One of the most dangerous things in the investing world is dealing with a Wall Street Bear. If you’re like me and a total CNBC addict, then chances are you’re going to hear all different sorts of opinions, but seriously – the Wall Street Bear is the worst!

Investopedia says that, “A bear is an investor who is pessimistic about the markets and expects prices to decline in the near- to medium term.”

On the other hand, you have Bulls, who are very excited about the market and expect prices to go up in the near term. You have likely heard the terms “bearish” and “bullish”, which are really just your opinions of what the market is going to do.

I’m not sure what it is, but you can always find people that think that the market is going to crash. I somewhat think that it’s almost like if you don’t have a favorite sports team, sometimes it can be more fun to hate on a team that always wins.

That way, you always have something to cheer for anytime the common winners like the Patriots, Yankees, Alabama, Duke, etc. are always winning games.

It’s the same way with investing. People are always wanting to call that bear market, which is when the market crashes 20% or more, rather than just continue life in their bull market, which is a 20% or more increase in the stock market.

Now, I get that there are many different factors that people can look at to predict a crash such as the RSI or the Cyclically Adjusted P/E Ratio (CAPE), but I also just think that there are people that are wanting to be the ones to “call the crash.”

I mean, it’s cool that you were able to call it, but how many times did you think the market was going to crash and just completely miss out? All the while, the market was continuing to go up. You see, these Wall Street Bears are so dangerous because while they’re sitting there trying to time the crash, they’re passing up massive gains that the market has given us for literally forever.

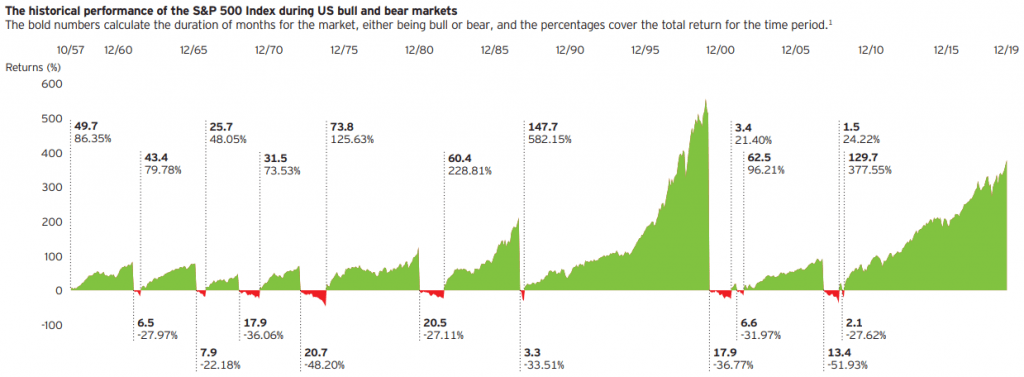

I found this awesome chart from Invesco and I’m not lying, it might literally be my favorite chart of all time. It shows the history of bull and bear markets, the timeframe that those periods lasted and the total return that you would’ve experienced if you had been invested during that time.

Take a look!

Starting in the top left in October of 1957, you can see that there was a bull market lasting 49.7 months where the total return was 86.35%. Then, you had a bear market lasting 6.5 months where the market lost 22.18% in value.

Some of my immediate takeaways from the chart are that the bull markets last way longer and that the peaks are way higher:

So, the average length is about 5x and the average returns are also about 5x the value for a bull market vs. a bear market.

Another thing that I notice is that if you look at the end of the bull markets and the beginning of the bear markets, typically they’re going up very rapidly and then dropping very rapidly.

AKA, if you’re going to try to time the market, you don’t have some massive runway. Things will change rapidly and you have to be prepared to adapt quickly but even if you do, you might still be making a massive mistake.

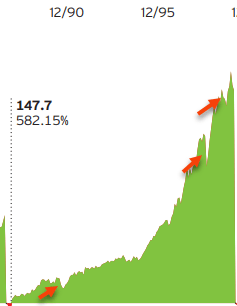

Let’s take a look at the time period between 1985 – 2000. I’m going to pretend that you could sell your holdings. I put red arrows in three likely periods where you’d sell your stocks because the market was dropping.

Guess what? Every time the market went right back up!

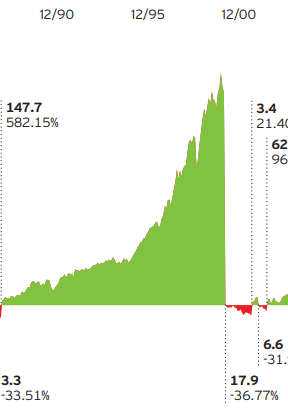

Even if you did time it perfectly and avoided the crash, all that you did was save a 36% drop. Now don’t get me wrong, that’s an amazing thing to do and an absolutely huge impact to your portfolio, but if you were constantly tinkering with your portfolio the decade before that where the market was up 582%, and maybe you were only up 400% because of it, then did you actually win?

Wall Street Bears are always looking to sell out of their stocks and get into cash. They feel like if they can avoid the crash then they’re going to be in a really good spot for some massive returns, and they’re right!

If you can avoid a 30% drop and then get back in at the perfect time, you’re going to be soooo far ahead of everyone else – but that is the most unrealistic thing ever, especially for rookies like us to do.

I am not a full-time investor – why would I think that I could actually time the market? Because someone on CNBC said that? Because of a ratio or two that I look at?

Asinine.

It’s January 14, 2021 when I write this – literally everyone, including myself, says the market is frothy right now and the valuations of companies are absolutely insane. But am I going to cash? NO!

People have been saying that for months and guess what, the market just keeps going up, up, up. Consistently hitting all-time highs. I don’t know if the market is going to crash, but I do know that there’s a really good chance it keeps going up!

If you find yourself listening to these Wall Street Bears then you also are going to be timing the market.

Stop.

Time in the market beats timing the market.

I know that’s somewhat of a cliché but it’s also 100% true. Just get your money invested and you’re going to be just fine. You can either do it via dollar-cost averaging or just throwing it all in via a lump sum, but either way, get that money into the market!

When I first started investing, I thought that I was a wicked day trader and would sling stocks and stack those gains, bruh!

Kidding.

I lost a ton of money lol.

I thought that I would be able to time these stocks just perfectly and buy at the lows and sell at the highs. I setup all these alerts on articles about the stocks that I owned and just told myself that if I was always looking at my phone, I could find the good news faster and then buy a stock and sell it after a quick run up.

Then one day I was listening to a podcast and they said, “Do you really think that you can read an article on Yahoo Finance and then invest in it? If someone has already written an article about it, posted it, and you read it – then you missed the news.”

I mean, that hit me pretty hard because they were right. A lot of people will “Buy the Rumor, Sell the News” and I just think that’s an absolutely awful strategy.

Instead, why not just focus on finding great companies at good prices, just as Warren Buffett tells us to do.

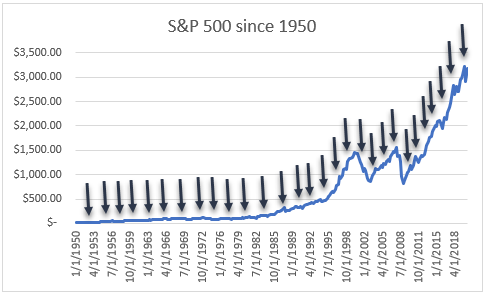

Do you know when it has been a good time to invest in the S&P 500? Literally every time:

All of those entry points eventually have just gone higher and higher. If you can just buy and hold for the long-term rather than being focused on all of these short-term trades that people get addicted to, you’re going to be infinitely better off!

Do me, and more importantly yourself, a major favor and make sure you keep the end goal in mind. You’re investing for financial independence – not to make $15 trading a stock that went up $.25/share.

Long-term or short-term? Long-term ALWAYS wins!

Related posts:

- “There is Always a Bull Market Somewhere.” Or is there? Brand new investors might look at a rising stock market and all-time highs as a potential indicator that stocks are expensive. However, new investors should...

- The Basics of Wall Street Explained – Is it a Place for Good? Updated 4/15/2024 So, you’re looking to start investing, but first, you want to know the basics of Wall Street. What is it? Why does it...

- Stock Market Cycles: How to Analyze and Profit Updated 7/24/2023 “Warren Buffett tells us, ‘The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our...

- Comparing the Bull and Bear Market In a nutshell, a bull is seen as someone who is optimistic and believes that stocks will rally. This is a bullish outlook. On the...