The real estate investing world utilizes debt to help finance growth. Nonrecourse debt is one of the types of debt popular in the commercial real estate space.

Many use it to help stimulate their growth while also protecting their downside. Nonrecourse debt protects borrowers by limiting the liability to its collateral.

One shining example of the potential of nonrecourse debt is Brookfield Asset Management. They have leveraged this strategy to unlock tremendous value and drive impressive returns. With nonrecourse debt, borrowers have limited personal liability.

Unlike traditional loans, where borrowers are responsible for repayment, nonrecourse debt separates personal assets from loan collateral. Lenders can only go after the specific collateral, protecting personal assets if there’s a default.

Brookfield Corporation has used nonrecourse debt to embark on ambitious projects. In many cases, it wouldn’t have been impossible to do otherwise by securing financing against assets like real estate or infrastructure. Brookfield has scaled their operations and diversified their portfolio, maximizing returns.

In today’s post, we will learn:

- Understanding Nonrecourse Debt

- Pros and Cons of Nonrecourse Debt

- The Differences Between Nonrecourse and Recourse Debt

- Nonrecourse Debt in Real Estate Investing

- Case Studies and Examples of Nonrecourse Debt

Okay, let’s dive in and learn more about nonrecourse debt.

Understanding Nonrecourse Debt

Nonrecourse debt is a financial concept that can empower borrowers by limiting their liability and providing a unique way to secure financing. Let’s break it down into its definition and key characteristics and explore some examples to understand better.

**A note, borrowers can use nonrecourse debt in personal and business settings. Our focus will center on the business aspect.**

Nonrecourse debt, in simple terms, refers to a type of loan where the borrower has restricted liability to the collateral securing the loan.

Unlike traditional recourse debt, which holds borrowers fully responsible for repayment, nonrecourse debt safeguards assets from the loan. If a borrower defaults on the loan, the lender’s recourse is limited to the specific collateral.

Key Characteristics of Nonrecourse Debt

- Limited Liability: One of the primary advantages of nonrecourse debt is its limited liability. Borrowers have protection from losing their assets in the event of default. This safeguard allows individuals and businesses to take calculated risks and pursue ambitious projects without the constant fear of devastating consequences.

- Collateral-based Repayment: Nonrecourse debt is typically collateralized, meaning that borrowers securitize the loan with specific assets that serve as collateral. In the case of default, lenders have the right to seize and sell the collateral to recover their investment. The value and quality of the collateral play a crucial role in determining the terms and conditions of the loan.

- Non-Recourse Nature: The defining characteristic of nonrecourse debt is its non-recourse nature. This means lenders have no legal recourse to pursue the borrower’s assets beyond the collateral securing the loan. It gives borrowers protection and peace of mind, allowing them to focus on their ventures and investments without excessive worry about financial ruin.

Examples of Nonrecourse Debt

- Mortgage Loans: Mortgage loans are a common example of nonrecourse debt. The property is the collateral when individuals or businesses secure a mortgage loan to purchase real estate. If the borrower defaults on the loan, the lender has the right to foreclose on the property, but their recourse is limited to the property’s value and does not extend to the borrower’s other assets.

- Project Financing: In project financing, many use nonrecourse debt to fund large-scale infrastructure projects such as energy facilities, highways, or airports. The project’s assets and future cash flows act as collateral, shielding the borrower’s assets. This allows project developers to undertake substantial financial obligations while minimizing risk.

- Commercial Real Estate Loans: Commercial real estate loans are another example of nonrecourse debt. The property serves as collateral when financing the purchase or development of commercial properties like office buildings, retail spaces, or industrial complexes. If the borrower defaults, the lender can foreclose on the property but cannot pursue the borrower’s assets.

Understanding nonrecourse debt and its key characteristics is essential for borrowers and investors. It offers a way to secure financing while limiting personal liability.

We can gain insight into how nonrecourse debt functions in practical scenarios by exploring examples like mortgage loans, project financing, and commercial real estate loans; more on this in a moment.

Pros and Cons of Nonrecourse Debt

Nonrecourse debt offers several pros and cons for borrowers to consider. Let’s explore the benefits and drawbacks of this financing approach to gain a comprehensive understanding.

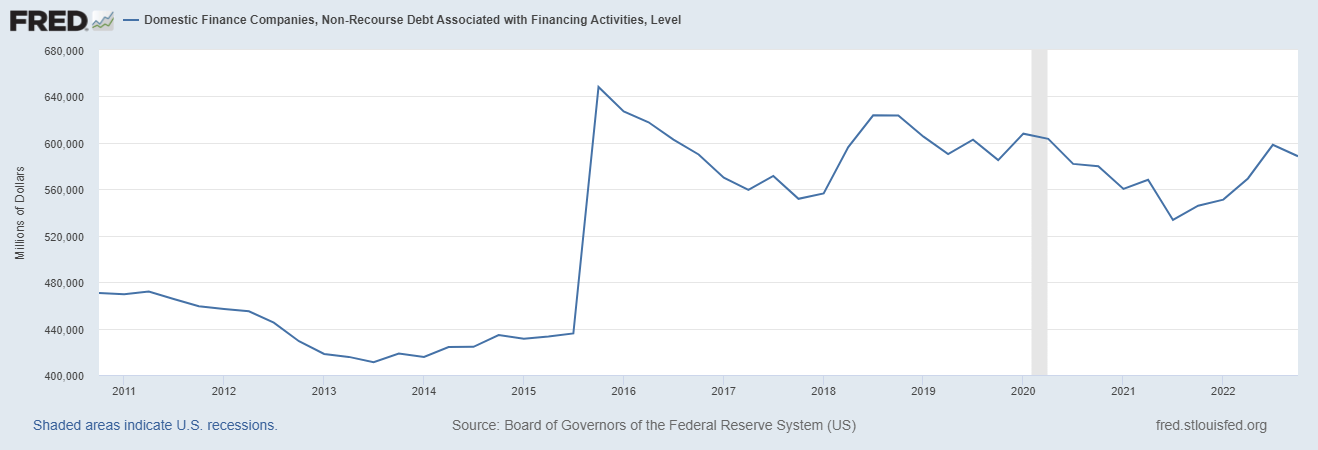

The use of nonrecourse has skyrocketed since 2016, as evidenced by the chart below:

Pros of Nonrecourse Debt

- Limited Personal Liability: One significant advantage of nonrecourse debt is its limited liability. Borrowers receive shielding from the risk of losing their assets in the event of default, allowing individuals and businesses to undertake ambitious projects and investments without constant fear of financial ruin.

- Risk Mitigation for Borrowers: Nonrecourse debt acts as a risk mitigation strategy for borrowers. By separating assets from the loan collateral, borrowers can focus on their ventures with greater security. If the investment or project faces difficulties, its assets remain protected, minimizing the potential impact on its overall financial well-being.

- Potential Tax Benefits: Nonrecourse debt may offer potential tax benefits for borrowers. Depending on the jurisdiction and specific circumstances, the interest payments on nonrecourse loans may be tax-deductible. Which can help reduce the overall tax burden and increase the financial viability of the investment or project.

Cons of Nonrecourse Debt

- Stricter Loan Requirements: Nonrecourse debt typically has stricter loan requirements than recourse debt. Lenders are more cautious when extending nonrecourse loans due to the limited recourse available in case of default. Borrowers may need to provide detailed financial information, demonstrate a strong credit history, and showcase the project’s or investment’s viability to secure nonrecourse financing.

- Higher Interest Rates: Nonrecourse debt often carries higher interest rates than traditional recourse loans. Lenders charge higher rates to compensate for the increased risk they assume by limiting their recourse to specific collateral.

- Limited Recourse in Case of Default: While limited personal liability can be advantageous, it also means that borrowers have limited recourse in the event of default. If the value of the collateral securing the loan falls significantly or the project fails, lenders may only be able to recover their investment by selling the collateral. Borrowers should brace themselves for losing the collateral without recourse to their other assets.

Understanding the pros and cons of nonrecourse debt is crucial when evaluating financing options. Limited liability, risk mitigation, and potential tax benefits can make nonrecourse debt attractive.

However, borrowers should be mindful of the stricter loan requirements, higher interest rates, and limited recourse in case of default.

The Differences Between Nonrecourse and Recourse Debt

Nonrecourse and recourse debt are two distinct types of financing that borrowers should understand when considering their options.

Let’s explore the differences between these two approaches to debt and how they impact borrowers. Remember, this is from the point of view between Blackstone and an asset they buy, for example.

Nonrecourse debt is a type of loan where the borrower’s liability is limited to the collateral securing the loan. In contrast, recourse debt holds borrowers fully responsible for repayment, extending the lender’s recourse to their assets beyond the collateral.

Key Differences Between Recourse and Nonrecourse Debt

- Personal Liability: The primary difference between nonrecourse debt and recourse debt lies in the level of personal liability. With nonrecourse debt, borrowers enjoy limited personal liability, as lenders can only seek repayment from the specific collateral securing the loan. Recourse debt, on the other hand, holds borrowers fully accountable, allowing lenders to pursue their assets if they default on the loan.

- Collateral Evaluation: In nonrecourse debt, collateral evaluation plays a critical role in securing the loan. Lenders carefully assess the value and quality of the collateral before extending financing. Lenders can only recover their investment if the borrower defaults by selling the collateral. In recourse debt, collateral evaluation is also important, but lenders have the additional assurance of recourse to the borrower’s assets.

- Loan Terms and Conditions: Nonrecourse and recourse debt also differ in terms of loan terms and conditions. Nonrecourse loans often have stricter requirements due to the limited recourse available to lenders. Borrowers may need to provide more detailed financial information and demonstrate higher creditworthiness. Recourse loans may offer more flexible terms and lower interest rates since lenders have greater recourse to the borrower’s assets.

When choosing the right financing option, understanding the differences between nonrecourse and recourse debt is essential. Companies like Brookfield and Blackstone will weigh the difference carefully and use the best financing option for their investment.

Nonrecourse debt provides limited personal liability, giving borrowers a sense of security. However, it requires thorough collateral evaluation and may require stricter loan requirements.

While carrying higher liability, recourse debt often offers more flexible terms and lower interest rates. Borrowers can decide whether to opt for nonrecourse or recourse debt by considering their risk tolerance and specific financial goals.

Case Studies and Examples of Nonrecourse Debt

Let’s use a couple of companies to illustrate the impacts of nonrecourse debt on businesses.

Brookfield Corporation is a global alternative asset manager with a diverse portfolio spanning real estate, renewable energy, infrastructure, and private equity.

Brookfield has established itself as a leading player in the investment management industry with a focus on long-term investments.

They leverage nonrecourse debt to fuel their projects and mitigate liability. Brookfield has achieved impressive returns and scaled their operations through the strategic use of nonrecourse debt, such as in real estate and project financing.

Their success serves as a testament to the potential of nonrecourse debt as a powerful tool for financial growth and risk management.

Case Study: Brookfield Corporation

Brookfield Corporation serves as an exemplary case study showcasing the strategic use of nonrecourse debt. They have successfully utilized this financing approach to fuel their investments and drive impressive returns.

For instance, Brookfield has leveraged nonrecourse debt in their real estate investments.

By securing financing against the property itself, they have been able to pursue ambitious projects with limited personal liability. If any of their real estate ventures were to face difficulties, their assets would remain protected.

Additionally, Brookfield has utilized nonrecourse debt in project financing.

They have funded large-scale infrastructure projects, such as energy facilities and transportation networks, by leveraging the future cash flows of those projects as collateral. This approach allows them to undertake substantial financial obligations while mitigating personal risk.

For example, Brookfield Renewables, one of the Corporation’s subsidiaries, purchased renewable developer Urban Grid, adding almost 20,000 Megawatts of solar and energy storage projects in the U.S.

The purchase price equaled $614 million, of which Brookfield used $346 million in non-recourse debt to help finance the deal. In 2022, Brookfield Renewable purchased $2.5 billion of assets and used $800 million of nonrecourse debt to help finance those deals.

That means the company used 32% nonrecourse debt to finance growth, which is normal for a subsidiary of Brookfield Corporation. And because of the structure of the deals and use of nonrecourse debt, the parent company, Brookfield Corporation, isn’t on the hook if any deals go south.

Looking deeper at the capital situation for Brookfield Renewable. It carries almost $24.6 billion of debt on its balance sheet, but $22.3 billion is nonrecourse, which equals 91% of the company’s debt.

By strategically utilizing nonrecourse debt, Brookfield Corporation has scaled its operations, diversified its portfolio, and maximized returns for its investors.

They have effectively harnessed the benefits of limited liability while making calculated investments in various sectors.

Case Study: Blackstone

Another example of the use of nonrecourse debt is Blackstone.

Blackstone is a prominent global investment management firm known for its strategic use of nonrecourse debt. They currently have assets under management (AUM) of $991 billion. Blackstone has leveraged this financing approach in real estate investments and project financing to drive impressive growth.

In March 2023, Blackstone entered into a nonrecourse loan for $325 million, using 1.5 million square acres, including ten office buildings and 110,000 square feet of retail space. All this was for the Hughes Center in Las Vegas, NV. Blackstone used a commercial mortgage-backed securities (CMBS) loan to finalize the deal.

Although they use nonrecourse differently, both companies have leveraged the benefits of nonrecourse financing to help finance their growth.

Investor Takeaway

In conclusion, nonrecourse debt offers advantages and disadvantages that investors should consider carefully.

The limited liability it provides can be a significant benefit, shielding borrowers from the risk of losing assets in case of default. This feature allows individuals and businesses to undertake ambitious projects and investments with greater security.

Nonrecourse debt is a risk mitigation strategy separating personal assets from loan collateral. This separation gives borrowers a sense of stability, allowing them to focus on their ventures without constant fear of financial ruin.

However, it is also essential to weigh the drawbacks of nonrecourse debt. Stricter loan requirements are often associated with nonrecourse loans, as lenders mitigate their risk by thoroughly assessing borrowers’ financial information and creditworthiness.

Moreover, nonrecourse debt generally comes with higher interest rates than recourse loans. Lenders charge higher rates to compensate for their limited recourse in case of default.

One of the significant disadvantages of nonrecourse debt is the limited recourse available to lenders in the event of default.

If the value of the collateral securing the loan falls significantly or the project fails, lenders may only be able to recover their investment by selling the collateral.

Borrowers should be aware of the possibility of losing the collateral without recourse to their other assets.

Understanding the pros and cons of nonrecourse debt is crucial when evaluating financing options.

Nonrecourse debt can be a valuable financing option when used strategically and in alignment with the borrower’s circumstances.

The bottom line is that when analyzing a company and you discover they carry nonrecourse debt, we need to analyze them differently. The risks associated with “normal” debt don’t have the same impacts as nonrecourse.

For example, when you know Brookfield Renewable carries 91% of its debt as nonrecourse, we worry less about defaults and their impacts. And worry more about the value of the collateral falling.

And with that, we will wrap up our discussion around nonrecourse debt.

Thank you for taking the time to read today’s post, and I hope you find something of value. If you can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- What is Minority Interest and How Do I Find It? Acquisitions, as a part of growth, continue to play a role in the markets. Many companies use this strategy. Berkshire Hathaway, Google, and Constellation Software...

- Starting an Investment Firm: LLC, Limited Partnership, or Incorporate? As an investor for over 9 years and LLC co-owner for over 5, I’ve thought a lot about utilizing my passion for investing in the...

- Beginner’s Guide to Total Current Assets You can use total current assets to assess a company’s financial standing. Today’s post will teach us the formulas to use and what to do...

- The 8 Main Types of Investment Risk “If you’re not willing to react with equanimity to a market price decline of 50% two or three times a century, you’re not fit to...