Net book value (NBV) is an accounting term which refers to the value of an asset as it can be seen on the balance sheet of the financial statements. The term carrying value is also commonly used to refer to NBV. The “net” in NBV signifies that the figure is the asset’s gross original cost less any accumulated depreciation, amortization, or depletion depending on the type of asset in question.

Net Book Value (of an Asset) = Original Cost – Accumulated Depreciation

The term net book value can also be used when discussing a company as a whole and signifies the “net” assets that are attributable to shareholders after subtracting liabilities. This phrase is more commonly shortened to the “book value” of a company and is synonymous with the amount of equity seen on the balance sheet.

Net Book Value (of a Company) = Assets – Liabilities

Either for a specific asset, or a company as a whole, net book value is an important concept for investors to understand because it is a conservative benchmark against which a company and its assets are valued.

The Concept of “Net” Book Value

Within a company’s accounting system (in the olden days, this was literally a book!) there are multiple related accounts for certain assets or liabilities. These related accounts are “netted” together to come up with the total net book value that is shown on the balance sheet.

Net book value is the relevant figure to show on the face of the balance sheet as it is a summarizing approximation of the remaining worth of the asset. While different than market value, which is based on external supply and demand forces in the market, NBV is an important benchmark to judge an asset and company’s economic worth.

What is Included in Net Book Value?

In the notes to the financial statements, the company will break out the gross cost of various asset classes and the accumulated depreciation, amortization, or depletion figures which are being netted together. The term accumulated refers to the fact that on the balance sheet we are not concerned with the depreciation for one year (which is shown on the income statement), but the total depreciation that has “accumulated” since the start of time.

Gross Original Cost: The original historical cost to acquire or build the asset, which also includes other related costs capitalized to the balance sheet in order to get the asset ready for use such as transportation and delivery charges, setup and installation costs, and custom duties.

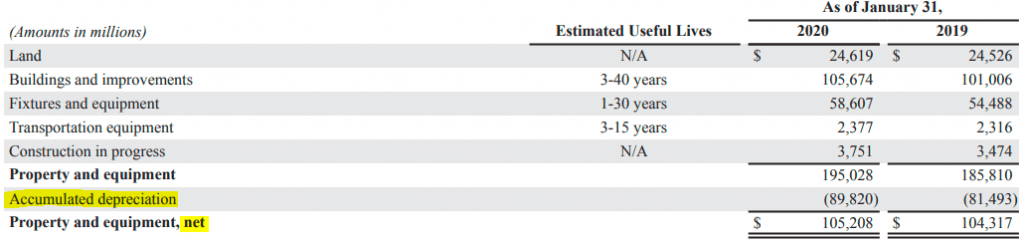

Accumulated Depreciation: The term used for tangible assets and the reduction in an asset’s value due to use, wear and tear, and obsolescence. Below is an extract from Walmart’s annual report which shows the gross amount and accumulated depreciation related to the company’s property and equipment.

Accumulated Amortization: The term used for intangible assets and the reduction in an asset’s value due to the passage of time and obsolescence (for example a 10-year patent slowly expiring). The term amortization is also used for the reduction in a liability over time as payments are made such as an amortizing loan or mortgage.

Accumulated Depletion: The term used for finite resource assets such as minerals, timber, and oil/gas as it relates to the reduction of the reserve as the resource is extracted.

Sourced from Walmart’s 2020 annual report

An asset’s gross book value net of subsequent depreciation, amortization, or depletion are a reliable estimate of an asset’s remaining worth. If net book value is still too high after subtracting depreciation, amortization, or depletion, the company will be forced to take impairments against the asset to bring to value down to its economic worth.

Side Note: For major assets in industries such as real estate, infrastructure, or investment funds, it is common to hold assets such as properties and stocks at fair value on the balance sheet if they can be reliably measured. For such assets and companies, NBV can be a very close approximation of market value.

Investor Takeaway

Net book value is the carrying amount of assets (and liabilities) on the balance sheet. While different from market value, NBV forms the benchmark of an asset or company’s worth based on its gross original cost and estimated reduction in value since then. Net book value is an important concept for investors to understand because it is a conservative estimate of an asset or company’s net worth based on accounting principles.

Related posts:

- Valuation Basics: Market vs Book Value – and The Argument for Both When performing a DCF valuation, you must make a distinction between using market vs book value for debt. It is a critical part of calculating...

- How to Test Goodwill & Intangibles for Possible Impairments As technology increases and goodwill and intangibles continue to get more common on the balance sheets of companies, it becomes ever more important to understand...

- What is EBITDA and Should Equity Investors Care About It? The term earnings before interest, taxes, depreciation, and amortization (EBITDA) has gotten extraordinarily popular over the last few decades. Companies will often comment on EBITDA...

- How the Beneish M-Score Keeps You Cognizant of Earnings Manipulation Earnings manipulations are one of the more sinister aspects of financial accounting. While it isn’t prevalent, it is an aspect of investing to be aware...