Updated 4/15/2024

So, you’re looking to start investing, but first, you want to know the basics of Wall Street. What is it? Why does it exist? Is it a place for good?

Key Takeaways

- Wall Street is a physical location in lower Manhattan, home of the New York Stock Exchange (NYSE), where daily investing occurs.

- Wall Street establishes a commonplace for companies to raise capital as well as a secondary market so people can buy and sell shares of individual companies.

- People have access to grow their individual wealth because of the access to Wall Street.

- Without Wall Street, achieving Financial Independence would be much, much harder.

In this post, I’m going to answer the following questions:

What is Wall Street?

Wall Street is a physical location in lower Manhattan, home of the New York Stock Exchange (NYSE), where daily investing occurs.

Wall Street has also become somewhat of catch all for the stock market/investing related things. If you’ve watched CNBC before, chances are you have seen a company ring the opening bell to indicate that the stock market is opening for the day.

Why Does Wall Street Exist?

The Balance wrote a great article that I think breaks down the very basics of what Wall Street is, and one thing that they focus on is that Wall Street has three key reasons for its existence:

1 – “To establish a market for institutions to raise capital through a centralized trading area that connects savers of capital with those who want to raise capital.”

If you own a business and want access to more cash, Wall Street provides a platform for you to have an Initial Public Offering (IPO) and then offer up shares of your company for more cash. By doing so, you essentially get access to many different investors that you might not have had access to or would’ve needed to work much harder to gain access to.

2 – “To facilitate a secondary market for existing owners of stocks and bonds to find parties willing to buy their securities so they can raise cash.”

Similar to the first point, after the company has hosted its IPO, all investors can buy and resell its shares at will. For an ordinary person like myself, this is the point at which I would be able to buy shares of the company.

I would guess that 99.99%+ of all retail investors will make their stock trades online, but people will refer to that as being on “Wall Street” simply because that is where the stock market trading began.

3 – “To assist those who wish to outsource the job of investing their capital so the client can focus on their primary career or activity.”

Some people will use brokers to invest their money so they can focus on other things. This might be the super successful businessperson, an athlete, an artist, or even someone who works a normal 8-5 and wants to pay Fidelity to manage their 401k for them.

Either way, Wall Street’s accessibility has helped these brokers to have much better access for their clients.

Is Wall Street a Place for Good?

Many people view Wall Street as a place full of corruption and greed. They view it as people willing to do literally anything to get ahead, including pushing others out of the way.

The naysayers will think of companies that have engaged in corruption such as Enron or even most recently, Luckin Coffee.

They think of movies they have seen, such as Wolf of Wall Street (which is one of my favorite stock market movies, by the way) and The Big Short, which focuses on banks lending mortgage money to anyone right before the 2008 housing market crash.

But just as with anything in life, there are a few bad apples that can really spoil a reputation and as always, the bad/corrupt people are always the ones that make the best stories!

Think about with baseball – some baseball players are frauds and use steroids to have amazing seasons, therefore they’re being fraudulent to their fans and their employers about their talent, as well as directly affecting the teams that they’re playing by having an unfair advantage.

Think about Pete Rose—he didn’t cheat but bet on baseball games. Do you know anything else about Pete Rose? Maybe that he played and coached for the Reds? I am guessing that’s it because the bad things stick out in people’s minds and make for the best stories!

For me to properly address this question, I want to go through the three reasons why Wall Street exists and explain my thoughts on them:

1 – Wall Street gives people access to capital for their business that might not have otherwise had it.

This is extremely good. People who have started businesses might be at a point where they’re maybe doing well but are really struggling to keep things going because of their cash flow.

Nowadays, many of the new up-and-coming businesses in the world are all going public before they have any earnings, and if they weren’t able to have their IPO, they might very well never even be able to survive.

I think about companies like ZM, FSLY, and ROKU – all three of which have had major impacts on many people’s lives since COVID-19 occurred, but likely even before then! These companies all have negative earnings or have in the recent past, and would’ve likely had some major struggles and not been where they are today without being able to IPO their company and get access to capital.

By having greater access to capital, these companies are able to provide their products and services to more people, therefore enhancing their lives, and they’re also able to grow faster and employ more people, therefore creating more jobs.

Providing a way for companies to access capital in exchange for ownership of the company is a perfect thing, not just for the business owners but also for many others who consume the product/service or are employed by that company.

2 – Wall Street gives people the ability to invest in individual companies

Honestly, I think that this reason impacts the majority of people the most of any of the three.

I’ve grown up in a family that has always invested, but honestly, I thought it was nerdy and boring… Then one day, I realized that I actually found it super interesting. And maybe that means that I am nerdy and boring…

The thing that got me invested is that I felt like I was always playing from behind financially. I could never get ahead and felt stressed about money.

That was when I learned about the power of compound interest and how investing can change my life. Let me explain:

Let’s pretend that I want to retire in 30 years with $2 million, and I have $0 saved right now. If I was to simply put my money into a high-yield savings account, even assuming a 2% interest rate despite my Ally account being .8% right now, it would take an annual contribution of $48,334 to hit your goal of $2 million in 30 years:

Yuck. That sounds awful.

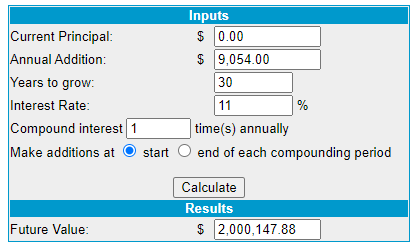

But since I am able to invest in the stock market, if I were to assume that I would realize a return similar to the S&P 500 since 1950 of 11%, I could get to $2 million in 30 years simply by only contributing $9,054/year:

Isn’t that insane? The difference between Wall Street accessibility for the individual investor is the difference between having to save $48K or $9K in a year.

To me, that is a huge freaking difference.

Another way to view it is if you were actually able to save/invest $48,334/year, then you would be able to retire at that $2 million goal after 15.62 years rather than 30.

You just cut the timing of your goal in half…HALF!

I can honestly say that having the accessibility to buy and sell individual stocks has been life-changing for me. It’s given me encouragement and excitement to really keep me motivated on my goals.

Personally, I like to invest in individual stocks but you can simply invest in an ETF like VOO for the total stock market return or MTUM if you want to use a Momentum Investing style (which has proven returns better than the S&P 500).

I say this because anyone can invest, and it doesn’t take a certain amount of genius for you to be in the stock market. All that you need to do is get started. Start with something as simple as this awesome free PDF or some great Twitter accounts and start learning.

The most important thing is time, so get started now if you want to reach Financial Independence in the future.

The question is – does this accessibility of investing to the normal person mean that Wall Street is a place for good? I think this is a resounding yes.

3 – Wall Street allows others the ability to have their money professionally invested by others

This one is also a ‘good’ in my eyes, but for the same reasons I mentioned for #2. Everything that I wrote above will also apply to this but I do think that there is an additional added benefit that needs to be considered.

The three main types of people that will benefit in this subsection are:

1 – People that don’t have time to invest

2 – People that don’t think they’re smart enough

3 – People who will get in their way

Personally, I can best relate to not having time. If you’re a major big shot at a company that’s making millions of dollars each year, then maybe you don’t want to invest and would rather just pay someone to do it.

Personally, I get that. You’re probably working 80+ hour weeks as it is, so why take the time to invest? I mean, you could always just invest in ETFs, but if you want your own personal touch, maybe you decide to hire a financial advisor.

For people who don’t think they’re smart enough – you’re mistaken. Investing is as complex as you want it to be. If you don’t want to get in the weeds, buy ETFs! They can replicate the market or a sector of stocks that you want them to, and they take, honestly, 0 analysis.

Now, I do think that you should still consider some analytical aspects, like I did when I was studying Gold ETFs, but it’s all about how much you want to invest.

Personally, I don’t like to invest in ETFs, but I will at times. I have invested in a few where I wanted some exposure to a particular industry without getting too far into the weeds because I was uncomfortable in that area, such as JETS for airline exposure and WCLD for cloud exposure.

It’s all about knowing yourself, but you are smart enough to invest.

If you’re worried about getting in your own way, then I do think that having others invest for you is a good way to help save yourself from yourself. You need to make sure that you’re not holding your investment advisor to the same standards that you’re trying to protect yourself from because otherwise, you’re just going to be paying someone to have the same bad results that you had.

The main thing is to make sure that your expectations are in line with reality and that you’re not expecting the world.

Summary

At the end of the day – is Wall Street a place for good?

I think the answer is a very clear ‘yes’.

Wall Street helps provide businesses with greater accessibility to capital, which they will then use to fund and grow their company. As their company grows, they will continue to revolutionize and adapt their product/service line, further enhancing the lives of their consumers. They will then need to hire more people, leading to more jobs and continued innovation, which will further develop new types of jobs.

Wall Street allows the average person to achieve financial independence much faster than they could otherwise. They can retire early, or maybe just retire at all, and spend time with their loved ones. Goals that didn’t used to be available are now within reach.

Wall Street is open to everyone! Even if you’re not cut out for it, you can have someone invest for you on your behalf. They can use their expertise to bring you closer to financial independence and ensure that you’re on track for your goals.

Of course, some crooks and criminals will defraud the system, but for every one of those people, I will show you thousands of people who have achieved lifelong goals that would NEVER have occurred without Wall Street.

Related posts:

- Wall Street Bear – Friend or Foe?! One of the most dangerous things in the investing world is dealing with a Wall Street Bear. If you’re like me and a total CNBC...

- The 7 Types of Capital Allocation and What They Mean for Shareholders Updated 9/3/2023 “Capital allocation is a senior management team’s most fundamental responsibility. The problem is that many CEOs don’t know how to allocate capital effectively....

- Guide: How to Evaluate a Stock Using Price Based Metrics Updated – 12/14/23 Learning how to evaluate the price of a stock means determining if the price is right, or not. The reason this is...

- My Thoughts After 10 Interviews on a Prudent Buy and Hold Strategy If there’s one thing many investors can all agree upon, it’s that buying stocks and holding for the long term is the best way to...