“I never buy anything unless I can fill out on a piece of paper my reasons. I may be wrong, but I would know the answer to that …I’m paying $32 billion today for the Coca-Cola Company because… If you can’t answer that question, you shouldn’t buy it. If you can answer that question, and you do it a few times, you’ll make a lot of money.”

Coca-cola or Coke is among the most famous brands in the world. Its signature soda is one of the most consumed products and is one of the signature investments of Warren Buffett. The Coke investment was the first change in investment theory that Buffett undertook from cheap stocks to quality stocks.

During that time, early 1988, Buffett was transforming his thinking. Charlie Munger had for years spoken about looking for “wonderful companies and fair prices,” and this was Buffett’s first foray into that idea.

Coke is a signature investment in Buffett’s career and one of his best investments in both returns and teaching moments. Along with the wonderful returns he earned, it also has become one of the best examples of ideas such as a strong moat, brand, and network effects.

Buffett loves Coke; it is obvious if you observe him at his annual Shareholder meetings, where Coke has a prominent place on his table. He continues to hold that investment.

In today’s post, we will learn:

- History of Coke

- Financial Condition in 1988

- Valuation of Coke Based on 1988 Conditions

- What We Can Learn From His Investment

History of Coke

To understand the investment in Coca-cola, we need to understand the company’s standing at the time in 1988. Sometimes, when we look at the past, we bring our prejudices or ideas that the “old” days were not as advanced as today.

Putting those ideas aside, we can look at the whole of the investment. And try to assess it on the idea of why he bought Coke and how we can learn from those ideas.

To a potential investor in 1988, Coke would have been a familiar name, with all the TV advertising and their memorable slogan, “buy the world a Coke.”

Coke is a company with a fascinating history with some recent developments. The company began in the 1880s as a patented medicine drink, and by the 1940s, the company had become a national icon.

And yes, Coke did actually have cocaine in it; the name stems from the connection to its first two main ingredients, cocaine and caffeine. The cocaine came from the coca leaf and caffeine from kola nut, ergo the name Coca-cola.

Coca-cola became a public company in 1919 and, by the 1980s, was a well-established global company. According to company annual reports, by 1985, over 65% of all soft drink sales by volume were outside the US.

The 1970s and 80s were also the middle of the “Cola Wars” with Pepsi. In 1975, Pepsi began its “Pepsi challenge” with the blind taste tests, which indicated Pepsi tasted better than Coke. Because of the success of that campaign, Pepsi was eventually able to steal some market share from Coke.

That led Coke to make the disastrous decision to create the “New Coke,” with a radical change to its recipe, trying to mimic Pepsi. It was much sweeter than regular Coke and led to a backlash from a small but vocal customer base to rebel and demand a return to the original recipe.

It is a case that has become a mantra in marketing classes and a standard lesson in brand loyalty. The ingrained image of Coke was so strong that regardless of the taste tests, there was an undeniable demand for a return to the original formula.

In 1985, Coke acquiesced and returned to the original formula and rebranded the returns as “Coca-Cola Classic.” And by 1985, the return was rewarded with sales that surpassed both New Coke and Pepsi. It was a classic example of how strong Coke’s brand was, and that brand could carry the company a long way.

There were two other inventions around the time that Buffett invested. First was the introduction of Diet Coke, and in 1985 it introduced Cherry Coke, Buffett’s personal favorite. Diet Coke has become a powerhouse of its own, but was starting to take off in 1988.

All of this was the backdrop occurring during the time that Buffett was contemplating his investment in Coke.

Financial Condition in 1988

In 1987, the last annual report available to Buffett before pulling the trigger on his investment, Roberto Goizueta, the company’s CEO and chairman, stated in the annual report that 95% of the company’s operating income came from soft drinks.

And if we look at the financials, we see:

Segment | Revenues | % Revenue | Operating Margin | Comments |

Soft drinks | $6,229M | 82% | 23% | Coke, Diet Coke, Cherry Coke |

Foods | $1,414M | 18% | 7.3% | Minute Maid |

Total | $7,658M | 100% | 17.8% |

As we can see from the above quick chart, Soft drinks drove the bus for revenues for the company. The company also tells investors in the annual report that it has two focuses for the soft drink business:

- Selling soft drink syrups and concentrates to bottlers and fountain customers

- Building a brand under the Coca-cola franchise that facilitates the purchase of end-consumers

The company also indicates it saw a six percent growth in volume and that overall growth in the segment revenue was 10%. That indicates the company raised its prices by an average of four percent.

As Buffett likes to point out, a company such as Coke that can raise its prices and improve its unit economics is a clear signal of a wonderful company. Indeed, Coke was able to grow its operating income by 21% during 1987.

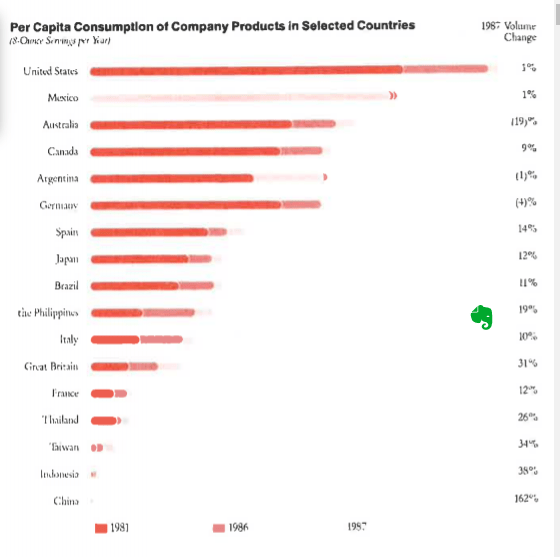

On page 8, the company shares a graph showing the per capita consumption of its products worldwide.

The above graph would have indicated to Buffett the opportunity for growth among consumers outside of the US, and the potential of these markets would not have been lost on him and Charlie.

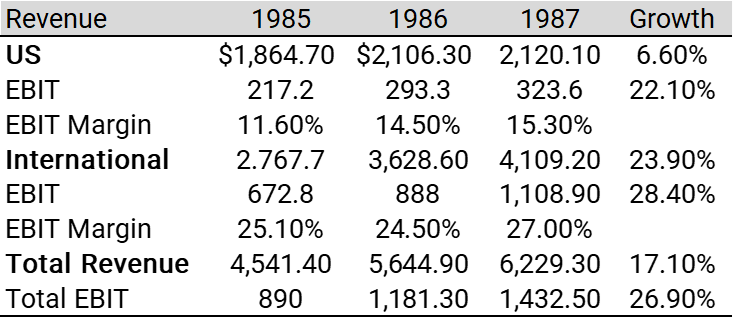

If we look closer at the financials of the soft drink division from 1985 to 87, we would have seen:

We can see from the small snapshot from the above financials that Coke was experiencing an expansion of operating margins of a substantial amount, to the tune of 22%+. And the international growth was even more spectacular, with operating margins of 28%+ over the three years.

That alone would indicate to a sharp investor like Buffett and Munger that Coke was a fantastic business with some serious tailwinds.

Another topic discussed the continuing trend of consolidation that is going on with bottlers around the world. That consolidation would accelerate in later years and become a large part of the continuing profitability of Coke and an integral part of the company’s success. The efficiency gains from distribution would help grow the margins and growth for the company.

At the time of 1987, Coke’s management team was in place for some time and carried a proven fantastic track record. Both Roberto Goizueta, CEO since 1980, and Donald Keough, COO since 1981, were in place.

The company at the time was performing at a high level; let’s look at some of the metrics associated with the company at the time.

| 1985 | 1986 | 1987 |

Return on Equity | 24% | 30% | 27% |

As we can see from above, the company was doing a great job of growing shareholders’ returns, but let’s look at the reinvestment efficiency of Coke in 1987. One of my favorite and Buffett’s ratios are ROCE, which helps us see how efficiently the company compounds its capital. To break this down, we need to look closely at the balance sheet to investigate Coke’s capital investments.

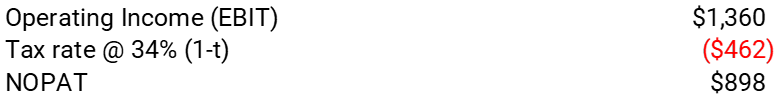

And then, determining the NOPAT (net operating profit after tax), we look at the EBIT of the company and the tax rate in 1987.

Based on the above numbers, we can calculate the ROCE, which is:

ROCE = NOPAT / Capital Employed

ROCE = $898 / $1,617 = 55.5%

That is a crazy good number, and well above any range we might associate with a “boring company” like Coke. Today, most investors would associate a return like that with one of the internet growth stories, but instead, it’s Coke.

After looking at some of the metrics and financials, it would have been apparent that Coke had some good things going on, but the numbers show that Coke was truly a wonderful business in 1987.

At the time of 1987, the year-end price of the company was $38.13, and estimating the price in early 1988, we could guess it was in the range of $40. In fact, Buffett tells us in his shareholder letters that he paid $41.13 for his first shares.

The price to earnings multiple, the basic valuation metric that many value investors use to get a quick glance at how cheap, or expensive a company might be, tells us that Coke in 1988, Buffett would have paid 18x earnings, which considering the time and the prevailing interest rates was not cheap like we would consider it today.

Many value stocks were trading at multiples in the single digits, and anything above 15 was considered an expensive company.

But that is where the genius of Buffett and Munger started to appear because they both understood that a company that can grow over decades because of the power of compounding and reinvestment strength. Also, consider that the earnings multiple of the S&P 500 at that time averaged 16x.

Valuation of Coke Based on 1988 Financials

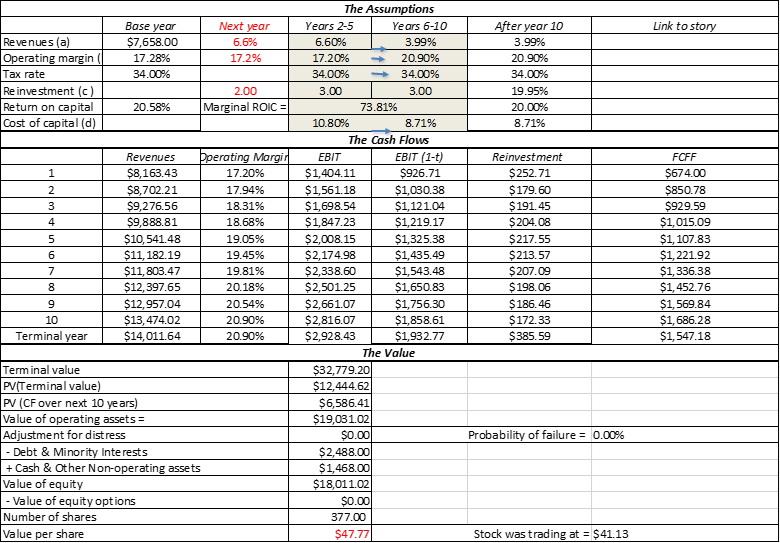

Using a DCF model, let’s look at what price might have made sense in 1988 for us to invest. I will lay out the assumptions based on the numbers from 1988. The model will be a free cash flow to the firm courtesy of Professor Aswath Damodaran, but all inputs are mine.

Revenues for 1987 were $7,658 million, with an operating income of $1,323 million. Interest expense for the year was $207 million, and shares outstanding was 377 million.

Here are the other balance sheet numbers for inputs:

- Cash and equivalents – $1,468 million

- Debt – $2,488 million

- Equity – $3,223 million

Some other inputs:

- Operating margins – 17.2%

- Tax rate – 34%

- Revenue growth – 6.6%

- Operating margin growth – 21%

To figure the cost of capital, we will need the beta, risk-free rate, and equity risk premium.

- Beta – 1

- Risk-free rate – 6.35%

- Risk premium – 3.99%

We will assume the company grows revenues at 6.6% and fall to the risk-free rate of 6.35% in the model. We will also assume that margins will grow at 22% over the first five years before settling to a more industry average margin of 15%. The tax rate will remain constant throughout the valuation, as will the discount rate.

After plugging in all our assumptions, we get a fair value of $47.77. Above the price that Buffett paid, giving us a margin of safety at the time.

If we adjust the revenue growth to 8%, we see an increase in fair value of $51.52, which tells us how sensitive the revenue growth driver for Coke was. All of which connects to Buffett’s observations in later years about the strength of the company’s brand and raising prices. Small tweaks to prices led to large increases in the value of the company.

What We Can Learn From Buffett’s Investment

In 1987, the stock market was coming off the crash that occurred over a few days in October. The markets crashed on Black Monday, losing upwards of 20% in one day, and over a few days was quite unstable.

During this chaos, Buffett was contemplating his investment in Coca-cola. He had determined, rightfully, that the company had a tremendous moat and could raise its prices incrementally without hurting the brand.

That moat gave Coke the ability to expand its reach and improve its efficiency of reinvestment while also growing the brand and revenues.

He also realized the market didn’t realize Coke’s tremendous value within its main product and the untapped worldwide potential laying at its feet.

Along with that untapped growth was the expanding business model of creating a distributor network that took on distributing the Coke products without the parent having to deal with the costs and headaches associated with distribution. Coke was moving towards a model to outsource the distribution by offering licensing franchises to distributors and collecting income from the distribution.

Buffett also recognized that Coke owned a wide and strong moat, as evidenced by its “New Coke” fiasco and its rebound from that potentially disastrous decision. Smart investors saw that Coke had a brand and popularity that could withstand even the dumbest decisions and keep on ticking.

As Peter Lynch liked to observe, “the best kinds of investments are ones a monkey could run because eventually, one will.”

Looking deeper at the numbers, Buffett also could see that the company was experiencing an expansion of operating margins, far ahead of its revenue growth. That indicated the company had pricing power along with operating efficiency. It also produced tons of free cash flow, which the company could reinvest at ridiculously high levels, which compounds for more growth.

I think those expansions of operating margins were the key observation because that indicates operating leverage and strength. All of which leads to better efficiency in the use of Coke’s assets, which drives more revenues. It is all a virtuous circle that leads to growth for Coke and any company.

“Leaving the question of price aside, the best business to own is one that over an extended period can employ large amounts of incremental capital at very high rates of return.”

– Warren Buffett, 1992 Berkshire Hathaway Shareholder Letter

Investor Takeaway

Studying history helps us learn from the past and how to avoid mistakes. Looking back at some of the investments of the greats like Buffett and Munger helps us pinpoint some of the ideas that helped generate their great returns.

It all comes back to a few basic ideas:

- Find companies with growing returns on capital over long periods.

- Pay a reasonable price for those returns on capital

It sounds so easy, but in truth, it is one of the hardest things to pull off successfully.

All good companies generate high returns on capital, and many do it over decades. Find those companies and pay a reasonable price for those companies. Don’t get hung up in the ratios or the minutiae of a percentage here or there.

Instead, please focus on the returns on invested capital and its relation to the cost of capital; the wider the margin, the more value the company is creating. Next, we need to look for companies with the business model to generate those returns over long periods, whatever the industry. And then finally, pay a reasonable price for that company.

What does a reasonable price mean? That is different for every person, but the most important thing to consider is paying what you deem is fair and then holding onto that company until something changes fundamentally. Remember, the price we pay is important, and that is the elusive goal we all chase.

A note before I go, if you want to learn more about Buffett’s investments, check out the amazing book, Inside the Investments of Warren Buffett by Yefei Lu; you won’t regret it. PS, there is no affiliate link, it is a great book, and I think you will benefit from the read.

And with that, we will wrap up our discussion today on Warren Buffett and Coca-cola.

As always, thank you for taking the time to read today’s post, and I hope you find some value in your investing journey. If I can be of any further assistance, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- What We Can Learn From Warren Buffett’s Four Pillars of Investing Warren Buffett has covered every aspect of investing over the years. Whether in one of his letters to shareholders, an interview, or an essay, a...

- The Importance of Pricing Power in a Company “The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a...

- How Buffett’s Purchase of National Indemnity Propelled Berkshire Hathaway Studying Warren Buffett’s past investments remains a great way to learn. Over the years, Buffett’s investments have changed, but not a ton. He still looks...

- Difference Between Operating Leverage and Economies of Scale “Do you know the difference between operating leverage and economies of scale? Seriously, take a moment to define the terms clearly (I did not know...