If there’s one thing many investors can all agree upon, it’s that buying stocks and holding for the long term is the best way to increase your chances for success in the stock market. But formulating a buy and hold strategy isn’t as easy as it sounds. What can you do?

This post attempts to solve this problem. Since everyone’s risk tolerance as an investor is different, not one buy and hold strategy will work for everyone.

Instead of trying to define one strategy as the best for everyone, I went out and interviewed 10 experts on their investing views. You can use one or a combination of some to discover your path. Here’s how this post is organized.

Warren Buffett Style Investing

- Ryan Hops; Wall Street Survivor

- Nick Kraakman; Value Spreadsheet

Value Investing

- Jae Jun; Old School Value

- Ken Faulkenberry; Arbor Investment Planner

- David Thomas; Shares and Stock Markets

Index Investing

- Miranda Marquit; Planting Money Seeds

- Kate Holmes; Belmore Financial

- Eric Roberge; Beyond Your Hammock

- Matt Becker; Mom and Dad Money

Long Term Trading

- Sasha Evdakov; Tradersfly

One of my favorite interviews that I did was something I ended up posting publicly on my Youtube channel, and that was the one with Sasha. Here you go:

Strategy #1: Warren Buffett Style

A buy and hold strategy based on Warren Buffett’s stock picking success tends to involve finding great companies at a fair price. As one of the most successful long term investors of all time, Buffett tends to be emulated and studied by many investors today.

Ryan Hops Interview

Ryan is from Wall Street Survivor, a start-up that has been helping investors since 2007. They are very well known for their Wall Street fantasy game, where they have over 420,000 users picking virtual stocks and improving their strategies.

They also have a library of great investing videos over on YouTube, and it was their videos that helped inspire my own channel. With everything going on at the company, the guys of Wall Street Survivor have just launched their new courses marketplace– which has been widely requested and is finally here.

We talked about the new courses marketplace in-depth, along with the problems they solve for investors. Ryan and I see eye-to-eye on a lot of issues due to the fact that we are both actively trying to educate the rest of the world about finance. From our short discussion I can tell that Ryan has the heart of a teacher who is focused on giving value.

Topics such as the mindset of investing, the strategies involved with investing, and the importance of fundamental analysis and ideas for great analysis were all covered in this session.

Ryan Hops Interview Part 1:

- How Ryan used his bad experience with naked options to learn a lesson and find a better plan

- The Warren Buffett way and buying shares in a company as an owner, not a speculator

- Why “the best holding period is forever”

- The importance of investing in companies that you know and businesses you understand

- The consequences of trying to time stocks

- Techniques to deal with volatility and limit downside risk

Ryan Hops Interview Part 2:

- The initiative to give investors a chance to practice strategies and educate themselves about Wall Street and the stock market

- Information about the course packs that Wall Street Survivor offers

- How investors can learn more by doing

- Financial illiteracy in this world and solutions to those who are

- Ryan’s best tip for beginners

Contact:

[email protected]

Twitter: @ryanhops

The following quote is a prominent one on the Wall Street Survivor site. It’s so applicable at all times. “Risk comes from not knowing what you’re doing” –Warren Buffett

Nick Kraakman Interview

Nick from ValueSpreadsheet.com is an investor with 10+ years of experience. In the interview, he talks about some of the first stock purchases he made, and how they didn’t go his way.

More importantly, Nick shares what he learned from this experience, and how he has completely changed his mindset and strategy to find success today.

Not only did we talk investing, but we also talk money and finance. Some of the advice definitely goes “against the grain”, and it’s counter to what you’ve probably mostly heard. But it’s this mindset shift that needs to happen if you are to find wealth in your life.

Nick Kraakman Interview Part 1:

- Why the “go to school” and “get a job” advice is misguided

- Spending money on cash producing assets vs. liabilities

- Differences between buying a company’s products vs. buying their stock

- How Nick lost half his savings in a few weeks

- A breakdown of Warren Buffett’s investing strategy

- How to avoid companies that are about to be bankrupt or in trouble financially

Nick Kraakman Interview Part 2:

- Why value investing isn’t that complicated, and how simple it really is

- Garbage in, garbage out with stock screens

- How to value a company with DCF (discounted cash flow)

- An opportunity to learn everything that Nick knows with investing

Strategy #2: Value Investing

This is the strategy I prescribe to and teach frequently on this site. The reason combining buy and hold with a strategy like this can be so powerful is because you are shielding yourself from the emotions from the market– and actually profiting from it.

Jae Jun Interview

Jae from Old School Value has been blogging about his value investing philosophy since 2007. In that time, he has succeeded in earning 18 – 20% average annualized returns.

But Jae doesn’t get caught up in his successes. Instead, he takes a humbled and highly intellectual approach to his investing philosophy. From this short conversation, it’s clear that he doesn’t borrow from just one strategy. Instead Jae has incorporated his vast sphere of wisdom from the value investing world, and processed and used it to achieve superior returns.

Much of the research and resources that Jae has collected is now available as a service on his site. His stock analyzer will equip you with all of this knowledge and save you time by instantly presenting the fundamentals of a company, so you can focus on the qualitative analysis.

Jae Jun Interview Part 1:

- Jae’s story. How he started investing right before the 2008 crash

- The importance of opening yourself up to get feedback from others who are more experienced than you

- The distinction between “cheap” and “value”

- Mindset and philosophy of value investing

- Using price as a tool, not an indicator

Jae Jun Interview Part 2:

- How Jae gets 18 – 20% annualized returns

- Special situation investing for favorable upside / downside ratio

- The importance of closely monitoring your decisions and results

- Finding a balance between using data and qualitative measures

- The art vs. science of investing

Ken Faulkenberry Interview

Ken Faulkenberry from arborinvestmentplanner.com has over 25 years of investing experience and over 10 years of advisor experience. In that time, he’s been able to outperform the S&P 500 significantly with his premium service.

Ken Faulkenberry Interview Part 1:

- Investing opportunities for new investors

- How the industry has changed for the better

- Words of encouragement for DIY investors

- The importance of a mentor

- Ken’s favorite investing book

Ken Faulkenberry Interview Part 2:

- A common beginner mistake

- Feelings about Facebook, Tesla, and more

- Interesting example with Microsoft and Cisco

- Margin of Safety

- Tortoise and the Hare investing concept

- Importance of Asset Allocation

David Thomas Interview

This conversation is with David Thomas from sharesandstockmarkets.com, who was a successful value investor with a portfolio that returned over 40% in 2013.

Those returns are astronomical were made with simple concepts that look past earnings. You don’t have to be a genius to succeed in the stock market, but you do have to be smart and look for the right mentors.

We discuss two important influences in David’s investing strategy. Not only do we review David’s successes, but we look back at one of his failures.

Learning from failure can be even more insightful than learning from success. Find out the first mistake that David made when starting out, and how it is common to many beginners. There’s also a quality that he’s observed that separates winners from losers.

David Thomas Interview Part 1:

- The Intelligent Investor

- Walter Schloss and tangible book value

- Seth Klarman’s Margin of Safety

- Balance sheet analysis compared to earnings analysis

- Enron fraud

- David’s 332% stock pick

David Thomas Interview Part 2:

- Optimal number of stocks for diversification

- David’s rookie mistake

- Revealing of formula used

- “Looking for rubbish”, and why it’s more profitable

- Top #1 tip for beginners

Strategy #3: Index Investing

While the majority of the public pile their money into expensive mutual funds, a small but growing section of the market are diving into lower cost ETF / index funds. These have proven to be as or more successful than many mutual funds and provide sufficient returns for little to no effort.

Miranda Marquit Interview

Miranda from Planting Money Seeds has been featured in many big name publications, such as the Wall Street Journal and TheStreet. She shares practical and useful strategies for building wealth.

The information provided is particularly useful for Generation X and Y investors, who still have many more years of possible compounding.

Miranda shared some inspiring examples to show that you don’t need a lot of money to build wealth. She also uncovered a few hidden expenses that are eating away at people’s budgets, and how these causing people to miss out– in a big way.

Miranda Marquit Interview Part 1:

- The idea of planting money seeds and money trees

- Why index funds are a great place to start

- Simple interest vs. Compounding interest

- How the rich get richer

- Ways that you could be wasting away wealth and not even be realizing it

Miranda Marquit Interview Part 2:

- Fundamental differences between older and younger generations, and how they affect people’s money situations

- How Miranda got started into journalism and blogging about money

- The importance of setting money priorities

- Miranda’s best beginner tip

Kate Holmes Interview

Kate is a CFP, founder of Belmore Financial and an experienced expert in the industry who takes a different approach to the client and advisor relationship.

She emphasizes the importance of building a relationship with her clients so that they are like friends who can discuss not only the more important things in life, but in identifying those things and aligning your finances to reach those goals. In a world where everyone seems to be so willing to “follow the leader” and copy generations past, Kate finds what makes her clients happiest and works towards that.

Each individual is different, and so each conversation and financial plan is different as well. Working for the same employer your whole life and hoarding cash for retirement isn’t always the best plan for everyone, and so traditional advice oftentimes doesn’t apply.

Kate shares the different mindsets that Millennials have towards the world, as well as the unique challenges we face, and the lessons we can learn from previous generations.

Finally we discussed the differences between a Roth and a Traditional 401k, a recommendation for the minimum that you should be investing, company match, active vs. passive funds, and the essential long term mindset.

Kate Holmes Interview Part 1:

- The importance of finding an adviser who can also be your friend

- Finding when you are happiest and matching that with your financial goals

- Why working for someone else can be very risky, especially for Millennials

- Differences between Roth and Traditional 401k

- Why Millennials should exploit the tax advantages of a Roth

Kate Holmes Interview Part 2:

- How much to invest and the importance of utilizing the company match

- Special conditions with the company match and calendar year

- Why being diversified in various asset classes is so important

- Actively vs. passively managed funds and the preferable choice

- A Better Alternative to Mutual Funds

- The importance of a long term focus, not just for investing but for relationships, careers, education, and more

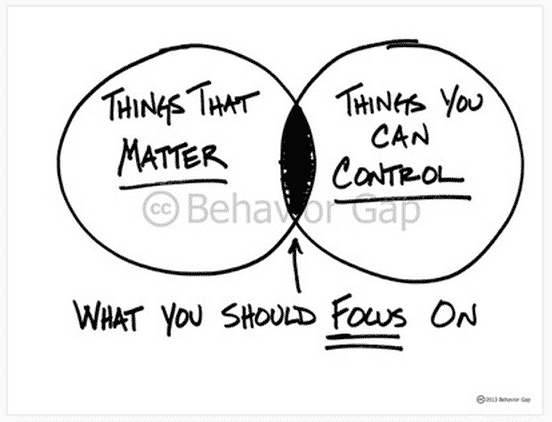

Kate’s best tip for beginners is the chart that I’ve included below. With the flurry of information and choices that is today’s modern world, you can lose yourself in focusing on all the wrong things.

Instead of falling victim to this trap, try instead to focus only on the small intersection of things that matter and things that you can control. Market downturns are a direct result of a herd of people reacting things that they can’t control, such as the outcome of a single investment.

Don’t become one of those people. You won’t win it all with one investment, in one year, or even with one decision. Your financial success depends solely on the saving habits that you create, and the sound consistency of a long term plan, regardless of the outcome of an individual stock or the broad market.

Always remember that.

Eric Roberge Interview

Eric is a CFP from Beyond Your Hammock. He takes a unique approach to money and personal finances by concentrating on designing the life you want, and not letting the traditional wisdom dictate where your money goes.

In this interview he shared practical techniques to manage cash flow, as well as uncovered 3 myths about buying your first home.

The reality of the situation is that we make choices during our 20’s and 30’s that determine how we live in our 40’s and 50’s and beyond, and many of these choices are permanent once made. Before jumping in to these choices headfirst, we should take the time to consider any and all other possibilities and ideas, and find the ones that best fit what we believe in.

Eric Roberge Interview Part 1:

- How to live for the now, while still planning for the future

- Shifting your financial focus closer to the present

- Defining true financial success

- Practical tactics on how to manage your cash flow

- How personal fitness relates to finances, and the importance of building momentum like you would a workout routine

Eric Roberge Interview Part 2:

- Why buying a home isn’t always a good investment

- 3 Myths About Buying Your First Home (article)

- Creating your life based on the freedom you want

- How to invest when you have no assets

- How people in their 20’s and 30’s can make big changes in their financial plan to truly love their life, using money as a tool to live a life you love

Eric also writes on the Huffington Post and Daily Finance.

Matt Becker Interview

Matt from Mom and Dad Money joined the conversation to talk about specific financial issues that parents face.

Being a new parent himself and not being able to find the right resource to speak to his particular situation and concerns, Matt took his financial background and created the resource to accomplish this.

One of the biggest choke ups that young people have when investing is finding that money to invest. In a time when you are learning so many new things at once, it can be easy to get discouraged about your budget and break it.

Matt presents a guaranteed way to set up your budget so that you always hit your savings goals. With this method you don’t have to know how to budget, or even expend energy towards thinking about it.

Another issue with new parents is their need for safety and security. Matt broke down exactly which protections you need to set in place, and ways to make that happen.

Then he talked about what to do with your money after that. We dove into an interesting metaphor between investing and the casino. In fact there’s a way to be the house instead of the gambler, and we broke down ideas for that.

Finally, we got into a great discussion about how it’s ok to make mistakes and it’s ok to not know everything.

Matt Becker Interview Part 1:

- How having a child helped Matt to create a resource to assist new parents, with a place where they can come for actionable and personal money advice

- A valuable technique to budgeting for people who don’t like to budget or think about budgeting

- How to prevent breaking your budget when emergencies come up

- A technique to save money for a vacation or car repair automatically in the background so you can live your life as easily as possible

- The importance of prioritizing so that you can reach your goals

Matt Becker Interview Part 2:

- The importance of creating security with life insurance, disability and liability insurance, and having estate planning in place especially as a new parent

- Why thinking about the kind of retirement you want can help you set your goals and attain happiness and security

- How investing can be like being the casino, and how you can attain this with your investing

- Why making mistakes with your investing isn’t that big of a deal

- The reason it’s ok to not know everything and how someone can leverage that to find success

- Matt’s best tip for beginners

Strategy #4: Long Term Trading

A buy and hold strategy post wouldn’t be complete without also including a unique brand of traders who also utilize the strategy. Some of the same principles such as diversification and position sizing are actually the same thing just called a different way.

Sasha Evdakov Interview

Sasha from Tradersfly has been so successful in both trading and teaching trading for beginners that he’s never had to find a job in his life. His story is fascinating, particularly how he started his entrepreneurial journey so young and had very humble beginnings.

We cover a broad range of topics that you’ll definitely find value in. Although our stock strategies are vastly different, we share many similar mindsets and ideas. Like the importance of patience and a long term horizon. Also in avoiding emotional investing and seeking out the abundance in our lives.

The perspective shared today was unique and helpful. From what I observed, I can easily see how Sasha is able to find success through his objectivity in viewing the market and trading. You can tell that he really loves what he does, as his passion shines through in his work and with our interview.

Sasha Evdakov Interview Part 1:

- How Sasha was able to become an entrepreneur and never have needed to work a job

- Why the “get rich quick” scheme leads to failure and how to succeed

- Jesse Livermore’s Reminiscences of a Stock Operator

- How emotions affect the market and how to find a balance

- A common mistake that beginners make regarding losses and how you can avoid this mistake

- Why being wrong is just part of the game

Sasha Evdakov Interview Part 2:

- Sasha’s background story and how it has led to his risk averseness and success in the market

- Abundance and focusing on the abundance already present in your life

- The effect of money and how it doesn’t change you, but just reveals more of who you are

- How Sasha’s free videos led to his audience asking for courses and what those products teach

- The importance of learning how to learn

The video for part 2 of the interview:

During this interview Sasha shared a really great quote from Bruce Lee. It’s extremely relevant to the market and how to find balance. Here is the whole quote in its entirety:

“Be like water making its way through cracks. Do not be assertive, but adjust to the object, and you shall find a way around or through it. If nothing within you stays rigid, outward things will disclose themselves.

Empty your mind, be formless. Shapeless, like water. If you put water into a cup, it becomes the cup. You put water into a bottle and it becomes the bottle. You put it in a teapot, it becomes the teapot. Now, water can flow or it can crash. Be water, my friend.”

–Bruce Lee

Related posts:

- The Basics of Wall Street Explained – Is it a Place for Good? Updated 4/15/2024 So, you’re looking to start investing, but first, you want to know the basics of Wall Street. What is it? Why does it...

- Stock Market Cycles: How to Analyze and Profit Updated 7/24/2023 “Warren Buffett tells us, ‘The less prudence with which others conduct their affairs, the greater the prudence with which we should conduct our...

- Buy Limit, Buy Stop, Buy Market – A Tale of Order Types It was the best of trades, it was the worst of trades (mostly worst). This is a cautionary tale of how an order type (buy...

- Guide: How to Evaluate a Stock Using Price Based Metrics Updated – 12/14/23 Learning how to evaluate the price of a stock means determining if the price is right, or not. The reason this is...