Updated 5/1/2024

Among the many valuation methods and models, the earnings power value formula is an undervalued model, no pun intended. It helps us find undervalued companies without as much estimating as the discounted cash flows, for example.

Is the earnings power value formula perfect? Unfortunately, it is not. But it is another tool in our valuation toolbox.

Using numbers from all three financial statements, the earnings power value allows you to find the intrinsic value of companies, but the technique ignores growth, which much of Wall Street obsesses around earnings growth. There is nothing wrong with growth; that is the only way companies can grow.

However, Wall Street’s fixation on growth tends to ignore other factors, such as the business’s fundamentals and their relationships to the continued success of the business.

The earnings power value formula helps us value a company and focus on the fundamentals of the business.

In today’s post, we will learn:

- What is Earnings Power Value?

- The Formula for Earnings Power Value

- How to Calculate Earnings Power Value

- What Does the Earnings Power Value Tell Us?

- Limitations of Earnings Power Value

Let’s dive in and learn about the earnings power value formula.

What is Earnings Power Value?

Here is how my friends at Investopedia describe the earnings power value model:

“Earnings power value (EPV) is a technique for valuing stocks by making assumptions about the sustainability of current earnings and the cost of capital but not future growth. We derive Earnings power value (EPV) by dividing a company’s adjusted earnings by its weighted average cost of capital (WACC).”

The calculations and formula for earnings power value are simple. However, there are numerous steps to follow to arrive at the adjusted earnings and the WACC; what we arrive at after those calculations are the earnings power value equity, which we can compare to the company’s market cap.

So, what is earnings power?

Simply, it is the company’s ability to squeeze every drop of profit it can from its operations. The more efficient a company is, the better it can create more profits from each unit sold.

Bruce Greenwald, a professor of economics and investment at Columbia University, created a little background on the model. He is a well-regarded value investor and has written multiple outstanding books, including one of my favorites, Value Investing: From Graham to Buffett and Beyond.

From the above book, I first came upon the earnings power value model.

Greenwald is a little under the radar, and he doesn’t always get the recognition he is due, but he is a fantastic teacher and has interesting ways of looking at value investing. Check out his lectures; they are worth your time.

A quote from Greenwald summing up his thoughts on the formula:

“The second most reliable measure of a firm’s intrinsic value is the second calculation made by [Benjamin] Graham and [David] Dodd, namely, the value of its current earnings, properly adjusted. This value can be estimated more accurately than future earnings or cash flows, and it is more relevant to today’s values than earnings in the past.”

If you would like to see the lecture that Greenwald uses to explain his model, please follow the link below; the comments on the EPV start on slide 16:

Greenwald Earnings Power Value EPV lecture slides

A note about the link above: it requires a subscription but is free.

Ok, let’s move on to the formula and dissect that slightly.

The Formula for Earnings Power Value

As we mentioned above, the formula for the earnings power value is simple; it consists of the following:

EPV = Adjusted Earnings / Cost of Capital (WACC)

Before we dive in and learn about this formula, if you are not familiar with the cost of capital or WACC, please follow this link to learn more about those items before moving on:

Weighted Average Cost of Capital (with Calculator)

Before we start to pick the formula apart and define the different segments of the formula, we need to consider three items:

- The value of any assets competitors must have to compete with the company in the market.

- The earnings power value that we arrive at is based on the current financial conditions of the company and ignores any business cycles to arrive at the intrinsic value.

- We will ignore growth in this equation, whether growth is a factor for the company or not.

Multiple steps need to be followed to arrive at the earnings power value; once we arrive, we can calculate the intrinsic value from the equity value.

Let’s move on and discover how to calculate earnings power value.

How to Calculate Earnings Power Value

As mentioned, there are six steps we need to follow to calculate the earnings power value.

For our walkthrough of the steps, I would like to value Intel (INTC), the semiconductor company. The company currently has a market cap of $257 billion and a current market price of $60.97

The six steps we need to work through:

- Step One: Estimate the Adjusted EBIT Margin

- Step Two: Estimate a Normalized EBIT Margin

- Step Three: Estimate a Normalized Tax Rate

- Step Four: Estimate Maintenance CapEx

- Step Five: Calculate Adjusted Earnings

- Step Six: Calculate Intrinsic Value

Ok, I will walk you through all six steps for Intel with explanations and pictures for you to follow. The steps may look daunting, but once you peel away the layers, you will find it is not so bad.

In essence, the first four steps involve adjusting and normalizing the earnings for the formula’s denominator.

Step One: Estimate the Adjusted EBIT Margin

Adjusted earnings are the bread and butter of this formula so that we will work with this for most of the walkthrough.

The formula for adjusted earnings:

Adjusted Earnings = Normaled EBIT – Tax Expense – Maintenance CapEx + Depreciation & Amortization (95% of CapEx)

Where EBIT equals Earnings Before Interest and Taxes.

Before we begin a note about normalizing earnings or any other numbers, for our purposes today, we will take five years of numbers and then use either the average of those years or the median.

Utilizing normalization helps smooth out the numbers and gives you a less volatile calculation.

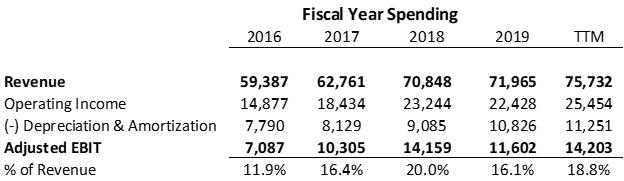

For the first step, we will need revenues, operating income, and depreciation, which we will gather from the income and cash flow statements.

Below is the breakdown of the adjusted EBIT.

After subtracting the depreciation and amortization from the operating income, we arrive at the adjusted EBIT, which we divide by the revenue to get our percentage of adjusted earnings to revenue.

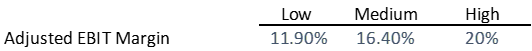

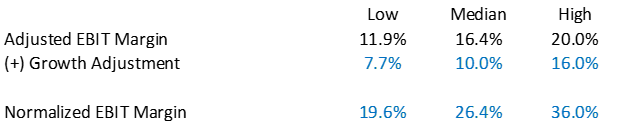

Next, we will find the low, median, and highest values from the adjusted EBIT margin percentages.

Step Two: Estimate a Normalized EBIT Margin

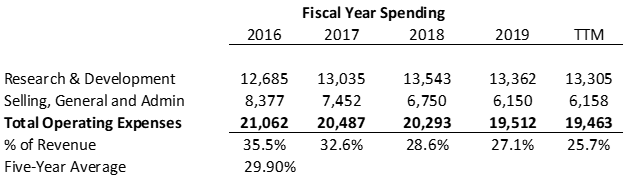

As we mentioned above, the earnings power value contains no traces of growth. Therefore, we need to remove growth items from the EBIT. Those items are research and development, marketing, and SG&A (sales, general, and administration).

Again, we will find all these items listed on the income statements from the annual reports or 10-k.

Once we have both of those figures, we can easily add them up and then divide them by the revenue from above. Once we have that percentage of revenue, we can find the average of those numbers.

Once we have both of those line items added up, we will add them back to the EBIT because the EBIT contains all expenses removed; we need to add them back.

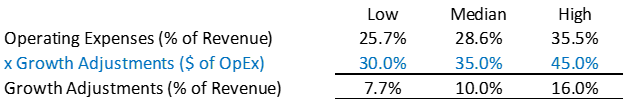

Once we know the operating expense margin, we will find those percentages’ low, medium, and high values.

Then, we will estimate growth adjustments that we will apply to the operating expenses percentage, which will boost EBIT.

The model we use boosts the adjusted EBIT margin we calculated a moment ago to calculate the normalized EBIT margin. Remember this EBIT margin assumption, as we will use it to calculate normalized EBIT in step five.

Step Three: Estimate a Normalized Tax Rate

Next up is taxes. Who likes taxes? No one! But they are a necessary evil; we must account for them in our normalized earnings.

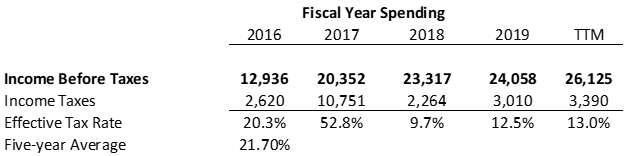

The next step is to normalize the tax rate by dividing the income tax expense by the income before taxes. Again, we will find all of this information on the income statement.

Once we have our effective tax rates for the five years, we take an average of those years and arrive at 21.70%.

That’s not bad, but it’s a little low for me. With the upcoming election and the likelihood of a Democratic government, tax rates will climb. To hedge that bet, I will estimate a tax rate of 25% for Intel; you can easily increase that if you feel it is justified.

Step Four: Estimating Maintenance CapEx

As a company ages, its equipment, such as computers, office space, and other properties, starts to wear down and needs to be replaced. Accounting for this normal wear and tear, we must estimate how much we think the company will spend on capex (capital expenditures) to continue with its current earnings level.

We can find these numbers from the income and cash flow statements.

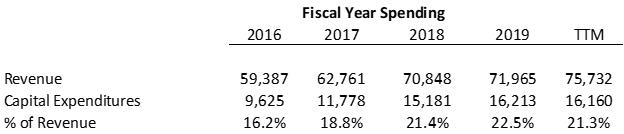

Once we have our numbers, we can compare the capex to the revenue for our percentage of revenue.

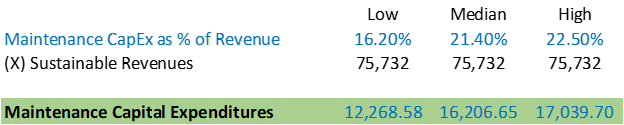

Next, we will find the percentages’ low, medium, and high values and then multiply those values by the sustainable revenues.

The sustainable revenue is the revenue from the last year/quarter, as we assume in this formula that those revenues will continue going forward.

I am using the TTM in the case of Intel, but you can use the last annual report just as easily. All of which will give us our maintenance capex numbers.

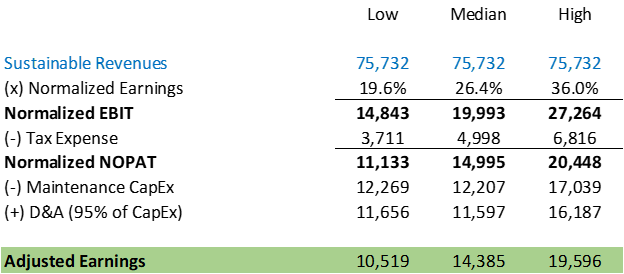

Step Five: Calculate Adjusted Earnings

Next to the last step, it is time to calculate our adjusted earnings for Intel. As mentioned above, we will use the TTM as the sustainable revenue source for the formula.

For reference, all the numbers will be pulled from the abovementioned steps.

Once we input the sustainable revenues and multiply that by the normalized earnings percentage, we will arrive at our normalized EBIT. To find the tax expense for our formula, we need to multiply the normalized EBIT by 25%, which is the tax rate I decided to use.

Once we expense the taxes, we arrive at our normalized NOPAT (Net Operating Profit After Tax), which we then subtract from the maintenance capex and add back in the Depreciation and amortization percentage. We find this by multiplying 95 percent by the maintenance capex.

After all that gobbly goop, we arrive at our adjusted earnings for Intel.

Have we got that? If confused, follow the chart, which should make much more sense.

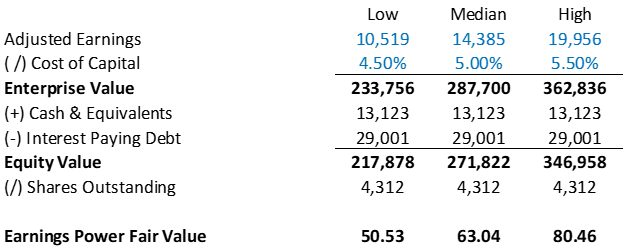

Step Six: Calculate Intrinsic Value

Now that we have arrived at our adjusted earnings, we can calculate the intrinsic value based on our earnings range.

The next value we need is the WACC to find our intrinsic value; for the formula, I am going to use a range of numbers for the low, medium, and high values to find a range of intrinsic values.

To do this, we divide the adjusted earnings by the cost of capital or WACC; once that is done, it gives us the company’s enterprise value. Remember that enterprise value contains debt and cash, which we must account for in the calculations.

To do that, we add the cash and equivalents to the enterprise value and then subtract the debt from the enterprise value to arrive at our equity value. I am using The numbers for the cash and debt from the TTM, but you can use last year’s numbers from the 10-k. As with the sustainable revenues, use last year’s numbers, not an average or median.

After all that is calculated, we have Intel’s equity value; we can then divide that equity by the shares outstanding from the TTM or last annual report to arrive at our intrinsic value.

As mentioned above, Intel’s current market price is $60.97, which indicates that based on the company’s earnings power, Intel is undervalued for both the median and high values.

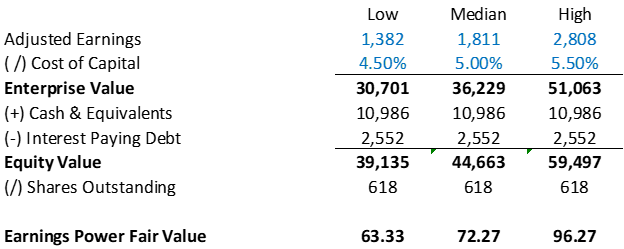

This is in comparison to the current price of Nvidia, which is one of Intel’s tech world competitors.

With Nvidia having a current market price of $413.14, it appears that Nvidia is overvalued based on our calculations.

The cost of capital is an important figure in the formula, and for the above calculations, I did put a pretty conservative number. I have seen some calculations using a higher cost of capital, which drives down the value. I like to use the more conservative numbers because they are closer to the lower beta and risk-free rates prevalent in today’s markets.

For those of you familiar with owner earnings, the structure is similar, and in fact, you can easily substitute that for the adjusted earnings if that is more your cup of tea.

What Does The Earnings Power Value Tell Us?

The earnings power value formula is another way to determine a company’s intrinsic value. Its main difference from a discounted cash flow is that it eliminates the need to estimate growth rates, cost of capital, growth margins, and required investments.

The EPV does contain the cost of capital, but it eschews the growth portion of a DCF, which is one of the main challenges of using a DCF.

Using this formula with a DCF and any other intrinsic valuation method is another tool to help you find a margin of safety in every investment you make.

Limitations of the Model

Like any formula or model we use to find a company’s intrinsic value, the EPV has limitations.

Greenwald based the formula on the idea that the conditions surrounding any company will remain constant and perfect.

There are no accommodations for any issues, either within the company or externally, such as from the market. This model does not account for any issues with operations that affect the company.

This model does not account for any of the risks associated with the business, such as macro factors, supply chain issues, personnel problems, or regulatory regulations that might affect the company’s operations.

Accounting for those risks is part of the valuation process, and if you are using this formula, you will need to account for those ideas or items separately.

Final Thoughts

The earnings power value formula is a straightforward way to find a company’s intrinsic value. The formula doesn’t account for growth, which is a huge component of many companies, which means you will find some of the bigger growth companies, such as Amazon, Facebook, Netflix, and Google, as overvalued.

The argument is the market prices in those growth assumptions, but when you address the fundamentals of any company, you take it at face value and try to assess what you think someone will pay for those assets.

In essence, any intrinsic value calculation tries to estimate what those assets are worth and how much someone will be willing to pay for those assets.

That will wrap up our discussion on the earnings power value formula.

As always, thank you for reading this post. I hope you find something valuable for your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- Calculating Intrinsic Value with a DCF Like Warren Buffett Would “Intrinsic value is an all-important concept that offers the only logical approach to evaluating the relative attractiveness of investments and businesses. Intrinsic value can be...

- Explaining the DCF Valuation Model with a Simple Example Updated 9/15/2023 Discounted Cash Flow (DCF) valuation remains a fundamental value investing model. Using a DCF continues as one of the best ways to calculate...

- Building a DCF Using the Unlevered Free Cash Flow Formula (FCFF) Updated 12/12/2023 “Intrinsic value can be defined simply: It is the discounted value of the cash that can be taken out of a business during...

- Guide to Terminal Value, Using The Gordon Growth Model When we buy a company, we dream that the company’s high growth rate will live on forever. Unfortunately, that is not a reality unless you...