It was the best of trades, it was the worst of trades (mostly worst). This is a cautionary tale of how an order type (buy market, buy limit, or buy stop) can change everything.

This is a guest contribution by Matt McMahon. Matt is a beginner investor who believes in a hybrid portfolio of mostly dividend stocks, and a basket of ETFs, non-dividend payers, and speculative “fun” stocks.

I began my investment journey much like everyone else, listening to podcasts, watching videos and through conversation. I regrettably started investing before I listened to episode 96/125 of The Investing for Beginners Podcast regarding limit and market orders.

The night was much like any other night, the wind was still, the waters were calm and a stock that was regarded as a pump and dump was ripe for the pickings. I was new and thought I got in just at the right time to make out big because I felt I knew how the game was played with about 2 months of starting my life-long educational journey of investing.

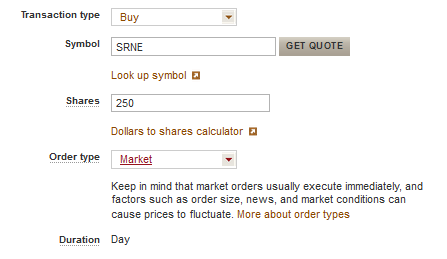

The stock was a therapeutics company $SRNE that did not really produce anything note-worthy, but they were one of the first to jump on the “COVID-19 cure”. I knew what it was, a sham, just like myself, impersonating a seasoned investor. I figured, I can buy some shares for cheap (it was a value trap) and sell at the top, EASY. I figured it out, I did my DD (due diligence) by spending 5 minutes in some obscure subreddit and knew this stock was going to print fast.

I was ready to buy, I had my third glass of wine in hand, the mood was right, and the internet connection was stable, I was ready to learn my first mistake.

For the sake of perspective, I live in Japan and the market opens at 10:30 PM for me, sometimes I must buy/ sell after closing. Regardless, I went in for the kill. I double checked the symbol, the price, shares, it all lined up, I clicked Continue then submit then went to bed, knowing I was a champion.

I woke up, checked on the stock and what did I find, something went horribly awry, it was red, not just normal red but a shade of red that indicates a catastrophe. The cost-basis was at -200% overnight, not because the value decreased but because of the buy order type I used.

When you use Market as your order type, the order executes as quickly as possible and generally if the stock is trades in large volumes, the order gets filled near the price you were quoted depending on the spread.

If the stock has poor liquidity, you don’t always get what you are quoted because in order to buy a stock, someone has to sell it and if you don’t specify how much you are willing to pay, you get stuck with the bill.

Your Market order puts you in front of the line and you may end up paying the highest price.

A good time to use Market Order

- During standard market times

- If you want to execute an order for a stock as soon as possible with some regard to the ask/bid.

- High liquidity stocks (they are traded often/frequently)

A bad time to use Market Order

- When you place it after hours as the order cost may be significantly different than the price quoted due to pre-market trades and over-night news.

- When price matters more then owning or selling shares at the exact moment.

So, what happened to my buy market order?

Well, my order got filled like it was supposed to, except someone was selling their stock at about $10.00 versus the $2.50 I was quoted on and remember, market order attempts to execute as fast as possible, prices be damned because when the market opens, all the buy/sell orders are piled together and it chose the highest price.

Lets turn back the clock and pretend I knew what I was doing at the time but instead used Buy Limit and Buy Stop.

Using a Buy Limit or Buy Stop Instead of a Buy Market Order

The mood is right yet again, this time, I was a bit more prepared. I set the order type to a Buy Limit order and set the price to $2.75 and went to bed with no worry.

The bell rings and my order is filled at $2.65. Sounds simple and finally smart right? Well, because it generally is. This story does not end in complete loss and I was able to get what I wanted at roughly the price I thought was fair.

What changed? Well, when you set your order type to Buy Limit, the order only executes if the price of the share is at or below your price limit, amazing!

The reason I set this price at $2.75 instead of $2.50 (the price I was quoted) is because when the market opens prices are volatile and I might not have executed the order because the market didn’t open up with the set price and I would have missed it entirely.

The Buy Limit hedges your risk because you will not be caught executing at a crazy spread but also run the risk of never actually purchasing.

This story ends with purchasing 250 shares at $2.65 versus $10.00.

The Buy Stop Order

Additionally, I could’ve used a Buy Stop order to achieve roughly the same result as well.

The idea behind using a Buy Stop order is mostly to catch a stock with momentum. So if the market opens and the stock goes down instead of up (from its closing price), my order isn’t executed.

But if the stock crosses my Buy Stop order (let’s say I used $2.75 again), then a Buy Market or Buy Limit order is placed at $2.75, but only once the stock crosses that $2.75 price first.

Like with the Buy Limit order, both parties are happy because everyone got what they thought was a fair price.

Lesson #1

- Listen to episode 96 and episode 125 of The Investing for Beginners Podcast to understand the types of transactions involved in buying/selling of stocks.

Lesson #2

- It is good practice to use buy limit/ buy stop orders. There is the chance that your order never gets placed (orders won’t execute because the price never matches and will then expire by the end of the trading day unless otherwise specified), but at least you won’t be a order type bag holder like me.

Lesson #3

- Understand that a spread is the difference between the ask (from sellers) and the bid (from buyers) and the limit/stop orders will hedge your risk and give you greater control of the executing price. If the bid is $2.40 and the ask is $2.60, the spread is $.20, and your order types will work within the confines of that range to your specification.

The point of this story is that an entry strategy is equal to or greater than your exit, and with proper planning, you are more likely to bring your investing goals to fruition. All the research you conduct will be moot if you cannot effectively enter the stock without the value you assigned the company in the first place.

I should end this with a little personal information, I am largely a dividend investor and believe in a hybrid portfolio that makes sense to support your financial goals. My portfolio is made up of 15% ETF, 15% non-dividends, 60% dividends. I reserve about less than 5-10% of my portfolio into stocks that are just plain fun and SRNE was part of that.

Being an avid listener to the podcast and attempting to extract the wisdom that Andrew and David have provided, I feel I am maturing a little more every episode. While this was a lapse in judgement and in their teachings, I still believe it was a necessary mistake to have early on and my only regret is I did not binge all the episodes before making a purchase and understanding how different order types can change everything.

Related posts:

- Quantitative Analysis Explained: Absolute vs Relative Valuation Quantitative analysis for stocks means finding the value (or “valuation”) of a stock using numbers. There are two main quantitative valuation methods for stocks—relative and...

- Comparing the Bull and Bear Market In a nutshell, a bull is seen as someone who is optimistic and believes that stocks will rally. This is a bullish outlook. On the...

- The 2 Main Types of REITs and Their Risks and Rewards REITs remain a key consideration when contemplating diversifying your portfolio. REIT, which stands for real estate investment trust, offers the ability to invest in real...

- The 7 Types of Capital Allocation and What They Mean for Shareholders Updated 9/3/2023 “Capital allocation is a senior management team’s most fundamental responsibility. The problem is that many CEOs don’t know how to allocate capital effectively....