Have you ever wondered what actually happens when a stock splits? Chances are there are two groups of people reading this right now – 1 group is emphatically saying “Yes!” and the other group is saying, “What do you mean my stock can split?”

Stock splits are definitely not an uncommon thing and in fact, I would actually say that they are very common. Has Apple ever split their stock? Yup. What about Microsoft? Yup. GE? Yup. Ok, what about Amazon though? YUP!

Those literally were the first four companies that I looked at to see if they had ever split their stock before and all of them were a definitive yes, and Amazon had the least amount of stock splits…at 3!

So, what even is a stock split?

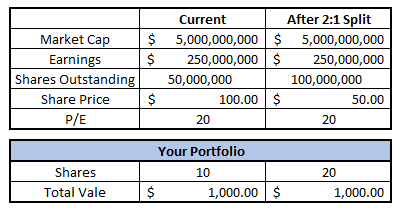

Essentially a company will split their shares, therefore creating more shares in the market. For example, if it was a 2:1 split and you owned 10 shares of the company, then you will now own 20 shares.

“Holy Crap – my shares doubled?”

Well, yes, but that also means that the value of the shares likely just were cut in half too. For instance, let’s take a look at the example below. All that changes for the company in the current situation and the 2:1 stock split situation is that the shares outstanding doubled and then the share price is cut in half.

You’ll see that the P/E is still the exact same because the value of the company isn’t actually changing at all – it’s just that there are more shares!

Why does a company want to split its stock if the value of the company isn’t changing at all?

The main reason is simply to change the share price of the company. Most often this means that the share price is going to drop down to a lower level as I just illustrated above.

I think that there’s a fine line between the common investor viewing a stock as prestigious and garbage and the key is to find the sweet spot. One stock that immediately comes to mind is with Amazon and if they would ever do a stock split again.

The current Amazon share price is $2,545.02, which makes it very hard for investors to buy a share of Amazon. I mean, not only is it hard for the common investor to save that much up to buy a share of the company, but if you’re trying to maintain a diversified portfolio, and even if it’s only 10% diversification, then that would mean you would need over $25K!

Of course, that’s absolutely not impossible by any means, but for the average investor that is just getting started, that might be hard to obtain.

But, luckily for us, partial shares have become incredibly prevalent at many brokerage firms now!

Not even a year ago we would find ourselves having to buy whole shares and pay at least $4.99/share if you were at a well-established brokerage like Fidelity, Schwab, E-Trade or TD Ameritrade.

Now you can make transactions at many of these brokerage firms without having to pay any sort of commission and you can also buy partial shares!

Personally, I love partial shares because it just means that I can get more of my money into the market faster than I used to be able to. I can literally put every single penny of my money into the market at all times because I can buy shares in any quantity.

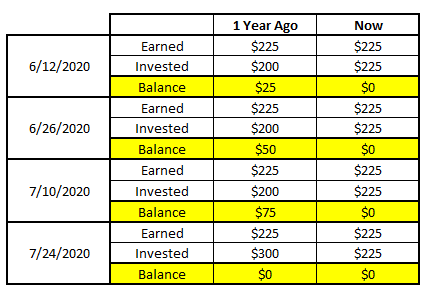

Imagine this – you get paid biweekly, and every time you get paid, you want to put $225 into the market. Currently you’re wanting to add to a position that just happens to be $100/share. In today’s world, you can simply buy 2.25 shares of that company every two weeks. 1 year ago, you would only buy 2 shares and just sit on the remaining $25 until you had enough to buy a third share.

Take a look below:

As you can see, you sit on $25 for the first pay period, then an additional $25 for a total of $50, then a total of $75, and then you finally get up to $100 where you can buy your third share. So, what did this cost you?

Well, $25 was out of the market for 6 weeks, $25 more was out for 4 weeks, and $25 more was out for 2 weeks. I always say that time in the market beats timing the market, and when you have to just sit on money you basically are being forced to sit on money and time the market.

Or, even worse, is that you’re going to buy a stock that has a lower share price but you don’t like as much, just to get your money in the market. Never sacrifice quality for a few extra weeks in the market.

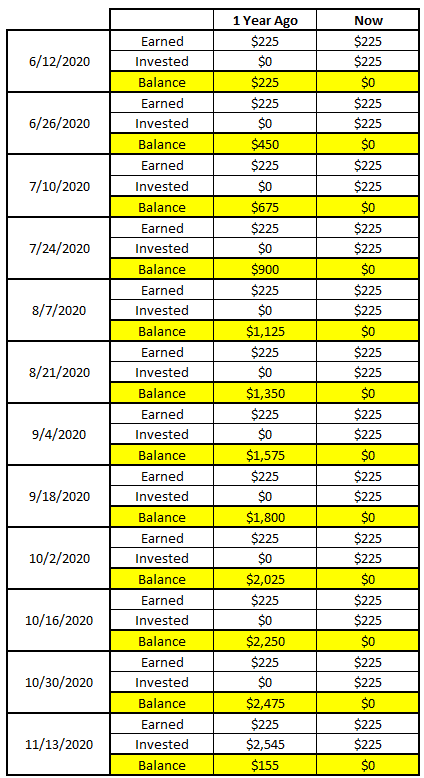

Imagine doing this same thing with Amazon stock – it would take you until November 13th to save up for one share!

That is really the entire thought process to why a company would want to split their stock, and partial shares have almost completely eliminated this hurdle, as long as you’re ok with holding .1 shares of Amazon. The key is to understand the value and not think about the share count. I’d rather have .1 shares of Amazon than I would 30 shares of Ford. All about the simple math!

Some companies will also do reverse stock splits if their price is getting so low that the perception is being so incredibly negative, such as with Chesapeake Energy.

This one is front of mind for me because it was so recent and so many people were negatively impacted by it. In my eyes, it honestly seemed like it was almost scammy, but the more I thought about it, the more that I just felt like it’s the investors fault for being tricked.

So, this is what actually happened – Chesapeake Energy decided on a 1:200 reverse stock split, meaning that for every 200 shares that you owned, you were going to get one share in return. Now, as I mentioned above, the value should still theoretically remain the exact same, it’s just that the number of outstanding shares is changing.

The main reason that they did this was to try to stay above the $1.00 minimum share price required by the NYSE to still be listed as a company that was able to be traded. It makes sense to me, but would I want to invest in a company that has to do such an insane reverse stock split to essentially artificially inflate their share price?

That answer should be obvious.

Well, the share price closed at just over $.13 the day before the reverse stock split and then when the market reopened, after the reverse stock split, the share price was not $26.64.

That caused a huge selloff because a major reverse stock split like this is oftentimes a bad sign that things are going to get worse for the company, as well as the fact that some investors were fooled and thought that they made a ton of money!

No lie.

Some investors literally thought that their shares went from $.13 to over $26 overnight. There are many Tweets to prove this…

The share price then proceeded to drop down to $16.38, a drop of 37.6% and the biggest daily decline in the history of the company. Ouch.

The share price today is up to $19.23, which is ok, but the company still is in awful, awful, awful financial troubles and I don’t expect things to get better at any point in the near future.

Initially, I did feel really bad for the investors like I mentioned, but the thing is – you need to put a little bit of common sense to it. Your shares will never be a 200-bagger overnight lol. That is BONKERS!

I mean, I talk about how amazing a 10-bagger is, meaning that the stock is now worth 10 times what you bought it for, and how hard that is to have happen to you, so imagine thinking something 20 times a 10-bagger happened overnight.

That company must have been drilling for oil and literally found a time travel machine where they can go back in time and make all the right decisions…spoiler…not what happened.

So yes, please just be really aware of reverse stock splits and make sure that you understand why the company did it and it could me a big red flag where you just need to pay a little bit closer attention to that company. Take another look at their financials. Use the VTI again and see how things look

Maybe even take a look at the qualitative data and listen to some recent earnings calls, look at competitors, look at all pieces of information that will help make you a better investor and more knowledgeable with this company.

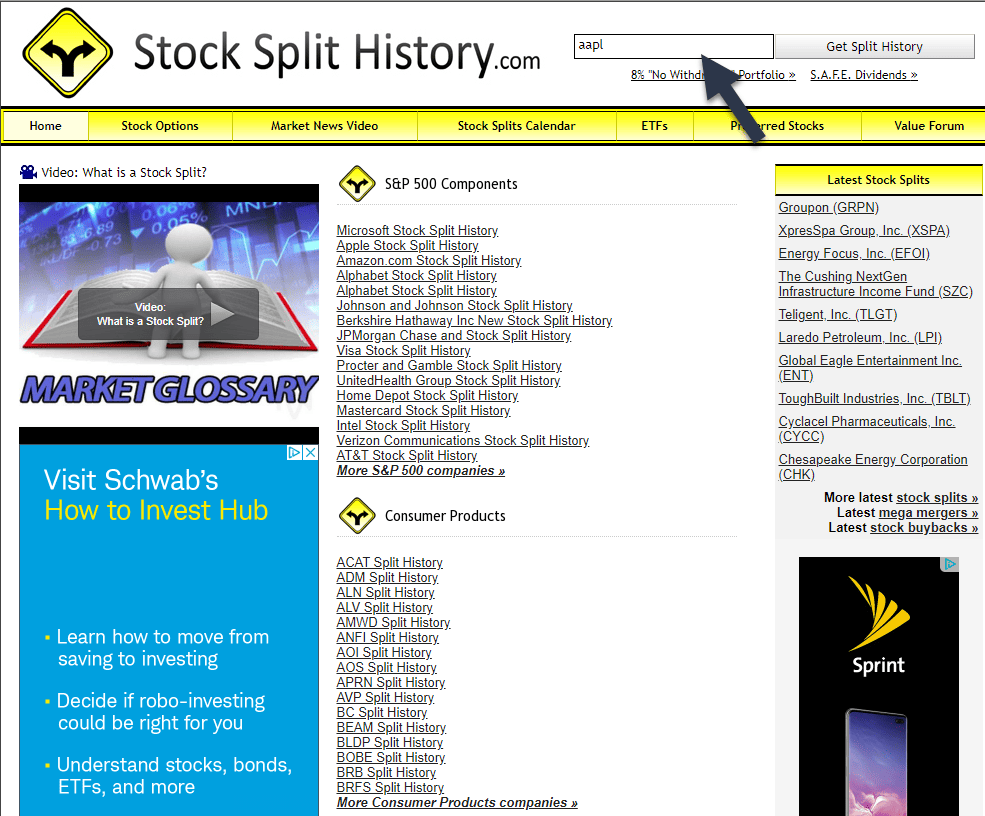

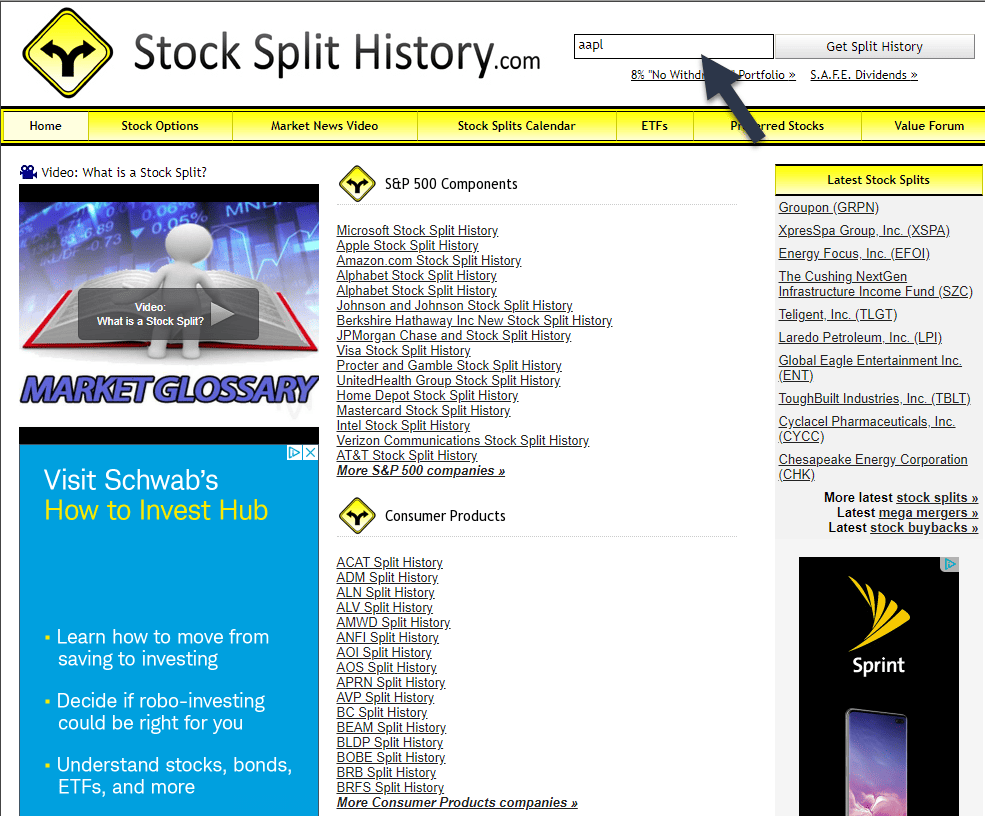

If you want to go back and look at stock split history, take a look at stocksplithistory.com. I really like this website because I can see the exact ratios and all the history that the stock split occurred.

For instance, I mentioned the Apple stock splits at the beginning of this article. Just click on that link and then put AAPL in for the ticker:

You can see that they have had four stock splits since existence, all of which were normal stock splits and none were a reverse stock split. The ratio in 2014 was 7:1 which is drastically higher than the other three, and much higher than I normally see in general, so I might want to dig in a little bit more just to see what happened.

I am assuming that the price was just really high and they wanted to bring it back down, but let’s check it out. Unfortunately, this website doesn’t have much more info that you can drill down into, but I simply googled ‘Apple 7:1 Stock Split” and found that the price before the split was $645.54, meaning that it was likely wayyy too high for the common investor to buy at that point in time.

For perspective, Apple hit at an “all time high” on an adjusted basis at just over $352 on 6/10/20.

Like I mentioned, stock splits don’t really mean a whole lot now that we have the ability to purchase partial shares. The biggest thing, in my eyes, is to pay close attention to reverse stock splits and understand that they could be a great indicator that the road is going to be a rough venture, so you either need to do your homework and strap on or be prepared to jump ship.

Just because a stock price is lower doesn’t mean it’s cheaper – it very well could be more expensive if the company is worse off than when you invested, so please, I beg you, do your homework on it.

Now that partial shares are becoming more and more prevalent, there is no reason to not max out your investments every time you get extra money to put into the market. Just do yourself a favor and make sure that you are taking advantage of that opportunity! It would really be a shame if you just continued to purchase whole shares only because of any “OCD” that you might have.

That is a sure fire way to miss out on some massive gains in the market!

I have had friends tell me that they will only buy whole shares because it drives them nuts having partial shares and that’s fine. Do you know what drives me nuts?

Not having all of my money invested!

Related posts:

- Stock Repurchases: How They Work and Their Effect on Earnings Updated 3/6/2024 In today’s market, share repurchases are the choice that most public companies use to return value to their shareholders. Investing giants such as...

- The Big Guide to Little Dividends Dividends are one of the best ways companies can return value to shareholders. Share buybacks have become all the rage in the investing world, pushing...

- What Investors Can Learn from a Possible Amazon Stock Split Amazon stock split? What the heck. “Hey, I have some AMZN stock, don’t split mine in half!” Was that you just now? If so, take...

- Tesla and Apple Did It – Is it Time for a Google Stock Split? Stock splits are a really unique thing nowadays and with so many companies doing it lately, it makes me wonder if it’s also time for...