I feel like anytime I listen to an investing podcast or turn on CNBC, everyone is talking about how insane the market has been right now. It seems like now more than ever, in the crazy year of 2020, people are talking about this epic battle of value vs. growth stocks.

While this debate does seem front and center right now, it’s definitely not a new phenomenon but rather something that has gone on literally for years. People seem to always fall on one side of the fence – either you’re going to invest in growth stocks or you’re going to invest in value stocks, and it seems like the two lines seem to never get blurred.

First, let me start off by explaining what value stocks and growth stocks even are before we start debating value vs. growth stocks.

Investopedia always is my go-to for definitions and learning new terms, so I thought it was best to use their definition of value stocks stating,

“A value stock refers to shares of a company that appears to trade at a lower price relative to its fundamentals, such as dividends, earnings, or sales, making it appealing to value investors.”

On the other hand, they define growth stocks as,

“A growth stock is any share in a company that is anticipated to grow at a rate significantly above the average growth for the market. These stocks generally do not pay dividends. This is because the issuers of growth stocks are usually companies that want to reinvest any earnings, they accrue in order to accelerate growth in the short term. When investors invest in growth stocks, they anticipate that they will earn money through capital gains when they eventually sell their shares in the future.”

After just reading the two definitions, I immediately thought of my recent blog post on Apple where I talk about their dividend history. While it’s not some crazy 50+ year period like Johnson & Johnson (JNJ) or 3M (MMM), they still do have a growing dividend over the recent history.

But don’t people invest in Apple because it’s a stable company with crazy returns? How can a company with great returns also pay a dividend…maybe this means the lines aren’t as clear as we think! ?

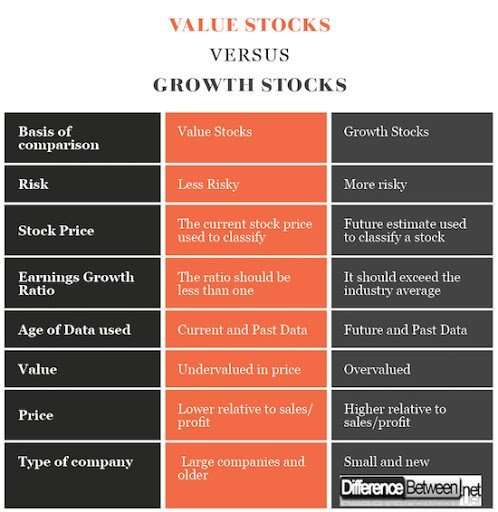

I found a nice little chart that shows some of the differences of growth and value stocks in an easy to comprehend way, compliments of The Difference Between:

If I had to summarize in my own words, I would do so by saying that growth stocks really seem to be way overbought, driving up the price of the company as investors hope that they will eventually grow into that valuation. Investors are putting their money to work in these companies because maybe they see a lifechanging technology at play and hope that the companies can eventually become profitable.

Some examples of growth companies that I can think of are Tesla, Fastly, Roku, and Uber. All are companies that are changing the way that the world works with electronic vehicles, cloud computing, streaming and then the way that people commute on a daily basis.

These companies are all truly innovative in the way that they do things but have a long, long way to go before they have sustained profitability, yet people invest in them like crazy because they have faith that these companies can eventually monetize their business.

Value on the other hand are companies that are typically much more established and seem to be unfairly beaten down. Companies that typically fall into the ‘value’ category are those that are industrial and very heavy on the capital expenditure side of the business. Some examples that I can think of are Exxon, General Motors and US Steel.

These companies all have very low P/E ratios, a sign that they might be undervalued, but also just a potential for people to get sucked into a value trap. Which is why we have the Value Trap Indicator, with years of history looking at bankrupt companies, to keep us from making these awful investing mistakes.

Honestly, as I mentioned before, I can see it from both sides and that’s personally why I actually have some investments in both value stocks and growth stocks, but we’re not here to talk about me! Instead, I would much rather get into some cold hard facts of how value and growth stocks have performed vs. one another.

Truthfully, it’s hard to compare something as broad as value vs. growth stocks, but I think the best way to do it is to compare two extremely similar ETFs, one of which is tracking value and another is tracking growth.

iShares, a very reputable company for many low-cost index funds, offers ETFs that meet these criteria:

- IWD – iShares Russell 1000 Value ETF

- IWF – iShares Russell 1000 Growth ETF

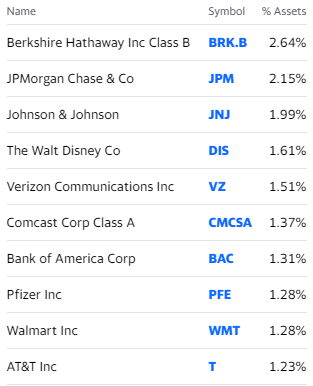

Both of these ETFs are tracking the same types of prominent companies, but the strategy is a little different. Below are the top 10 holdings for each ETF to give you a general idea:

IWD

IWF

Do those holdings surprise you? As you can imagine, the companies that are in the growth ETF are much “trendier”, per se.

But ok, let’s get on with the comparison

The first thing that I always like to look at because it typically packs the biggest punch is the price variance between the two different ETFs.

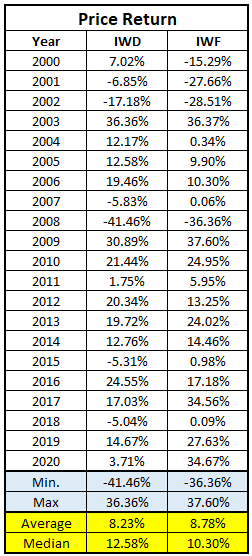

I chose these two ETFs because they both are very similar, the same company providing the ETF in iShares, and they also started the same day, ironically (or not). So, that gave me about 20 years of data that I could compare.

How do you think the math shakes out?

Believe it or not, despite this story that “value investing is dead”, they have been essentially on par with growth over the last 20 years:

As you can see, the average return for IWD (Value ETF) was 8.23% vs. 8.78% for IWF (Growth ETF) but the median for IWD is 2.28% higher at 12.58% vs. the 10.30% for IWF.

Right off the bat, this tells me that the volatility is just going to be insane when you start to actually look year-by-year at the data, as shown by the 70%+ differences between the Min. and Max years.

When I start to look through at some of the yearly differences between the two, it seems like on the years where the returns are less than optimal, the value ETF of IWD tends to outperform and have lesser losses than the IWF, which makes sense to me.

A lot of the value from “value stocks” is about companies that are already beaten down, so when the market takes a turn for the worst and continues to drop in price, they might not be hit as bad because they’ve already dropped in price.

But as I mentioned, it seems like people are always just talking about this decade-long bull market that we are in, where growth typically will outperform value, but does it?

Yes – it sure does!

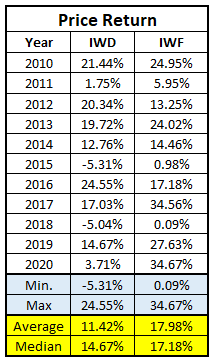

Looking at the data since 2010, we can see that IWF outperforms IWD pretty significantly during the decade. On average, we’re talking over 6%!

That might not seem like a huge amount, but if you invested $1,000 into both ETFs, your shares (not counting dividends) would be worth $3,128.53 with IWD and $5,829.34 with IWF.

That means you made $2,128 with value and $4,829 with growth – or, you made 2.27X in the growth ETF as you did on the value ETF…that’s a monster swing.

But we can’t just be infatuated with only the share price return!

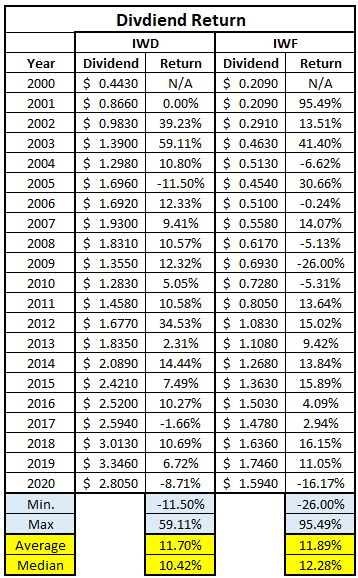

In addition to the share price return, we need to calculate the dividend yield of the company to get the total yield. It is extremely important to look at the total yield anytime you’re comparing a stock so that you have the entire picture, and it’s no different than looking at an ETF or even the S&P 500:

Taking a look at the dividend growth, it’s something that was extremely surprising to me. IWF outperformed IWD both on the average and the median basis, but there’s something very, very interesting here…

Note that the dividend in 2000 only included three quarters, but I kept it whole since in the grand scheme of things it impacts both ETFs the exact same. But there’s a big thing worth noting:

- IWD dividend in Year 1 is $.4430 vs. $2.8050 now, meaning it is now worth 6.33X what it was when you bought

- IWF dividend in Year 1 is $.2090 vs. $1.5940 now, meaning it is now worth 7.63X what it was when you bought

So, the dividend might look better on the surface for the value ETF, but the total growth over the 20-year span is actually better with the growth ETF.

All this information is great and all, but what we all actually care about is this – WHICH ONE WAS BETTER?!

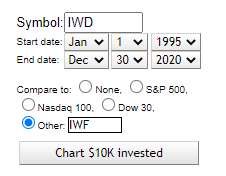

And better, for all of us, means which one did we make the most money with? The easiest way to find this out is to go to the Dividend Channel to see what your investment would’ve looked like if you had made it in the past.

All that you have to do is enter a few pieces of information:

After that, just select the “Chart $10K Invested” button and boom:

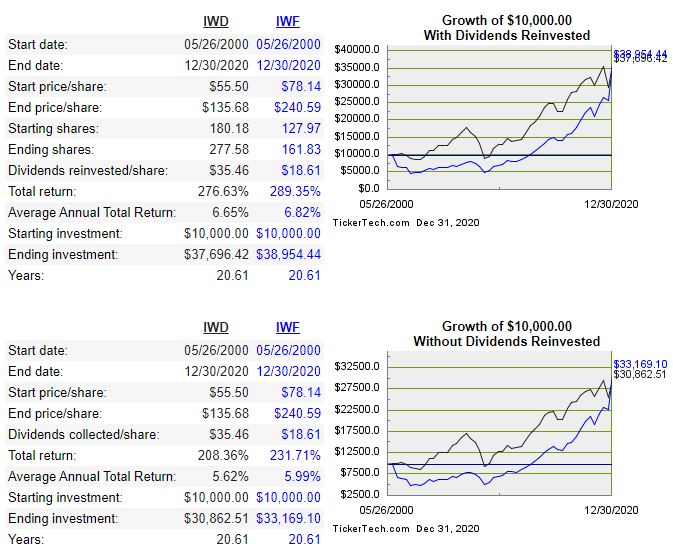

As you can see, it actually is a freakishly close comparison between the two ETFs. With that being said, IWF does outperform over this 20-year period, for both when you’re reinvesting dividends with the DRIP method and just on a standalone basis where you hold onto those dividends (don’t ever to that – always reinvest).

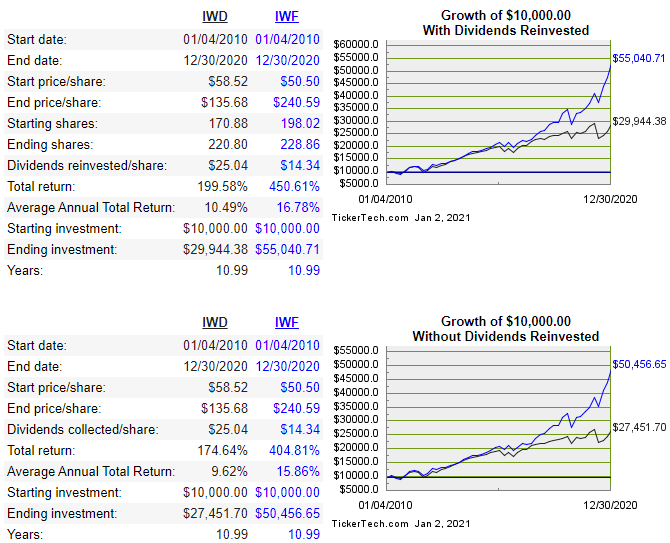

Just for giggles, let’s take a look at how the two ETFs performed during just the last decade:

If you’re a value investor only…ouch. That is not your ideal return when you see what the opportunity cost of investing in growth is.

Personally, I understand why people buy into one philosophy or another, but I really think that there are pros and cons to both strategies and times when it makes sense to shift your portfolio around a little bit.

Remember how I said that the lines never seem to get blurred? Well, I am here to blur them! Personally, I am here to invest in stocks that I think are undervalued.

That might mean that they’re undervalued in the historical sense where they have very strong balance sheets and the sum of their parts seem to be worth more than they’re currently trading at. It might mean that when I look at some of the traditional valuation ratios it shows that they have a lot of room to come back to where they should be trading at.

Or, it very well could be from a growth perspective. I think that the stock might be undervalued vs. their competitors rather than compared to the traditional metrics like finding a P/E of 15 or less. Maybe it’s a cloud computing company that has a P/S that is significantly less than some of the other highflyers.

At the end of the day, I want stocks that have room to grow into their value – and I think that can come by investing in EITHER growth or value stocks.

Notice how I said GROW into their VALUE? I’m clever, I know.

Currently, I have many value stocks in my portfolio including some great dividend payers like Realty Income, General Motors and Markel, but I also have some highflyers in the growth sector such as Roku, Fastly, and DraftKings.

You don’t have to be a value investor or a growth investor – you can be both!

People use the term “personal finance” because this stuff is just that – personal. You need to find the strategy that works for you and then implement that into your investing process.

Maybe you don’t want to be a stock picker like me and would rather just invest in ETFs – there’s nothing wrong with that!

You can start with these “catch all” ETFs like IWD and IWF or get a little more specialized with different sectors like gold or cloud computing to get you that different exposure but still keep it as a fairly “hands off” approach.

Related posts:

- Succeed with Dividend Growth Investing by Analyzing a Stock’s Growth In a recent episode of the Investing for Beginners Podcast, Andrew and Dave broke down how to analyze a stock’s potential by using dividend growth...

- GARP Investing – Growth at a Reasonable Price Growth at a Reasonable Price (GARP) investing is a hybrid style of investing which combines both growth investing and value investing attributes. Investors following a...

- Top Philip Fisher Quotes on a Matured Investing Strategy If you’ve been following along with some of my blog posts on the extremely popular book, ‘Common Stocks and Uncommon Profits’ by Phillip Fisher, then...

- Using Motif Investing to Build a Great Dividend Portfolio Motif Investing isn’t just a great tool for saving money investing but it can also help you find the best stocks for your needs. This...