To someone that is not an investor in the stock market, beginning to invest can be absolutely terrifying, and guess what – I 100% understand. It’s easy to get lost in the industry jargon and the numbers people talk about and just be turned off from investing altogether, but I am here to answer the question for non-investors – why do people invest?

Well, there are quite a few reasons, to be completely honest. One simple reason is that people do it for money. But that’s really the easy answer and one that doesn’t tell anything close to the full story.

Click to jump to a section:

I think that the reasons people invest come down to two different reasons – fun and making money!

Fun

Now, within the “fun” reasoning are many different subsections. The main one for me personally is the competition in investing.

This might sound ridiculous, but people that love the competition of anything are likely going to be those that are investors.

Personally, I know that I fall into this category. Now, I don’t invest only for the competition aspect, but I do absolutely thrive off of the competition. The competitive aspect is not something I even realized was going to occur until I got firmly planted into my investing journey.

You’re likely to frequently hear people say things about “beating the market.” For investors, that means that you’re trying to get better returns than what the overall market returns over a certain period of time.

For instance, I always benchmark myself against the S&P 500 because that it is the most representative index. With 150+ years of history to look back on, the S&P 500 has tracked the market more successfully than any other index. I also personally feel that if I had zero investing knowledge and didn’t want to touch my money for thirty years, I would invest it all into an ETF representing the S&P 500 like SPY or one that is an equally-weighted S&P 500 ETF like RSP.

So, I want to measure if I am actually better than this alternative of just investing my money and not touching it or if my “personalized touch” is better. It might sound ridiculous, but I literally track my performance every single week.

Now, I am not changing my investments weekly and I am not making decisions to buy or sell a stock just because of something that happens short-term. Regardless, I track it because I am a firm believer that the more you track something, the more likely you’re going to succeed at whatever you’re doing.

For this same reason, I track my monthly spending with Doctor Budget. I track every single thing that I eat every day, and I know this makes me more focused on my nutrition. I weigh myself every day, and this keeps my weight in check because I constantly want to see a new “all-time low” number.

By tracking, I am getting constant eyes on whatever my goal is. This keeps me very motivated and keeps it top of mind.

Sharing with Friends & Family

But I’m not just trying to beat the market – of course, I am always talking about my investments with friends and family, and everyone likes to talk about their winners! We all like to talk about stocks that are doing well for us and then also point out new companies to each other to try to be the ones to “find” them.

You know how as a kid, you always wanted to be the kid that heard the song first? It’s no different with stocks – we’re just older kids now!

Gaining Knowledge

In addition to the competition, you have the knowledge. I absolutely love learning about new companies, industries, and just different trends going on in the world.

Investing is my opportunity to literally own a part of a business, so why would I buy the normal boring stocks? Sure, that absolutely can be a great way to make money, but why not go out on a limb and research some new stocks that are transforming the world?

I obviously could learn about these companies without investing in them, but that is just not nearly the same amount of fun as when you’re actually looking at them as investments.

When you put your money at risk by investing in them, it drives a deeper desire to learn and investigate the inner workings of that company and to truly understand its balance sheet.

In addition, if you believe in a company, this is putting your money where your mouth is. If you constantly talk about how great Target is, why not put yourself out there and help support the company you love so much?

Now, I realize that this might not be fun for everyone, but to be a successful stock picker, you’re likely going to need to be able to dive into the details…or just be extremely lucky!

Joining Groups

The last aspect of “fun” is the friendships and clubs you will create/join. I know that I have become friends with new people because of our common love of investing.

In addition, talking about stocks is a very easy bridge into some financial literacy topics that just further drive that friendship and comradery. For instance – one of my former coworkers and I would always talk stocks together. Then, we had a different coworker (all of us are similar ages) go buy a $500K house, and my friend asked, “How can he afford that?”

Well, my answer was simple – I said, “Well, you have no idea how they spend their money. But I know that you max out your 401K, your HSA, and your IRA and you’re paying a 30-year mortgage off in 10 years. So, I know where your money is going, and I’m sure that their money is just going towards mortgage interest.”

Obviously, I don’t know, but I knew those things about my friend, and it truly all started with us talking about stocks and then developed into personal finance.

I have a group text with some friends where all we do is talk about stocks and the market, and honestly, it isn’t very good for my actual investing strategy. But it’s an excellent way for us all to keep in touch daily and bounce different ideas off each other.

Unfortunately, most of the conversation involves constantly reliving our regrets. But it can be fun, too, as long as it’s not just about regrets (like my Sunrun regret I’ve discussed previously).

There are also some investing clubs that you can join where you’re going to be talking stocks and sharing new ideas with one another. These clubs can be fun and beneficial to your investing abilities.

Honestly, investing is extremely fun, but I don’t know if I would only do it for the fun aspect. I might, but let’s be real – we’re all here to make MONEY!

Money

Oh man – it’s money time! Of course, everyone invests for money, but what exactly does that mean? Well, I think the first thing is that the ultimate goal is not to lose money, right? After all, that is Buffett’s number one rule:

Inflation Protection

Investing can help you not lose money by providing you with inflation protection. You’re not technically losing money when inflation occurs, but your buying power is shrinking.

Let’s say you normally eat at Subway and get a $5 footlong every day for lunch. Then one day Subway stops doing $5 footlongs except for the stupid bologna sub, and your salary doesn’t increase proportionally. At this point, you’re using more of your income to have the same lunch.

AKA, you can now spend less on other things because your normal lunch costs you more.

Inflation is real and can be a huge impact on your life without it being so obvious, so it’s important to understand the basics.

Inflation is typically 2-3% per year on average, which is easily outpaced by the 10% average returns in the market. However, during years like this when inflation skyrockets to 6%, that gap shrinks. If you aren’t investing, you are losing significant buying power every year.

In addition, you share their increased profits by investing in a company raising prices to account for inflation. As a given company increases revenue, its share price increases, making its investors money. To not invest is to miss out on piggybacking on this scenario.

Tax Advantages

Along the same lines as not losing money is finding ways to keep your hard-earned cash creatively, and a way to do that is by finding any and all tax advantages!

Investing is one of the best ways to reduce your taxable income and pay fewer taxes as a whole. There are multiple ways to do this:

IRA’s & 401K’s – both of these give you the option to put in pre-tax dollars (Traditional Account) or after-tax dollars (Roth) into your account that will keep you from paying taxes on the other side.

For instance, if you max out a Traditional IRA at $6,500/year, that money will come straight from your salary with $0 in taxes taken out, meaning you’re investing more than you would’ve actually earned if you just got paid the cash. This lowers your current taxable income, lowering your tax bracket, and deferring the taxes until you withdraw in retirement.

A Roth is the opposite, where you pay taxes upfront and then avoid paying them again when you retire. Personally, I prefer Roth because I am younger and likely in a lower tax bracket than I will be later in life. Also, I know that the money in my account is MINE! There is no risk of taxes increasing because I already paid my portion.

Either way is good, but I recommend you check out this IRA calculator to do the math yourself! The important thing is having tax advantages of some kind.

HSA (Health Savings Account) – this is my favorite investing tool because you avoid taxes at all stages! Pretax money going in, no taxes on the growth of your investments, and you don’t pay taxes at the end. It is truly an incredibly useful tool that I really recommend everyone try to use.

HSAs are used to pay for anything health-related. This can be anything from bandages to an X-Ray. These accounts are surprisingly flexible for the tax-advantages they offer.

After maxing out my 401K employer match, the HSA is #2 in my priority list of investments.

There are other tools as well with tax advantages, such as a 529 for further education, so don’t hesitate to find ways to minimize your tax bill.

You worked hard for that money – you should work hard to keep it, too!

Early Retirement

The main reason that people will invest, though, is so that they can retire early. I mean, that’s why we started our investing journey.

When you start to play with some compound interest calculators and see how investing can change your life, it’s incredibly motivating.

I’ve told this story before, so I won’t completely restate it, but when my now wife and I lived in Chicago, we wasted so much money every week on random things – food, drinks, events, etc. It was fun but a waste.

We decided the only way to get ahead was to cut off the head of the snake and stop trying to save a little more each week, but rather make a drastic change and invest for retirement. I view it as buying in bulk.

Day-to-day changes are great for lowering your spending, but rather than just using that money for a short-term goal or paying down debt, we chose to use it to plan for a goal that was 30+ years away – retirement.

Because of that decision, we have been able to get ahead in our retirement journey and still live comfortably. Later in life, we won’t be forced to “cram” cash into a retirement account.

Legacy

The last reason that people, myself included, will invest is to leave a lasting legacy. I don’t mean that I want my name on the side of a building or something. I mean that I want my family to have an amazing life after I am gone.

That means my wife, kids, grandkids, and so forth. You see, the thing with compound interest is that it’s just the time and money that you’re going to have your money in the market.

So, while investing for me is great, why not for my kids too? If I can save some small amount of money for many years, they’re going to have such an amazing balance for their own spending.

Now, I don’t just want to give tons of cash to my kids to be idiots – I want them to pay it forward. I want them to take this account and try to siphon some of it off for their kids. As I mentioned, it really doesn’t require a ton of money, but starting early for your kids is such an amazingly motivating thing that I have taken to heart.

Example

I’ve heard people say that you should “live the life now that nobody else will so later you can live the life that nobody else can.”

AKA – take it on the chin and do everything you can to get your retirement savings going and reap the rewards later.

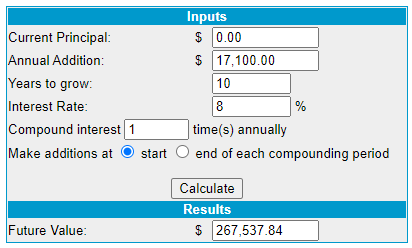

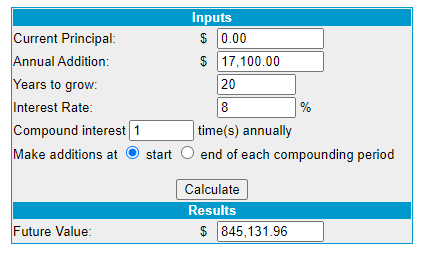

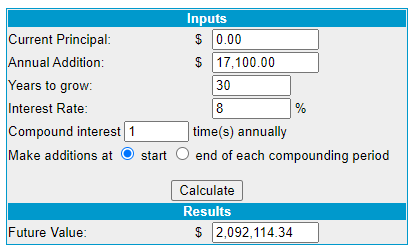

Let’s pretend your household makes $100K/year, and you’re going to max out your HSA at $7100, 1 IRA at $6000, and then max a company 401K match at 4%. In total, you’re saving $17,100 each year!

You can see a few examples with this compound interest calculator of how your balance might look using a conservative 8% among 10, 20, and 30 year investing timeframes:

To me, this is motivating because it keeps me on track with where we need to be with our investing journey for retirement. If we’re on track, great. If not, time to pick it up!

With anything in life, you need to have a goal in mind because otherwise, you’re just shooting from the hip.

That goal starts with knowing your retirement number, and mainly, looking at the 4% rule. Sound tough? It’s not! Let me help!

Closing Thoughts

So, there you have it – as with most things in life, they come down to fun and money! Hopefully, you were able to learn something from this post and if you’re itching for more information, I recommend checking out this free Stock Market PDF.

It has tons of great information and is a concise guide for how you can start your investing journey.

Oh yeah, did I mention that it was free? Cause it’s free!

FREE!

Related posts:

- The Key to Using the Rule of 25 to Plan Your Retirement Properly As a young teenager, all you can think about is moving out of your parent’s house. Then as you hit your early twenties, it turns...

- There are Several 401k Alternatives Available to You Are you stressed about your company not offering a 401K retirement plan? Don’t worry, there are tons of 401k alternatives for you to choose from....

- How Much Should I Have Saved by 30? It’s Less Than You Think! Updated 3/27/2024 If you’re wondering, “How much should I have saved by 30?” then let me tell you this—you’re not alone. It’s scary how little...

- What’s a Reasonable Goal for an Average Retirement? Many of us wonder how we are doing when it comes to retirement savings. It can make us money hungry, not because we are greedy...