The Price to Earnings, or P/E ratio, is one of the most basic ways to try and figure out if a stock is generally cheap.

The logic behind the P/E ratio is quite simple. The equation for the P/E ratio is simply Price / Earnings. A low P/E is generally considered better than a high P/E. A low P/E can happen one of two ways: either a low price, high earnings, or both.

What is a good P/E ratio?

The short answer is that it depends—it depends where the market is, what a company’s future growth rate is expected to be, and the uncertainty of that growth.

How Wall Street expects a company to grow tends to set its P/E ratio more than anything else, as the P/E is a good shortcut to understanding how bullish or bearish investors are on the stock.

Higher P/E stocks, in general, are considered more expensive; while lower P/E stocks are, in general, considered cheap.

Over history, the average P/E ratio of the stock market has been around 15-17.

But the average P/E of the stock market has fluctuated for many reasons over time, and actually has rarely traded right at that average 15-17 mark. For example, in bull markets where investors tended to be more optimistic, average P/E’s traded much higher than 15-17.

The average P/E of the stock market has traded lower than the 15-17 mark in bear markets with economic recessions, or time periods with higher interest rates or general uncertainty.

So, a “low P/E” or “high P/E” or “good P/E” can be very relative depending on current market conditions and the average current P/E of the stock market.

Why does expected growth affect P/E ratios?

Though investors can use metrics like the P/E ratio to examine a company’s past, investment results and future compounding depend on a company’s future.

Investors generally don’t make a return on what a company has done, but rather on what it will do moving forward.

Over the very long term, stock prices follow earnings growth.

A stock cannot sustain high share prices for very long without also growing its earnings per share (EPS) to a high rate.

Investors know this, so—the stocks that are expected to grow their EPS the most in the future will tend to be more popular in the market, making them more expensive, making them have a higher P/E ratio.

Compounding Helps Companies “Grow Out” of High P/E’s

The famous superstar investor from Fidelity, Peter Lynch, talked about how stocks with higher EPS growth rates and higher P/E’s can outperform companies with lower growth and lower P/E’s because of the power of compounding.

To illustrate this, let’s look at an example I shared on another blog post:

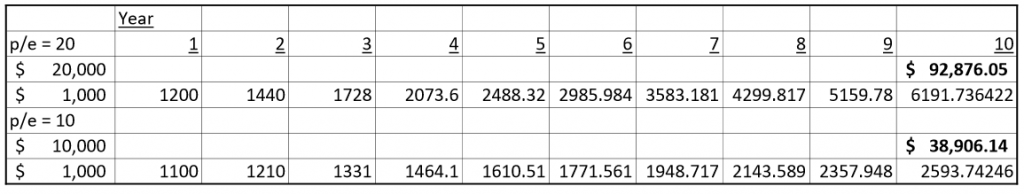

Taking two examples of a stock with earnings of $1,000: one is trading at a P/E of 20 ($20,000) and one at a P/E of 10 ($10,000). Now we’ll grow stock A’s earnings at 20% and stock B’s earnings at 10%. Then, after 10 years, we’ll take year 10’s earnings value for both stocks and multiply both by 15 to account for mean reversion. Which stock does better?

As investors, we need to be careful not to take this idea too far—because of another truth…

Wall Street tends to be overly optimistic about future growth.

This is especially true with sell-side analysts, who often change their estimates frequently as a stock performs better or worse than expected. Their price targets are often way off the mark, and often overly optimistic, yet they are not generally held accountable for these errors.

Investors, too, tend to be overly optimistic about future growth, as the number of stocks which actually “grow out” of their high P/E’s is much lower than people think.

Michael Mauboussin had a great look back over many decades of stock market history and found that the vast majority of companies saw their growth revert to the 0-10% range over a 10-year period, even if they had growth rates of 15%+ in their recent past.

Cheaper Stocks Tend to Outperform Expensive Stocks

Over many years, “value investors” have tended to outperform “growth investors” over time (spanning 80+ years of recent stock market history).

Value investors tend to look for stocks that are trading at lower valuation multiples, with a low P/E ratio being one example of that, and tend to “buy low” and “sell high” in order to earn higher returns.

The reason this strategy has worked for so long is because of that same fact, that investors and Wall Street tend to be overly optimistic about future growth.

When you buy a stock with a lower P/E ratio, expectations around future growth tend to be lower, and so it’s easier for a company not to disappoint those expectations and cause big stock sell-offs. This is a concept referred to as a buying with a margin of safety.

Warren Buffett has been the most well known and successful investor who used the concepts of value investing and buying with a margin of safety to earn superb returns over many decades.

Warning: A Good P/E Ratio Depends on the Industry

Because P/E ratios tend to depend on expected growth rates, the P/E ratios of a company or industry also depend on current growth rates and how they set the expectation for future growth rates.

In industries that are more mature, and have seen growth rates slow down, the P/E ratios for the stocks in these industries have tended to be lower than the average P/E of the stock market as a group.

Examples of industries with low P/E ratios because of lower expected growth include the big automakers (like Ford and GM) and many insurance companies (such as life or property & casualty).

Industries can also trade at lower P/E ratios as a group because of the uncertainty of their future growth, especially in industries that are heavily cyclical.

A cyclical industry means one that performs extremely well during economic booms but performs very poorly during economic slowdowns, and the future growth rates of these companies tend to be much more unreliable.

Examples of industries with low P/E ratios because of the cyclical nature of their growth include homebuilders, commodity producers such as steel or oil & gas, or some discretionary retailers.

Just because a company in a highly cyclical industry has huge profits today doesn’t mean they will have similar profits and growth if the economy enters a recession.

A company with a low P/E ratio compared to the market (say at a P/E = 10 versus the market at a P/E = 20), may actually be expensive if its peers in its industry are trading at a P/E = 5 because of cyclicality or lower expected future growth.

What is a high P/E ratio?

A company can be considered to have a high P/E ratio if its P/E is higher than the stock market’s current P/E, or even if its P/E is higher than the historical average of 15-17.

But, this higher P/E ratio can be justified if a company does grow at above average rates to the rest of the market.

Industries such as technology tend to trade with high P/E ratios because many are expected to achieve above average growth rates due to the promise of innovation, and new technology quickly replacing the old.

That said, be very careful with companies with higher P/E ratios.

History has proven time and time again that the companies with the highest P/E ratios also tend to be those that see the biggest stock sell-offs, and these occur with the overwhelming majority of stocks in this category.

It’s really, really hard to compound your wealth as an investor if you hold a stock which sell-offs at a much higher rate than the overall stock market—especially when the reason that a stock sells-off is usually because the reality of the company’s prospects turns out to disappoint its impossibly high expectations.

Hope springs eternal especially in the stock market, but that’s a dangerous mentality when it comes to stocks and P/E ratios, so use judgement wisely.

Learning about P/E ratios is just the starting point of a journey to understanding stocks; I highly recommend also reading our Value Investing Guide for Beginners.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- Why Liquidity Ratios Are Important, With Examples Using Real Companies In times of financial uncertainty, finding companies with a good amount of liquidity provides a margin of safety. Companies in good shape regarding liquidity can...

- The Price to Sales (P/S) Ratio Formula Explained Price to Sales (“P/S”) is one of the more common and simple relative valuation ratios used to generally compare how expensive or cheap a stock...

- What’s the PEG Ratio in Finance – Does it Work on Large Companies? Price-to-earnings, or P/E ratio as it is also known, is probably the most recognizable metric used to value stocks. Are they the most useful? Well,...

- How to Use Net Profit Ratio to Find a Worthy Investment “If you do good valuation work, the market will eventually agree with you.” –Joel Greenblatt There are many methods for determining a company’s profitability. The...