Dividend (and dividend growth) investors have long debated what is a good dividend yield. How little yield is too little, and is a high yield always better?

This post will dive into this debate to provide an answer to this question and why this is the answer.

Click to jump to a section:

If you’re like me, when I first started listing to the Investing for Beginners Podcast, I had absolutely ZERO experience with investing. Sure, I took some finance classes in college, but they didn’t focus much on dividends or investing. Even if they did, it’s been quite some time without using them in my daily life, so any knowledge learned is completely gone from my brain.

Sure, the company that I work for issues a dividend, so I vaguely understood that money was being given back to the investors. But I had no idea what the purpose of a dividend was or whether my company gave enough of a dividend or not.

So, as I listened to the podcast, I kept hearing Andrew and Dave talk over and over about dividends, the power of the DRIP (Dividend Reinvestment Plans), and how they won’t invest in a company unless it has a dividend. So, I started to research and try to understand dividends, and there’s a ton of information on the internet about them!

But, if you try to find what a good dividend yield is…you just can’t do it. So here I am. I’m going to tell you.

What is a good dividend yield, you ask? Well…

The Answer

A good dividend is one whose yield continues to increase!

Let me guess – my answer bums you out a bit.

You were expecting a number like 8%! Or maybe even higher! Something crazy. But I cannot give an answer like that because each situation is different. The ideal dividend is based on the company, the current market atmosphere, profit margins, sector, etc.

For instance – Let’s pretend that I said 5% is a great dividend yield. Now, let’s say that Andy’s Baseball Cards (a completely made up company with ticker ABC for this example) is priced at $100/share. ABC historically is a very strong company that has increased dividends, but they just lost $30,000,000 in 2018. Plus, the outlook is worse for the future years due to kids preferring virtual baseball cards instead of the paper ones that ABC makes.

The question now is, if you’re a long-term investor in ABC and see that ABC needs to make a huge change to their business and shift from paper cards to virtual cards, would you prefer that they continue to increase their dividend, taking into account that they lost money last year, or cut back the dividend and try to right the ship?

Personally, I would prefer that they try to make this overhaul and reduce the dividend to keep them from pulling on their cash or going into debt to fund the dividend. It really comes down to personal preference, but as a long-term investor and believer in ABC, I’d prefer to decrease the dividend to fund the investment for the major overhaul of the business.

High Yield Example: AT&T

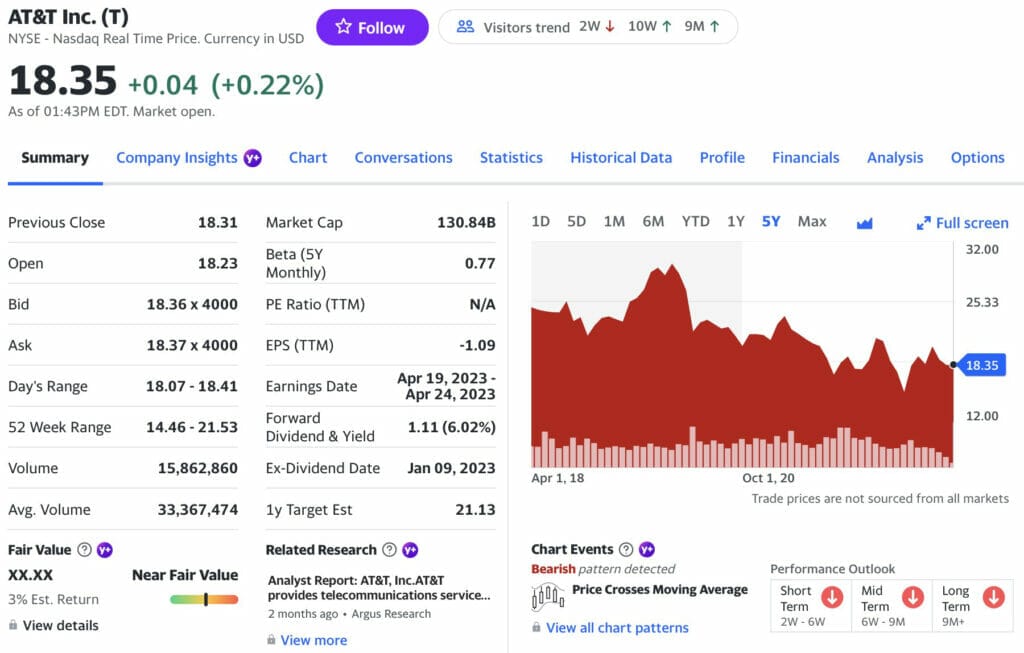

There are many companies out there that offer noticeably higher dividends than the traditionally expected 4%. For instance, let’s look at AT&T ($T):

Currently, the stock is offering a 6.02% dividend! That’s great! Sign me up all day for that. Right? WRONG.

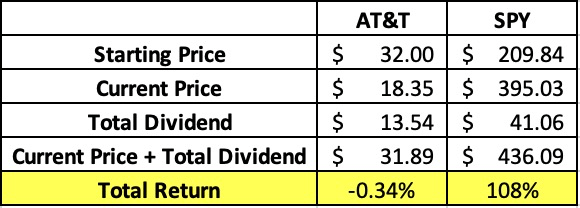

Just because a stock has a high dividend yield, it might be a “good yield” but not necessarily a good investment. Since Q2 2016, AT&T has given back very strong dividends, but the stock also has dropped from $32 to $18.35. Personally, I would’ve rather just bought the SPY ETF that’s representative of the S&P 500. In the example below, I outlined the share price 6 years ago, the current share price, and the total dividend. The total dividend is the sum of all dividends paid during those five years.

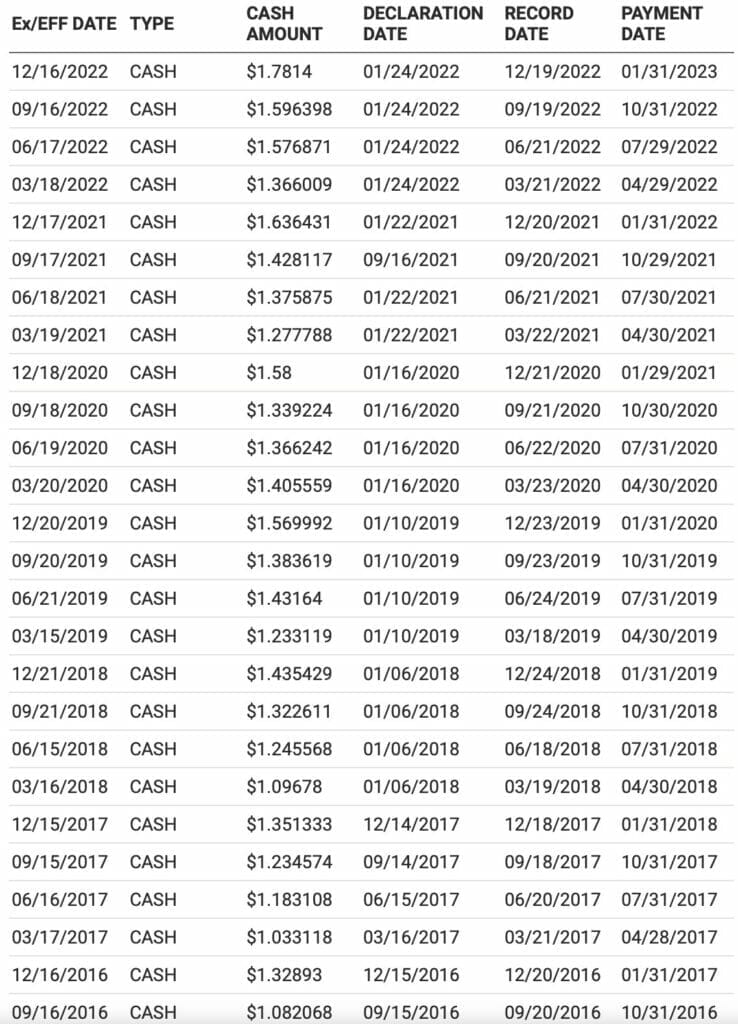

You might notice that the ‘Total Dividend’ is only $13.54 for AT&T, but it is $41.06 for SPY. Keep in mind that the dividend yield is directly correlated to share price. SPY is a much more expensive stock than AT&T, so it can pay a higher dividend, while still having a lower yield. AT&T has a 6% yield and SPY only has 1.66% yield, but the dollar value is much higher.

As you can see, if you bought one share of AT&T, your total return (including paid dividends) would’ve been -.34%! Your SPY return would’ve been over 100% during that same period! That is a massive difference in return between those two stocks.

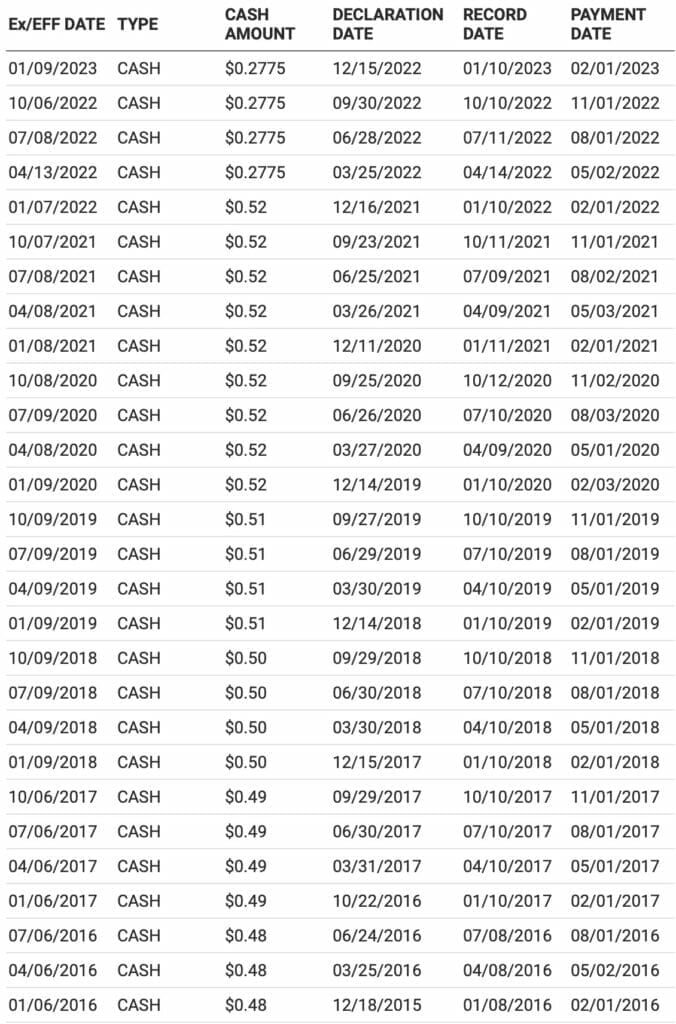

Below I’ve broken it out quarter by quarter, so you can see the exact quarterly dividend that you would’ve earned:

NOTE: Don’t worry AT&T’s dividend drop in March 2022. They had a stock split with Time Warner, so their dividend AND share price dropped in half. This kept the yield the same, but the dollar value dropped.

At this point, you might be confused – I’ve told you that dividends are good, but too much of a dividend might not be good, yet Andrew and Dave won’t invest in stocks without a dividend – SO WHAT THE HECK IS A GOOD DIVIDEND???

The Key: Dividend Growth

Well, I’m going to revert back to my first answer. The correct answer to this question is a dividend that continues to grow. A growing dividend is a good dividend, but it is possible to have growing dividends in bad investments, as I just showed.

The ideal goal is to find a good, growing dividend in a strong, undervalued stock.

To accomplish this, I’d recommend taking a look at the Dividend Aristocrats. To qualify as a Dividend Aristocrat, you have to be a member of the S&P 500 and have increased your dividend for 25 consecutive years.

Currently, there are 57 members in the Dividend Aristocrats including household names such as 3M, Caterpillar, Coca Cola, McDonalds and Walmart.

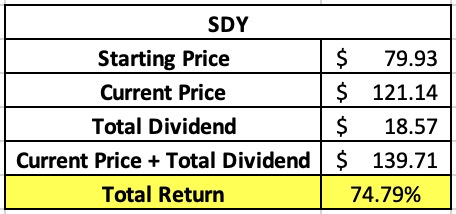

Fortunately for us, we can invest in some great Dividend Aristocrat ETFs if ETFs are your preferred method or potentially a good way to start your investing journey. A couple that I would recommend are NOBL and SDY. Both have increased at least 32% in the last 5 years and have fairly strong Dividend Yields (over 2%). SDY has realized a 32% return in stock price over the last 5 years, but including the dividend, the total return is just over 46%.

Closing Thoughts

In summary, there really is no true number that is going to tell you if a dividend yield is good. You don’t want to focus solely on yield because you could still lose out as we explored with AT&T. You also could target a company that has higher growth but a lower dividend, such as Visa (one of my personal favorites). They only have a forward dividend of .62%, but they’ve grown by 322% in the last 5 years, as well as 10 consecutive years of growing dividends. Dividends are necessary to me, but they are not used as a tool to make the final decision.

The dividend is nothing more than the cherry on top – but would you ever order ice cream without a cherry? I wouldn’t.

Related posts:

- Dividend Ratios Pt. 2: How to Identify Sustainable Dividend Growth As we discussed in part 1 of this dividend mini-series, there is much focus on the past dividend growth of a stock– yet this doesn’t...

- Dividend Ratios Pt. 1: Evaluating the Dividend History of a Stock One of the most disturbing trends on Wall Street that I’ve noticed over the last 100 years is the movement away from an emphasis on...

- High Dividend Stocks: The Risks and Double Compounding Potential A stock that can grow their dividend payments over time consistently provides compounding like no other opportunity. Naturally, investors try to maximize this compounding by...

- Building a Dividend Growth Portfolio with Tomorrow’s Dividend Aristocrats If you’ve ever listened to Andrew on the Investing for Beginners podcast then you know that he is the “DRIP King!” You might know this,...