Updated 12/12/2023

Valuing a young company is one of the more difficult tasks in valuation. Trying to pin a value on a young company, startup, or idea business is difficult because of little or no revenues and large operating losses.

Other challenges are the short financial histories of young companies, plus the dependence on outside capital to start the business. All of those aspects make valuing these young companies much more challenging.

Other considerations are that many new companies don’t survive beyond the first few years. As with any other company, you are basing any valuation work largely on estimations, and working with young or startup companies is no different.

In today’s post, we will learn:

- What are the four questions to ask?

- Avoid the dark side of valuation.

- The Steps to Valuing a Young Company

- Putting it all to work with a real company

Okay, let’s dive in and learn more about valuing young companies.

What Are the Four Questions to Ask?

Before valuing any company, we must understand where each company is in its life cycle. Whether they are Amazon, Apple, or the most brilliant idea in someone’s head, each company is part of a life cycle. Each company, as they grow to go through this cycle, moves from:

- Idea companies – no revenues, operating losses

- Startups – small revenues, increasing losses

- Second-stage companies – growing revenues, moving towards profits

- Mature companies – stable revenues, growing profitability

- Declining companies – falling revenues, stable profitability

As you can see from the list above, the newer companies have little to no revenue and zero profitability, so assigning a value should be difficult but not impossible.

Why is it not impossible?

Because each company has certain characteristics that allow us to estimate the future and then assign a value based on those projections.

To determine the value of a new company or startup, there are four questions we need to ask. These questions are the basis of valuing a young company. They are ideas that Aswath Damodaran promotes in his fantastic book, The Dark Side of Valuation, and his phenomenal lectures as a professor of finance at NYU Stern.

- What are the cash flows from existing assets

- What is your value from future growth?

- How risky are the assets and cash flows?

- When will the firm become mature?

Asking the above questions allows us to dig deeper into the three sources of information available when valuing young companies.

- The company’s current financial statement

- Financial history

- Industry and comparable firm data

Using the publicly available financials from SEC.gov, we can determine what is going on with the company today and any financial history that might be available. Sometimes, there might be only one-quarter of public info if the company recently went public via an IPO or SPAC.

These financials can be a great source of foundational information on revenues, margins, and prospects. It also helps us see into the minds of the managers running the company. Other great sources are recent earnings presentations or calls, which provide additional insights into management thinking, particularly when listening to the analyst’s questions. These provide deeper insights into management thinking beyond the prepared remarks.

Other sources are trade magazines or newsletters, subject-relevant blogs, podcasts, and other sources outside the normal channels.

These resources help give you a better picture of the company and insights into its sector. With these resources, we can better craft an idea of what will likely come for the sector.

This information helps us build a model using any DCF (discounted cash flow) basics such as revenue growth, margins, and any risk associated with an investment.

Avoid the Dark Side of Valuation

As we will see, valuing young companies involves a heavy dose of estimates. It is no surprise that there is a dark side of valuation in the world of young companies or startups that there is a dark side of valuation offering solutions for those estimations.

Many of these solutions offer a way out and sound good on the surface, but underneath, they are often the source of many errors in valuing young companies.

Below are some of the more common mistakes:

Focusing on the top line and bottom line

Many investors and analysts focus completely on the top line (revenues) or the bottom line (earnings) without much discussion on the sources of revenue or the costs associated with creating and growing those revenues or earnings.

Those costs, such as R&D, payroll, costs of goods sold, reinvestment, and taxes, have a direct bearing on the growth of revenues and profitability, and by ignoring those impacts, we run the risk of overestimating growth.

Short-term focus

Estimating growth beyond a few years is a difficult task, and many analysts or investors rely on short-term estimates because they rationalize that estimating uncertain long-term futures is too difficult, and why bother?

Instead, they focus on the next quarter’s performance or compare short-term performance. Focusing on the short-term can lead to not focusing on the factors that matter, such as long-term prospects, shifts in the macroeconomics of the sector, or any long-term changes in customer behavior.

Mixing relative valuation with intrinsic valuation

Many analysts use exit multiples in their valuations, such as EV/EBITDA, as a terminal value instead of intrinsic value methods.

Mixing relative metrics can lead to errors in valuation because many of the metrics used are not in line with the principles of intrinsic value. For example, if the EV/EBITDA multiple is high relative to others in their industry, that same industry is high relative to the rest of the market. The estimate runs the risk of being overvalued overall.

Assigning sky-high discount rates

Many risks are associated with young companies, and many analysts assign higher discount rates to attempt to encompass all of the potential risks in one metric.

They use the discount rate to roll all of their concerns about the company into the discount rate, including any risk of failure.

The biggest issue with valuing young companies comes from the temptation to swing to the dark side by embracing three ideas:

- Paradigm shifts

- New metrics are created

- The story is all that matters

The paradigm shifts, and stories become companies’ main valuation focus because the industry or sector is shifting customer behavior. The story about the founder or CEO becomes the focus.

A perfect example is WeWork; the company’s CEO became the company’s focus and how he and his company would change how and where we work. Instead of focusing on the economics of the business or the likelihood of that change occurring, it instead became the focus on the paradigm shift and the CEO and his vision.

Another focus is creating new metrics, such as click per user or revenue per click, and moving away from GAAP accounting standards. Analysts have started creating new ways to measure the performance of a young company that focuses on the positive instead of the overall picture.

Both examples provide probable situations but are not necessarily likely to happen. The probability entices investors and creates a narrative around the company that focuses on the short-term and positive. Instead of focusing on the likelihood of success and the market reality they are entering.

The Steps to Valuing a Young Company

There are multiple steps we need to follow to value a young company. Below are the steps we can use to value a young company.

- Assess the company’s position.

- Estimate revenue growth

- Estimate operating margins in sustainable growth stages

- Estimate reinvestment rates for growth

- Discount rates

- Estimate the value of the company

Let’s look at each step in detail to outline the process.

Assess the Company’s Position

Most analysts use the financial numbers from the latest financial year, and in keeping with that idea, it is best to use the most up-to-date financials, which often means using the TTM or trailing twelve months.

Keep in mind that young companies typically have negative earnings and high revenue growth, and these numbers can vary wildly. That is why looking at the most recent financial information, particularly for revenues and earnings, makes the most sense.

Using the most up-to-date info will help give us the best benchmark for estimating the company’s value.

Estimate Revenue Growth

One of the trickiest parts of valuing young companies is estimating revenue growth because young companies tend to have small revenues, expecting these to grow to much bigger revenues.

Because revenue growth is the big driver of value in young companies, it is best to focus on several sources of information to help guide our estimates.

- Based on its historical record, historic growth for the company is the first and best source of information. Remember that those huge revenue growth numbers will be harder to replicate as the company scales up. For example, if our company grew 300% two years ago and 200% one year ago, this year’s rate will likely be lower.

- Look at the growth rate of the overall sector in which the company resides. It is easier for our company to grow at high rates if others in the same sector grow.

- Barriers to entry or competitive advantages for our company help give us a leg up on the others in our sector. Any company such as Amazon must have a competitive advantage to generate high revenue numbers. If that competitive advantage is sustainable, sustained revenue growth is far more likely. Without a competitive advantage, revenue growth tends to fall off quickly.

Estimating Operating Margins in Sustainable Growth Stages

Companies losing money with high revenue growth numbers will accomplish nothing more than bigger losses over time. The expectation is that money-losing companies will begin to have positive operating margins over the long term.

Here are a few ideas:

- Look at the business the company is in and find comparables to measure against, and as the company grows, it moves toward profitability that matches the competition.

- Deconstruct the income statement to align the operating costs, such as R&D, marketing, and SG&A, with how the company invests in its growth. The growing operating costs that lead to unprofitability are often reinvested in the company and must be amortized instead of expensed. Accounting conventions regard these as operating expenses, but many of these expenses are their reinvestments in the new world of internet-based companies. The company won’t realize the benefit for many years. To learn more about this valuable idea and how to deconstruct an income statement, check out this article:

Analyzing Intangible Assets and Their Impact To Assets and Operating Income

Estimate Reinvestment Rate for Growth

As with any company, you have to reinvest to grow, which is especially important with young companies. But unlike a more mature company, the historical data to help estimate that reinvestment rate won’t exist.

As the young company grows, the nature and rate of the reinvestment will change, which leads to additional challenges in estimating the reinvestment rate.

Typically, we would look at the expected growth for a company based on the following formula:

Expected growth = reinvestment rate * return on capital

But, with young companies having negative operating margins, the formula becomes unusable because we can’t estimate returns on capital with negative operating margins.

Instead, we would use a sales-to-capital ratio, allowing us to assess a number that would help us determine a reinvestment dollar amount for each dollar of revenue created.

For more on the sales-to-capital ratio, follow the link to learn more:

Sales to Capital Ratio: Measuring the Efficiency of a Company’s Reinvestments

For example, suppose we use the sales-to-capital ratio to determine reinvestment growth. In that case, we see that to grow revenues by $1 billion with a sales-to-capital ratio of 4, we would need a reinvestment of $250 million.

We can estimate this number by looking at industry averages or the company’s historical average to get us in the ballpark.

The sales-to-capital ratio can change throughout the valuation as it approaches a steady state of growth; no law states reinvestment rates need to remain steady.

Discount Rates

Estimating the risk and discount rate for young companies presents a few problems, the first being the risk. The standard measure of risk is to use the beta, and for young companies, the simplest course of action is to assign a higher beta than more stable companies in the same industry.

Estimating the cost of debt for young companies is difficult because, as they are new to the market, they typically won’t have any debt rating, making it a challenge to estimate the cost of that debt.

One solution is to look at the interest coverage ratio for companies in the same industry, project those ratios for your company, and use similar debt ratings from Moody’s, S&P Global, and others.

As the company grows over time, we should change the discount rate or cost of capital over time. As the company moves towards a more stable state, we should assume more stable costs of debt and betas to reflect the stable state of the company.

The same rules apply for estimating the cost of equity; as the company matures, we need to adjust our cost of equity to reflect that maturation.

As the company moves towards a more stable state, adjust your discount rate to reflect that stable state with numbers that align with the industry.

Estimate the Value of the Company.

Now that we have our inputs for revenues, operating margins, reinvestment rates, and discount rates, we can value our companies.

We can use an FCFF (free cash flow to the firm) DCF model to help us find the value of our company. Once we have our equity value, we subtract the cash and equivalents and then divide by the shares outstanding to find the company’s per-share value.

Putting It All Together to Value a Young Company

The first company I would like to analyze using our guide from above is Crowdstrike (CRWD). Crowdstrike is a cloud-based security software system that provides protection. It operates as software in a subscription-based model and sells through its platform and sales team.

The company started in 2011 and recently went public on June 6, 2019, and currently has a market cap of $56.9 billion.

Okay, let’s work through the problem of valuing this growing company with negative operating earnings. Finally, I will include a downloadable file to check my work and adjust anything you see fit. I based the model on the work available from Professor Damodaran’s FCFF model.

Revenues

The company’s latest TTM numbers show that Crowdstrike has earned $999.2 million in revenues over the last twelve months, with expectations for greater growth in the future.

Analysts predict sales growth this year of 55.9%, with numbers approaching 36% and 33% over the next two years, respectively. Over the last five years, the revenue growth year over year (YoY):

- 2018 – 125.14%

- 2019 – 110.37%

- 2020 – 92.70%

- 2021 – 81.64%

- TTM – 77.35%

As we can see from above, the revenue growth is falling sequentially as the company scales up, aligning with our study earlier.

Predicting revenue growth will be an item to check on an annual basis and adjust accordingly; for now, let’s assume the revenues will continue to grow over the valuation period before topping out at 11% at year-end and then growing at the rate of the 30-year Treasury rate which is 1.97% currently.

Operating Margins

The company currently has negative operating margins as it is expending a ton of R&D, 71.74% of revenues, and SG&A, which is 44.69%. As we mentioned earlier, the prudent approach is to amortize the R&D, which is unquestionably reinvestment in the company. Crowdstrike is a tech company that stays cutting-edge by improving its products and services. It spends little to nothing on traditional Capex, such as buildings or other large expenses.

Crowdstrike will grow based on improving its products through R&D or acquisitions, and studies have shown that reorganizing the income statement will give a truer picture of the financials.

The next step will be to look to others in the industry to understand where the margins should be once the company matures.

Two of the more mature companies in the space that Crowdstrike operates are:

- VMware (VMW) – 19.38%

- Fortinet (FTNT) – 19.52%

Next, we can compare it to the sector average, which Crowdstrike operates in the software (system and application) sector. The current operating margin (EBIT) is 23.30%, so let’s target 23.30% for our operating margins.

Until the company reaches that goal, I will go with six years as our convergence, but you can adjust as you feel accordingly.

Reinvestment rate

As we mentioned earlier, the usual ROIC calculations will not work with negative operating margins. Instead, we can assign a sales-to-capital ratio to factor in the reinvestment.

Per Professor Damdodaran’s worksheet, the sector average is 2.22. We can assume that Crowdstrike will reinvest at a higher rate to continue its growth so that we can assign a sales-to-capital ratio of 3 for the duration of our valuation.

Discount Rate

To account for the higher volatility, we can assign a higher than normal beta to account for the volatility. The sector beta is 1.04, and we can use a beta of 1.53 to account for the additional risk.

That beta will return closer to the industry average over time, increasing our discount rate over the valuation.

The starting discount rate for our work will be 8.50% and fall the industry average of 5.05% over the valuation.

Valuation

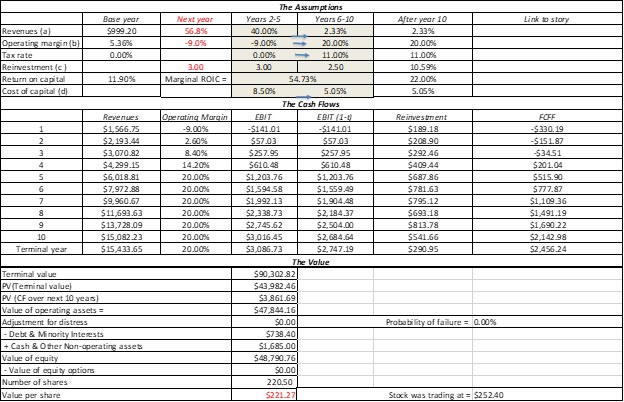

The spreadsheet below is a screenshot showing the valuation results based on all the above inputs we used to create a possible value. Remember that any model is only as good as the inputs, and remaining consistent is one of the keys.

None of this is investment advice; rather, it is an attempt to find the value of a young company as a guide to help you calculate your valuations. Teaching someone to fish is far better than providing the fish.

As you can see, it is close to the current market value, but again, these are all assumptions. Before buying any company, we must do our due diligence to learn about the company, sector, and potential opportunity.

Here is the model you can download to play around with any assumptions or use as a basis for your valuations.

Investor Takeaway

Valuing young companies is a challenge, but it is not impossible; the main focus needs to remain as consistent as possible and follow the steps to determine how likely we are in our assumptions.

Professor Damodaran includes several diagnostic tabs to view better our assumptions and how they play out, allowing us to assess our numbers and determine the likelihood.

For more resources on this subject, here are a few more links to give you data and deeper subject matter.

Operating and Net Margins by Industry Sector

Capital Expenditures, Depreciation, Reinvestment Rate, and Sales to Capital Ratio by Industry

Valuing Young, Start-Up and Growth Companies: Estimation.

Chapter 23: Valuing Young or Start-Up Companies

Valuing Markets and Young Companies

And with that, we will wrap up our discussion on valuing young companies.

As always, thank you for taking the time to read today’s post, and I hope it helps you on your investing journey. If I can further assist, please don’t hesitate to reach out.

Until next time, please take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Building a DCF Using the Unlevered Free Cash Flow Formula (FCFF) Updated 12/12/2023 “Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during...

- Explaining the DCF Valuation Model with a Simple Example Updated 9/15/2023 Discounted Cash Flow (DCF) valuation remains a fundamental value investing model. Using a DCF continues as one of the best ways to calculate...

- Average Discount Rate for the Top Companies in the S&P 500 Setting a reasonable discount rate is critical to getting a reasonable valuation. Like with history, I believe that getting context on averages, in this case...

- How to Use Reinvestment Rate to Project Growth for Valuation Updated 5/22/2023 “Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of...