Updated 9/15/2023

2007, Warren Buffett revealed he had bought over 60 million shares in Berkshire’s first railroad.

Buffett continues as our generation’s greatest investor. And studying his investments can give us insights we can use in our decision-making.

Many investors look up to Warren Buffett because he makes success appear attainable. Buffett’s yearly letters to Berkshire Hathaway shareholders read like a penny store novel. But they contain the knowledge of a philosopher, with evidence of his talents as a writer and teacher.

Buffett also did not amass his money while standing atop a lower Manhattan building. He did it while sipping Cokes and munching on hamburgers in a little office in Omaha, a sleepy city in the Midwest.

Buffett’s propensity to appeal to “ordinary investors” is both motivating and deceiving. For instance, we shouldn’t overlook the exceptional mind lurking beneath Buffett’s informal writing and affable personality.

Buffett makes it look simple, but we should remember simple doesn’t always equal easy.

In today’s post, we will learn:

- Which Railroad Does Warren Buffett Own?

- Overview of the Railroad Industry

- Why Did Buffett Buy the Railroad?

Which Railroad Does Warren Buffett Own?

As mentioned earlier 2007, Buffett purchased 60 billion shares of a railroad. The railroad in question was Burlington Northern Santa Fe (BNSF). He made the buy for $4.73 billion, which gave him 17.5% of the company. The average price paid equaled $77.66 per share, marking his initial investment in BNSF.

During that time, BNSF ranked number two in North America, behind leader Union Pacific.

In 2009, Buffett completed the buying of the company. He bought the rest of BNSF for $34 billion, or roughly $100 a share. The buy gave him an extra 77.4% stake in BNSF, or 100% control.

The buy equaled around $44 billion. At the time, this made it the largest acquisition in Warren Buffett’s career. Included in the buy was $10 billion of BNSF’s debt.

For those unfamiliar with Berkshire and Buffett, they own a diverse universe of companies. Over the years, Berkshire has become one of the leading conglomerates. Meaning they own a wide range of different businesses. Many are not related to each other.

Berkshire has a market cap of $609 billion, making it one of the largest global companies.

For example:

- Insurance (GEICO)

- Clothing

- Transportation

- Media

- Financial

- Energy (Berkshire Energy)

- Real Estate

Buffett also owns minority and majority stakes in hundreds of other companies. Giving Berkshire many different opportunities to find profit.

Because of Berkshire’s portfolio diversity, the company has proven quite resilient during recessions.

Some specific companies Berkshire owns:

- Duracell

- Fruit of the Loom

- GEICO

- Mid-American Gas

Buffett’s first buy, National Indemnity Company, occurred in 1967, starting a long history of strong buys.

Overview of the Railroad Industry

Before we look into Buffett’s railroad investment, we should take a short detour and look at the rail industry itself. Understanding the industry will help us understand why Buffett reacted as he did.

The national rail network is home to three different kinds of rail systems:

- intercity passenger

- commuter

- freight

Together, these trains enable:

- job development,

- economic growth,

- important environmental advantages,

- and increased productivity and competitiveness for our country

We will focus on the freight, as that remains BNSF’s specialty.

America’s freight railroads are the most efficient and productive in the world.

They are connecting customers and companies nationwide while enhancing safety and the environment. Shippers use Freight railroads from almost every industrial, wholesale, retail, and resource-based sector of the American economy. They transport their raw materials and completed goods to markets here and abroad.

We transport over one-third of the nation’s exports by freight. Accounting for about 40% of long-distance ton-miles and more than any other method of transportation.

Many rail customers and hundreds of smaller railroads collaborate with the seven major “Class I” railroads to generate:

- economic growth,

- support job creation,

- offer critical environmental advantages now

- while planning for future difficulties in freight transportation

Almost all of America’s freight railroads are privately owned and run. Instead of vehicles and barges, freight trains rely on the infrastructure they own, construct, maintain, and fund themselves.

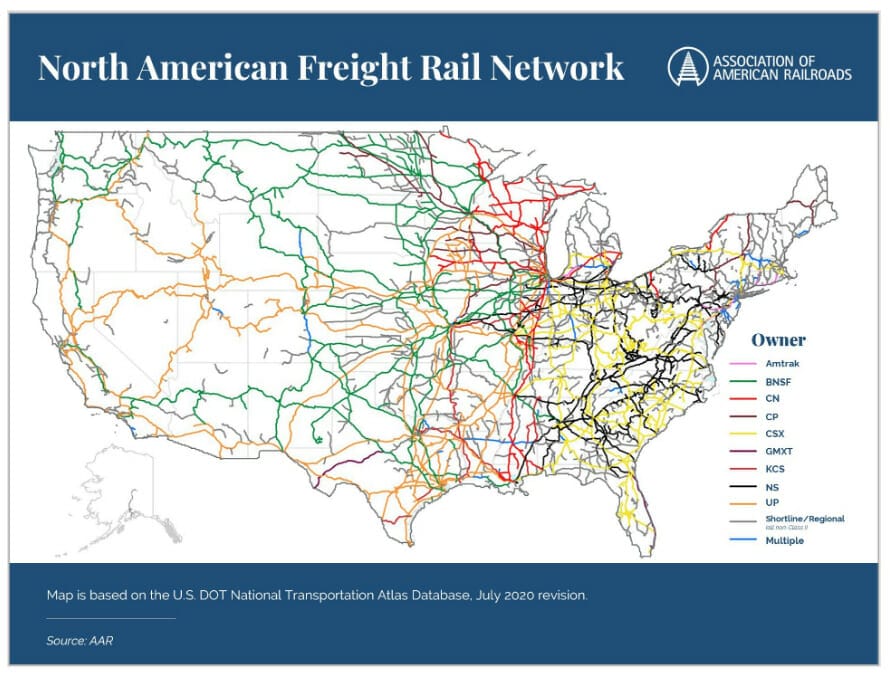

The over 140,000-mile U.S. freight rail network services about 630 freight railroads. The seven “Class 1” railways account for Around 68% of freight rail mileage, 88% of employment, and 94% of revenue or railroads with 2021 revenue of at least $900 million. Each Class I railroad runs thousands of miles of track across several states. Non-Class I railroads referred to as short lines and regional railroads, can be as little as a few carloads a month. Or as large as multi-state enterprises that are almost Class I in size. Together, they offer a network of transportation that serves customers and the country’s economy.

Freight rail is a piece of a network of trains, trucks, and barges transporting around 61 tons of products per American every year, ranging from food to fuel for our cars. Railroads transport Raw materials and finished goods in large quantities. Below are a few examples:

- Intermodal: Over the past 25 years, the dominant rail traffic with the highest growth remains the transport of shipping containers and truck trailers. There’s a high probability that the railway will transport whatever you find on store shelves.

- Energy: To meet America’s energy needs, railroads transport goods, including coal, ethanol, and crude oil. Coal transportation by rail remains the biggest volume. Rail delivers the coal to power plants to generate energy and to ports for export.

- Chemistry: America’s freight railroads continue to move the chemicals necessary for modern living. And to meet the expanding demands of chemical manufacturers. From:

- Moving fertilizers to farmers,

- plastic resins to auto part manufacturers,

- caustic soda to pulp and paper manufacturers,

- and a plethora of other chemical products to go between end users

A few examples exist across the United States and the rest of the world.

America’s freight railroads link producers and consumers in different parts of the nation. Thus enlarging current markets and creating new ones. For example, as an Important Employer: In 2020, the average yearly salary for Class I freight train employees, benefits included, was about $135,700, 64% higher than the national average.

Greater capacity, dependability, and productivity across the rail network have made optimizing operations possible, leading to record-breaking performance and service levels. Customers who use rail enjoy efficiency and productivity improvements that increase rail’s cost-effectiveness. The low cost of freight rail increases the competitiveness of American goods abroad. Helping to save billions of dollars for rail customers (and American consumers).

The ordinary rail shipper can carry much more freight for about the same amount it paid 35 years ago because rail rates are 44% lower than in 1981 in inflation-adjusted revenue.

Per the Federal Highway Administration, there will be a 30% increase in U.S. freight shipments. Rising from an expected 19.3 billion tons in 2020 to 25.1 billion tons in 2040. Between 1980 and 2021, America’s freight railways invested over $760 billion. Their own money, not taxpayer money. In capital projects and maintenance costs for:

- locomotives

- freight cars

- tracks

- bridges

- tunnels

- and other machinery and infrastructure

Out of every $1 in revenue, that amounts to more than 39 cents. Between 2011 and 2020, railroads invested over 19% of their revenue—six times more than typical manufacturing.

Why Did Warren Buffett Buy the Railroad?

Buffett bought BNSF Because he believes railroads remain essential to American prosperity.

Buffett rejects short-term investment ideas that promise immediate gains. Instead, he adopts a long-term strategy of investing in a business and enhancing its performance over time.

According to Buffett, purchasing BNSF is an “all-in bet on the economic destiny of the United States.”

It’s important to remember that buying BNSF does more than grow Berkshire’s ability to profit from the railway sector. It also gives Buffett chances to increase the value of his other investments.

Businesses that must ship goods nationwide may increase revenues with more effective railways. Buffett invested by buying BNSF, helping his other companies’ supply chains.

Buffett’s buy of BNSF highlights three of his favorite reasons for investing:

- Pricing power

- Competitive moat

- Fair price

Analysts’ theories of Warren Buffett’s buy of BNSF are many. According to one theory, it would be expensive to construct a railway now and navigate the local and governmental red tape. So, little anticipated rivalry outside the existing railways results in the future.

Since there will always be a need for railroads and no more competition, prices can grow, bringing ever-increasing profits to Berkshire.

Running train networks comes with High capital requirements. Which requires BNSF to pay for the upkeep of a fleet of:

- locomotives and freight cars

- a track infrastructure

- and a vast network of support facilities

- such as yards

- terminals

- dispatching centers

- and specialized service and maintenance shops.

The vast majority of BNSF’s revenue comes from moving freight between important economic centers.

The railroad had about 40,000 personnel, 6,510 locomotives, and 82,555 freight cars, according to BNSF’s 2008 annual report. According to BNSF’s CEO and chairman, Matthew Rose, the business invested $30 billion in upgrading its train equipment and rail infrastructure between 1997 and 2008.

BNSF’s previous investments are a significant financial commitment by any standard. Running a profitable railroad entails managing day-to-day operations—plus managing expansion, navigating the competitive environment, and handling regulatory difficulties, including trackage rights.

BNSF splits into four major divisions and an “other” category, per the BNSK 2008 annual report. The revenue distribution looks like this:

|

Segment |

Revenue |

% of total |

|

Consumer products |

$6,064 million |

34% |

|

Industrial products |

$4,028 million |

22% |

|

Coal |

$3,970 million |

22% |

|

Agricultural products |

$3,441 million |

19% |

|

Other |

$515 million |

3% |

|

Total |

$18,018 million |

100% |

Further investigation into the specifics of each freight category reveals that Consumer Products comprise 90% containers (including domestic and international shipping containers) and 10% automobile products.

Construction, building, petroleum, chemicals/plastics, food, and beverage are all industrial products. Coal is coal, which refers to the BNSF’s transportation of low-sulfur coal coming from the Powder River Basin in Wyoming and Montana.

Transportation of bulk foods, including agricultural:

- corn

- wheat

- soybeans

- ethanol

- fertilizers

- and other agricultural items

Generally, BNSF’s primary operations remain moving bulk goods, regardless of the category.

Individual customer contracts cover approximately two-thirds of BNSF’s revenues. In contrast, the remaining one-third of revenues come from customers who pay the common carrier-stated tariffs. The revenue generation comes from the way BNSF interacts with its customers.

The volume of ton-miles has climbed by one to two percent each of the last two years, while average haul lengths have stayed relatively constant. The average revenue per ton-mile, or pricing, which climbed dramatically between 4% and 13% in the previous two years, makes the real difference.

BNSF’s precise financials show that fuel expenditures climbed by only $1.7 billion while freight revenues increased by $3 billion, in part because of rising fuel prices. This information shows that BNSF can set prices.

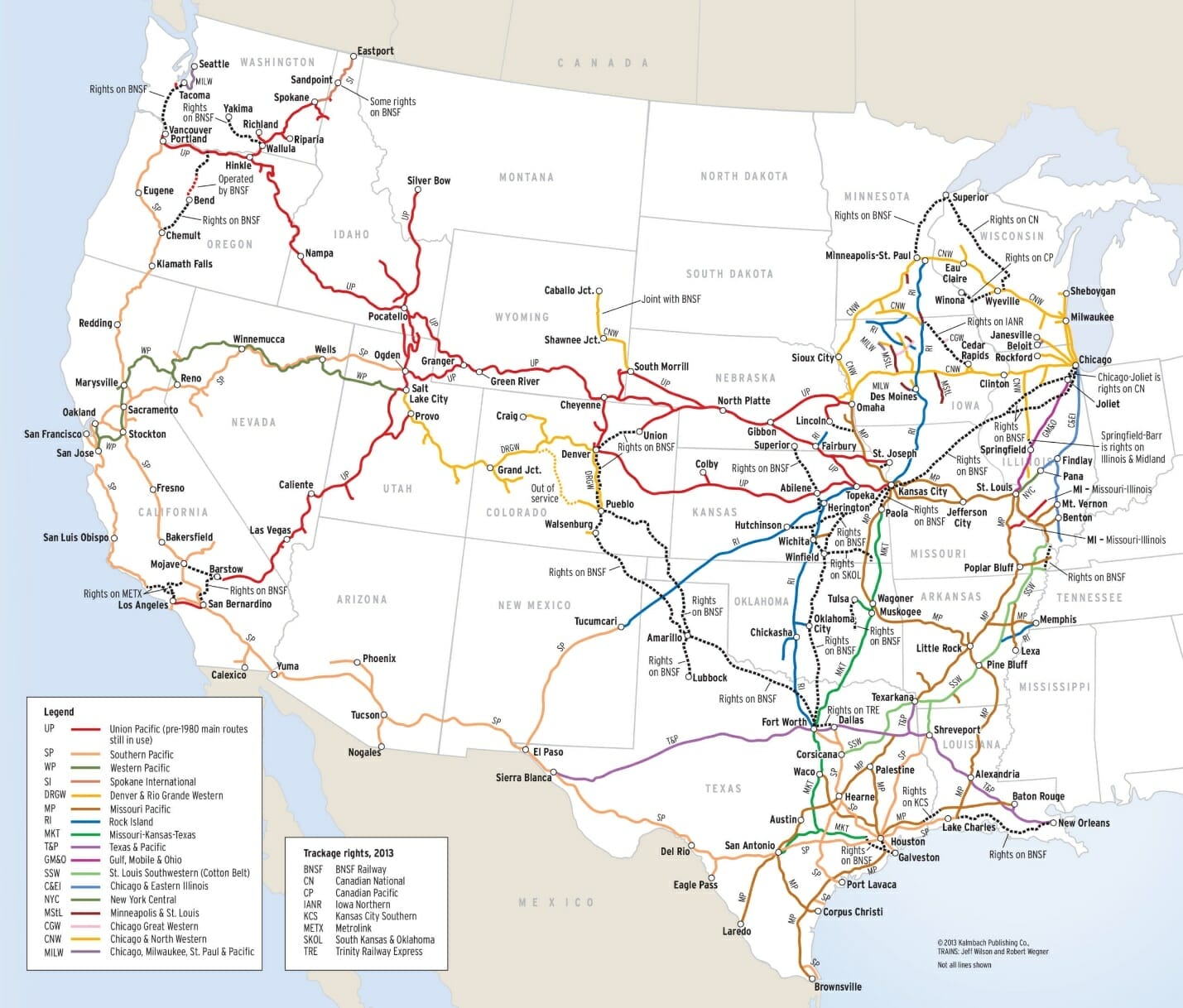

Recognizing BNSF’s competitive position is a crucial part of knowing the company. Initially, BNSF faced competition from other railroads. Union Pacific was the biggest rival railroad, with 48,000 employees and around 8,700 locomotives in 2008. Look at the Union Pacific operations map to see how much BNSF competes with it.

As you can see, a sizable number of routes between the Central Plains and the West Coast were subject to competition between Union Pacific and BNSF. Given this fact, the two railroads must also compete on operational factors such as cost, timeliness, and service quality.

These parameters can be compared to BNSF to arrive at two conclusions. At first glance, BNSF had added trackage or outperformed Union Pacific in volumes. Contrary to Union Pacific, which experienced a minor decline in revenue ton-miles from 2006 to 2008, BNSF experienced a 3% rise.

Second, Union Pacific was raising prices, much like BNSF. The fact that both railways were able to raise prices suggests the sector has a favorable pricing environment. And that there isn’t intense price competition between the railroads.

Union Pacific was a serious rival to BNSF’s direct rivalry, but given the prior research. It was probably a respected duopoly with strict pricing policies. Although Union Pacific likewise performed well, BNSF appeared to be the better operator of these two operators since it increased revenue ton-miles profitably between 2006 and 2008.

The competition from other modes of long-distance freight transportation. We must also consider the most obvious: transportation by truck, water, and air, as well as direct competition from other railroads.

Truck transportation is the most appropriate successor for cargo rail, as water transit restricts itself to places near waterways. And aviation transportation is too expensive.

Besides the “quantitative” qualities described, Buffett also wants a good price. Buffett acquired BNSF in many installments. Buffett spent $4.7 billion for his initial buy of a 17.5 percent share in the business in 2007, valuing it at $27.0 billion. This is an average price of $77.78 per share. For this acquisition, the standard value multiples would have been as follows:

Valuation Multiples 2006/2007

|

2007 Expected |

2006 Expected | |

|

EPS (diluted) |

$5.10 |

$5.11 |

|

PER |

15.3x |

15.2x |

|

EBIT |

$3.49 million |

$3.52 million |

|

EV/EBIT |

10.1x |

10.0x |

|

P/B |

2.43x |

2.42x |

Although it is not inexpensive, this is more than fair for an investor who believes in the importance of growth for a well-managed, naturally high-quality company, with an understandable justification for having 7% yearly gains in earnings and revenues at a high marginal ROTCE. The assurance of that growth thus becomes the crucial factor.

Buffett would have felt confident in BNSF’s growth prospects as a potential investor. Given that it had the structural advantage of being a:

- more fuel-efficient mode of cargo transport

- had a lengthy history of development

- and had a capable management team

Investor Takeaway

The state of the economy was most impressive to me regarding Buffett’s purchase of BNSF. The US economy had recently emerged from one of the longest and most severe recessions when Buffett made this purchase in late 2009.

He was confident enough to pay a price others would have deemed exorbitant since he recognized a chance to buy a high-quality company with respectable growth and high marginal ROTCE. This was especially true in 2009. I can only speculate as to why, in late 2009, Buffett decided to continue with a solid investment that he had grown to know well rather than other, undoubtedly intriguing investment options.

In sum, Buffett saw an opportunity in 2009 to buy a good business with good management at a fair price. He saw in BNSF, a company with good pricing power and competitive advantages, selling reasonably.

It is a lesson we can all learn from when analyzing any company.

And with that, we will wrap up our discussion regarding Warren Buffett’s railroad.

Thank you for reading, and I hope you find something of value. If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- What We Can Learn From Warren Buffett’s Four Pillars of Investing Warren Buffett has covered every aspect of investing over the years. Whether in one of his letters to shareholders, an interview, or an essay, a...

- What is Minority Interest and How Do I Find It? Acquisitions, as a part of growth, continue to play a role in the markets. Many companies use this strategy. Berkshire Hathaway, Google, and Constellation Software...

- How Buffett’s Purchase of National Indemnity Propelled Berkshire Hathaway Studying Warren Buffett’s past investments remains a great way to learn. Over the years, Buffett’s investments have changed, but not a ton. He still looks...

- What’s the Difference Between Revenue and Profits? An investor must comprehend how revenue enters a corporation and transforms into profit. Here’s how it all works, including instances of unusual cost structures. Revenues...