Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

Welcome to episode 49 of the Investing for Beginners podcast. In today’s show, Andrew speaks to Nick McCallum from Sure Dividend.

You might remember Ben Reynolds from episode 7; Ben’s the founder of suredividend.com. Nick writes for him, and together they are starting a new podcast called the sure investing podcast. And so you know I’m kind of friends with Ben, and we’ve been going back and forth so I thought it’d be a good time to release this episode.

This interview that I’m going to do here with Nick around the same time that Ben and Nick are releasing their podcasts out into the world. It would be a great opportunity for you guys to check them out and if you’re at all interested in dividends you can listen to Ben’s interview, we did in episode 7.

Listen to today’s interview and get a lot of insights on the power of basically combining value stocks and dividend stocks and creating the best types of compounding interest and wealth that you can.

Andrew: To start off first off thank you, Nick, for coming on.

Nick: my pleasure I’m excited to be here.

Andrew: and one of my favorite articles you wrote it is called the better investment dividend stocks or growth stocks. I love that idea because especially in today’s environment everybody, and it doesn’t matter what asset class we’re talking about. Everybody wants to gravitate towards capital appreciation everybody wants to talk about what has doubled what’s tripled what’s could triple.

Obviously, we thought with all the tech stocks today we saw biotech in previous years, and we see it with the crypto, and it has fallen off a bit. But you see a lot of momentum build on itself, and a lot of that momentum when you’re talking about the stock market starts from these companies that might not necessarily be so profitable, but they’re growing at a fast rate in whatever metric Wall Street likes to use for the day.

Basically these growth stocks create really big increases in share price, and it creates a sort of craze, and you can see a lot of these different bubbles and you kind of get like that contrasted with a dividend stock where people might think that that’s maybe a little bit more boring.

Have you done any research on dividend stocks versus growth stocks and maybe what were some of the simple findings you got from that and we can kind of take that more in depth from there.

Nick: well I guess the first thing that’s worth pointing out is that the whole stigma of dividend stocks versus growth stocks is a little bit misleading because there are growth stocks that pay dividends. And there are dividend stocks that are growing, and I would say there are quite a few stocks that meet those criteria.

the research that we’ve done suggests that dividend stocks tend to be better than growth stocks and in fact, stocks with higher yields tend to perform better than stocks with your lower yields almost being equal.

Now we’ve seen evidence that says the highest-yielding quintile of stocks that performs the lowest yielding quintile stocks by about 2% per year over long periods of time. We’ve also seen evidence that says stocks that grow their dividends beats those with unchanging dividends by two and a half percent per year.

I think that that that description of stocks that grow their dividends over time is the sweet spot between dividend stocks and growth stocks and you could say you know classify them as dividend growth stocks.

I think that they get the benefits of both dividend stocks and growth stocks and they also capture other unintended benefits that aren’t characterized in another one of those other two groups.

Andrew: do you have any examples off the top of your head of some stocks that we’ve seen in the past that were able to have both of those characteristics?

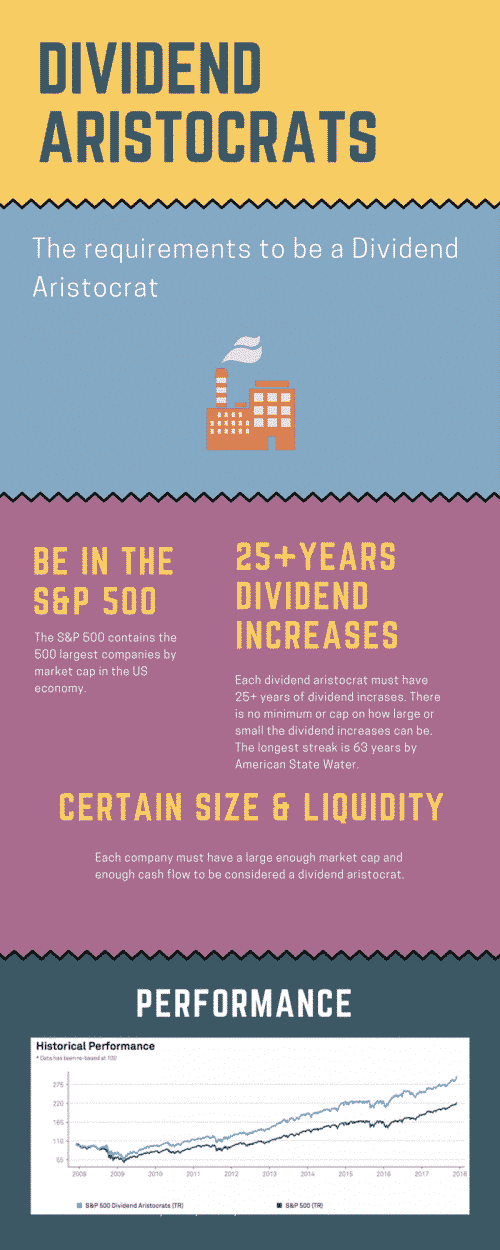

Nick: when I think of dividend growth stocks the group of stocks that comes to mind immediately for me are the dividend aristocrats, and there are three requirements to be a dividend aristocrat.

The first is to be in the sp500, the second is to meet certain minimum size and liquidity requirements and the third and most important criteria is to have 25 years of steadily rising dividends.

so every single year for two and a half decades every member of the dividend aristocrats index has hiked this dividend. The hikes don’t have to be large, but they have to be consistent, and the last time I checked the data about a month ago the dividend aristocrats, it outperformed the broader sp500 index by about three percentage points per year for the last decade.

I think the actual people tracking the dividend aristocrats is a fairly new thing which is why it only goes back only a decade.

Andrew: is that correct?

Nick: um I think the inception of the dividend aristocrat’s index was in the early 2000s or late 1990s. I’d have to check to be certain but SNP which is the index provider for the dividend aristocrats and the S&P; 500 for that matter. They only provide data on a trailing ten-year basis. So the data we see only always goes back ten years but they’ve been tracking it for longer than that I think.

Andrew: okay that makes a lot of sense. I always love harping the idea of dividend growers, but it’s nice that you guys have done the research and these are cold hard facts.

Nick: right these are numbers that have been proven with studies and people can look up and see the difference.

Andrew: I liked a graph that you guys sourced from Hartford funds about the power depends and so you have dividend growers on the initiator’s dividend payers and then some of you who pays a dividend but doesn’t grow it and then they compare to an equal with S&P and then people don’t pay them.

Then the people who cut the dividend and that order that I just gave of that list is the order, and how well those various groups of stocks performed and that was from 1970 to 2015.

You see a big difference, and so I want to ask the dividend cutters and eliminators that’s something I prescribed to when I talk about which stocks I want to sell.

Do you have any big things that lead to you wanting to sell a stock? Because I know we can talk about what stock to buy, what dividend stock to buy. Anything we should touch on that in a bit but let’s kind of flip and talk about selling.

First, do you have any indicators that will tell you when you want to sell a dividend stock?

Nick: as Suredividend we follow an investment strategy called the eight rules of dividend investing and the eight rules has five buy rules two sell rules and one portfolio management rule.

I’m not going to go into detail on every rule because Ben did that in the episode that he was on. Episode 7 I think you said but the to sell rules I will talk about specifically here in the context of your question.

So we recommend selling a stock when one it cuts its dividend payment or two it becomes extremely overvalued and the quantitative cutoff that we use for the second sell rule is when it’s adjusted the price to earnings ratio exceeds 40 which very rarely happens.

and that’s by design because there are all kinds of qualitative and quantitative benefits that happen when you invest for the long term. So our two sell rules are intentionally exclusive and are designed not to trigger sells excessively often.

Andrew: that makes sense. It’s like on one side if the business is struggling with the other value a dividend is just so extreme that it doesn’t look likely that it can be sustained.

Nick: yeah exactly and I mean both of them are very geared towards income investors because when a company cuts its dividend, obviously your income is reduced, and when a company becomes grossly overvalued you can sell that stock and reinvest those proceeds into higher yielding security to generate more income instantaneously.

Andrew: Okay and then I guess on the buy side without talking about everything been talked about. Let’s talk about your strategy right.

you got into value investing obviously Ben’s huge on value and dividends maybe what got you into starting value investing and then understanding that what you guys are doing that sure dividend is something that makes sense I’m finding a lot of undervalued securities.

Nick: well for me the time when the time when I became interested in value investing goes back to when I was about 19 years old my sister gave me a copy of Benjamin Graham’s Security Analysis textbook for Christmas and you know I read it cover-to-cover over a span of about six months.

And it was almost like an inoculation Warren Buffett always talks about how when he tells people about value investing it’s like an inoculation and either stick, or it doesn’t stick, and he could explain it to them for hours, and it still won’t stick.

So for me, the first time I read about book value investing in margins of safety and buying stocks below their intrinsic value it just seemed to make sense and I was lucky I was lucky enough that it happened to me early on in life.

Andrew: that’s very interesting. I think the last thing my sister would ever read or give to me would be Security Analysis.

Nick: yeah I was super interesting I think I asked for it I’m not a hundred percent sure about that. But I can’t imagine she just would have randomly gifted it to me.

Andrew: oh this book looks nice blue cover I think I’ll give it to you. So I guess you mentioned the margin of safety and you have the five buy rules.

Nick: I have those five from the shore dividend rules of investing that you particularly maybe favor or feel passionate about when it comes to buying the stock.

Yeah, so I’ll give you guys a super quick zoom through the five buy rules of the eight rules of dividend investing and then I’m going to tell you which rule I guess would be my favorite. I’m also going to explain another kind of mental model that I used to make better portfolio management decisions.

So the first rule is the quality rule, and it says invest in stocks with long histories of steadily rising dividends and long corporate histories because those types of businesses are more likely to be around for the long term and continue to probably continue having profitable operations for decades and decades to come.

That’s the quality rule the next rule is the bargain rule which just says to rank stocks by their dividend yield and all else being equal you want to buy stocks that have a higher dividend yield versus stocks that have a lower dividend yield that’s the bargain rule.

The next rule is the safety rule, and this rule says buy stocks below their intrinsic value and the roundabout way they should have it in does this is to rank stocks by their share repurchase yields. Because when companies are repurchasing their stock, it indicates that corporate management.

The people that know the most about the company think that shares are undervalued, and we think that’s a good sign and a signal that you should buy the stock that’s the safety rule.

The growth rule just says it’s exactly like it sounds buy fast-growing stocks before you would buy slow-growing stocks and the last rule is the peace of mind rule which just says to favor low volatility stocks and stocks with low betas.

So that is that’s the five buy rules, and for me, the one that is the most intriguing and the most interesting is the one the safety rule which is the one that says to rank stocks by their share repurchase yields. I think that share repurchases are a very an underdog component of stock market investing that shows a lot.

It tells a lot about how corporate management tends to allocate capital and whether they operate with shareholders best interests in mind or not. One of the key red flags for me is when a company’s stock is overvalued, and management is aggressively repurchasing shares anyway.

That is an easy recipe just to destroy shareholder value and unfortunately over the past several years with valuation multiples stretched across the stock market, it’s been far too common among large corporations.

Andrew: I love it we have a bit of a discussion on share purchasing. When I went to your guys just show real quick can you explain for people who don’t know what the share buyback yield is, share purchase yield?

Nick: yeah definitely, so a share buyback is when a company takes company money to repurchase shares outstanding and then cancel them, and the analogy that I always use this to explain share repurchases to the layperson is that it imagines that you owned a 10% stake in a ten million dollar business.

So your stake is worth 1million dollars, and one of your partners says I’m done being an investor in this business, and I want to cash it so the business managers can say ok we agree to your cash out, and we will buy your 10 percent stake for 1 million dollars. The size of the business has not changed, but every continuing investor’s fractional ownership in the business has gone from 10 percent to a little over 11 percent because now it’s split between nine people instead of between 10 people.

If you take that on a large scale with way more than ten investors in a much larger business that’s precisely what share repurchases are and then where does the yield part come into that.

A share repurchase yield says what percentage of a company’s stock price is being used to repurchase its stock every year. So if a company has a share repurchase yield a 5 percent and is trading at a stock price of $100 that means $5 per share is devoted to sharing repurchases each year.

If you have a general rule as far as what kind of a range of that kind of a yield you like to see them what kind would give you some trouble does it depend on valuation for me that decision is extremely valuation dependent. One of the nicest things that I like about certain companies is when they aggressively repurchase undervalued shares and when they have very strict quantitative guidelines for when to do that, and I imagine most of the times those quantitative guidelines aren’t disclosed to the public.

but in some cases they’re like Warren Buffett has publicly said that he will aggressively buyback Berkshire Hathaway stock price when it trades it 120% of Book value.

Andrew: okay cool I guess so with the five rules have you seen any lately that stick out to you as good buys even in the market?

Nick: how we see it today with it being a bit more overvalued and maybe much more of a value depending on who you talk to how you look at it.

Andrew: but have you in your research seen some good examples of exactly what we’ve been talking about here.

Nick: yeah I mean I agree with what you said 100% I think that the stock market is trading well above its long-term average valuation multiple. Now with that said there are still certain bargains in the stock market they’re just harder to find them they normally would be. I’ll go back to the dividend aristocrats that we discussed earlier three that have been undervalued in recent months I would say are Walgreens AT&T, and Cardinal Health and they each have their reasons for being undervalued which is best summarized with the following quote from Warren Buffett:

“We like to buy great companies when they’re experiencing temporary trouble. We like to buy them when they’re on the operating table.”

Now that that’s been the case with each of those three companies. They’ve been experiencing some isolated incident that has driven their stock price lower and provided a buying opportunity for opportunistic long-term investors.

Andrew: you sell all three of those are dividend aristocrats so by definition assuming that they’re able to continue the kind of dividend growth rate that they’ve had in the past it should continue into the future and only add to whatever premium you’re getting from buying an undervalued stock.

Nick: yeah definitely I mean AT&T; in particular stands out as a fantastic income opportunity for investors the companies yield is above five percent right now and although it’s annual dividend increases are probably going to only be in the range of about 2% per year. It stands out for investors who need income now rather than later.

Andrew: okay cool that’s good to have some tangible things that people can look at, and they can do some independent research and kind of compare notes with everything we’re talking about today.

Do you know this is a kind of off-the-cuff question but do you know what kind of success rates these dividend aristocrats tend to have like if you are obviously I think it goes without saying that you don’t want to throw 100 percent of your capital into anyone dividend aristocrat stock. But have you seen in your research indications that these stocks tend outperform better than a group of stocks? Is it only the undervalued in an aristocratic and to outperform or are we just doing everything as far as trying to put all the odds in our favor and combining the two gravy trains of value investing and then in growth investing to try to make these bigger returns if that makes sense?

Nick: yeah definitely, so it’s very interesting that you ask that question because we run a research program called undervalued aristocrats and it’s precisely what it sounds like. We study the dividend aristocrats, and we run a hypothetical portfolio that buys the dividend aristocrats when they’re trading below their ten-year average price to earnings ratio, and it sells them when they’re trading at more than 150 percent of the long-term average price to earnings ratio.

The reason why we use 150 percent instead of 100 percent is to minimize the number of transactions that the portfolio incurs because that causes you know that triggers capital gains taxes and causes slippage and brokerage commissions and those sorts of things.

That program has been running since the summer of 2017, and you know this very basic strategy of just buying undervalued aristocrats and not selling them until they become pretty overvalued has done quite well. Our average recommendations total return has been more than 20 percent, and for context, the average S&P;500 12 returns been eight point nine percent as of our last weekly portfolio update.

Andrew: can you give away like the number of stocks that end up on that screen or is it this is something where it’s like ranked as far as like a backtest goes?

Nick: no so it’s not a backtest we’ve been doing this it’s been a live test since inception. So we didn’t backtest it at all it’s just been since the summer of 2017, but because of the selectivity of the dividend aristocrats, there are only fifty-three dividend aristocrats right now. Right so because of that and then because of the selectivity of the valuation screen there have only been nine recommendations so far, so that’s not a very diversified portfolio, but this doesn’t necessarily have to be something that investors follow perfectly either. This could be a component of their portfolio, and then they would own other stocks as well.

Andrew: no yeah no I had no idea you guys are doing that. That cool you taking a great idea and putting your money where your mouth is by having it run that’s cool.

Nick: yeah I mean to be clear there’s no real money backing the strategy it’s just it’s an exercise we’re doing through seeking alphas marketplace service, and we have yeah we’ve been very happy with the results so far. But the short-term results have probably been buoyed by a few really strong performers including AbbVie is up 65 percent since we recommended it.

We don’t expect that to continue, but we do expect it to perform better than the broader stock market because it’s following this very basic notion of buying high-quality businesses at fair better prices and holding them for the long run.

That’s how Warren Buffett does it, and that’s kind of how this service was designed as well.

Andrew: yeah that’s what that’s what I meant though. I mean like there are recommendations based on what you guys teach at the dividend aristocrats, and it’s you’re building the track record right.

This portfolio is something you can look back on over the years as this thing progresses. I’ll be interested to see how that goes in the future as well.

Nick: yeah definitely I’ll keep you I’ll keep you posted.

Andrew: Okay so we talked a little bit about you know some good sell side strategies good by the side talked about the dividend aristocrats, and that’s obviously been a sort of topic with dividend growth that I’ve found it over and over and over again. And it’s something that hopefully people intuitively understand when it comes to managing a portfolio yourself.

How do you or sure dividend as a website how do you guys approach portfolio management what kinds of ideas get into your head as far as how for example on Monday we saw the SP drop for about four percent.

Okay, so you had people a lot of people were freaking out. It’s comical to see on Twitter because there are so many people I follow who are they make jokes about it but even just seeing all the jokes all on my timeline and like kind of gets overwhelming because they’re joking about how much it’s going down.

It still shows how so plugged in we are and like how easy it can be to get caught up in the whole day of the daily movements and everything of that nature. I think it’s quite obvious if you want to be a successful long-term that’s not something that you can expect to overload your brain with so do you have any mindsets or ways that you approach managing a portfolio that help you to combat those types of things or just give you an advantage overall.

Nick: yeah I mean I think portfolio management or at least successful portfolio management can you boil down to three components.

The first is what stocks to buy, and we’ve talked about that in pretty heavy detail already. The second is how many stocks to hold, and the third is when to sell so I’ll talk briefly about how many stocks to hold before talking more about when to sell because I think that’s where investors make the most mistakes. So you know if you look at the way successful investors like Buffett and Seth Klarman and Joel Greenblatt do it they don’t hold as many stocks as conventional academic theory would suggest.

I think the magic number for most people is between 12 stocks and 18 stocks that gives you about 95 percent of the quantitative benefits of a fully diversified portfolio. But it gives you two other benefits as well the first is that its way easier to manage and you don’t pay as many commissions. It’s just an easier portfolio to understand what you know what’s your exposure in this sector and those sorts of things and the second benefit are from a research and a continued due diligence perspective.

owning 18 stocks you know that’s only 18 quarterly earnings reports that you have to follow every quarter to understand what’s going on with your stocks really and honestly, you would probably be fine too checking with each of your holdings every six months. That probably goes against what a lot of people think but if you’re a long-term investor what happens on a quarter to quarter basis.

it’s not going to change your investment thesis that much so eighteen stocks are checking in every six months that’s only thirty-six tasks in a whole year, and that’s very feasible from the portfolio manager.

The third component of portfolio management is when to sell, and I think that this is where most individual investors make the most severe mistakes when it comes to their portfolio management.

Warren Buffett has this great quote talks about when to sell and also when to buy actually that I think about a lot regarding my personal portfolio management and also the things we write about a sure dividend and he says this:

“I could improve your ultimate financial welfare by giving you a ticket with only twenty slots in it so that you have twenty punches representing all the investments that you got to make in a lifetime and once you punch through the card you couldn’t make any more investments at all under those rules. You’d think carefully about what you did, and you’d be forced to load up on what you thought about.”

So you’d do so much better that’s the end of the quote, and I think investors especially individual investors need to take the same mindset where if they buy a stock they’re committing to it for the long term, and they’re going to be quite happy if they never have to sell. It’s a much different approach that kind of what you see today right with people second-guessing themselves and saying oh my money doubled. Let me get out, and that knowledge will graduate four triples, and you see that with almost every gross stock these days where everybody has this wishful thinking that only out will they gotten in and pulling over they’ve gotten out before it crashes. And then it’s just you know at some point it becomes less of investing in more of just speculation and almost gambling.

If you’re trying to time it whereas when you do these punch cards punch card theory where you got your shot you got to take it you’re going to approach it from a business owner perspective. And you’re going to look for these businesses that are going to last for decades, and you’re going to look at it as almost as if you’re a guy down the block, and it’s like damn I am going to buy this pizza store that pizza store and which one do I think is going to be able to feed my kids and I think it’s really very mature and a very profitable way to look at investing in general.

Nick: yeah I mean I think any excuse to be more of a long-term investor should be welcomed by investors because there are all kinds of unintended benefits. You know you pay fewer commissions you get to defer capital gains taxes and allow those continued tax liabilities to compound in your investment account for your benefit.

I think that the issue with investors selling too frequently comes down to their due diligence process. When buying you know, they think about these stocks as holdings for one year or three years or five years instead of for twenty years.

Phil Fisher who is this famous investment in investor guru who wrote this book called Common Stocks and Uncommon Profits, he has this great quote which is one of my favorite investing quotes and he says this if the job has been correctly done:

“When common stock is purchased the time to sell it is almost never, and I think that is extremely true but it comes down to having a robust and thorough due diligence process at the time of the purchase.”

Andrew: I love it Phil that that book -that’s a great book I didn’t agree with all of it but it was one of those that helped me out in the beginning, and it has a lot of good strategies that’s Common Stocks and Uncommon Profits.

You alluded to some of the mistakes that investors can make you talked about how they can sell too soon have to short of a mindset. Have you noticed any other sort of I mean it comes down to like talk about the wrong mindset it’s done you have any other maybe mindset problems or kind of traps investors fall into?

Whether that’s of their self-doing whether that’s something outside from the markets whether it’s a psychological thing, do you have you notice any other sorts of things that maybe somebody who’s jumping in and trying to get into the value investing trying to get into the dividend growth stock space. Whether some of those things you’ve noticed that maybe they can take and avoid making those mistakes for themselves?

Nick: I think that regarding dividend growth investing one of the major mistakes that a lot of investors make in the accumulation stage of their financial planning is to chase yield. When really if you’re not dependent on your portfolio income free to sustain your lifestyle you shouldn’t care too much about portfolio income.

Instead what you should be focused on is total returns you should be you should be aiming to compound your overall portfolio at the maximum rate possible given your risk tolerance, and the actual composition of those returns between dividend payments and capital appreciation is rather irrelevant.

In my opinion, another more actionable mistake that people make and that is very easy to avoid is constantly checking in on their portfolio. I find that in today’s smartphone age it’s really easy to you know to get the Fidelity app on your phone and check your portfolio balance a few times a day and while that can be exciting on a good day. It’s on the bad days when that habit can cause you to make poor investment decisions with the key one being selling when your stocks are down.

so I strongly believe that most investors would be far better off if they just deleted their smartphone app off of their phone and you know checked it on a computer on a fairly regular basis.

Andrew: yeah I love that I love that suggestion that’s I probably check I mean I forced myself to check like once a month when I’m making my new newsletters for my paid subscribers. And I have alerts to tell me when that if I have any trailing stops other hit but other than that it’s really few and far between that I’m checking what my profile value is and if I do see market updates it’s usually because it’s whether like I mentioned.

Now I’ll tell you it’s one it’s very it frees up your mind because you don’t have to stress about it and it’s just so freeing and to it’s nice because when you come back after 2 3 4 weeks. And you see wow I made you know X amount of dollars and it was just from my portfolio using compound interest and then the stocks creating these earnings and it turning into accumulation.

Accumulation and profits and that are cool too because you know it’s almost like running a marathon. Right, you don’t it doesn’t seem like you’re getting very far when you’re watching every step but when you look back after two miles, you see why you covered a lot of ground.

Nick: so I think it’s very healthy I think it helps the investor to stay away from burnout too because I think that’s something that can affect you. Then if you just throw your hands up and you give up, then that’s probably the worst thing you can do maybe even worse than picking some really bad stocks.

Yeah definitely I mean if you’re an investor checks their phone and checks their portfolio balance two times a day even, and I think that is on the low end of the spectrum, unfortunately.

But if you check your portfolio balance two times a day and the stock markets flat for a week you might say well I checked my stocks 14 times, and they haven’t moved yet well that’s not because of your stocks are performing for at least because you check them too often.

Andrew: you know that’s funny sounds it sounds like that came from personal experience there.

Nick: yeah I mean unfortunately that was me several years ago.

Andrew: yeah we’ve all been there right. So that’s a great tip and very relevant for the audience here. We try to focus on helping beginners, and I think it’s something that they can take to the bank.

I appreciate you coming on Nick that was a fantastic discussion, and it was nice to get another member of Sure Dividend on the podcast talk about your guys’ approach and digging more into the dividend aristocrats and how we can grow dividends and compound their wealth in that way.

How can we find you online what the best place to go is and do you have I mentioned the podcast launch to maybe you can talk about that as well.

Nick: yeah so I mean if you want to contact me personally the easiest ways to email my emails [email protected]. If you want to tune in to our podcast, it’s the sure investing podcast we have a website sureinvesting.co. so we’re excited to see you there will also be on the App Store and all other podcasts syndication platforms, and if you want to check out the Sure Dividend website where we do all of our detailed research and articles it’s suredividend.com

Andrew: awesome well thanks again for coming on and best of luck on the launch and I’ll be keeping in touch with you guys and following along with what you’re doing awesome.

Nick: thanks, Andrew all the best.

Related posts:

- IFB07: Creating Portfolio Income with Ben Reynolds from Sure Dividend Creating portfolio income is one of the main reasons we all invest. There are many ways to create that income. One of the best ways...

- IFB95: Real Estate, Annuities, and Dividend ETFs with Kenny Robinson Announcer: 00:00 You’re tuned in to the Investing for Beginners podcast. Finally, step by step premium investment guidance for beginning led by Andrew Sather and...

- Intro to Protective Puts with Cameron Smith Welcome to the Investing for Beginners podcast. In today’s show, we discuss: *How you can use protective puts as a hedge option to protect your...

- IFB88: How to Buy Canadian Stocks Guide and Rules with Braden Dennis Announcer: 00:00 You’re tuned in to the Investing for Beginners podcast. Finally, step by step premium investment guidance for beginners led by Andrew and Dave...