Unit economics – what a boring topic amiright?

No – I am not right. And chances are, you also agree that unit economics aren’t boring since you are reading this article. Or maybe you have no idea what they are but you’re here to learn a little bit about them. Either way, you’re in the right place!

Honestly, I think that unit economics are actually the literal opposite of boring – I think they’re extremely exciting.

In a nutshell, unit economics are the economics of a business that are simply just broken down to a smaller, more easily interpreted, scale.

Instead of looking at the economics of the entire company, you’re going to see it broken down on a “per unit” basis to help you understand some of the metrics behind that company. Let me explain with a very high-level example.

For instance, let’s pretend that you own a company that sells beer. Last year, you sold 100 beers for a grand total of $500. The unit economics for the revenue of your company would be $5.

In this case, you’re taking the total revenue of $500 and dividing it by the total units sold of 100. $500 revenue / 100 Units = $5 of revenue per unit.

When you breakdown the economics of a business into a “per unit” basis it just makes things a little easier to comprehend. Businesses that you invest in do the same thing when you think about it.

EPS? That’s earnings per share. It’s easier to comprehend a company’s performance when you think of it as $4 in earnings/share rather than $200 million of earnings. That way, you can compare it on a like vs. like comparison with other companies as well, in addition to the current share price of the company and many other valuation ratios.

If you’re a fan of the show Shark Tank like I am, then I guarantee you have heard the Sharks asking the business owners some of these questions about their products:

- How much do you sell it for?

- What does it cost you to make it?

- What’s your gross margin?

- What’s your customer acquisition cost?

- Does the customer reorder/how long do they remain a customer?

I think that all of these questions are extremely important for you to know regardless if you’re a business owner or an investor.

If you’re a business owner, I think that the very first thing that you need to understand is quite simply the margin that you’re making on the product that you’re selling. So, the first thing that you need to know is the gross margin.

The formula for gross margin is Revenue – Cost of Goods Sold (COGS).

COGS are quite simply the costs that are absolutely required for you to be able to sell that product, or typically notated as your variable costs. So, let’s use paper plates as an example. The COGS would include the raw material cost, plastic wrap to cover the plates, and then all shipping costs.

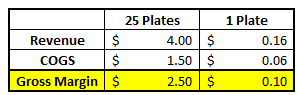

If you’re selling a 25 pack of plates for $4 and your raw material costs are $1.50, you’re making $2.50 as a gross margin. Now, that’s per a pack of 25 plates, so we would need to break that down even further to get it on a per unit basis. See below:

Does that make sense? Basically, you’re making $.10 every plate which makes sense with your gross margin being $2.50 for 25.

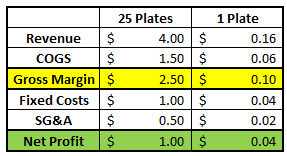

Now, the next move is for you to get even more in depth to figure out net profit. To do so, you need to breakdown two different types of costs that you’ll encounter, your fixed costs and then selling, general & administrative (SG&A) costs.

Fixed costs are the costs that don’t change and will stay steady regardless of the volume you sell. For instance, the cost of your manufacturing facility.

SG&A on the other hand are costs a catch-all for all non-production expenses such as salaries, advertising, accounting, etc.

The formula to go from gross margin to net profit then is Gross Margin – Fixed Costs – SG&A. So, let’s keep going on with our same example and pretend that your fixed costs are $1 and your SG&A is $.50 per 25 paper plates.

Another way that many businesses will calculate unit economics is rather by using the consumer as the unit instead of the actual product. The concept is the same, but you’re basically trying to find out how much that customer is worth to you and then what the cost is to acquire that customer.

To do so, we have another pretty simple formula for you to use: Lifetime Value (LTV) / Customer Acquisition Cost (CAC).

Now, the way that you get to LTV and CAC also require a little bit of math, so bear with me while I describe them and show you how to calculate it on your own.

LTV is essentially the total value that you will encounter throughout the entire lifetime that a person is a consumer of your product.

So, if they are on average going to be a consumer for 5 months and you charge $10/month, then the LTV is $50. Or, if you’re selling something for $40 and they on average repurchase a product 3 times, then the LTV is $120.

Make sense?

The concept really is fairly easy to understand and it’s one that is used very, very frequently in the investing world, especially with companies that are offering subscription-based services like SaaS companies do.

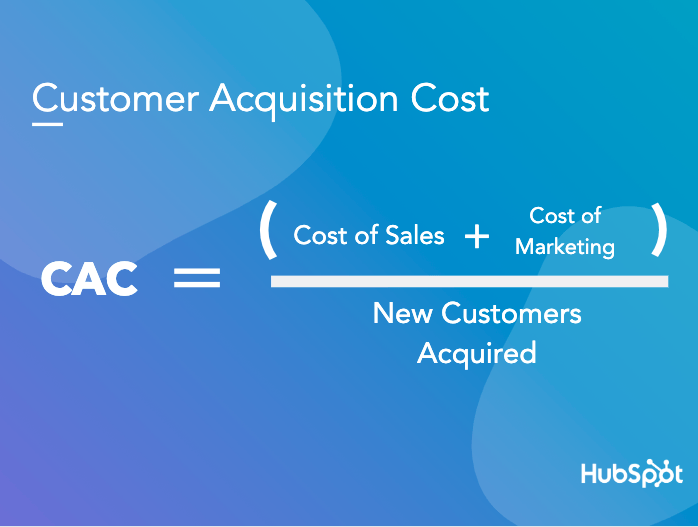

On the bottom half of the formula, we have CAC. CAC is the cost that the business incurred to acquire this customer, as shown below:

Some common items that would make up the CAC expense in a business would include the salaries of sales and marketing customers, promotional materials, any sort of advertising expenses, etc. Basically, I think of it as everything that is being done to actively seek out new customers and then retain them.

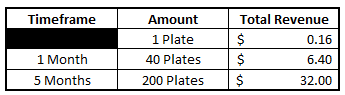

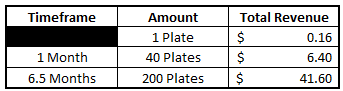

So, let’s use the same example that we have been working off previously with the paper plates but now with a few different caveats and using the consumer as the unit in the example. Let’s assume the following:

- The average customer buys 40 plates/month

- The customer typically isn’t very brand loyal and instead might only be a customer for 5 months

Using those different assumptions, we would end up with the following LTV of the customer:

Hopefully you will see this customer again later on as they’re not very brand loyal, but that’s nothing but a hope and a prayer!

Now we head onto the CAC side of things.

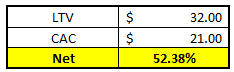

Let’s assume that you have to spend a total of $21 on marketing, salaries, etc. for the entire amount of CAC to acquire this customer. That would mean that your CAC is $21 therefore making your net gain on this customer to be 52.38%:

Now, it’s important to note that this “Net” is not a net profit per se as you’re still not including in a lot of the costs to make the actual product. This number is merely a factor that shows what you had to do to capture a customer and then the total amount of revenue that you received from that customer.

This is a very important differentiation of net profit and one that you need to make sure you’re aware of.

You’ll always hear about different companies talking about ARPU, which is the average revenue per user, because that is essentially the same thing as the LTV for a customer.

Anytime you hear about these subscription-based up-and-coming tech companies, ARPU seems to always be the #1 item for discussion over anything else, including their earnings. I know for a fact that it’s the most important thing when people look at ROKU, one of my favorite speculative stocks.

I mean, I totally get it. When you’re running the ARPU, or LTV, of a customer – you’re basically seeing how much revenue you can squeeze from a single customer. So, if your ARPU is growing as a lot of these tech companies are experiencing, and your CAC is staying the same, then everything that you’re making in additional revenue is pure profit, right?

Talk about an ideal situation to be in!

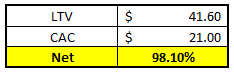

So, let’s go back to our paper plate example just one time and imagine that you were able to keep your CAC at $21 but now have been able to keep the customer buying your plates for 6.5 months instead of the measly 5.

Sure, that additional 1.5 months might seem like something that’s really not that important, but when you look at your net impact it is INSANELY important:

SEE! The net effectively doubled from 52% to 98% simply by retaining that customer just a little bit longer. That’s why you see companies focus so hard on the ARPU.

They’re doing everything that they can to grow as quickly as possible and expand their user base. They want to make their platform as “sticky” as possible so it’s incredibly hard for the consumer to ever switch to a different brand, similar to what you see Apple do with their iPhones.

Their operating system is so sticky that people, me included, don’t ever want to leave Apple because they don’t want to learn anything new. That is 100% me and whenever my phone dies, I’ll just go buy the second-most-new iPhone.

Yes – I didn’t say the newest iPhone because I don’t need all that. I just need it to work. I’d rather live like a “minimalist” (with my iPhone lol) and just invest that extra money instead of paying it to Apple/Verizon.

But once these companies have a really strong user base and can’t leave the platform – that’s when they will start to monetize. They’ll work to cut their CAC and drive down costs and start returning it to shareholders.

And not a second before!

Again, just like Apple, as they have just recently started to pay a dividend again!

Now, the question is “what is considered to be strong” when it comes to Unit Economics? Cleverism defines it very well by saying the following:

- CAC < LTV – Strong Unit Economics

- In other words, you have a compelling business reason to keep growing your business rapidly. Cleverism says that the best case is if the LTV is 3X your CAC, meaning you have to spend $1 for $3 of revenue.

- CAC = LTV – Business Stagnation

- This is a tipping point – you need to make some major moves as you’re currently in what I would call the “danger zone”. If you’re just equating to your CAC, then you’re not giving yourself any sort of financial runway or ability to grow.

- CAC > LTV – Poor Unit Economics

- You’re in trouble. Serious changes need to be made right now or you’re at risk of a continuous loss of cash and inevitably having to fold up shop.

They go on further to say that there are really 5 different times that you should consider applying unit economics:

- Expose Gaps Hindering Profitability

- Identify Optimal Strategies

- Calculate Reasonable Spending

- Evaluate Potential

- Analyze Startup Performance

Now, a lot of these are really focused on the small business owner perspective which I think makes a ton of sense, but as I mentioned before, there are definitely situations where you’re looking to invest in a publicly traded company, and knowing the unit economics can really help you make sure that you’re looking at the business in an easy-to-comprehend manner.

If you really think about it, understanding these 5 different aspects all are drastically simplified by breaking down the comparisons into a per unit basis, which is why the benefit of understanding unit economics is so strong.

If you are a small business owner, I think it’s imperative that you “know your numbers” just as the Sharks preach to each of the business owners because that’s the best way to identify what is working, what’s not working, what might be at risk and where your largest opportunities fall.

Hmm – I’m pretty sure I just talked about Unit Economics teaching you to know the Strengths, Weaknesses, Opportunities and Threats of a business. Do you know what that is?

It’s called a SWOT Matrix, and it’s beneficial to anyone that is selling paperclips all the way up to looking to buy the largest companies in the world!

But for us – the peasants of the world – we use it when we buy our partial shares of Apple stock because even those small investments add up! ?

Related posts:

- What is a Breakeven Analysis? A Breakeven Analysis is one of the most common ways to assess a business decision. In its most simplistic form, a breakeven analysis looks at...

- Understanding Buffett’s Owner Earnings for Beginners As we continue to get more and more into the weeds with Warren Buffett in his book, ‘The Essays of Warren Buffett’, he focuses on...

- Understanding Run Rate and Applying it to Your Stock Investing Strategy The term “Run Rate” is one that you quite possibly might have heard before, but many people do not know what it means. It is...

- Avoid Value Traps by Understanding Various Valuation Multiples by Industry! One of the hardest things to do when investing is figure out the proper value for a company. Sure, “buy low, sell high” sounds easy...