Investors rightly focus on reducing risk. After all, investing your own hard earned cash is not a light matter. Sector diversification is talked about a lot, but what about international and global diversification?

Such a diversification strategy is essential—especially in a world that’s increasingly undergoing globalization.

It’s not just a good thought experiment. Legendary investors like Jim Rogers, creator of the Rogers International Commodities Index, and George Soros of the Quantum Fund have made their bread by trading internationally.

Soros used leveraged bets like going short the pound ($10 billion worth!) to eventually achieve returns believed to be over 30% per year, and Jim Rogers famously used his travel experiences riding a motorcycle halfway across the globe to buy cheap stocks in beaten up countries like Austria and Germany, doubling his money in both instances in a very short time period.

But global diversification isn’t just for traders.

Long term buy and hold investor billionaires like Warren Buffett have made outsized gains by buying U.S. stocks with international exposure—a fact quietly going unnoticed by this popular national hero figure.

But it’s not just examples of success that model the importance of global/ international diversification.

Some of the biggest risks implied with investing capital in a globalized economy (which isn’t a new concept by the way), have erased what should have been great gains for many investors—and it’s again not talked about because it’s no fun to talk about the losers.

The Lack of Global Diversification Has Caused Catastrophic Losses

I’m no economic historian, but I am on a bit of a history nerd kick right now and have uncovered some interesting discoveries around investing in the global economy.

The plight of U.K. Investors – I was really curious about trying to find the best U.K. investors of the last century, as America has so many that have become like celebrities these days: Buffett, Peter Lynch, Carl Ichan, Ray Dalio, and others.

I was shocked to find that I couldn’t find any notable famous figures that have done extremely well over the past several decades. Even a simple Google search returns only newer British investors, and none over the late Nineteenth century.

And if you take a deep dive into the history of the London Stock Exchange, you’ll see some pressing developments that make you hope that investors at that time had a global diversification strategy for their portfolios.

Some quick background context about the U.K. market is that England used to dominate the global economy, from as far back as the 1770’s until about the end of World War 2. Reasons for that prosperity included:

- Vast system of global trade and exports

- A privileged status of the Pound Sterling as the World Reserve Currency

- London being the financial center of the world

- Dominant military force with a large international presence

- Among many others…

But, starting in the 1900’s England’s dominance started to decline, particularly as the United States rose up to beat the country in technology, innovation, population, and eventually… a strong currency with an influential international presence as well.

Eventually, countries around the world started to trade more in U.S. Dollars rather than U.K. Pound Sterling, until the USD officially took over the status as the World Reserve Currency.

This has had massive implications for U.K. investors.

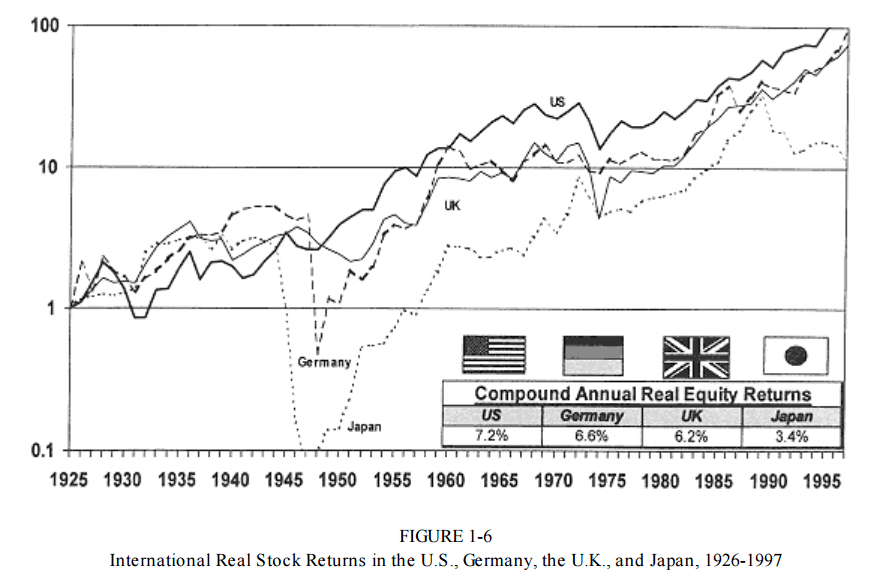

A chart from Jeremy Siegel in Stocks for the Long Run depicts the returns of various international stock markets from 1926-1997, displayed as:

Part of this under-performance can also be explained by currency. The relationship between currency purchasing power always has the possibility of having a substantial influence on total return for investors without global diversification.

Turns out, for the U.K. market, that’s exactly what happened to the Pound Sterling.

I tracked the currency rate between the Pound Sterling to the U.S. Dollar to its initial starting point from the graph above. After WWI (1914-1918), the Pound Sterling to USD hit $3.66 (source). From A History of Interest Rates by Sidney Homer, the Pound Sterling declined to $3.49 in 1931, down to $2.80 in 1949, finally to $0.81 in 1997.

That’s a serious development for a U.K. investor who invested only in the stocks or bonds of their home country, particularly if a large concentration of that wealth was focused on companies that only did domestic business.

A prudent global diversification strategy would help mitigate the negative effects for an investor who happens to be caught in a terrible currency devaluation.

The Obvious Troubles of the Japanese Stock Market

It’s well known to seasoned investors that investing in the stock market isn’t a guarantee of wealth particularly if you’re stuck in a country with poor demographics and poor economic growth: just look at Japan.

In 1989, the Nikkei Index hit an intra-day high of 38,957.44 (source) and still hasn’t recovered from that peak!

Some interesting statistics confirm that the country has a tough go about it economically, such as the heavy deflation faced from 1998-2013, resulting in a GDP deflator of -1.06% and that the aging population, wherein the number of workers is expected to decrease in this century despite better life expectancy, just exacerbates the problem.

Regardless of how the Yen, Japan’s currency, as performed compared to the USD or other currencies is irrelevant for the investors of that country if all of their wealth is concentrated on domestic stocks that have floundered for decades and decades!

So we can see several different ways that a lack of global diversification can make things go very wrong. These aren’t the only scenarios. You could have other unexpected losses, such as:

- Political risk: what if your country collapses like the Soviet Union in 1991?

- Pandemic risk: Sadly, the recent COVID-19 crisis has shown that inequality can even happen between countries facing dangerous external forces

- Military risk: What if an unexpected military conflict suddenly inflicts your country? Then what?

- Black swan risk: What if another unforeseen development plagues your domestic holdings?

I hope I’m not being a Debbie Downer here, but these are all things to consider, and things that many of us (particularly U.S. investors) take for granted having come from one of the most stable, mean reverting economies of all time.

How to Build a Practical Global Diversification Strategy

If you’re someone who’s unapologetic about buying domestic stocks (and lots of them), like I am, then that doesn’t mean you can’t have a globally diversified portfolio.

After all, the tax implications of investing abroad can be considerable.

Here’s a nice, simple way to do it, with some other common sense alternatives.

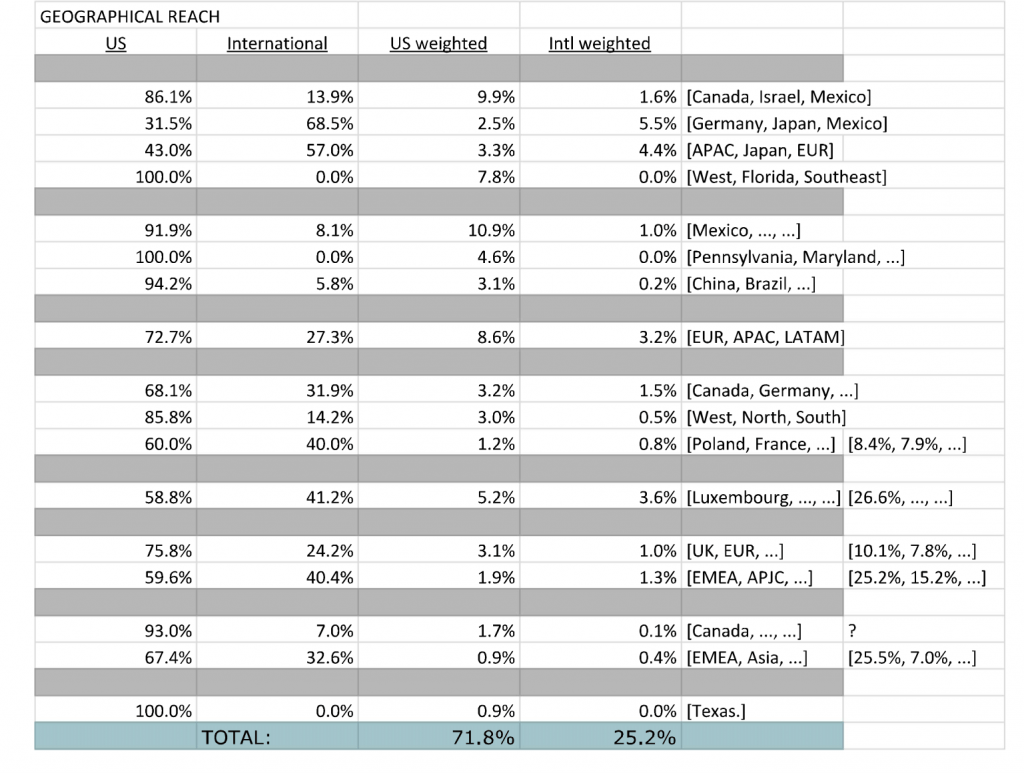

What I did recently was re-evaluate my entire stock portfolio and how exposed they were to the global market. I did this by re-reading the 10-k of each stock I had, which is an essential process if you’re going to be buying individual stocks.

Then, I simply created a spreadsheet to track percentage of revenues that each company received from various geological regions, and organized those in my portfolio spreadsheet.

Tip: to quickly obtain this information from a 10-k, go to sec.gov and search for the stock ticker, then use the Search shortcut (“ctrl + f”) to search terms like “geographical”, “international”, or “segment”, to see the geographical breakdown.

Finally, since I didn’t have equal weightings of my stocks in the portfolio (some make up 10% of my portfolio, some as little as 1%), I made sure to multiply the portfolio weighting of each stock with its International exposure percentage to come up with the final figures.

Here’s what that looked like for me:

By obtaining these percentages for stocks inside of the U.S. and outside of the U.S., I have an instant snapshot of how globally diversified my portfolio really is, all without having to buy stocks on international exchanges and dealing with the complex exchange and tax protocols.

Because I’m in my early 30’s and have several decades of investing life left in me, I’m comfortable with a portfolio of 100% domestic stocks with international exposure.

Maybe the risks are different for you, maybe your asset allocation is different.

But the same logic can be applied intelligently, and all it takes is really understanding your investments.

Risk management and investing always come down to education, and knowing what you’re doing.

Some other options that can be useful for investors:

- An ETF that specifically invests in the stocks of a particular country

- Emerging market specific funds, or a stable value fund

- For high net worth individuals:

- Hedge funds specialized in providing sufficient international exposure

- Government bonds in countries with high demand currencies

And if you’re really hoping for more common sense education on the stock market, how it works over the long term, and how to examine businesses and stocks in a simple way, I insist that you check out my free eBook on the matter.

It’s called 7 Steps to Understanding the Stock Market, and it’s available for an immediate, free download at this link.

Whether that’s useful to you or not, I hope you remember…

Please, please, please…

Learn from the lessons of the past. Learn from the lessons from the U.K., from the stock market in Japan, from the Dutch in the late 1700’s, from the Romans after Caesar…

No country lasts forever. No currency is a guaranteed success.

Global diversification is mission critical.

Related posts:

- Why Diversification is Important in Investing (Timeless Principle) Diversification is important in investing because you don’t want a single mistake to destroy your portfolio. Even the best investors (and businesses) make mistakes, it’s...

- How Important is Sector Diversification for the Average Investor? Chances are that if you have been investing for any period of time, you have heard about the extreme importance of diversification. While I do...

- Core-Satellite Portfolio Strategy: Adding Stability and Alpha to Your Portfolio The core-satellite approach to building an investment portfolio can help reduce portfolio risk while still giving investors an opportunity to outperform the market. The core-satellite...

- Position Sizing for Beginners – The 3 Key Basics to Remember Position sizing is something that’s discussed more in the trading world, but it’s just as important for the long term investor. Investors like to talk...