Have you ever realized that you have unrealized gains? See what I did there?!

I know, I know – I really need to stop being so cheesy…

So, what actually is an unrealized gain? Well, you’ve likely heard of the term ‘realized’ which simply means anything that has come to fruition. For instance, you might’ve invested in a company an expected annual 8% return, but the return was actually 10%.

So, let’s say that you bought the $1000 worth of stock and sold It for $1100 – your ‘realized’ return was 10% because that actually happened.

Now, an unrealized gain would be the exact same scenario except that you don’t sell the stock. So, instead of selling the stock for $1100, you’re still holding it but it’s currently worth $1100. In other words, the difference between realized and unrealized is if it can change or not.

The first example is realized because you sold the stock for $1100. So, even if the stock crashes, or continues to rise, it doesn’t matter – you sold your holdings and locked in a 10% gain. So, you realized a 10% gain.

In the second example, those are unrealized gains because while you’re currently up 10% over your investment, if the stock boomed or crashed, your returns would be lesser or greater, depending on which way the stock went.

I will oftentimes in my 8-5 job talk about realized margins when I am doing a post-audit on a contract. For instance, we will put out an ‘anticipated margin’ but we don’t know what the ‘realized’ margins are until the product has already been sold and a margin has been locked in.

If I had to boil it down into a simple thought, it’s this:

Realized Gains = Actual, locked-in, gains; not able to change

Unrealized Gains = Current snapshot in time; able to change

So, now that you understand what unrealized gains are, how do they impact your life?

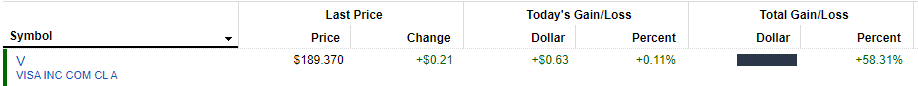

The most likely impact that they will have on your life is with investing. If you were to pull up your investment account, which hopefully is a tax deferred account like an IRA, then you would be able to see how each stock has been performing based off where you bought it and the current price it is at. To help put this into perspective, I have included a screenshot of one of my favorite stocks to buy and hold, Visa, to help better explain:

So, as you can see, my total gain on Visa has been 58.31% since I purchased the stock. I purchased Visa at $119.62/share, and it is now at $189.37 as of me writing this post, so my total gain has been $69.75/share, or that 58.31% that I mentioned.

At this moment in time, these gains are all unrealized because the stock could theoretically go back down to $119.62 within the next minute, therefore wiping out all the gains that I have ‘earned’ so far.

Now, if I was to sell the stock, then these gains would be locked in because regardless of what happened to the stock, I no longer hold any shares so I had locked in my gains and the $69.75/share had become a realized gain at this point.

I feel like you probably have a good grasp at this point on unrealized gains, but the question is – how do they impact your taxes?

Simple answer – they don’t! Unlike realized gains that are taxed every time you sell; unrealized gains are not taxed because they’re gains that you’re only seeing on paper and nothing has been finalized. I mean, it wouldn’t make a ton of sense to tax a gain that hasn’t even actually occurred yet, right?

Like in my Visa example before – can you imagine paying tax on that $69.75/gain and then the next minute those gains are completely wiped out?

Man, that would be awful.

This might seem obvious that you’re not going to pay taxes on a gain that hasn’t occurred yet, and that’s good! But the logical next step is to think – “dang, if I don’t have to pay taxes when I don’t sell my stock, why would I ever want to sell it?”

And that, my friends, is yet another reason why Andrew and Dave recommend buying and holding on their podcast and why I will preach that on my blog posts as well.

So many people are concerned about finding the most optimal stock every second of every day that they will trade in and out of stocks trying to find the next stock that is going to outperform the other one.

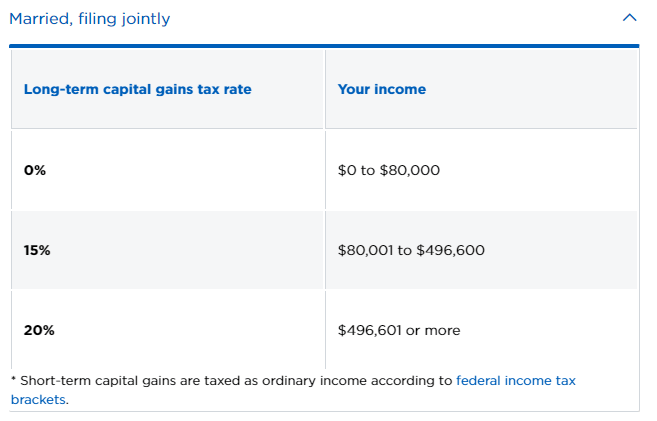

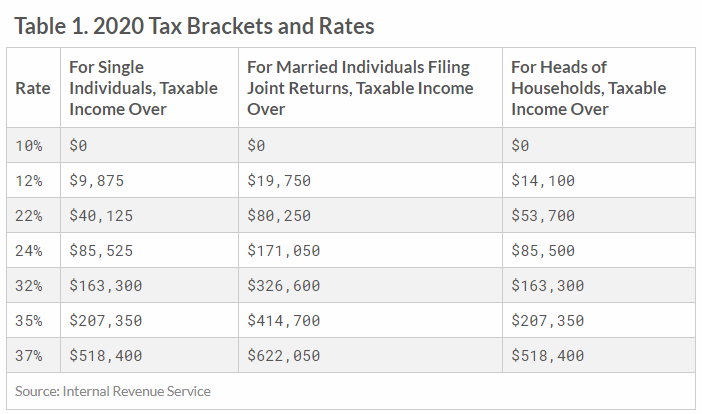

Unfortunately, every time that you sell a stock that you’ve held for less than a year, you’re taxed at your normal income tax rate instead of the capital gains rate of anywhere from 0% – 20%, as you can see below:

To put it into perspective, if you were to be earning $80,000 as a family, you’re going to pay 22% in come tax (shown below), but your capital gains tax would be $0.

I don’t know about you, but that’s enough of an incentive to simply buy and hold instead of trying to trade in and out of stocks as it is, especially when you add in the facts that most people do worse when they trade in and out of stocks as it is.

In summary, unrealized gains are simply a snapshot in time of how your stock/portfolio is performing. Those gains will not become locked-in until you decide to sell, at which point they will become realized gains and they will also be taxed.

So, if you want to avoid paying tax for as long as you can (and I don’t know who doesn’t want this), then take the time upfront to identify stocks to buy and hold and try to keep those gains for at least a year to avoid the income tax rate.

If you’re having issues identifying good stocks to buy and hold, check out Andrew’s Value Trap Indicator which does a lot of the leg work for you.

As always, we try to focus on investing with a margin of safety and avoiding unnecessary tax payments is a great way to do so!

Related posts:

- How to Find the ADR Dividend Tax Policy of a Company in Minutes An ADR, or American Depositary Receipt, is a simple type of share that allows U.S. investors to invest in companies headquartered outside the U.S. But...

- Capital Gains Tax Calculator for Relative Value Investing Turnover of investment holdings is a natural occurrence in any portfolio that triggers realized capital gains and taxes, which can eat into a portfolio’s return....

- How Do Dividends in a Roth IRA Work? What about REITs, MLPs, or ADRs? When I first learned about Roth IRAs, I thought the whole point of them was to eliminate taxes. Well, in essence, pay the taxes first...

- Should I Lock in Profits or Let My Stock Ride? – 3 Important Considerations Investors fortunate enough to see the share price of an investment increase up to their calculated intrinsic value are then faced with the hard dilemma...