expand outwards with a franchise model after being on Shark Tank, which is actually a great way to learn about investing!

If they wanted to speed up growth even more, they could simply acquire other chains with similar models in other markets to add to their portfolio.

Not saying that this would be the right choice or the wrong one, but it would expedite their growth for sure. Now that brings on its own challenges in itself, but it definitely would give them the ability to grow into more markets, faster.

Product-Extension Merger

The fourth different type of merger and acquisition is the product-extension merger. This is when a company merges with, or acquires, another company that then allows them to expand the product offering that they currently have. Notice how a lot of these names are pretty self-explanatory? Kinda nice!

Similar to the market-extension merger, companies will undergo this sort of merger because it is the fastest way for them to continue to grow and develop their business. Personally, I really see three different scenarios where this would benefit a company:

1 – Adding a complimentary product

A company might merge with another so that they can offer a complimentary product. An example of this is when Pepsi acquired Pizza Hut in 1977. It might not seem like a natural fit when you think about the core competencies of a business, but is there a more synonymous drink and food pairing? Maybe Italian and wine or beer and chicken wings, but I think pizza and pop is right up there!

By acquiring Pizza Hut, Pepsi now had a natural pairing for their drink that they could push with promotions and product placement to try to drive incremental sales.

2 – Meeting/Eliminating Competition

If you have some intense competition then maybe that company will want to acquire that other company to not only give them a leg up on this product but also to eliminate a competitor. Let me explain better with an example – Snapchat.

Snapchat is a form of social media that is very different than many of the other forms that were out there when it was started. It was new and was really shaking up the social media game. Facebook was threatened by Snapchat and actually tried to buy the company for $3 billion in 2013.

Snapchat turned down that offer, to the shock of many, and instead Facebook decided to try to make Instagram a direct competitor of Snapchat with similar features. The question is – who do you think won?

Well, Snapchat now has a market cap of $66 billion…so I’ll say them!

3 – Creating a One Stop Shop

This is similar to #1, but I do think it’s different if you can provide an all-inclusive service for your customers. For instance, let’s say that you’re an inventory management company. You can automatically detect for restaurants what products they need to order to make sure they never run out of items.

While that is great, consider what happens if the perfect order is placed but there are trucking delays and now the restaurant runs out of food. So, that inventory company goes out and buys a truck fleet as well to manage their own trucking. Their trucking is a new product/service that will make it that much stickier and keep customers from wanting to switch away from that company.

Conglomerate Merger

The last merger that we will discuss is the conglomerate merger. A conglomerate merger is a merger between two products or services that are completely unrelated. Truthfully, the product-extension mergers can really fall into this bucket a lot of times, such as with the example that I gave with the inventory company buying a trucking fleet.

There are really two types of conglomerate mergers:

- Pure conglomerate merger – two completely unrelated companies merging

- Mixed conglomerate merger – companies that are expanding product lines/markets

How it Impacts You

Any of these five types of mergers and acquisitions all can have a drastic impact on your investments, if you’re invested in a company that announces this sort of M&A. Typically, the share price of the company getting acquired will jump majorly and the buying company will have their shares drop in price.

This is because the company doing the acquiring is typically going to overpay for the company to get it approved by the board. They have to do some good faith to get everyone to approve them actually buying the company, so the board of the acquired will expect to be paid a premium for their company.

So, if you own the company getting acquired, you likely will also get a really nice hefty payday as well on this news. We saw this very recently when news broke that Salesforce (CRM) was looking to buy Slack (WORK).

When this news was announced, the shares did exactly what I described above. The Slack shares jumped by 38% that following day while the Salesforce share price dropped 5%. It was almost too predictable.

The scary thing is that if for whatever reason the acquisition doesn’t go through, then you can go ahead and bet the farm that those Slack shares are about to come down 38% and you’re going to wipe away all of those unrealized gains that you had from this announcement.

I frequently hear CNBC talk about how certain companies are “takeout candidates” and that they might be acquired. I personally think it’s very interesting to hear their logic and thought process but investing for this sole purpose is the most speculative thing imaginable.

There’s no analysis. No valuation ratios. No actual learning about the company. Nothing. Just guessing.

I think investing this way is reckless and dangerous and I would highly encourage doing the exact opposite. Focus on finding great companies that are undervalued vs. their intrinsic value and then you will be poised for long-term success.

My recommendation would be to continue to just keep expanding your circle of competence and when these M&A take place, then you can reap the rewards if you’re a shareholder. If you’re not, maybe you should take a look at the company to see if their M&A news is making them a more attractive investment for you.

Chances are, their share price is now a little bit cheaper. Go through the little bit of extra effort to put their financials into the Value Trap Indicator to help show you if you’re making a wise investing decision!

Related posts:

- Mergers and Acquisitions: Easy Basics for Beginners Updated 7/6/2023 Global mergers and acquisitions (M&A) volumes hit a record high in 2021, overtaking 2020’s deals. According to Refinitiv data, the total volume of...

- Financial Impact of Mergers and Acquisitions: Amazon’s Purchase of Whole Foods Updated 8/7/2023 Companies expend more energy on mergers and acquisitions (M&A) than any other means of capital allocation. For many companies, such as Cisco and...

- Cash Vs. Stock Acquisitions: What’s Driving The Bus? Updated 7/24/2023 “If you aggregate all of our stock-only mergers (excluding those we did with two affiliated companies, Diversified Retailing and Blue Chip Stamps), you...

- M&A As A Growth Strategy Updated 7/6/2023 Merger and acquisition activity drives much more growth than investors realize, and many companies practice mergers and acquisitions or M&A as their main...