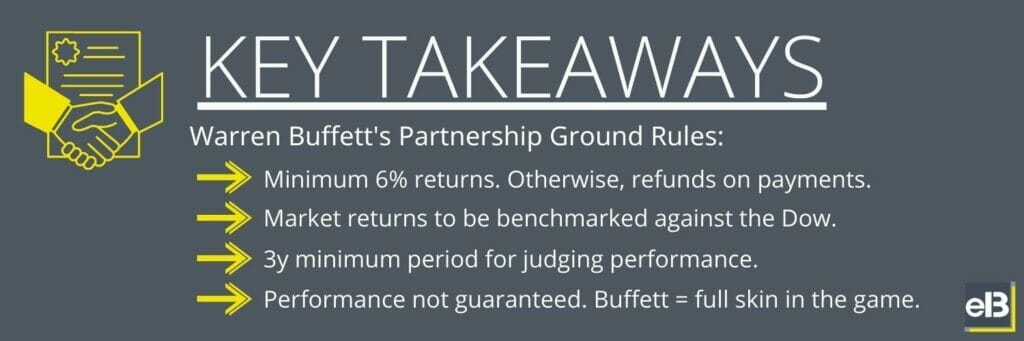

At a young age of just 25 years old, Warren Buffett had a keen vision on how he would run his partnership and achieve superior returns for investors. He called these principles The Ground Rules. All partners, friends and family had to agree to these terms so they could understand Buffett’s vision.

To say that Warren stayed true to his ground rules and used them for great success would be an understatement:

From 1956 to 1969, Warren Buffett recorded a rate of performance for his investors in the Buffett Partnership that is now legendary. For these 13 years, Buffett gained an astounding 24.5% CAGR after fees, turning $105k into over $7 million.

So what were these famous Ground Rules from Warren Buffett? I’ve included the 7 Ground Rules below with some commentary on why I think each were integral to his success as a fund manager.

1. In no sense is any rate of return guaranteed to partners. Partners who withdraw one-half of 1% monthly are doing just that—withdrawing. If we earn more than 6% per annum over a period of years, the withdrawals will be covered by earnings and the principal will increase. If we don’t earn 6%, the monthly payments are partially or wholly a return of capital.

From the onset, Buffett tries to set expectations and be sincere. There are no guarantees, and anybody who tries to tell you that about investing is lying to you.

What I like about what Warren Buffett did here is that he put himself into the investor’s shoes. He realized that just because he was in the wealth accumulation stage, his partners might not be.

In other words, his partners might want to withdraw capital so that they could have an income from their investment in the Buffett Partnership. And so, the 6% goal would allow that while also still growing the partner’s total investment value in the fund.

2. Any year in which we fail to achieve at least a plus 6% performance will be followed by a year when partners receiving monthly payments will find those payments lowered.

Luckily, performance to the downside was never much of a problem for the partnership. But, Buffett decided to consider these risks anyway.

The likely reason for this Ground Rule is that the best time to be buying stocks is usually when returns and performance are depressed. Too many partners withdrawing capital would limit Buffett’s ability to attack when the market was down. This would inevitably limit future performance if/when the market recovered.

3. Whenever we talk of yearly gains or losses, we are talking about market values; that is, how we stand with assets valued at market at yearend against how we stood on the same basis at the beginning of results for tax purposes in a given year.

Here, Buffett is being transparent about how performance will be measured. This way investors will know exactly how he is doing. He does not try to craft some creative return metric, now or in the future, if his investments don’t perform as expected.

4. Whether we do a good job or a poor job is not to be measured by whether we are plus or minus for the year. It is instead to be measured against the general experience in securities as measured by the Dow-Jones Industrial Average, leading investment companies, etc. If our record is better than that of these yardsticks, we consider it a good year whether we are plus or minus. If we do poorer, we deserve the tomatoes.

I find this ground rule interesting as it’s slightly controversial. There are investors who believe that a manager’s performance should be measured by absolute and not relative performance. I tend to agree with this philosophy somewhat, even though there is value in measuring both.

5. While I much prefer a five-year test, I feel three years is an absolute minimum for judging performance. It is a certainty that we will have years when the partnership performance is poorer, perhaps substantially so, than the Dow. If any three-year or longer period produces poor results, we all should start looking around for other places to have our money. An exception to the latter statement would be three years covering a speculative explosion in a bull market.

Here Buffett tries to set the right expectations on future performance again. He warns against the possibility that market exuberance, such as the one seen in the Roaring 20’s, could occur again.

Being a student of Graham’s, Buffett was well aware that the valuations from the stock market can fly wildly above a company’s true intrinsic value. Mr. Market can sometimes be quite irrational in how he sets prices.

6. I am not in the business of predicting general stock market or business fluctuations. If you think I can do this, or think it is essential to an investment program, you should not be in the partnership.

This ground rule is classic Benjamin Graham philosophy. As Graham’s student, Buffett was fully convinced with the stupidity of trying to time the market. He did not want his investors thinking he had any sort of ability to.

It goes back to the theme that is constant in many of Warren Buffett’s ground rules—that expectations need to be set, and they generally need to be tempered. Luckily for his partners, Buffett wildly outperformed these very modest and humble expectations.

7. I cannot promise results to partners. What I can and do promise is that: a. Our investments will be chosen on the basis of value, not popularity; b. That we will attempt to bring risk of permanent capital loss (not short-term quotational loss) to an absolute minimum by obtaining a wide margin of safety in each commitment and a diversity of commitments; and c. my wife, children and I will have virtually our entire net worth invested in the partnership.

In these closing words, Buffett reveals the parts of his investment philosophy that are among what I greatly admire most about him.

He was an adamant and unapologetic value investor.

Buffett truly had his interests aligned with the investors in his partnership.

It’s hard to find either of those qualities on Wall Street today. It could be the reason why it’s so hard to find active management who are able to follow in Buffett’s footsteps.

You might believe that today’s investors can achieve superior returns from the market like Warren Buffett did. You might not.

Regardless, we can all learn and implement Warren Buffett’s ground rules to our own expectations and mindset. It’s a great way to think about achieving compounding returns from the stock market.

Related posts:

- Graham and Doddsville: A Group of the Greatest Investors of All Time Updated 6/24/2023 “While they differ greatly in style, these investors are, mentally, always buying the business, not the stock. A few of them sometimes buy...

- What the Berkshire Hathaway Owner’s Manual Says About Buffett’s Approach Ever wonder what blueprint Warren Buffett uses? Or how he manages his company or decides what companies to invest in or buy outright? Well, we...

- What is a Good Number of Stocks to Own? The number of stocks in a portfolio can have a major influence on your ultimate results as an investor. Because of this, every investor must...

- Investing Lessons from Nick Sleep of Nomad Investment Partnership Updated 9/15/2023 Generating true investment success remains rare, even more so the prospect of long-term success. Nick Sleep and his partner Qais Zakaria (Zak) generated...