The technology behind crypto is very promising. Blockchain apps are unlocking decentralized solutions that could make the world a much better place. That does not mean buying and holding crypto will be a successful strategy for serious long term investors, however.

Buy and hold works. It might not work for crypto.

Here are 4 reasons why [Click to Skip Ahead].

- Productive assets win in the long term

- Supply and demand drives price over the long term

- Innovative investments have a poor long term track record

- Crypto is not different in this one regard

Crypto investors have to respect that the successful buy and hold strategy came from investing in the stock market and real estate.

Other investment assets, such as Gold and currencies, have not been good long term buy and hold investments.

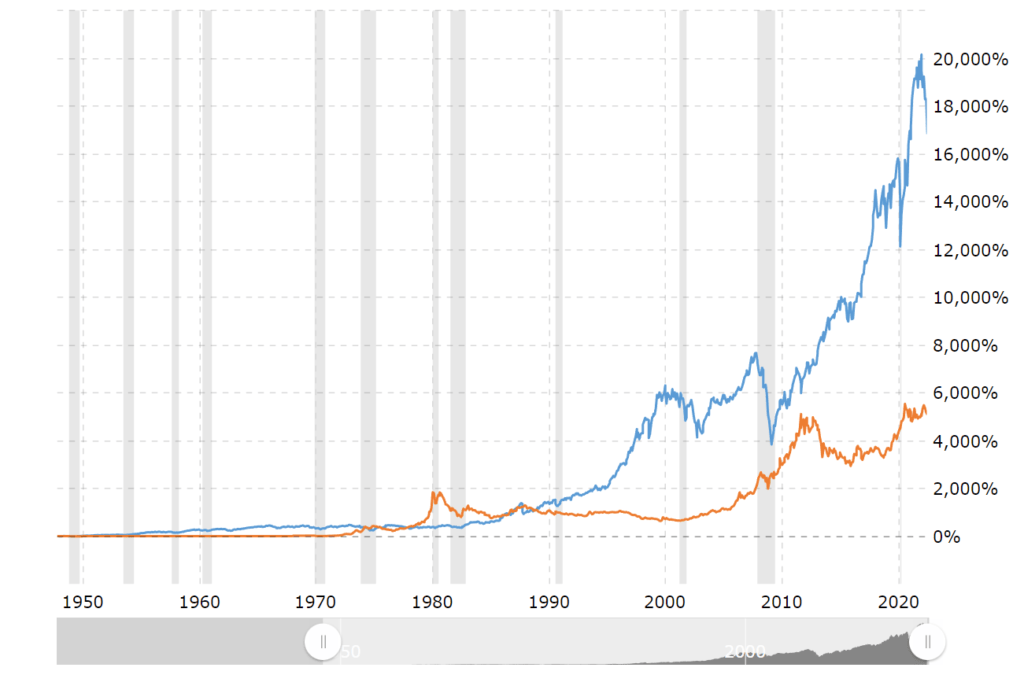

For example, here’s a long term chart of the returns for the price of Gold (orange) vs the stock market (blue):

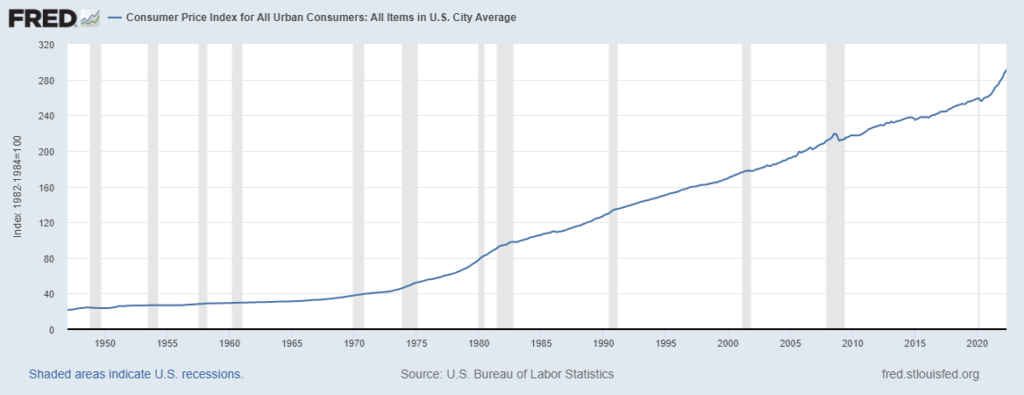

Of course, we also know that other currencies like the US Dollar and Euro have been poor buy and hold “investments”; most Bitcoin “HODLers” know the value of fiat currencies like USD and EUR have become diluted and lost much value over the years.

In fact, tracking the rate of inflation for USD and inverting it will give the exact value lost by the currency compared to everything else (goods and services).

In other words, if inflation has been around 2%- 3% per year—the overall value of USD has dropped around 2%- 3% per year.

Just holding dollars would have been a disastrous decision for investors.

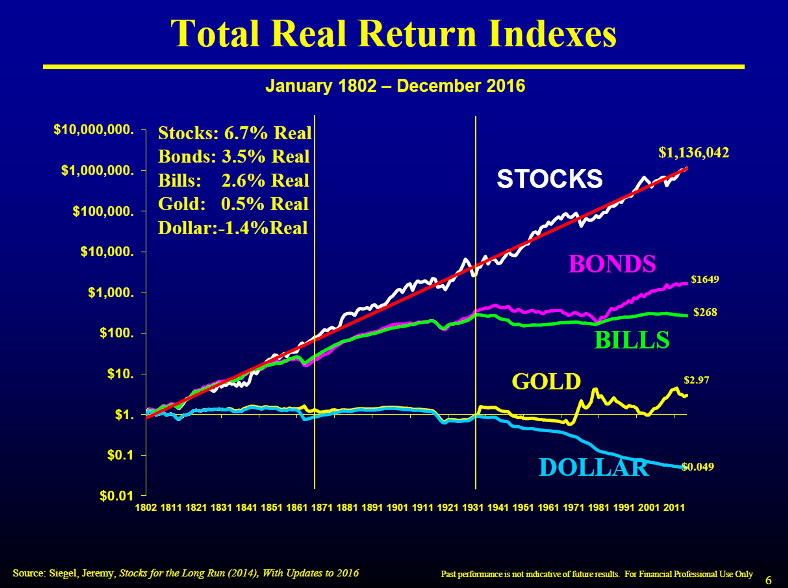

Compare the long term returns (“real, or inflation-adjusted, returns”) for Gold and currencies to those for stocks and bonds.

As you can see from the charts above, buying and holding either bonds or stocks would give much better returns; with real estate generally performing close to, or better than, bonds depending on the type.

Why Do Bonds, Real Estate, and Stocks Outperform Gold and Currencies?

The four-word answer: they are productive assets.

Stocks are productive assets. Shares of stocks are ownership stakes in businesses; businesses produce value for customers, employees, and owners by trading customer value for profit.

On the whole, the stock market is just the total collection of ownership stakes in a wide range of the biggest businesses. Even those businesses not making a profit yet have value as assets, due to the expected future profits created by producing customer value.

Bonds are productive assets. Bonds are simply loans to the same businesses described above. Bonds are a form of investment capital which allows businesses to invest, expand, and have liquidity—all leading to producing customer value.

Even other types of bonds, such as government and municipal, are usually issued for the purpose of driving investment in projects—again creating value to government employees and the community.

Real estate properties are productive assets. Yes, real estate as an asset has a fixed supply, and so has inherent value in this way.

However, the real value behind real estate lies in the productive purposes laid on-top of that real estate. Real estate provides shelter, it stores inventory in warehouses for businesses, and it allows production of commodities like lumber. Real estate that appreciates over time has some aspect of producing value to it.

Gold is not a productive asset. Though Gold has utility, in-and-of-itself it does not produce anything of value when it sits in a vault.

Though you can use Gold in consumer product applications like jewelry, the ownership of Gold itself produces no value. If you hold Gold as an asset, it produces nothing for you.

You cannot create income from Gold besides when you sell it. It is not a golden goose laying eggs. Stocks, bonds, and real estate can all produce income as you hold it, as well as hold value when you sell it. Gold cannot.

Currencies are not productive assets. While currencies also have utility as the vehicles for commerce, simply holding currency under your pillow does not create value.

Yes, you can hold currency in a bank account, at which time the bank creates value as a middle man as it lends the currency to others. However, in that value creation, the bank takes most of the profits (and the risks) while the deposit holder gets a very small slice.

This is why stocks, bonds, and real estate outperform Gold and currencies over the long term.

Holding stocks, bonds, and real estate provides the investor with a much greater proportion of the value produced by these assets—especially compared to holding Gold and currencies.

Is Crypto a Productive Asset?

Many cryptocurrencies today promise to create value for stakeholders (customers and investors). A crypto like Bitcoin does not, other than its promise to be a store of value with its fixed supply (very similar to Gold).

So in this regard, crypto does hold a greater promise than fiat currencies for a buy and hold strategy as productive assets.

However there is something else to consider about investing in productive assets:

Price = Supply vs Demand

Supply and Demand Will Likely Destroy Many Cryptos

Think of supply and demand as two curves on a chart, with the curve for supply running along the x-axis and the final price running up the y-axis.

In a free market, the place where supply and demand meet will determine the price (left/y-axis).

Greater demand moves the price higher (pushing the meeting point up and to-the-left), while greater supply moves the price lower (moving the meeting point down and to-the-right).

Going back to our example, the following assets have these supply/demand characteristics:

- SUPPLY

- Shares of Stocks = fixed supply which generally decreases with buybacks (in aggregate)

- Bonds = fixed supply, supply doesn’t change once issued

- Real estate = generally fixed supply

- Gold = generally fixed supply

- Currencies = supply which generally increases over time (inflation, printing, etc).

- DEMAND

- Shares of Stocks = generally increases the more value is produced

- Bonds = generally sustained as long as investors are willing to lend

- Real estate = always there as long as there are needs for shelter, storage, etc

- Gold = generally there as long there’s utility as a product and store of value

- Currencies = used as a medium of exchange but not necessarily for investment

You can see these assets pretty much all have demand for them, in various ways. However, the supply changes drastically for currencies, which has led to much of the value destruction in its prices over the long term.

In other words, a buy and hold strategy for currencies has been a terrible idea because of the gradually increasing supply.

This means that assets with increasing supply are likely to underperform those with fixed supply if you assume demand is similar.

Crypto vs Stocks: Ponzi Schemes vs the “Old Economy”?

This leads us back to the promise of crypto.

Crypto, blockchain, and web3 are all perceived as extremely valuable because they are expected to provide a better way for commerce and meeting customer needs.

In other words, crypto has value if it replaces some of the value currently produced by businesses.

One of the bigger problems with crypto is in its greatly increasing supply. Many, many crypto projects today rely on the issuance of additional currency in order to generate value.

That staking reward you get from holding the crypto is not being generated by the value of the crypto if a project is unprofitable—it’s coming from the devaluation of your crypto (through increased supply).

Like a ponzi scheme…

If demand outstrips supply, you can get an increasing price even with increasing supply.

Once the demand for the crypto you hold dries up, the increasing supply now outpaces demand and pushes the price of that crypto downwards.

Your staking reward (income from holding the crypto) is simply more crypto being “printed” with some of it given back to everyone.

That’s not sustainable!

Until crypto can get to a point where it is profitable—where it creates enough value for customers that it can generate a profit—it cannot sustainably pay out staking rewards without increasing supply.

Which puts a long term downward pressure on its price.

What About Stocks That Issue Shares and Increase Supply?

You can say that many companies do similar things with their shares, increasing supply by selling shares and using those proceeds to fund their unprofitable operations.

However, in aggregate, more companies in the stock market buyback their shares vs those that issue them.

Take some of the biggest companies in the stock market as an example:

- Apple = $85 billion in buybacks (TTM)

- Microsoft = $29.3 billion in buybacks (TTM)

- Google (Alphabet) = $52.2 billion in buybacks (TTM)

- Facebook = $50.1 billion in buybacks (TTM)

Yes, many growth companies issue shares, pushing up the supply of those shares.

But a long term buy and hold strategy in the stock market generally includes many of the businesses which do not issue shares, and keep the supply of their shares constant or trending downwards (with buybacks).

And those companies that do not issue shares tend to be matured, and orders of magnitude bigger in size than those companies that do.

There are so many more companies in the stock market which do not issue shares than those that do, making a general buy and hold strategy in stocks comprise of mostly holding a fixed or decreasing supply of shares.

So a general buy and hold strategy in the stock market will likely involve buying shares with decreasing or fixed supply.

A general buy and hold strategy in crypto today will do the opposite.

This means that buying and holding many different cryptocurrencies will (statistically) result in holding assets with great downward pressures on their prices from increasing supply; in contrast to the stock market.

That’s not a great long term bet.

The Cold Hard Facts About Innovative Investments

Do you know that even a long term, buy and hold strategy for IPOs is a terrible idea?

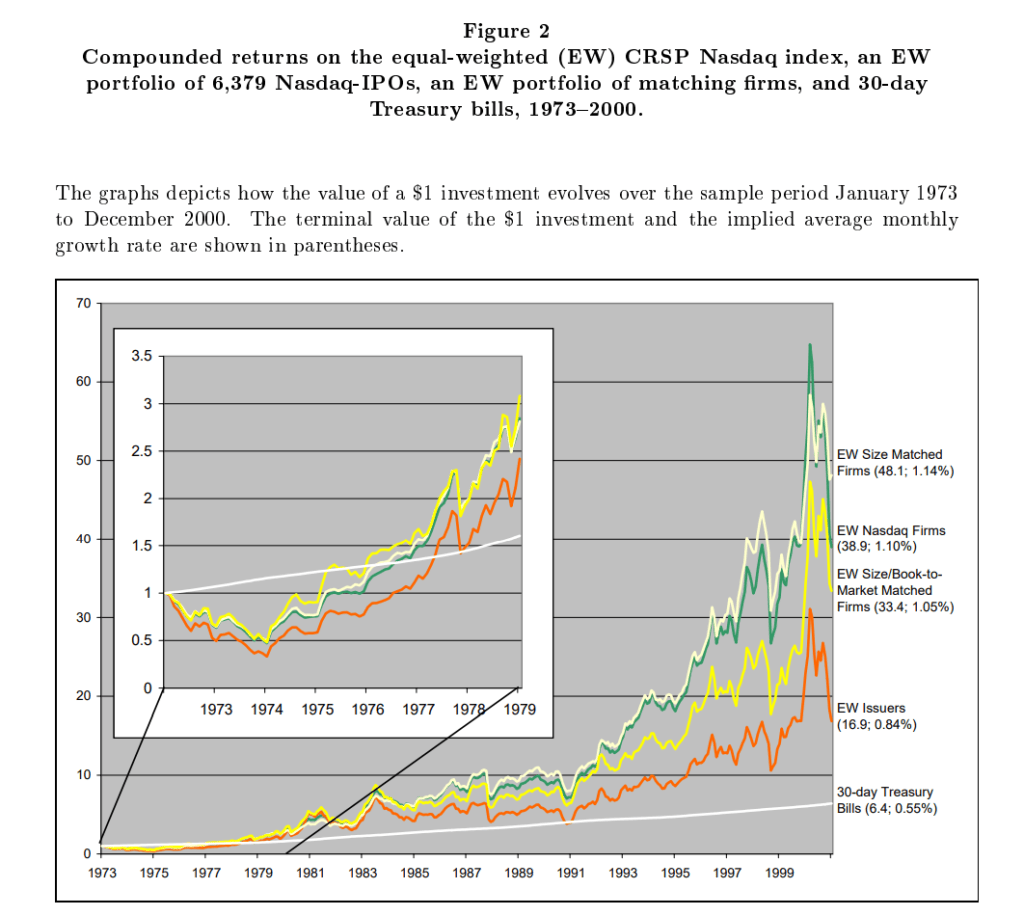

This paper from Berkley showed that an equal weighted portfolio of 6,379 NASDAQ IPO stocks would have returned compounded annual returns of 0.84%- 1.14% from 1973-2000.

That’s awful; much lower than the general average stock market return of 10% annually.

Many other studies out there have reported similar finds for the long term performance of a large basket of the IPO stocks.

The problem with IPO stocks is that we only hear about the greatest companies—the “lotto winners”, with no press given to the thousands of failed companies.

A portfolio with even the best winners does not tend to pay for the many losers, even when a 100x+ return is included—if you’re buying a large basket of these.

Sure, as investors we can boldly believe we won’t pick those sucker bets.

And you will hear stories of those investors…

But just like only a few players can get luck on their side to win a World Series of Poker, while many other gamblers become degenerates and lose everything—many investors in a long term buy and hold crypto strategy or IPO strategy will perform terribly.

IPOs Are Terrible, and Better Than Crypto

The state of cryptocurrencies as I write this today, in 2022, is extremely dangerous for long term “investors” today.

Even IPOs, with their huge crash-and-burn rate, at least have many employees, revenues, and perceived customer value with enough reasonably probable potential for future profitability.

In order to go through the process of an IPO, a company has to go through auditing and regulation by the SEC, which is there to protect and stand up for investors. There’s much greater scrutiny to at least mitigate many of the risks of those kinds of innovative investments.

IPOs have at least some sort of productive and verifiable track record.

You can not say the same about many cryptos out there today.

It baffles me to see how the “due diligence” for investing in a crypto for the long term involves a scantily written whitepaper backed by anonymous developers.

Even with some of the most popular cryptos today, we have no way of knowing if they’re actually generating revenue, or simply diluting their currency and propping up a ponzi scheme!!

This is not a sustainable way to produce great investment returns for buy and hold crypto investors, because in the real world (for businesses and investments)—results matter and drive returns. We don’t even know what the real results are today; much of it could be pie-in-the-sky.

“But Crypto is Different…”

Look, I get that the technology behind cryptocurrency has immense potential. It’s exciting. I’m excited to see what’s to come.

But think about it…

Every year someone is inventing or innovating on something. This means that there was a better way of doing things created in 2022, 2021, 2020, 2019, 1999, 1987, 1969…

There’s ALWAYS innovation. There’s ALWAYS a better future.

The internet was arguably the greatest invention we’ve ever seen, and it changed our world forever. Yet even still, a broad buy and hold strategy of internet stocks would’ve been a disaster for you.

Those of you old enough to remember Myspace and Vine know that for every Facebook, there’s a Myspace; for every Twitter, there’s a Vine. Myspace was THE social media network to be on, and it disappeared in a flash.

The same thing is likely to happen to many of the most popular cryptocurrencies today; first mover advantage is an advantage, not a guarantee.

Remember this quote and respect the wisdom behind it:

“The players may have changed but the game remains the same”.

Innovation as a long term buy and hold strategy for investing has been a terrible way to invest in the past, and will likely continue to be in the future. Innovation investing gets its 15 minutes of fame every market cycle, but over the long term, it creates tragedies.

To Summarize…

A buy and hold strategy for crypto is not likely to work because:

- The best investments are productive assets

- Some cryptos like Bitcoin produce nothing

- The best investments have a fixed or decreasing supply

- Most crypto/web3 projects have a greatly increasing supply

- Innovative investments, on average, perform poorly over the long term

- Crypto’s innovations is the same game, different players

Before you think this all doesn’t apply to you because you are a special snowflake, I’ll repeat what I said above because it holds so much truth:

Just like only a few players can get luck on their side to win a World Series of Poker, while many other gamblers become degenerates and lose everything—many investors in a long term buy and hold crypto strategy or IPO strategy will perform terribly.

Related posts:

- Crypto and Blockchain for Beginners – It’s All About Democracy! I’m not a crypto or blockchain expert. In fact I barely know what I’m talking about, and maybe because I’m such a crypto beginner I...

- Crypto Pt3: Hidden Disadvantages of Crypto (Fees, Wait Times, Complexity…) Many people can intuitively grasp the obvious disadvantages of cryptocurrency—it’s risky, volatile, unregulated, and (currently) unwieldy. However, there’s additional disadvantages of using cryptocurrency you’ll only...

- Understanding Cryptocurrency (Pt 2): Token Vs Coin The crypto world can seem endlessly confusing, but it isn’t that bad. There are tokens, coins, blockchains, deFi, dApps, and ‘doh (kidding)—but there is a...