Understanding one’s circle of competence helps you avoid problems, identify strengths, find opportunities for improvement in any field, and helps you learn from others.

We often quote Warren Buffett when discussing a circle of competence. He has used this description to help investors focus on the areas they knew best. He first shared his thoughts on this concept in his 1996 Letter to Shareholders:

“What an investor needs is the ability to correctly evaluate selected businesses. Note that word “selected”: You don’t have to be an expert on every company, or even many. You only have to be able to evaluate companies within your circle of competence. The size of that circle is not very important; knowing its boundaries, however, is vital.”

A circle of competence often relates to investing. Still, it encompasses much more than that; often, a circle of competence relates to our jobs, hobbies, learning at school, and many more.

In today’s post, we will discuss the following:

- What is a Circle of Competence?

- Warren Buffett and the Circle of Competence

- Defining Your Circle of Competence

- Expanding Your Circle of Competence

Ok, let’s dive in and explore more about the circle of competence.

What is a Circle of Competence?

An explanation of the circle of competence from Farnam Street:

“Circle of Competence is simple: Each of us, through experience or study, has built up useful knowledge on certain areas of the world. Some areas are understood by most of us, while some areas require a lot more specialty to evaluate.”

Most of us are familiar with restaurants and how they work. We buy a space, rent it out or buy the land and build our building. We create a menu, hire staff, serve the food, take payments, and pay our bills. What remains is either for the owners to keep or reinvest back into the restaurant.

The restaurant business remains fairly simple and most of us can understand how this works, but how many can say they understand how Microsoft or Google works, or even Wells Fargo?

Most of us remain unfamiliar with those types of businesses. Yet, most investors on Robinhood continue investing in tech, even though that may reside out of their circle of competence.

Going outside of our circle can lead to some pretty disastrous consequences.

As Buffett has illustrated repeatedly, we don’t need to necessarily understand the goings-on with Facebook to invest our hard-earned capital.

More importantly, we must be honest with ourselves, analyze what is in our competence circle, and stay within those bounds.

Put it this way: think of the great swimmer Michael Phelps. If you try to make him the next Michael Jordan, probably not going to work, at least at the onset; maybe given enough time, he might improve his game to become competitive. But put him in the pool, and he becomes unstoppable.

By expanding outside his circle of competence, we get his comfort zone and away from what he knows best, the pool.

The same rules apply to investing; the ones who do the best tend to stay within areas they know best. Warren Buffett has areas he knows extremely well, such as insurance, retail, and financials.

Another story to relate how this can work outside of investing comes from Charlie Munger:

“You have to figure out what your own aptitudes are. If you play games where other people have the aptitudes and you don’t, you’re going to lose. And that’s as close to certain as any prediction that you can make. You have to figure out where you’ve got an edge. And you’ve got to play within your own circle of competence.

If you want to be the best tennis player in the world, you may start out trying and soon find out that it’s hopeless—that other people blow right by you. However, if you want to become the best plumbing contractor in Bemidji, that is probably doable by two-thirds of you. It takes a will. It takes the intelligence. But after a while, you’d gradually know all about the plumbing business in Bemidji and master the art. That is an attainable objective, given enough discipline. And people who could never win a chess tournament or stand in center court in a respectable tennis tournament can rise quite high in life by slowly developing a circle of competence—which results partly from what they were born with and partly from what they slowly develop through work.”

Such simple, straightforward advice about living life; I wish I had learned to follow it earlier; it would have helped me avoid many mistakes in life.

Sherlock Holmes once said:

“I consider that a man’s brain originally is like a little empty attic, and you have to stock it with such furniture as you choose.”

Despite being a genius, it was surprising what Sherlock Holmes didn’t know that lay outside of his work.

For example, when Dr. Watson talks to him about the solar system, he doesn’t know the stars, planets, etc. And according to Holmes, it makes no difference to him in solving mysteries.

Only what matters to him and his circle of competence is important to his work and passion.

Warren Buffett and the Circle of Competence

“Draw a circle around the businesses you understand and then eliminate those that fail to qualify on the basis of value, good management, and limited exposure to hard times…Buy into a company because you want to own it, not because you want the stock to go up.”

–Warren Buffett from Forbes Magazine interview

Think of it this way.

Buffett explains his strategy for avoiding problems is a two-part system. He knows his circle of competence and, more importantly, its boundaries, and he stays within them.

If we can learn one thing from Buffett and his investment strategies, it’s that he only invests in businesses falling within his circle of competence, and he rarely strays outside of the circle.

Recent developments aside, with his exiting airlines recently, no one could have foreseen the coronavirus pandemic and its effects on the airline industry. He has stayed within his circle over the years.

Understanding our circle of competence completely is just as important as knowing what we don’t know as what we do. If I struggle to grasp an industry or an idea, I should walk away.

As value investors, it is important to understand the business we are buying because the goal of buying a business will create value for us. If we don’t know how the business makes money, we will never truly understand the business.

Like baseball, we don’t have to swing at every pitch Mr. Market throws at us; we can wait for our pitch and then take our swing.

Even Peter Lynch talked about buying what you know in his book “One Up on Wall Street.” Lynch wasn’t referring to buying Starbucks because you love their coffee. Rather, he was discussing buying businesses you understand and can relate to their strengths and weaknesses as a business.

For example, if you invest in banks, you must know how a bank makes its money and where its greatest risks for failure lie. Most laypeople think a bank makes most of its money from the fees it charges customers, but in 99% of cases, that’s incorrect; banks make their money from interest earned from credit products such as loans, mortgages, and credit cards.

Understanding where your circle of competence lies and staying within the realm can help you avoid mistakes and losing your capital permanently, which is rule number one.

Avoiding overreach is one of Buffett’s keys to his success when he felt the investment was too tough; it went directly into the “too hard” pile, and he moved on to other companies.

Ok, let’s take a look at defining our circle of competence.

Defining Your Circle of Competence

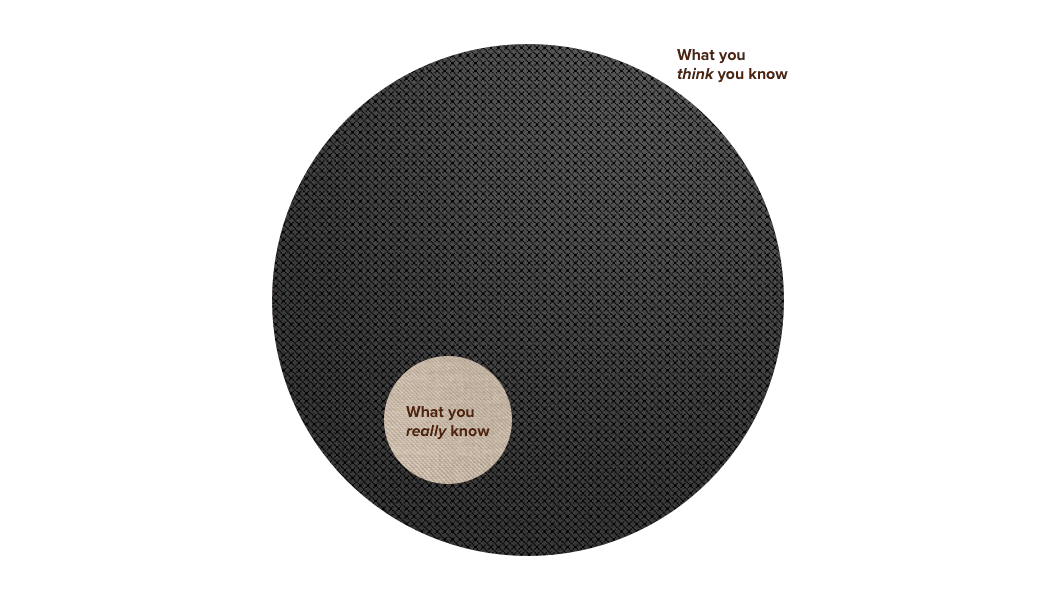

What resides inside our circle of competence? When we consider the question, a common behavioral bias pops up: overconfidence.

Not trying to slam anyone; I fall into this category myself. I will give you an example from my story. As a young man, I studied music and went to college, where I received a degree in jazz guitar. As a trained musician, I felt I had learned as much theory and technique as I needed to make my way into the music world.

One of my friends offered to take me to see B.B. King, the legendary blues musician, at a local show. At first, I was reluctant because I felt the blues was below me, and I only wanted to stretch myself as a musician. Well, needless to say, I was blown away by the musicianship and emotion he displayed with his playing and singing.

I decided I needed to learn how to play this music, and at first, I thought it would be easy because I was a trained guitar player. But as I learned very quickly, just because it was simple didn’t mean it was easy. The music lay outside my circle of competence, even though I thought it was because of my level of overconfidence.

So how do we define our circle of competence? By looking at three psychological definitions:

- Behavioral Comfort – If you are comfortable buying a company, you need to consider the other decisions, such as when to sell, how to anticipate future investments with the company, and when to make a larger commitment. If those decisions make you uncomfortable, then the initial investment may not be the right decision, and the company may fall outside your circle.

- Inherent Predictability – Some businesses, like Walmart, remain easier to predict and get caught up in the new, shiny objects tech offers. But the future offers uncertainty, and it doesn’t matter how much expertise or experience you have; the future remains unknown. Your comfort level with the uncertainty goes a long way toward understanding your circle of competence.

- Domain Expertise – If you are comfortable making an investment where the inherent predictability is unknown, and your sufficient domain expertise allows you some ability to understand and estimate what the future might hold for that investment, domain expertise is where your time and effort in studying the industry will pay off.

Let’s look at how we can expand our circle of competence.

Expanding Your Circle of Competence

Not everyone is born with an investment circle of competence, but it is a skill that we can learn over time.

Growing our circle of competence requires an equal dose of deserved confidence and humility. The confidence comes from learning, reading, studying for the master’s, and having successful investments.

Once you have completed some simple investments, you can choose whether to expand your circle or stay within that current circle. There is nothing wrong with staying within that circle; many successful investors stay within a narrow field of competence, which is great.

Never feel pressured to invest outside your circle; you will regret it, if not in the short-term, but in the longer period, as you expand without truly understanding the industry or company. And this could lead to losing your capital or, even worse, never investing again.

Rather, it is certainly possible and doable if you wish to expand outside of your circle.

An example of a famous value investor who stepped outside his comfort zone to invest in the auto industry is Mohnish Pabrai.

Pabrai discovered a fantastic investment opportunity, but he knew nothing about the auto industry, so instead, he passed it by. Later he was presented with the same opportunity, and this time, it tweaked his interest.

Instead of just buying the company and rolling the dice, he decided to learn as much about the auto industry as he could. He started studying the industry, reading books, periodicals, and industry reports, interviewing other investors in the space, and talking with insiders in the industry. Basically, he immersed himself in the industry to learn as much as possible before deciding to buy any company in the industry.

Bottom line: all the hard work and effort paid off because he was able to invest in Fiat Chrysler, and the company has proved to be an incredible investment for Pabrai.

The takeaway from the story: find a passion and follow it. If you are passionate about the beverage industry, then study the industry to become more knowledgeable about how the industry works and what success and failure look like in the field. Find others who share the passion and learn from them, study companies specializing in beverages, and maybe even work in the field to gain more insights.

I was lucky enough to work for Wells Fargo early in my investing career; it taught me much about finance, credit, and how to read financials. I was lucky enough to find a great mentor who helped guide me and was a fantastic resource when I had questions.

My experiences ignited a passion for banking and how it worked. I studied the industry and taught myself how they work, make money, and what kinds of banks would fit into my new circle of competence.

The bottom line is that you can teach an old dog new tricks and always learn something new and expand your circle of competence. I encourage you to look around and find something you are passionate about and explore. You never know what you may discover.

Final Thoughts

Discovering what our circle of competence is and where the edges are is instrumental to success in investing. Warren Buffett and Charlie Munger introduced this idea to the investing world in the mid-90s.

Warren and Charlie have stayed within their circles of competence during their investing careers; if you study their portfolios over the last 30 years, it is a pretty narrow focus of industries. And they have had tremendous success with that narrower focus. But notice the branching out lately with the investment in Apple; Buffett said he would never invest in technology because he didn’t understand the industry.

My advice is to spend some time thinking about where your circle of competence lies and explore the edges of the circle. Once you are comfortable with those edges, think about what areas ignite excitement for you. Mine was financials like banks, insurance, and the Federal Reserve. Find your own, whether it be tech, retail, food, or commodities, and embrace as much as you can about those fields.

That will wrap up our discussion for today; as always, thank you for taking the time to read this post.

I hope you find something of value to help you along your investing journey.

If you have any questions, please don’t hesitate to reach out.

Until next time.

Take care and be safe out there,

Dave

Related posts:

- What We Can Learn From Warren Buffett’s Four Pillars of Investing Warren Buffett has covered every aspect of investing over the years. Whether in one of his letters to shareholders, an interview, or an essay, a...

- Is Cloning Top Fund Managers and Their Portfolios a Good Way to Go? In Alice Schroeder’s biography of Warren Buffett, The Snowball: Warren Buffett and the Business of Life, Buffett admits that much of his early success resulted from...

- Inversion Thinking: How Charlie Munger Avoids Stupidity with Investing In today’s post, we will discuss ways to use inversion thinking to avoid stupidity with investing decisions. Using a framework established by Stoics such as...

- Using a Checklist to Find Five-Tool Companies “The trick in investing is just to sit there and watch pitch after pitch go by and wait for the right one in your sweet...