Do you find yourself in a situation where you’re having no issues living within your means, but you’re really not just getting close to financial freedom as quickly as you might want to? Knowing what to do to generate wealth creation isn’t easy – at all – but that’s why I’m here to help you along the way with a few simple steps, as well as how I personally implement this in my daily life!

Live Within Your Means

The #1 thing that you have to do is live within your means. This likely sounds easy but trust me – it’s not! If you’re not living within your means then you’re never going to hit your goals. You HAVE to make sure that you’re spending less than you make and creating that surplus of cash each month that allows you to do other things with your money.

Living within your means really opens the door for you to be able to do many other things, including retiring early, providing more for your family, or even simply just being able to do more fun things – vacations, sporting events, anything!

Invest

This is the one that we all get excited about, right? Of course! That’s why you’re here at the Investing for Beginners blog!

Investing is the best and the reason that we all do it is because of compound interest. Compound interest is where you basically will make money on the money that you made the previous year, so that “interest” just continues to “compound” year after year after year.

As you can likely imagine, the two things that really make this work are:

- Time

- Principal

The more time that you have to invest, and the more money that you can invest, the faster that you’re going to reach your goals – the key is just that you’re actually going to invest!

Some people shy away from investing but I really think that this is a fatal error to make. If you’re one of those people, check out these investing myths (myths/reasons not to invest) as well as these insane compound interest examples that will really get you motivated!

Take Advantage of Tools Meant to Help You

To me, this primarily means tax-advantage accounts. This can mean using an IRA, HSA, 529, 401k, 403b, anything!

The thing is that all of these accounts are tax advantaged and just waiting for you to use them. But it doesn’t only apply to tax advantaged accounts – it also applies to things such as making sure you have the best savings account for your emergency fund, the best mortgage loan for your down payment on a house, and many other things!

There are tons of tools in today’s world – you just need to make sure that you are aware of them and are using them to your benefit.

“Andy, this is great and all, but how can I actually use this in my daily life to jumpstart my path towards wealth creation?”

Well, let me show you exactly what I do!

1 – I Budget Everything

This might seem overwhelming or like a huge time suck but it honestly isn’t. I use Doctor Budget for my budget and it allows me to easily customize my entire budget with just a few minutes of work.

Every month, around the 20th of the month or so, I will start to make my budget for the following month. All that I have to do is duplicate the tab in Excel and then just update the expenses that might change.

This probably takes a total of 5-10 minutes but it’s very crucial to do so. For instance, you might think that groceries would generally stay the same from month to month, but for us, they don’t. We are huge fans of meal prepping because it can save time and money, but that means that we buy our groceries on Sunday each week.

That means sometimes there are 5 Sundays in a month and sometimes there are 4, so if we spend $150 each week then the budget is either $600 or $750 – that’s a big swing! But by literally taking 5 seconds, I could see how many Sundays are in the month and update the budget accordingly.

Same thing with expenses that might not occur every month, such as our Water/Sewer bill that occurs bimonthly or our trash service that occurs trimonthly.

Might not sounds like a huge deal, but if these both occurred in a month that I wasn’t planning on them then I was going to get hit with $51 for trash and $86 for water/sewer – a total of $137 that I could’ve easily planned for if I had just thought ahead.

Taking 5 minutes to plan for the month can save a huge mistake at the end of the month that was entirely preventable!

At the end of the month, I will then spend another 15 minutes tracking my expenses and post-auditing myself to see how I did. This is so important because it will help me actually dig into the areas I did well, the areas that I failed, and allow myself the opportunity to learn and not make those mistakes in the next month.

In total, I probably spent 20 minutes and I was extremely prepared and becoming a more financially responsible person every single month.

2 – I Use a Budget Calendar to Plan for Upcoming Expenses

Along the same lines of budgeting, I will use a budget calendar to plan for upcoming expenses. I won’t go in depth on this because I have a different blog post that talks about it but I truly think that using a budget calendar is one of the best ways to stay motivated about actually sticking to your budget.

Just as you do with a checklist, you actually will get a sense of satisfaction of paying a bill, so when you cross that expense off on your budget calendar, then you actually will feel excited about it! I love feeling this way because it turns something that might seem like a negative (having less money than you did previously) into a good feeling!

Weird, right? But paying off debt like mortgage payments, school loans, etc. are actually all great things! It’s good to pay off that debt so you should feel great and using a budget calendar is one way that I will keep myself in this mindset.

3 – I Prepare for the Worst

Quite simply, I hope for the best but prepare for the worst! This means that I am going to go out of my way to simply be prepared if something bad was to happen.

For starters, this means that I have a fully funded emergency fund. “Fully Funded” will be different for each person, depending on their own specific situation, so you need to make sure that you apply it to your own situation.

Many people give some blanket answer like “3-6 months expenses” but that is not the case at all.

What if you’re single, healthy and have a super stable job – do you really need 3-6 months of cash?

What if you’re living well below your means and could actually survive off unemployment? Do you need 3-6 months?

What if you have 8 kids? Will you ONLY need 3-6 months?

These are all personal things that you need to think about. I put together a pretty thorough step-by-step guide to determine exactly how much of an emergency fund that you need for yourself if you’re struggling to get to that number.

Once you figure out your emergency fund and have it fully funded – put it somewhere safe and don’t touch it! It’s there for emergencies only!

Personally, we only have a couple months of savings sitting in our emergency fund because we have a lot invested in a brokerage account that we could pull out at any point in time if need be. We have enough saved that we could be totally fine for a couple months, without unemployment, withdrawing from HSA, or anything like that. But I also have a backup plan to my backup plan and am always prepared for the worst.

We also have a Non-Emergency Big Purchases (NEBP) plan, which is essentially a catch all that we save money in for when things come up. A flat tire is not an emergency. Fixing our asphalt driveway is not an emergency. These expenses shouldn’t draw from your emergency fund, but they are major costs that you should plan for!

For that reason, we have a NEBP that we simply put a little money in each month to prepare for bad things that aren’t emergencies. It’s really not a lot – maybe $50/check – but that helps out a ton when these expenses occur.

When my wife needed new tires on her SUV last year, it was amazing to drop $600 without even thinking because we had it saved up. Then we just kept on keeping on like normal and slowly continued to add that $50/paycheck back into NEBP!

4 – I Prepare for the Best

Along with preparing for the worst, you need to prepare for the best! Engagement ring or wedding, vacations, new car, or anything along those lines – you should be saving up well in advance!

I oftentimes will hear about people that pay off their car and then two years later get a new car without saving any money at all…why? If your car payment is $200/month and you pay it off, why not just keep “paying” that $200 and stashing it away into a savings account?

If you planned for these good things to happen, you could potentially buy the car outright, rather than being in this continuous circle of debt and never being able to actually catch up from what you owe.

Notice a theme? It’s all about PLANNING!

5 – I Have a Financial Order of Operations for All Accounts

To me, this means that I have a “pecking order” of the things that I need to do every time that I get paid. Again, it all starts with planning.

At the beginning of the year, I will take a look at my wife’s and my own salary, think about any major expenses that we might have during the year that we can plan on (children, medical procedures, new acquisitions like a car, new home, vacations, etc.) and then I will back into the amount of “extra” money that I think we have. For instance, I’ll say something along the lines of this:

If we both make $50K and are taxed at 25%, now we have $75K total. If we spend $4K/month and are planning a $5k vacation, that means we have $22K of after-tax income – what do we want to do with it?

Now, I personally will get more in the weeds than this and really drive into the details, but I bet that most people don’t even go this far. So, what would we do with our money? We would prioritize it in the following manner:

1 – Max out 401k company match

2 – Max out HSA

3 – Contribute $X/paycheck to a 529 for our son

4 – Contribute $X/paycheck to our NEBP

5 – Max out Roth IRA

6 – If any excess money, put into the savings account or a brokerage account

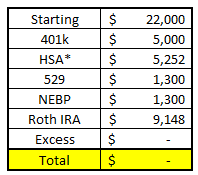

It’s that simple! Now of course, I’d go more into the details like I mentioned and try to figure out exactly how much I’d be contributing to these accounts with a simple spreadsheet like I did below:

As you can see, I have an asterisk next to HSA* because it’s pretax income, so while it’s $7K in pretax, I’d really only be losing about $5,252 assuming I was taxed at 25%.

The reason that I do this is because it gives me a simple baseline at the BEGINNING of the year for a goal. Then, I just will challenge myself to try to beat it. For instance, you can see that in this case, we’re not going to max out both of our Roth IRAs – challenge accepted!

I am challenging myself to try to find another $2,852 to max out that second IRA. By doing this at the beginning of the year, I am giving myself an entire 12 full months to try to hit this goal rather than doing the math in June when half the year is gone already.

It’s nothing more than planning and simply just being a little bit prepared!

The math wasn’t hard. The time that I spent wasn’t overwhelming. It just takes a little thought about what you want for your future.

6 – I Optimize My Money in EVERY WAY Possible

“Andy, you’ve already talked about these tax-advantaged accounts – how else do you optimize your money?”

Simple – I just make my money work for me!

Putting money in a savings account? Make sure it’s a high-yield savings account.

Going grocery shopping? Make sure you’re using an app like Ibotta or finding coupons from your grocery store.

Going out to eat? Use an app like Seated or Yelp to find amazing deals.

All of these things are super simple to do and are ways to make your money work just a little bit farther! I am not a minimalist by any means, but I try to take a minimalist mindset in my everyday life to make sure that I am spending my money in the wisest way possible.

I don’t spend $20/week on groceries like I know some insane people do. Hell, I will spend $20 on a 4-pack of beer at times! I do that because it’s important to me.

I know what’s important to me and I know what’s not. Clothes are not important, so I will almost never buy new clothes unless I absolutely need to for work. It’s really just knowing yourself and making sure that you’re optimizing your spending anytime that you are purchasing anything!

Summary

None of these 6 steps are hard to do – they truly just take a little bit of dedication and time to plan out what your future entails. I am not one for cheesy quotes, but I really think that with financial planning, “if you fail to plan then you plan to fail.”

Don’t be a failure and just take some time to plan. Looking for some more motivation to get you on your path? I got you covered with these insanely motivational financial freedom quotes!

Related posts:

- Want to Retire Early? You Better Understand the Importance of Investments! If you’re even thinking about retiring early, or really even retiring at all, then the importance of investments absolutely cannot be understated. If you’re struggling...

- Some Popular (and Unpopular) Wealth Creation Strategies When someone says fire is your first instinct to run for the door? To be honest, I think that I’m at the point now where...

- The 3 Timeless Principles of Wealth Creation to Live By When it comes to building wealth, there’s an endless supply of advice and ideas to get there. If we really boil it down to the...

- Retiring at 55? 9 Tangible Steps to Turn that Goal Into a Reality! Are you pumped for this blog post? I hope so! I know that I am extremely pumped to write it and show you all about...