Updated 9/3/2023

American Express was one of the turning point investments for Warren Buffett. It began his path to becoming the investor he is now. Buffett’s buying of American Express was the first of “buying wonderful companies at fair prices.”

Today, American Express is one of his largest positions; fifty-seven years later, he owns over 18% of the company. And it continues to earn Buffett high returns on capital, one of his benchmark ideas behind finding wonderful companies.

In today’s post, I thought we would examine the status of American Express in 1964, along with the conditions that led Buffett to pull the trigger on one of his seminal investments. Along with examining the company and the economic conditions, we could look at what a valuation might have looked like in 1964, hindsight being 20/20 and all.

In today’s post, we will learn:

- American Express Business Model in 1963

- American Express Financials in 1963

- The Salad Oil Scandal

- Valuation of American Express in 1963

American Express Business Model in 1963

The American Express model of today was vastly different in 1963. At the time, the company was the leader in traveler’s cheques to pay for travel expenses such as hotels and airlines. But, American Express was also pioneering using the first plastic credit card.

With the growing U.S. population and interest in air travel, American Express was on the cusp of becoming the giant today.

American Express understood that the main advantage of traveling with traveler’s cheques and the new credit card was that it helped eliminate the need to travel with cash. It also reduces the impacts of exchanging foreign currency, traveling abroad, or worrying about having enough cash as you travel.

American Express traveler’s cheques carried the trust of the name behind the brand. Merchants knew when they received their Amex cheques, the money was good. At the time, the other alternative was to carry large sums of money, never good, or travel with a letter of credit, which was a slow and clunky process.

American Express helped pioneer the change to traveling without cash.

At Buffett’s purchase, American Express operated in ten different segments. The segments, from largest to smallest in scale, were:

- Traveler’s cheques

- Money orders

- Utility bills

- Travel

- Credit cards

- Commercial banking

- Foreign remittances

- Freight

- Wells Fargo/Hertz

- Warehousing

A note before covering the segments for American Express: a company with ten segments was not simple to understand, unlike someone like Wells Fargo or Walmart with a simpler business model.

The 1963 annual report describes all of the segments in a ton of detail; to be brief, we will focus on the bigger and smaller segments.

Traveler’s cheques

The largest segment of revenues for American Express consists of paper checks that customers could purchase that they could use when they travel to pay for items such as hotels, food, entertainment, and various other items.

Vendors and banks accepted these traveler’s cheques worldwide, and customers could exchange them for foreign currency. American Express collected cash and a small fee for the cheques, providing customers with a trusted network to exchange during their travels.

To encourage more adoption of their cheques, American Express offered a small commission to merchants in exchange for accepting their traveler’s cheques.

The top competitor to traveler’s cheques was getting a letter of credit, which consisted of going to the bank using deposits or collateral to ask the bank for the letter of credit. The customer could take this letter of credit to local or foreign banks, allowing the customer to make payments while traveling. Talk about cumbersome and painful.

Traveler’s cheques offered many benefits, such as ease of purchase and exchange. Another benefit was lower customer costs as you could purchase them in larger amounts and reduce transaction costs. The final benefit was replacing them easily in either loss or theft, which provided additional security for the customer.

Banks liked the traveler’s cheques because they attracted additional customers to their branches, providing additional opportunities for cross-selling other products. The traveler’s cheques provided standardization for receiving banks and made it easier to accept the cheques across the banking networks than to process letters of credit.

The financial performance of this segment is evident by the increase in revenues, from $260 million in 1954 to $470 million in 1963, which was a 6.8% CAGR over that period.

Money Orders and Utility Bills

The second-largest segment of American Express is the money order and utility bills business, which started back in 1880 as competition to the U.S. Postal Service.

The business was simple: provide a safe and simple way to transfer money or pay bills via courier or mail. By 1963, the money order segment was the largest commercial instrument in the U.S. and the only commercial money order available in all fifty states.

Travel

American Express’s third-largest segment was the travel business, which sold steamship cruise tickets and organized international travel.

The travel segment had large and small competition and was largely dependent on execution, with little barrier to entry. Meaning the business was ripe for disruption and less and less focus for American Express.

Credit Card

Even in 1963, the credit card segment provided growth and became an important foundation for the company’s future growth.

The credit card, which first appeared in 1910, was started by Western Union; it didn’t reach popularity and grew widespread use until the 1950s with Diners Club.

By 1958, American Express became the leader with its strong network and brand. By 1963, the credit card segment showed profits for two years despite early operational struggles, which drove American Express’s success.

1963, the company reported total card membership growth over the one million-member mark. Along with the growing member count, the card billings were rising at a tremendous rate as well.

The card made money for American Express in a two-sided exchange. The company could make money from both sides of the equation by charging merchants a fee (interchange fee) for processing their card and the members an annual fee for the privilege of using their American Express card.

The company could leverage its brand and reputation from traveler’s cheques into adopting their credit card. Funnily enough, it became “cool” to have an American Express card, and merchants were happy to pay the interchange fee because it helped attract affluent customers to their stores.

The American Express card created value for both the customer and the merchant was a win for both parties, and helped increase its cache and value.

American Express benefited from the growing popularity of the credit card and the absence of much competition; the company enjoyed some hidden pricing power. The power of their network allowed American Express to expand quickly and keep competition at bay, at least for the time.

American Express Financials in 1963

In 1963, the company was firing on all cylinders from a financial statement basis. From 1954 to 1963, the company grew revenues from $37 million to $100 million, 10.45 CAGR over that period. In fact, during that time, not once did the company fail to grow revenues year over year (YoY).

Earnings per share (EPS) grew from $1.05 to $2.52 at 10% CAGR, and American Expresses book value grew from $42 million to $79 million.

The $11.2 million in 1963 equated to operating margins of 16% and net income margins of 11%, which showcased how profitable American Express was in 1963. Not too bad for a “boring” company, huh?

As a side note, American Express highlighted their financials on a 10-year basis, unlike today’s financials, which are only three or two years, depending on the statement. Remember that the cash flow statement didn’t exist in 1963; it wasn’t introduced until 1971 and didn’t evolve into the document we use today until 1985.

Moving to the balance sheet side of the equation, we see:

Assets:

- Cash and equivalents – $263 million (24% of assets)

- Investments – $507 million (45% of assets)

- U.S. Treasury bonds – $40 million (3% of assets)

- Loans and discounts – $186 million (17% of assets)

- Accounts receivable and accrued interest (6% of assets)

Liabilities

- Traveler’s cheques – $525 million (47% of liabilities)

- Deposits and credit card balances – $387 million (35% of liabilities)

- Deposit liability related to U.S. Treasury bonds – (4% of liabilities)

Shareholder equity

- Shareholder equity – $83 million

American Expresses shareholder equity grew 7.4% CAGR from 1954 to 1963, from $44 million to $83 million in 1963. During this time, American Express was also paying a dividend of $1.40 per share, with a payout ratio of 56%.

As we can see from the above numbers, American Express was a strong, growing company in 1963 with a long runway ahead. The company was paying a growing dividend and had great returns on equity of 15% in 1963, up from 13.9% in 1954.

Suppose we look at the company’s return on capital employed (ROCE). We see that the company had returns of 78% in 1963, which tells us that the company was a capital-light company with some serious franchise or brand power. Those returns on capital indicate that American Express could grow without reinvesting much capital to continue to grow.

The Salad Oil Scandal

American Express was exactly what Buffett was looking for or beginning to identify as an excellent investment in 1963.

That begs the question, why was the company dropping like a rock in 1963? What led Buffett to swoop in and buy it at such a discount?

In a phrase, the Salad Oil Scandal rocked American Express and the market’s reaction to the company. To understand what happened, let’s explore the Scandal a little.

In 1963, American Express experienced one of the worst corporate scandals at the time, known as the Salad Oil Scandal. In November 1963, inspectors discovered that one of its subsidiaries, a warehouse in Bayonne, NJ, had written receipts, which were the basis of loans made to Allied Crude Vegetable Oil Refining.

It turned out that Allied committed fraud by filling their oil tanks with seawater and layering the salad oil over the top because, as investigators discovered, oil floats on top of the water. Allied told everyone the tanks were full of oil when there were only a few feet of oil, which fooled inspectors.

Soon after, Allied and the American Express subsidiary filed for bankruptcy, and no one was sure if the parent company, American Express, was liable for any damages.

The fear on Wall Street was Allied reported it had assets worth $175 million of salad oil when it had far less. Allied used that asset to take out loans against the salad oil, which they subsequently defaulted on and filed for bankruptcy.

Word on the street was American Express was facing insolvency and was on the hook for the bad loans to Allied. Because of the bad press and fear of bankruptcy, American Express’s stock price fell from $60 to $35 in early 1964.

Buffett then went to work, studying the company and asking local merchants and vendors whether their spending habits were changing because of the scandal. He also spoke to banks and travel agencies to get their take on their usage habits. After speaking to numerous people, he determined that American Express would likely continue operating as before. The possible damage to its reputation wouldn’t be permanent, and the brand was strong and resilient.

Another point of fact from Buffett:

“There was one other little wrinkle which was terribly interesting. American Express was not a corporation. It then was the only major publicly traded security that was a joint-stock association. As such, the ownership of the company was assessable. If it turned out that the liabilities were greater than the assets, [then] the ownership was assessable. So every trust department in the United States panicked. I remember the Continental Bank held over 5% of the company, and all of a sudden, not only do they see that the trust accounts were going to have stock worth zero, but it could get assessed. The stock just poured out, of course, and the market got slightly inefficient for a short period of time.”

Buffett felt that the company was worth $150 million after his research, but the scandal terrified the market, and no one would touch American Express. He judged that the potential loss to the company for the Salad Oil Scandal would be between $60 million to $100 million, a lot to be sure, but far less than the company’s value.

“The whole American Express Company synonymous with financial integrity and money substitutes around the world. When they closed the banks, when Roosevelt closed the banks, he exempted American Express Traveler’s Checks, so they substituted as U.S. currency. It was not a business that should have been selling for $150 million, but everyone was terrified.”

That is when Buffett pounced, buying 5% of the company with a purchase of $13 million. The company was selling between $35 and $38 a share at the time.

Valuation of American Express in 1963

After looking at the financials and the details around the Salad Oil Scandal, we get a good sense of why Buffett bought American Express. One of my questions remains: What would a price look like compared to the intrinsic value?

At the time, American Express would have traded at 16x earnings in 1963, which would not have been a cheap stock for Buffett. Remember that the S&P 500 average P/E was around 14x in 1963, and by the time Buffett started buying the company, the P/E would be in the 24x range, far from cheap.

I know these numbers seem low, but we have to remember this is before the internet, and the rise of intangible assets and today’s lower interest rates lead to higher valuations.

The AAA Corporate bond rate traded at around 4.4% in 1964, compared to today’s current 30-year rates of 1.63%. Generally, higher rates equal lower valuations, and Buffett would have been buying at the highs.

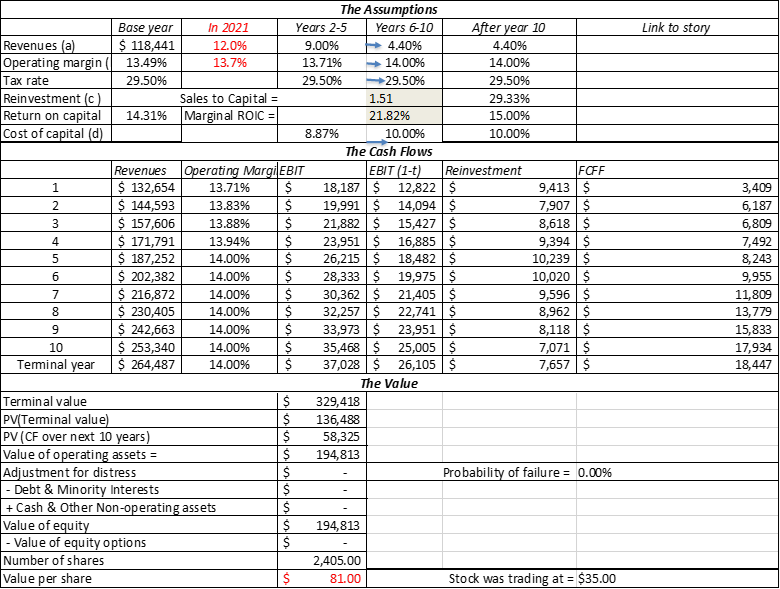

If we plug in the financials from 1964 to a DCF model, we get a value of $81, based on the growth of revenues, margins, and cost of capital from the current time. That figure is above the trading price at the time of Buffett’s purchase but in line with what the company would have been worth before the scandal, based on future projections.

Based on the DCF (discounted cash flow) model, the company traded below its intrinsic value in 1964. It provided Buffett with an ample margin of safety and an opportunity to take advantage of fear in the market.

Investor Takeaway

At the end of the day, American Express was not a cheap buy for Buffett in 1964 on a relative basis. It looks in hindsight like Buffett was looking beyond the relative valuation at the company’s future earning potential and the likelihood it would bounce back from the scandal.

American Express offered a fantastic business with a strong business model and a moat to withstand the shock of the potential loss from the scandal. It also offered a strong core business, with the expansion potential of the credit card offering to grow with high returns on capital, a Buffett favorite.

After studying Buffett’s purchase of American Express, you can see the makings of a great investment with long-term potential. The company experienced a bump in the road, but Buffett could see beyond the scandal and sense that the company’s operations would offer much more over the long run.

American Express was the first of his “buying a wonderful business at a fair price” mantra he would later adopt, with strong encouragement from his business partner, Charlie Munger.

If you want to learn more about Warren Buffett and the Salad Oil Scandal, check out these additional resources; they were instrumental in helping write this post.

Buffett: The Making of an American Capitalist by Roger Lowenstein

Inside the Investments of Warren Buffett by Yefei Lu

With that, we will wrap up our discussion of Warren Buffett’s purchase of American Express.

As always, thank you for taking the time to read today’s post, and I hope you find some value in your investing journey. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- The Secret Behind Warren Buffett’s Coca Cola Investment Revealed Post Updated: 6/30/2023 When you look through the history of Warren Buffett’s career, you see a few key decisions that fueled so much compounding of...

- The Essays of Warren Buffett: A Complete Book Summary I feel like I’ve been reading the Essays of Warren Buffett for literally a lifetime, and although it hasn’t nearly need that long, it does...

- The 8 Top Fintech Podcasts of 2022 Lots of us here are big podcast fans, and learning more about the exciting sector, fintech (financial technology), through the top podcasts helps focus the...

- The Intelligent Investor: Is it Outdated? Is it for Beginners? Should I Read it? Edited 3/24/2023 Warren Buffett started learning about investing when he was seven or eight. I know a late bloomer. Buffett’s father started a small investment...