As you know, Andrew, Dave and I are major dividend lovers! We all think that dividend paying companies are one of the best ways to reap the rewards of compound interest, but what if you don’t want to invest directly in stocks? Can you still reap the rewards with an ETF like VHDYX?

The reason that I started investing in the first place is because the power of compound interest spoke to me. Like, if you invest $1000 when you’re 22 and don’t touch it, you realistically could have $16,000 at age 58 by only achieving an 8% annual return!

That was literally all that it took to get me hooked.

Many will choose not to invest because they don’t think they’re smart enough or that it’s too complex/time consuming, but this is just not true. It can be number oriented if you really want it to be, and fortunately for me, I am a huge numbers an Excel nerd, so I absolutely love digging into companies and trying to find the best place for me to put my money, but I know everyone isn’t like that.

Many investors will turn to an ETF or Mutual Fund to try to gain some sort of exposure to the market while also allowing them to stay an arm’s length away from some of the risk, and I totally get that, so how do you still gain some great exposure to these dividend paying stocks?

VHDYX, or the Vanguard High Dividend Yield Index Fund, is simply a fund made of up high dividend yield stocks. Unfortunately, VHDYX is closed to new investors, but instead you can invest in VYM and still get some amazing exposure!

Personally, I think that investing in individual stocks is the best way to go, but I do understand the draw of wanting to invest in an ETF.

So, what is VYM? VYM is the Vanguard High Dividend Yield ETF and it essentially tries to mimic the returns of great dividend companies. Per the Vanguard website, VYM “seeks to track the performance of the FTSE® High Dividend Yield Index, which measures the investment return of common stocks of companies characterized by high dividend yields.”

Personally, when I am looking at an ETF, I like to look at a few different criterium:

- Expense Ratio

- Top 10 Holdings (and their respective weights)

- Dividend Yield

- Historical Performance

- Anything that is very specific to that dividend – in this case, it’s mainly the dividend yield in my eyes

But I never like to look at anything in a vacuum. I always try to benchmark my investment because if you’re not doing that, you don’t really have anything to compare it to, right?

For me, my benchmark is always an S&P 500 index fund, so in this case, I am going to use VOO as that is the Vanguard S&P 500 ETF.

- Expense Ratio

- VYM – .06%

- VOO – .03%

- Both of these are extremely low. I am 1000% fine with any ETF that charges under .10% fees, so these easily clear that personal hurdle of mine

- Top 10 Holdings (and their respective weights)

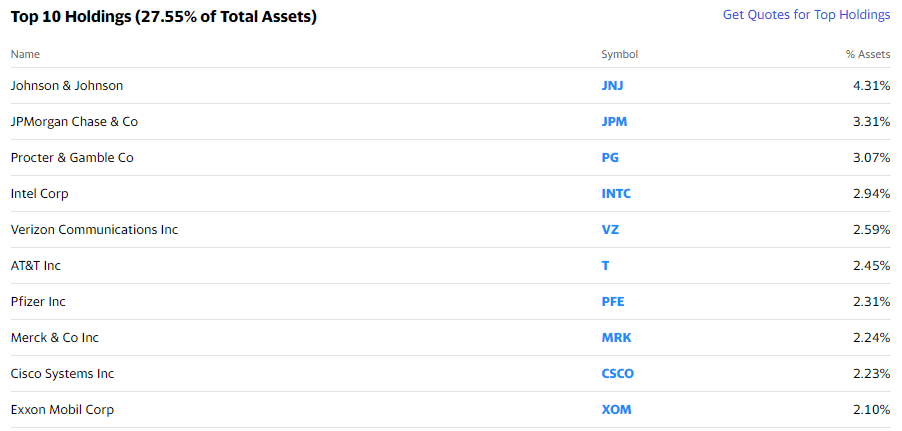

VYM

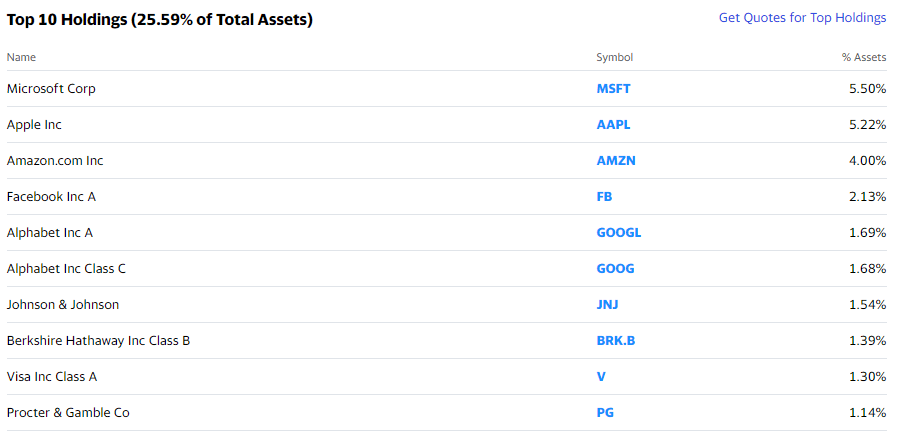

VOO

- The main thing that I look at here is just to get a general feel about the outlook of the companies that are being included and to see if any of them appear to be significantly weighted over the rest. VOO has 3 companies over 4% while the 4th largest is FB at just barely 2%, meaning MSFT, AAPL and AMZN are much, much more important for the performance of the ETF.

- VYM on the other hand is much more evenly distributed with the exception of JNJ, but even JNJ is only 4.31%, which would be the third biggest weight in VOO, and JNJ is one of the best performing dividend stocks…of literally forever!

- Dividend Yield

- VYM: 3.75%

- VOO: 1.88%

- That is a significant yield outperformance by VYM by nearly double. I’ve seen many dividend ETFs that simply have a yield that is just over 2%, so barely outperforming a normal S&P 500 ETF, meaning to me that it’s not really accomplishing the goal of what I invested in it.

- Historical Performance

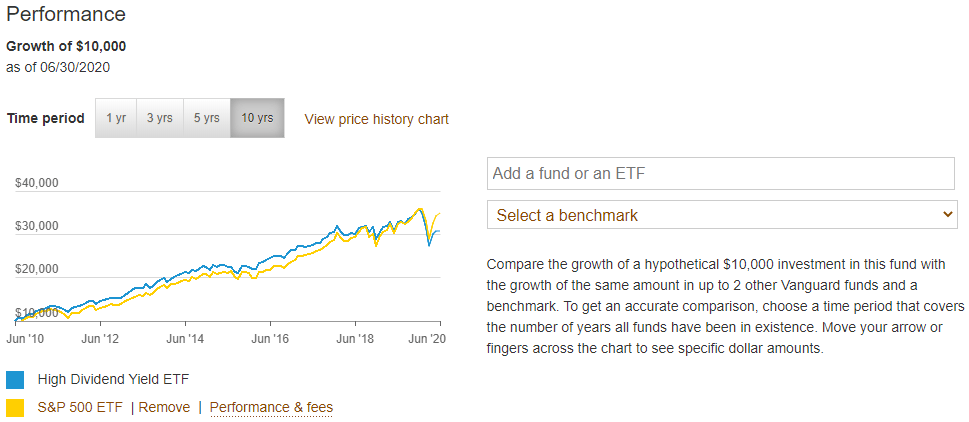

- This is one of the most important pieces of information to be because I like to look at the history to try to get a good idea of how it might perform in the future as well.

- Vanguard gives you the ability to compare the ETF vs. a benchmark, such as the NASDAQ or the Dow, or even a different index fund of your choosing, which I obviously chose VOO. When I do this, you can see that VOO (S&P 500 ETF) underperformed VYM (High Dividend Yield ETF) over the last 10 years right up until this most recent coronavirus crash:

Once I have looked at these four pieces of information, I then will make a decision if it’s worth me looking into further or not. In a way, this is almost my way of running a “stock screener” but on an ETF. I’m looking at a lot of the big, overarching details to see if it looks enticing enough.

For me, the expense ratio is amazing, the dividend yield being double the S&P 500 is great, and the performance looks really strong and in line with the S&P 500, so I would definitely consider looking into it more!

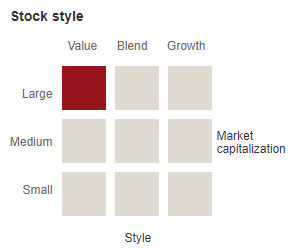

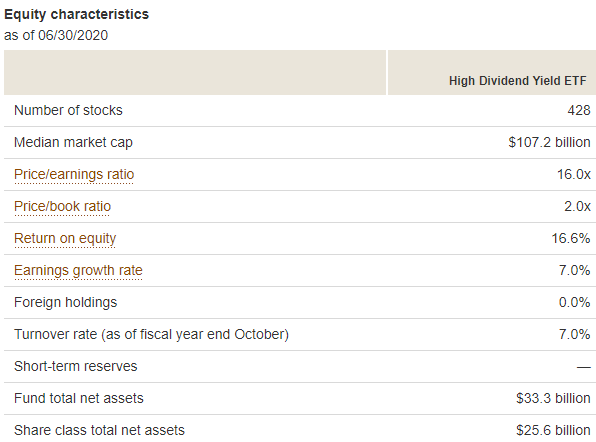

On the Vanguard website, you can easily drill down even further to look at things like the stock style and even some great valuation ratios like P/E and P/B:

Admittedly, doing research on an ETF is much harder to do because there are so many companies, but I also think that it requires much less research to be done and a different type of research. For the most part, ETFs are meant to be safe investments that can still give you exposure to the market and let you capitalize on the 11% CAGR that the stock market has returned since 1950.

As I mentioned, I am not a huge fan of ETFs but I absolutely do think that they have a time and a place, and if you’re wanting to get some major dividend exposure for essentially no cost at all, then VYM could be a great way to do so!

Move on over VHDYX – there’s a new ETF in town!

Related posts:

- How to Choose the Right ETF Updated 10/27/2023 With more than 2,000 ETFs or exchange-traded funds available in the U.S. alone, choosing the right ETF might seem like picking out the...

- 8 Major Stock Market Factor ETFs and Their Differences Updated – 11/3/23 A factor in the stock market is a set of characteristics, or style, of a group of stocks. Factor ETFs allow investors...

- Why Now is a Great Time to Build a Globally Diversified Portfolio U.S. stock market valuations are beginning to excite me again after this year’s fall of 15.3% from 52-week highs. Even more so, developed markets across...

- How Tactical Asset Allocation Works – (With Example Portfolios) Asset allocation is arguably more important than which stocks you pick. For most investors, focusing on your asset allocation is a lot more important than...