PPE accounting refers to long term assets categorized as PPE (plant, property, and equipment), which are tangible assets that are expected to create cash flows over the long term.

These can be significant to investors because their depreciation schedules directly influence the bottom line (earnings).

This post will cover:

The Basics of PPE and Depreciation

PPE is also known as a fixed, or tangible, asset. It must have two features:

- A useful life of more than 1 year

- A value that depreciates over time

These are real expenses that the company pays, but it’s tricky because the expenses are accounted for over multiple years rather than just 1 (like a regular expense). That’s where the depreciation comes in.

Some examples of Property, Plant and Equipment (PPE):

- Land

- Buildings

- Machinery and Equipment

- Networking Equipment

- Computer software

- Computer hardware

- Office furniture

- Office supplies

The list could go on and on, as long as it satisfies those two features at the start.

PPE will vary depending on industry and even company to company, as there’s no standard for GAAP accounting other than that PPE is a long term asset.

Where to Find Depreciation / PPE in a 10-k

Let’s take two examples of big businesses in the S&P 500 that have very different business structures but the same end market.

This should give us a good representation on either end of PPE light or PPE heavy balance sheets, for illustrations of different capex requirements, depreciation, and general PPE accounting.

I want to look at Walmart ($WMT), which is much more capital intensive due to its need to invest in physical store locations, and Johnson & Johnson ($JNJ), which is very capital light due to being a consumer brands company.

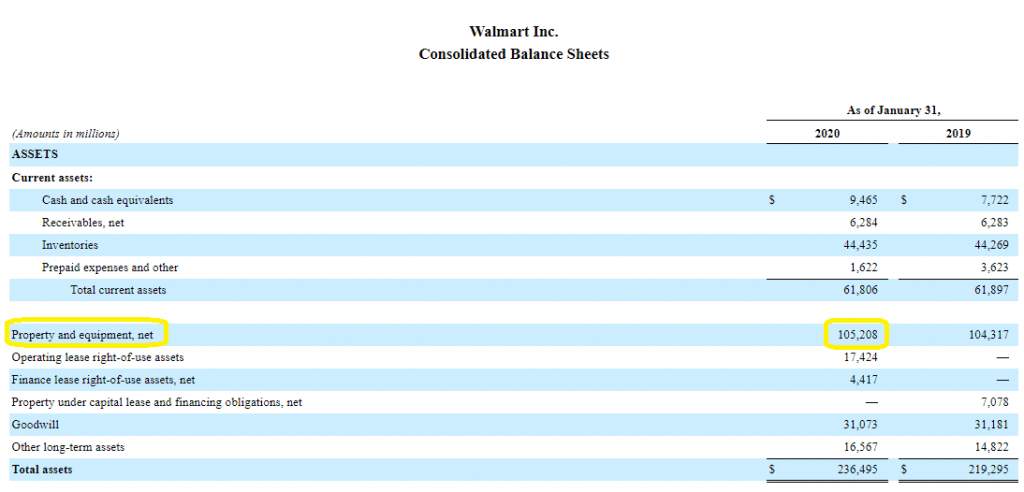

First, Walmart. This company has 44.5% of its Total Assets in PPE, as you can see in this screenshot from their last 10-k:

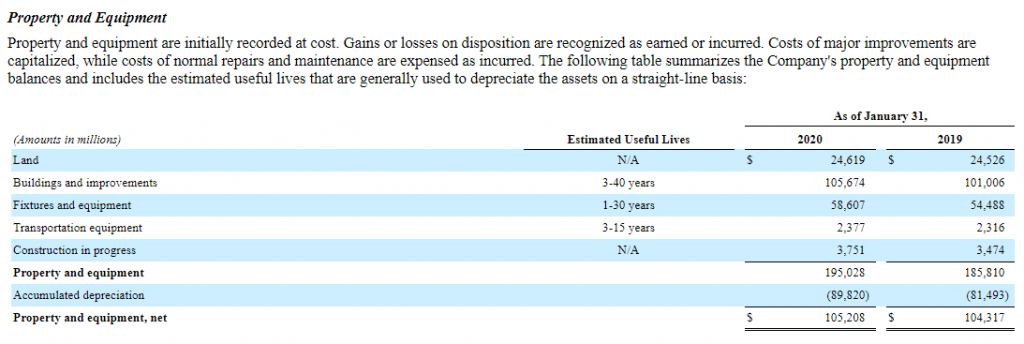

To find the breakdown of this PPE, we need to scroll down to the Notes to the Financial Statements. In this case, they’ve put the breakdown inside Note 1, under Property and Equipment.

Nice of them to include the useful life inside that table as well. We can see that the large majority of Walmart’s PPE is all related to their physical stores (Buildings and improvements, Fixtures and equipment), and possibly much less has to do with distribution (Transportation equipment).

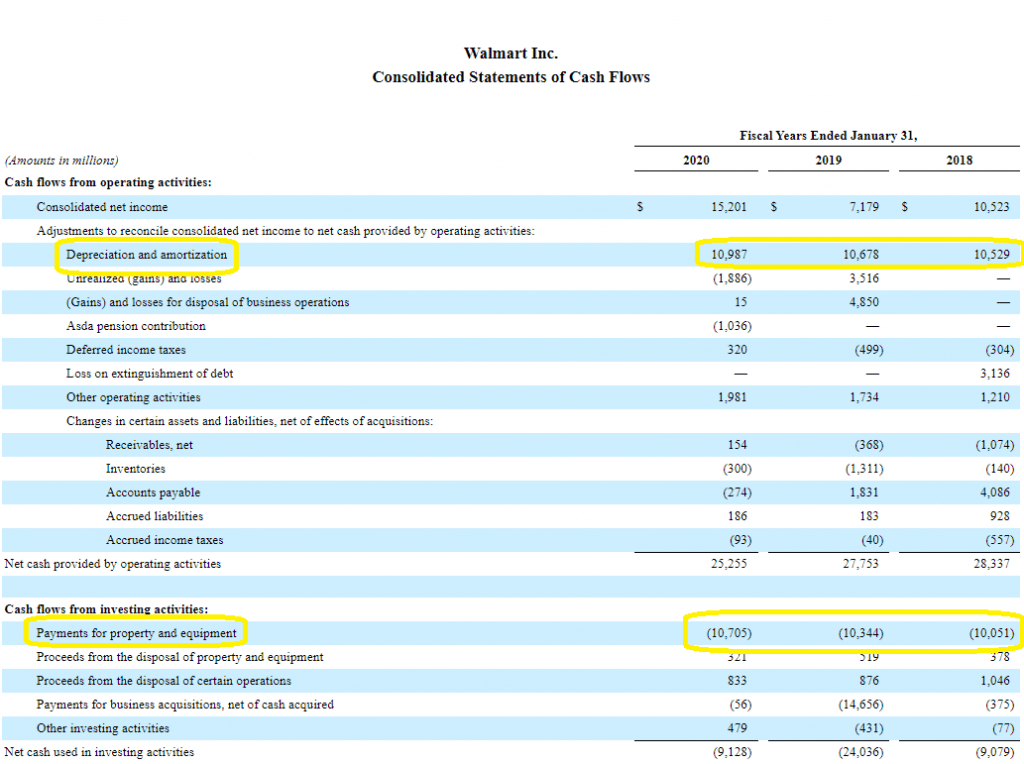

If we go back to the cash flow statment, it seems like depreciation each year is about in-line with new capital expenditures (~$10B per year).

We might imply from this that the company doesn’t seem to be involved with aggressive internal expansion, and there also probably won’t be much in the way of earnings surprises from creative PPE depreciation accounting.

Example: Johnson & Johnson

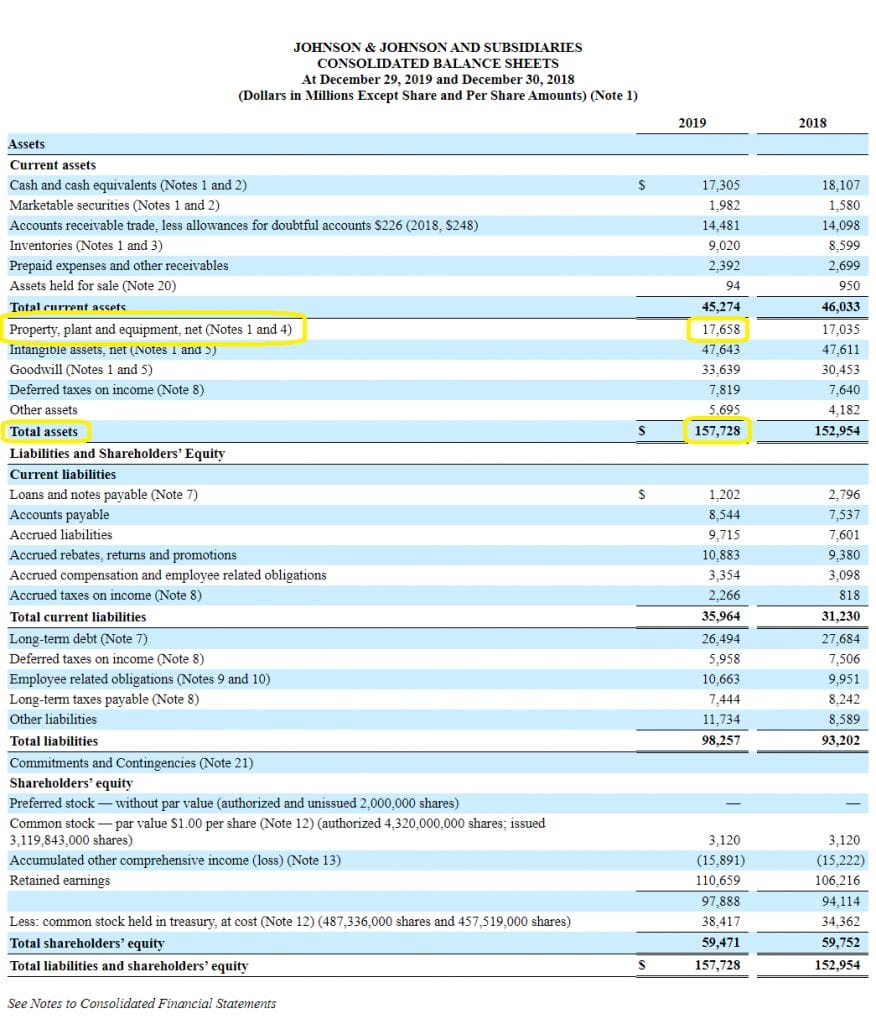

Now we move on to the 10-k for Johnson & Johnson ($JNJ), with 11.2% of its $157.7B in Total Assets comprised of PPE, net.

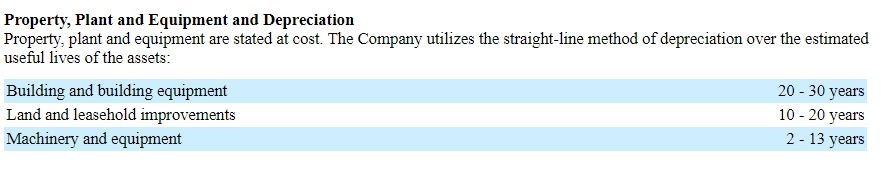

Of that PPE, we can see from their Note 1. Summary of Significant Accounting Policies, the estimated depreciation schedules:

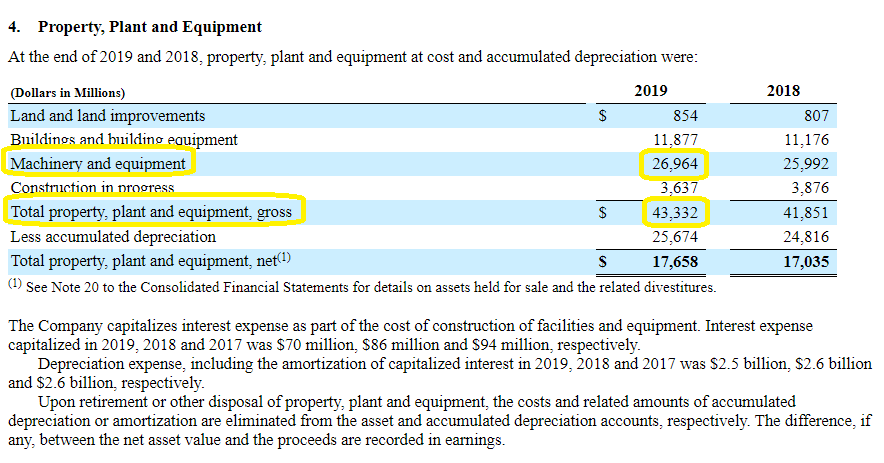

And in Note 4: Property, Plant and Equipment, the outline of the company’s PPE assets:

Notice that in contrast to WMT, JNJ has the majority of their PPE in Machinery and equipment, which is probably used in manufacturing and distribution of their various products to retailers like WMT.

I’d also like to note that the PPE table outlines the accumulated depreciation, representing the portion of PPE in the balance sheet that has already been depreciated. The rest that will be depreciated in the future comprises the Net PPE.

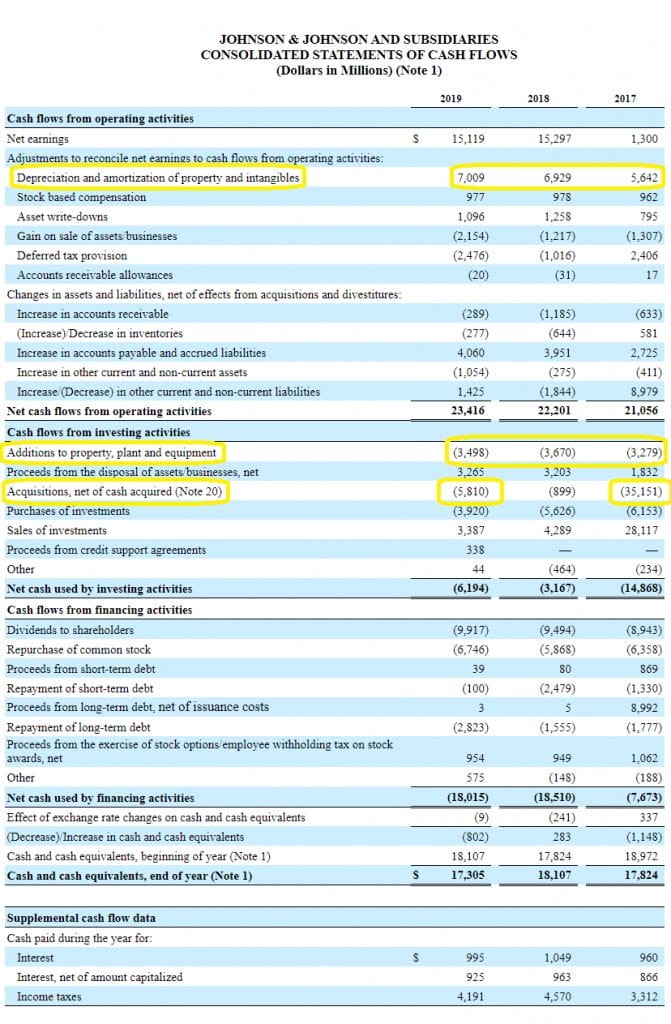

Looking at the cash flow statement to compare current depreciation with recent capex and other capital allocation decisions:

Recent depreciation is much higher than recent capex, which means there will likely be less depreciation in the future, as the company appears to have reduced investments in its core business and instead looked for outside investments, such as acquisitions (as highlighted in the screenshot).

Example of PPE: Data Centers

Take Facebook as an example of a tech company that has been scaling up their PPE investments.

Back in 2011, Facebook built its first in-house data center.

Today, it has announced a new $1B facility in Singapore (1.8 million square foot), and had 6 “cloud” campuses as recently as 2019, and continues to grow its network and its business (and subsidiaries like Instagram, which migrated from AWS to Facebook servers).

Let’s look at an example of Facebook’s PPE, to show just how different its balance sheet looks from the average company due to its massive data storage needs.

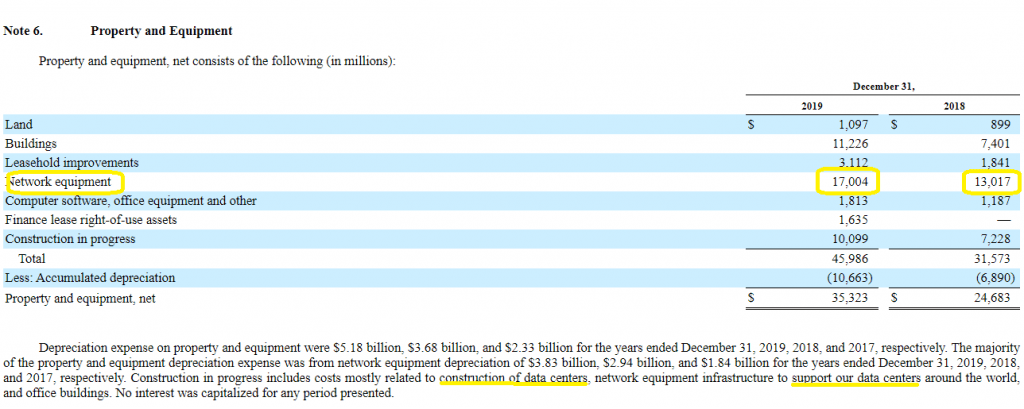

As found in the latest 10-k for Facebook, Note 6. Property and Equipment: Network equipment in 2019 was $17B out of $35.32B in total PPE, a staggering 48%.

On top of that, much of the other PPE such as Land, Buildings, and Construction in progress either directly lead to the construction of more data centers or in-directly or directly support the data centers themselves (you gotta store the data centers inside buildings after all).

These data centers are like other types of “old hat” PPE, they also depreciation in value over time and need to be maintained and replaced.

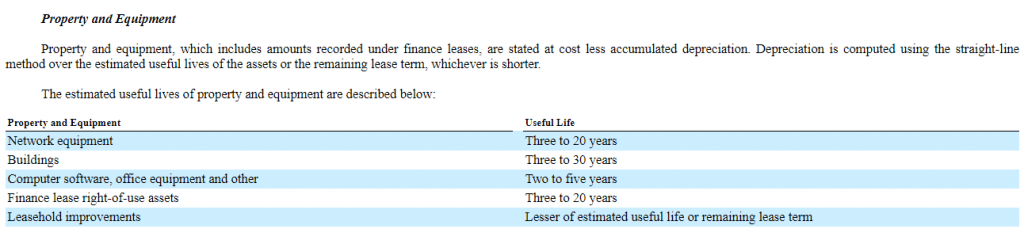

Facebook here has been vague with their Network Equipment Useful Life, reporting a range as wide as 3-20 years, which could lead to wide variations in depreciation expense.

Other competing companies with large percentages of PPE in networking and data centers reported shorter lifespans in their 10-k’s:

- Microsoft computer software: 3-7 years

- Microsoft computer equipment: 2-3 years

- Amazon servers: 3 years

- Amazon networking equipment: 5 years

- Google IT Assets: 3-5 years

- Google servers: 3 years

- Google Network Equipment: 5 years

Investor Takeaway

- Amazon (AWS)

- Total Assets = $162,648

- PPE, net = $61,797 (38% of assets)

- PPE, gross = $95,770

- Equipment = $54,591 (57% of PPE)

- Microsoft (Azure)

- Total Assets = $301,311

- PPE, net = $44,151 (14.7% of assets)

- PPE, gross = $87,348

- Computer equipment and software = $41,261 (47.2% of PPE)

- Google (Google Cloud)

- Total Assets = $232,792

- PPE, net = $59,719 (25.7% of assets)

- PPE, gross = $82,507

- IT Assets = $30,119 (36.5% of PPE)

I find it interesting that we are on the cusp of these huge FANG stocks, now thought of as big tech, becoming hugely capital intensive business.

Where these businesses and other technology businesses like them are usually thought of as “capital light”, we might need to think of these big data center empires (AWS, Azure, Cloud) as needing high PPE investments similar to a vertically integrated Exxon Mobil or physical retailer Walmart.

Scale is not infinite, even in the data world.

Data consumption and storage has real world, physical limits, and high capital requirements, as can be seen with these data centers– which are rapidly becoming large PPE components of balance sheets.

Investors should adjust their forecasts for income statements, balance sheets and free cash flows accordingly.

Related posts:

- Financial Accounting for Beginners: Debits/Credits, P&L, Assets/Liabilities Updated 8/7/2023 Recently, Berkshire Hathaway earned $81.4 billion in 2019, a 1,900% increase from the year before! How was this possible, by an accounting rule...

- What is Net Book Value? Net book value (NBV) is an accounting term which refers to the value of an asset as it can be seen on the balance sheet...

- Is Depreciation an Expense? Is EBITDA Deceitful? Well, it Depends From a purely accounting standpoint, the answer to “is depreciation an expense” is that yes it is, both in the income statement and the cash...

- Enterprise Value Formula and Definition – CFA Level I & II Fundamentals A company’s enterprise value (EV) is an important point of understanding for investors and is a fundamental learning point in many business schools, as well...