Underwriting is a process that essentially involves a company or group of people that are willing to take on a certain amount of risk in exchange for compensation or a service. You likely are familiar with underwriting in the insurance industry, but it is also very common in investing with the underwriting of shares.

Essentially, the company is trying to determine a certain value that they deem as being fair for the amount of risk that they’re about to take on. As I mentioned, this really hits home in the insurance industry.

When you’re applying for car insurance, you have to answer many questions about your age, driving history, gender, type of car, and many other things because the insurance company is trying to get a feel for the type of risk that they’re taking on by insuring you.

If you’re a 16-year old boy that’s driving a red Ferrari, you’re going to pay more than a 40-year old woman with four kids in a minivan. One of these people are statistically more likely to get into an accident, and while I only have one son, I can honestly say that four kids might actually make me think the mom would be more likely…just kidding!

There are many different types of underwriters in the world today as you can see below from InvestingAnswers.com, but of course, we’re all here to talk about the underwriting of shares!

Underwriting of shares is different but the same common denominator is the same – those that are doing the underwriting are determining a true market value of the risk that they’re going to take on.

The Situation

A founder wants to take their company public after being a successful private company. They have decided to IPO their company (instead of the new fad SPAC process) and have hired an investment banking company to help them in their journey.

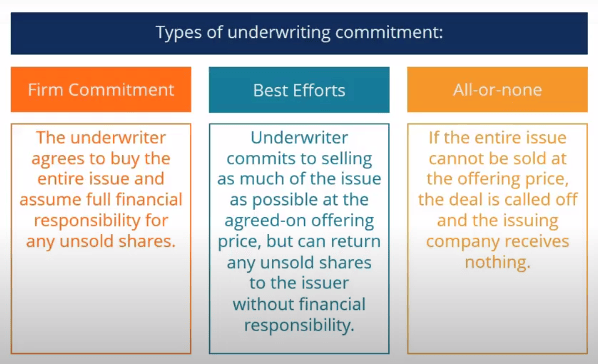

In general, there are three different types of underwriting commitments, as shown by the chart below from the Corporate Finance Institute:

The Best Efforts type of underwriting commitment is the most common and is the type that you will typically see when a company is wanting to go from being private to publicly traded.

To try to make the process seem a little bit simpler, let me try to explain it in layman’s terms. Basically, the company is wanting to hire an investment banking company to underwrite their company shares. Now, the company that is going public could theoretically do this themselves, but it makes sense to use an investment banker that is well-versed in the process and also has the connections to have a successful entry into the public sector.

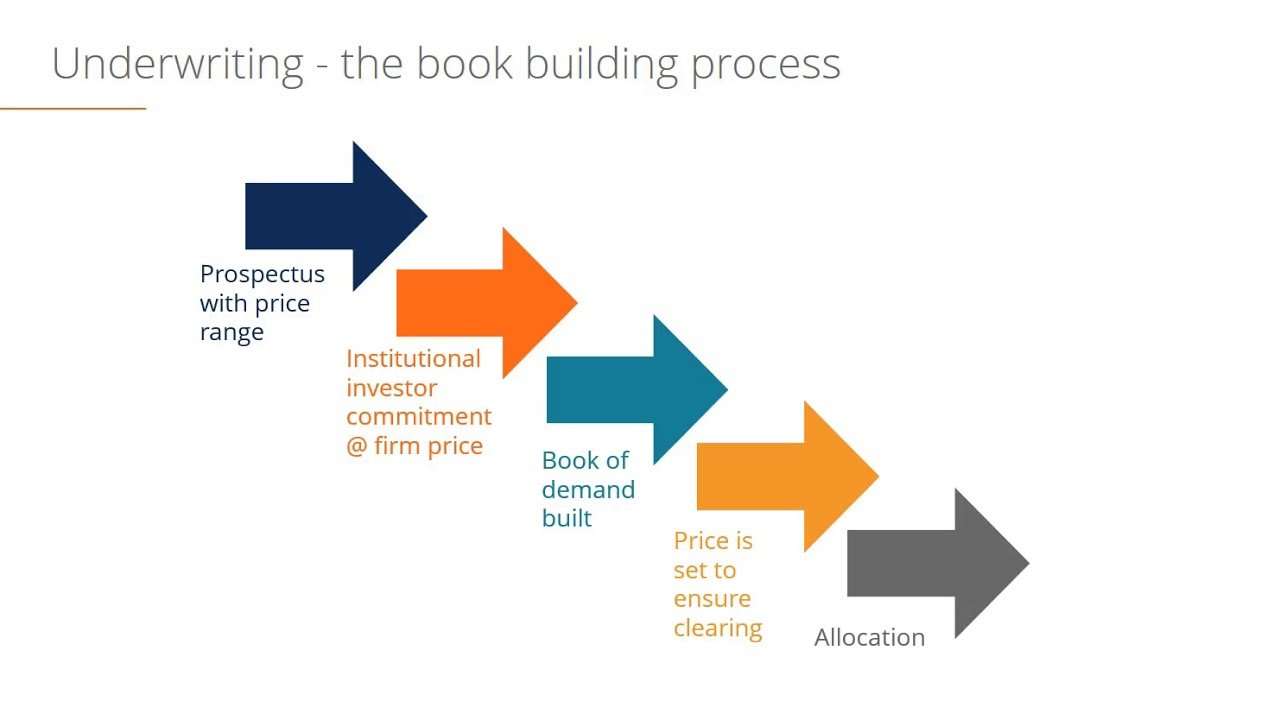

What that means is they’re going to follow the basic steps that I outlined above. They will go gauge the market and essentially try to stir up a lot of demand for people to want to own shares of the company that they’re taking public.

They’re trying to get a general feel for the demand that is out there in the market and at that point, they can set an appropriate price that the company is going to sell their shares for, or as many people know it as, the IPO price.

Once the IPO price is set, the shares will eventually hit the market on the effective date and at that point, anyone is able to buy the shares. Recently, we have seen an absolute hysteria around new companies that are coming on the market such as Airbnb, Snowflake, Opendoor, Beyond Meat, and others, and it is really just astonishing.

Most of these companies have had their share price double in the first day of trading and in the case of Snowflake, their initial IPO price was around $75 and by the time a member of the public could actually buy the shares, it was around $240! Over 3x the original IPO price.

Something that is important to remember is that while share underwriting is most common when a private company is going public, it can also occur when an already private company wants to issue more shares.

This is by no means an uncommon phenomenon and is typically seen when companies are either desperate or right after some piece of really good news. But why is that?

Well, the companies that issue shares as a “secondary offering” are doing so to get more cash, it makes sense that they’re either coming from a position of strength or as a last-ditch effort.

We frequently will see this with growth companies after they report a massive quarter where they’re basically saying, “look how much we grew our revenue! By the way, we burned a ton of cash and need some more money plz.”

Of course, that’s oversimplified, but growth companies are trying to show that their proof of concept is playing out with some good news and then asking for more funding to keep growing the business.

On the other hand, we have companies like GameStop and AMC that recently either issued a secondary offering or at least talked about it.

Both of these companies have seen massive runups in their stock lately due to Reddit investors trying to “take it to the man” and squeeze the short-sellers, and it has created an opportunity for them to issue more shares of the company at a much higher price.

The benefit of them issuing shares now via a secondary offering is that they can issue shares at a price that might seem completely fabricated and not representative of the value of the company as it’s been inflated purely for game in a way, but that would allow both AMC and GameStop to sell less shares but still generate the cash they needed.

Think about it – if your stock price goes up 3x, then you would only need to sell 1/3 of the number of shares that you might’ve been planning to sell prior, right? You’ll get the same cash and dilute your current shareholders less than originally anticipated – win-win!

At the end of the day, the share underwriters are basically helping these companies sell more shares of their company in an effort to raise equity. They’re going to do what it takes to create as much buzz as possible and drive that share price up because it looks even better for them when they do so.

That’s part of the fun of investing in an IPO, but I have been burned way too many times to try to do something like that again. Is the IPO dead, you ask? Well, I wouldn’t say “dead” – but SPACs sure do seem to be taking over the world!

Related posts:

- Convertible Preference Shares – Great Alternative to Buying Bonds Updated 8/7/2023 Preferred shares are the red-headed stepchild of the investment world; they are relatively unknown among most investors. But investors such as Warren Buffett...

- IPO Basics: Explaining IPOs in Simple Terms, With Examples Companies in the U.S. have generated more than $70 billion in IPOs thus far in 2020. All of which outdistances the total for 2019, is...

- Corporate Restructuring Basics: How Taxes and Politics Play a HUGE Role History provides a valuable guide and lessons to finance, and the history of corporate restructuring is no exception. In particular, the Merger mania in the...

- More than Just Shark Tank Investors Can Partake in an Equity Raise! For any business, the art of raising capital is an extremely important aspect task to stay afloat, at many different times of the business. One...