So, you’re finally drinking the Kool-Aid about value investing, but the issue is that you’re a brand-new beginner, and you can’t find that perfect value investing blog!

So, as expected, you come to your favorite blog of all time (this one, duh) to try to find some recommendations about where to start. Well, I think that Andrew has a great blog post about where to start investing just in general, but I encourage you to take a look at all blogs to see what fits for you!

Personally, one of my favorites (for personal finance) is Personal Finance Blogs because they will send you three awesome links everyday for great posts to read. I mean, you don’t even have to do anything…just, wham! There they are in your inbox in the AM – not too shabby.

But if you’re looking for that best value investing blog that I teased a bit, then I highly recommend you check out Jae Jun’s blog called Old School Value.

I think that this blog has an absolute ton of information, ranging from beginner topics to topics for the advanced investor. Being an excel nerd, I was immediately sucked in as soon as I clicked on the main page and saw this message:

I mean, like, the words ‘free spreadsheets’ are two of the greatest words ever, and you just combined them together?! That’s right up there with March Madness, Chicken Wings and Dividend Stocks for the things that get me excited. Side note…those are three very different things when I think about it lol. Maybe I research some dividend stocks while I’m watching March Madness, smashing some chicken wings? Who knows?

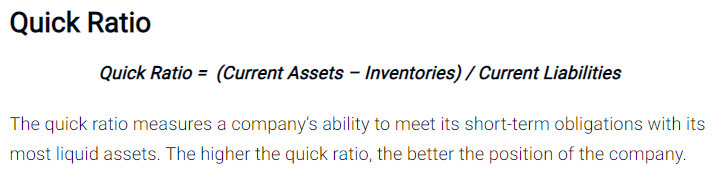

But let’s get back on topic – Old School Value! So, as I mentioned, the blog has a very wide array of topics for different skill sets. One of the first blogs that I saw was this blog called ‘20 Balance Sheet Ratios Investor Must Know’. I immediately keyed in on this because as a value investor, it is imperative that you understand the numbers.

This blog post gives a very high level about what the ratio is, how to calculate it, and the reasoning as to why you should understand the ratio. For instance, see the screenshot below with the Quick Ratio:

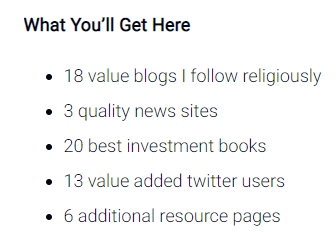

When you type in ‘Jae Jun Value Investing Blog’ the first blog to pop up is a blog titled ‘60 of My Favorite Value Investing Resources You’d Be Crazy to Miss’.

I think that this blog post is freaking amazing. In a sense, it’s an all-inclusive look at what you need to do to really get going on a sustainable value investing journey. When you first start investing, you’re not going to know everything. In fact, you’re likely going to know almost nothing.

My personal advice has always been to get in and buy a stock that you’re familiar with that might seem like a good value from what you have learned. Don’t overthink it – just buy a small position. This is going to allow you to continue to learn different things and apply it to the stock that you already own.

If you just try to learn on your own, I truly feel that it’s not going to stick as well as it would if it was applied to a stock that you currently own because it’s impacting your actual money!

I relate it to getting your MBA. You can get your MBA right after you get your undergrad and feel like you’re more prepared going into that first job, and you likely are, but at that point it’s really just an accumulation of education and it’s not really knowledge, per se.

If you were to go into the workforce and then get your MBA after working for a few years, you would be able to apply that information to things that you have learned while working. That’s the difference between education and knowledge. Personally, I am only about 10 credit hours into my MBA and I already feel like I’ve learned more than I did in my 135+ hours of undergrad.

I think that investing is the exact same. Buy a stock, get your feet wet, and then continue to learn, and this blog post gives you some great ways to continue to learn while your money is invested, and you can apply it.

Jae Jun gives 60 recommendations of things that you should do as an investor to continue to learn, shown below:

I was personally ecstatic when I got to the Twitter followers because I get a ton of my information from Twitter as does a lot of the world nowadays. I was proud that I am currently following three of the 13 but also pumped to learn that I get to follow 10 more new investors now!

Also, very exciting to see that Tobias Carlisle was on the list of Twitter followers. I have been a huge fan of Tobias Carlisle ever since I listened to him on Andrew’s podcast where they really talked about having a contrarian opinion to the market and zigging when others are zagging. If you’ve ever seen me write that before, it’s from Tobias Carlisle.

Alright, that’s all I got folks! Hope you liked it!

…………..

Kidding!

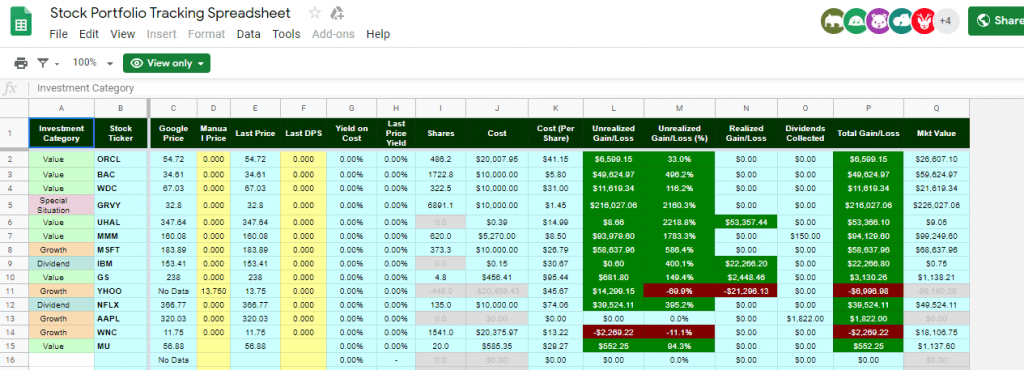

You didn’t think I was going to actually just end the post without talking about this free spreadsheet did you?!

So, not going to lie – when I first started investing, I tried to make a spreadsheet like this, and it was somewhat close to it, but not nearly as sophisticated. Essentially, I was wanting to track my stock purchases and see how I was able to perform. Well, this tool is absolutely insane, especially if you love Excel. Below is a screenshot from the spreadsheet:

It might look overwhelming at first, but it really isn’t. All that you have to do is put in the Stock ticker, the price that you bought/sold the stock at, the amount of shares, and that’s it! The rest is done automatically for you. Seriously, go check out the spreadsheet and download it – I have no idea why you wouldn’t when it’s 100% free.

I did chuckle a bit when I came to the fee section…if you’re still paying fees then you need to have a sit down with yourself and wonder what you’re doing! So many brokerage firms offer no fees now…

Do yourself a favor and check out this blog sometime when you have time, especially if you’re a beginner. There are a ton of blog posts that are great “starter packs” for the new investor and I think it can really set yourself up for success if you’re willing to take the turn that education into knowledge!

Related posts:

- 4 of the Best Value Investing Books Recommended by Top Investors Updated 6/30/2023 So, you’ve reached the point in your investing career where you’re looking for the best value investing books out there for you to...

- 3 Essential Investing YouTube Channels For The Educated Investor Have you ever googled for some good Investing YouTube Channels? If not, you need to – but first, let me tell you which ones I...

- What is Andrew Sather’s Stock Market PDF All About? Updated 4/21/2023 When done correctly, stock investing can lead to long-term wealth. But how do we start? Starting to invest can be a scary, intimidating...

- The Best Investing Instagram Accounts to Follow for Tips and Advice I recently wrote a post about learning how to invest from different YouTube channels because if you’re anything like me, then you’re likely a visual...