A common pitfall that I often see new investors fall into is that they get sucked into the “get rich quick” mantra that they think comes with the stock market. Unfortunately, they think that this means that they have to invest in volatile penny stocks because of the high risk, high reward that comes with them, but let me tell you this – just be patient.

I completely understand why people think that the stock market is a get rich quick option. Everything that you initially think about it leads you to believe that. You hear about the corruption in classes and you see the insane movies like Wolf of Wall Street. Before you actually know anything at all, you have this preconceived notion that it’s immoral but it’s not – the stock market is a place for good, and if you’re patient, you can make a ton of money in it.

I have noticed that for me personally, I have outperformed the market on average throughout my life. But, ironically enough, I actually do worse than the S&P 500 in the great S&P 500 years and do better in the bad years – why is this?

I think that when the market is doing well, I will start to get greedy. I won’t be happy with a 30% return that we saw in 2019, the 16% in 2020, or the current 22% that we’re at in 2021 – I want MORE!

But when the market isn’t doing great, I tell myself to “just focus on finding great, cheap companies for the long-term” and I am able to stick to that. I get short-sided in the great years and make dumb decisions. And a lot of those dumb decisions have been me investing in some volatile penny stocks.

So, what even is a penny stock?

Investopedia defines it as “the stock of a small company that trades for less than $5 per share.”

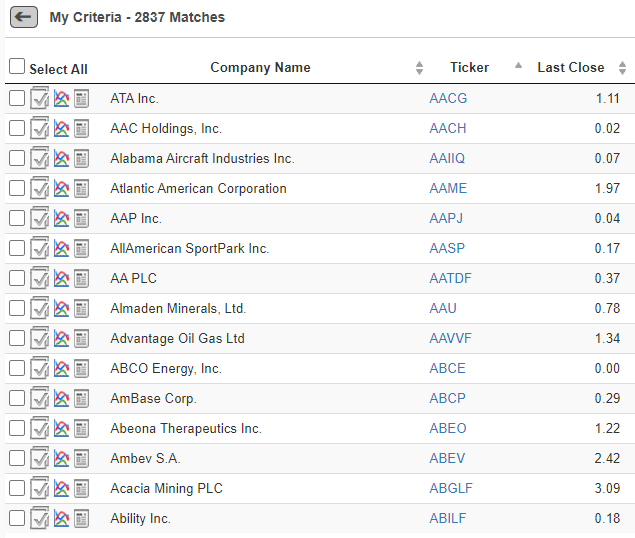

As you might anticipate, there are a quite a few stocks that would meet this criteria. When I run a simple stock screener, I end up with a total of 2,837 companies out of 7,645 that currently have a price that is $5 or less:

Of course, you’re going to have a huge variance of the types of companies within this grouping, but as we all know – the share price of a company is nothing more than the market cap/total outstanding shares, meaning that the share price can be manipulated if a company was to do a stock split like Tesla and Apple have done…any maybe Google will split here soon?

You’ll hear about some absolutely crazy success stories of certain penny stocks such as Amazon, Apple, Ford and even the famous chip maker, AMD, but there are far more losses than there are gains when investing.

By nature, penny stocks are those that inherently have more risk. These companies are penny stocks because they’re likely very unproven and the success that you should anticipate is unknown. You’re banking on investing in a stock and just praying that you hit the jackpot.

It’s nothing more than gambling and that’s not something that we advise at einvestingforbeginners. In fact, we advise the exact opposite as Dave ends every single podcast by saying “invest with a margin of safety…emphasis on the safety”.

When you gamble on some of these penny stocks, you’re essentially just buying into a hope and prayer that the stock hits it big and you get some massive returns. Maybe the company is a biotech stock that doesn’t have any premier drugs on the market and you’re simply hoping that they can get something to the market sooner rather than later.

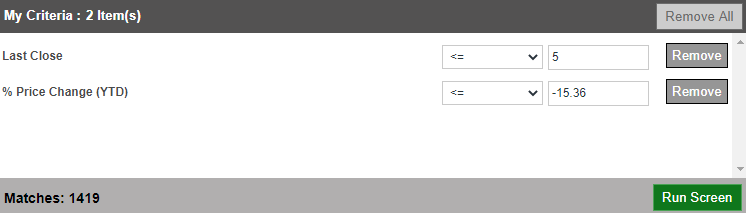

You know how earlier I talked about there being 2,837 stocks that have a price of $5 or less? My mind was making me question if the performance of these stocks was evenly distributed or not. The best way that I could think of was to head back to the stock screener!

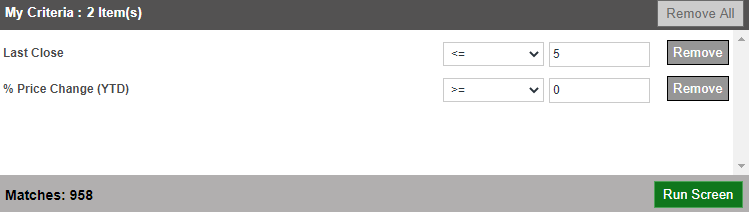

I did the same screen as before with the price of $5 or less but then also added in what the price change % was YTD, as of 10/7/2020. My first test was to try to just see what stocks have even had a positive return so far in 2020.

When I did that, only 958 of the 2,837 stocks were showing, meaning that 33.7% would’ve made you money (or at least broken even) in 2020:

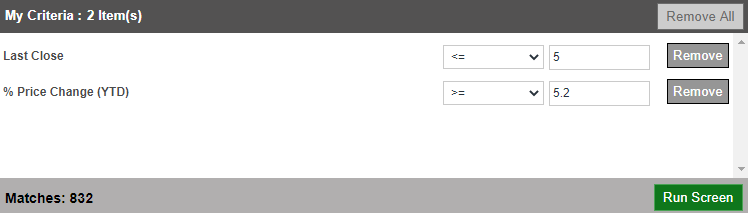

Now, if you had simply just invested your funds into a S&P 500 ETF like VOO, then you would’ve had 5.2% returns through 2020. When I change the stock screener to only show me companies with at least a 5.2% return, I now only have 832 companies, or 29.3% of these penny stocks:

Now my mind is immediately intrigued – the large majority of these stocks are losing to the S&P 500, which anyone can buy for essentially no cost with 0 investment knowledge. Literally just go to your brokerage and buy SPY or VOO and that’s it!

But my mind is wandering because I want to find what the average return for these companies are. Now it took some “guess and check” as you might remember that term from grade school math, but essentially I was randomly putting percentages into the stock screener to try to find a level that showed the median return by finding half of the companies at a certain return.

When I did this, I found that the median return in 2020 for these penny stocks was -15.36%:

Can you believe that? That means half the ocmpanies had worse than -15.36% return, just a slight underperfmance of the S&P 500 by 20%.

But as I mentioned – when you’re buying penny stocks, you’re not wanting to buy a basket of stocks – you’re going to try to find some diamonds in the rough and try to hit it big!

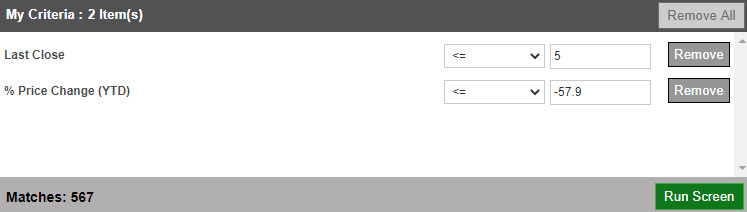

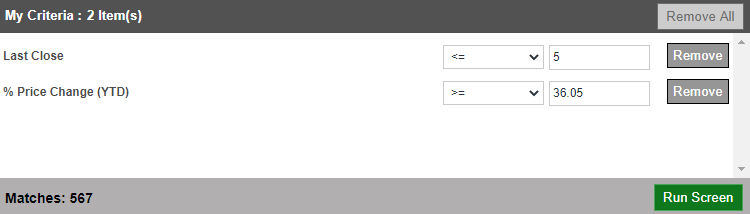

So let’s do this – let’s imagine that you’re able to time it up well and you only buy two volatile penny stocks – one of which is the first company in the Top 20% and one is the first company in the bottom 20%. How do you think that would look?

Well, by doing the same stock screener manipulation that I have been doing, you can see that the bottom 20% stock would’ve returned you -57.9%:

Ok, ok – that’s freaking awful, but as long as the top 20% stock would be at a positive 57.9% return, then you breakeven, right? Right!

The only issue is that it’s not even close…

So, you have one stock that’s almost negative 58% and one is just over a positive 36% return – that means your average return, if you were equally distributed in these two stocks, would be -21.85%. OUCH!

Essentially, I am telling you that not only are the averages of the penny stocks likely going to significantly underperform the S&P 500, but you’re going to have lower lows as well. It’s really not a good situation.

The reason that I am going into this much detail as a high-level is because I want you to understand the landscape of penny stocks. Many people that invest in these companies will try to day trade them and guess what, that’s not at all what we do.

We buy companies with strong balance sheets that are undervalued vs. their intrinsic value and present an opportunity to rebound back to their true value.

Normally when I am trying to learn about new stocks, industries, etc., I am willing to buy a basket of funds known as an ETF to try to get some exposure to those companies without feeling like needing to pick an individual stock. This allows me to get some skin in the game and gets me motivated to learn about companies and industries while being able to actually apply it to my investments, which is something that I think is extremely valuable.

I have done this in the past with gold stocks and cloud stocks and I think it’s made me a much better investor in those realms because I’ve been hungry for the knowledge rather than reading just for educational purposes – my money was actually at stake!

However, with all that being said, penny stocks are NOT a type of stock that you should buy as an ETF. I just went through explaining how the median return of these penny stocks is so abysmal that it should’ve scared you far away from ever wanting to buy that ETF.

An ETF simply will remove some of the extreme volatility, both for the good and bad, and bring you more towards an average return for that grouping of stocks. Well, as I mentioned, the average return in 2020 for these cloud stocks is AWFUL!

But guess what – it’s not just in 2020 – it’s in many years throughout history.

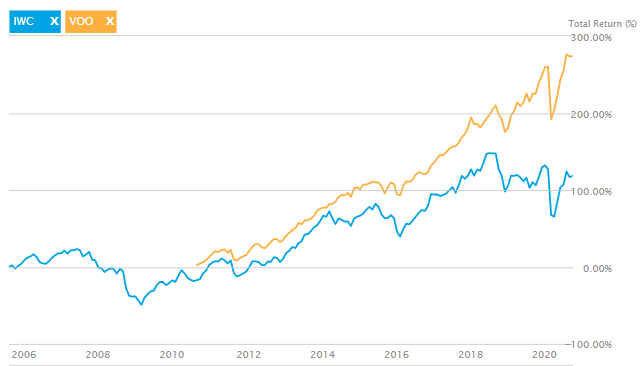

If you wanted a penny stock ETF, one way to get something similar would be to look at micro cap stocks, which are stocks that have a market cap of $50 million – $300 million, meaning they are very, very small companies, that likely have a lower share price, although that’s not a given.

If you were to look at IWC, a very popular microcap ETF, you would see that the returns might leave you a little bit unsatisfied.

The graph below from ETF.com shows you how IWC has compared vs. VOO (S&P 500 ETF) over the last few years:

I mean – those returns are not even in the same ballpark! Since 2010, the returns for VOO are ~ 275% while the returns for IWC are just over 100%. And honestly, this isn’t surprising at all!

The thing that makes a penny stock so enticing is that it’s an opportunity for a lottery ticket, but so far in 2020, your odds of winning were only 30%!

Would you ever bet on anything where your odds to win were 30%? Heck no!

I mean, maybe if I was guaranteed a higher incentive, but you’re not! Even at the 20% levels, the top 20% returns are lower than the losses that you would anticipate for a bottom 20% stock.

To me, that tells me all that I need to know – if you invest in penny stocks, the volatility is going to be absolutely insane. You’re going to see some major wins and some even larger losses.

What to Do with Volatile Penny Stocks

If you want to take out a very small portion of your investments and invest in penny stocks as speculative investments, I am ok with that – but you need to understand the risk that you’re making yourself susceptible to.

History says that you’re going to potentially lose money, but you’re almost guaranteed to underperform the S&P 500. If that’s a risk that you want to take, and you’re willing to take the time to still do all of the research to learn about these companies, then I don’t have a problem with you investing in them – but you need to do so with eyes wide open.

Personally, I have invested in some small companies before such as some oil companies that saw their stocks drop below $5, and it was a pretty big mistake! Fortunately, I literally went into those investments with the same mindset that I have when I go to the casino – If I walk in with $100, then I ask myself, “are you ok with living your life with $100 less?”

If the answer is no, I don’t go to the casino. I keep my money parked where it is and just life my life like normal.

You need to have the same mindset when you invest in penny stocks. And honestly, your odds are way worse with these stocks than they are at a casino! I’ve never seen someone with 70% odds to lose money…unless it’s your odds playing me in Poker ?

Andrew and Dave had Timothy Sykes on their podcast to talk about trading penny stocks, and he has been very successful doing this but it has been a long, bumpy road. He advises that you can be successful but it’s like 2 full time jobs with the time requirement to be good at it. Is that something you want to do?

I don’t…

As I said, at the end of the day, we focus on finding companies with strong balance sheets and great track records. I know that might seem overwhelming, but it’s really not. Start small with these three simple tips to get investing and you stand a much better shot at avoiding information overload!

Related posts:

- Penny Stock Investing: 5 Rules It’s time to finally write about the infamous topic of penny stock investing. Chances are, you’ve heard or seen them peddled before. Scammers and fraudsters...

- Where to Put Your Money? Large Cap vs. Small Cap Stocks! Where to Put Your Money? Large Cap vs. Small Cap Stocks! I love listening/watching CNBC whenever I have free time, solely for the entertainment factor,...

- Investable Themes for 2020 Stocks and ETFs So, 2020 is finally upon us! First of all, congrats to everyone for making it through another decade and hopefully you’re a decade closer to...

- I Know Micro Cap Stocks are Risky, but do They Generate Massive Returns? “Micro Cap stocks? I thought it was only large cap and small cap!” Nope. You’re wrong. Remember how I used a comparison of Brock Lesnar...