Podcast: Play in new window | Download

Subscribe: Apple Podcasts | RSS

Welcome to Investing for Beginners podcast this is episode 48. Andrew and I are going to talk about distressed businesses or negative earnings, negative shareholder equity we’ve never really delved into that aspect of investing and kind of what to look for in companies that having falling stock prices.

We’re going to talk a little bit about maybe some cautionary tales as you’re looking for companies to invest in for your potential retirement,

- The importance of the price to cash ratio

- The impact of declining shareholder’s equity

- The impact of declining earnings

- What to look for in the financials of a falling company

- Not every falling company is failing

Without any further ado, I’m going to turn it over to Andrew as always and let him start us off.

Andrew: yeah so I mean we did a bunch of episodes on beginning with the basics. I think let’s dive in we haven’t done anything pretty technical in a while, and I always love to talk about I know some at least some of our listeners like to hear about it.

I thought maybe we could like stay relevant. Obviously there’s been a couple of things that have happened lately, and I realized in the podcast world by the time this comes out it’s going to be months old news. But we had Tesla lose taxpayers billions of dollars we’ve talked about Tesla before so I’m not going to talk about that story with the whole SpaceX thing.

But there is another one, and it’s Sears Holdings it’s on CNBC, and the media and everybody talks about the fall of retail and talks about how Amazon’s taken over that space. And then made a lot of businesses fail and it is very true, and I thought this could be one that we’ll look at a little bit deeper and see.

Because obviously if you look at the stock chart it’s been beaten down and with stocks that are being down sometimes that comes an opportunity. Because then you can buy a low price for Sears, in particular, I will look at like a basic price to cash. The price of cash is 1.8 which means if you’re buying this stock you’re almost getting the cash if the price the cash was 1.

That means let’s say you’re paying a hundred million dollars to get a hundred million dollars in cash like that’s like almost getting like free cash.

It sounds like a like a great value play, but I think you’ll find as we dig deeper into the numbers that there’s more to this story and that even though you see a couple of good metrics from a value standpoint. Because the complete picture isn’t all there than it is a cautionary tale and there are several different symptoms with Sears right now that signal a business in decline.

I think those are some of the things that you should look at when you’re looking at evaluating various stocks particularly in ones where industries are being I don’t want to say under attack or siege. But going through a lot of change so obviously retail is one of those and with a lot of change comes a lot of opportunities.

But also a lot of risks anytime you’re getting into what’s almost called like a devalue with really distressed companies it’s very important that you are differentiating between opportunity or risk.

Dave: yeah exactly and I think the big thing was Sears is you look at the evolution of the company over the last eight, nine years, and they’ve been in a kind of a scramble mode to try to figure out how to stay relevant and stay alive.

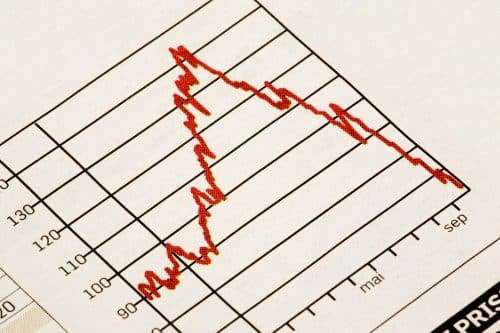

And as Andrew and I were talking about preparing for this episode tonight I was looking at just a price chart of the company in since 2009. They were at the height of 122 dollars a share and currently they’re at three dollars and 33 cents a share.

That is quite a precipitous drop the city of the least and when you talk about some a company that’s in a distressed industry which retail would certainly fall into that. There as Andrew was mentioning earlier a moment ago, there is quite a bit of change that’s going on in the retail world.

There are all kinds of rumors swirling around right now about Amazon looking for a physical place to branch into, and I’ve heard lots of rumors about Target, and I’ve heard lots of rumors about Sears and who knows whether this will come to fruition or not.

But people that aren’t looking at Sears as a possible value play look at something like that and gives them hope, and that would be certainly a life vest to a drowning man. But boy that’s it’s that’s a big stretch and as we go into a little bit deeper dive in here in the numbers of the company.

We’re going to see that there are a lot of things that can really set off a lot of alarm bells and would caution you to maybe think that this is maybe not the greatest investment, and I think with that comment I think we should start looking at some of the ratios other than price-to-book that Andrew was talking about let’s take a look at some of those.

Andrew: yeah I love how you brought up the stock price chart because when you get into stocks that are beating down at this level, and you get to like the below 10 below 5 below to $1.00 range you look at the long-term success, and you start to think well you know it hasn’t fallen that far. Or do you look at it and you say well it’s fallen this far surely buying it means you can’t fall that much more right?

Because a lot of these stock charts will bottom out a lot of times, you’ll have pessimism, and there’s only so much of a beating the stock can take before either normalize or goes completely bust.

The thing to understand is when you talk about the stock going from like 100 to 50 that’s a 50% loss you buy the stock in at 3, and it drops to a dollar 50. Doesn’t sound like a lot but it’s the same as if you had held on to the stock and it dropped from 100 to 50.

You have to be careful when you’re getting into these situations where the trends lower because that your risk is only 100 percent. No matter how much how cheap of a price you get in that and a stock can fall very fast and that look closer and closer you get to zero.

I think the more drastic some of these movements can be and it can be you can see about your money evaporate overnight, and it could be really scary. So definitely something to keep in mind when I looked at the financials I did a real like surface level look. I went to advfn.com which is a website we’ve talked about a lot that preloads a lot of the information that you can get from a financial statement, and it puts it all out there. It’s not always 100% accurate which is why whenever you’re looking at analyzing the stock to purchase I always recommend also looking at the sec.gov report because you might find some of the discrepancies. But for today, I think this gives us a nice picture and can tell the story.

Because it’s one thing to hear all the rumors it’sone thing to maybe see stores close and see people talking about it on TV.

It’s a completely different thing when you look at the numbers that are going to tell you what the story is because you can spin it in a way where a store is closing number business is closing stores, and it’s able to create more profits doing that by cutting losses.

You can also look at in a different way where they are closing stores because their business model is just absolute garbage and the demands really low and you won’t know until you look at the financial statement. Look at more than one metric so right off the top you look at revenue which is called the top line you see from 2013 2017 that’s been steadily declining.

You went from 39 million; this is actually in millions so let’s say 39 billion to 36 billion 31 billion, 25 billion, 22 billion. That’s obviously not good you never really want to see a declining top line. Not you know a company can still grow earnings while their top-line is declining. But what that means is they’re going to have to cut costs heavily.

You think about cutting headcount and maybe cutting corners on production costs and things of that nature. That’s the stuff that companies will have to do so I meaning the short term. It’s not necessarily a terrible sign, but in the long term, it’s like how do you expect earnings to grow when all the money that you’re bringing in is decreasing you’re going to have to do some drastic things.

That’s the first obvious red flag you also look at their net income and obviously I don’t think we’ve hammered this down enough yet because we haven’t talked too much about bankruptcies and value traps and all of those things.

But the number one goal of business at least in the comments when you think about common sense and yes common sense is not that common these days. But when you examine and think about on the conceptual level why do we have a business? It’s to create profits so when the business is failing at doing that especially if their top line is growing, then that’s an obvious sign of a failure of a business model.

And so for Sears not only how are they losing money they have continued to lose money for the same five-year period that we’ve been talking about. In my opinion, it’s amazing, they’ve been able to last this long because you’re looking at a loss of negative nine hundred million to 1.3 billion to 1.6 billion. It looks like they got a little bit of an improvement in 2016 going to 1.1 billion and then again the latest one. That’s it’s the biggest loss they’ve ever had its 2.2 billion dollars.

That’s not good at all for obvious reasons and when I found most profound about all of this is on top of all these negative metrics and all these declining trends. They have shareholders equity that’s been steadily decreasing like a straight line. Just like their top-line revenue, so they’ve gone from 2,700 in shareholders equity down the 1,700 down to negative 900 negative 1,900 negative 3,800.

It’s just not only is their equity shrinking which what’s that means is either their total assets are going down, or their total liabilities are going up or a combination of both. Not only is that going in the wrong way they now owe more than they own. If we were to liquidate the business today, they would sell all their assets and still owe together, and creditors and all those things that are it’s absurd to think that the business is still alive and that people are still in the stock.

Like what do you see in the business where you owe more than you owe you know you owe more than you own you don’t it just doesn’t make sense right. And it’s just funny how what looks so obvious, and you know a 5th grader should be able to understand that concept.

It still gets lost because you still have the stock trading at around three dollars. Obviously, there’s hope they’ll be able to turn it around, but I asked you this question as an investor. Why even bother with stocks that you know would you invest money in a credit card knowing that you have to pay interest to the bank or would you invest it in a business that creates a profit.

Right so why would you buy a stock that’s already in the hole and is already own so much and having such a negative trend lower when there are so many other stocks out there that are growing that have actual assets and more assets than their debt and their liabilities and the things that they owe it’s just absurd to me. And I don’t like to beat down on the stock.

But I think it’s something to consider and not only should it make sense to like a conceptual and logical level. But I think when you go through history you’ll start to see that these type of warning signs have been present before and obviously, the future doesn’t repeat history exactly in any period. Then and the future always kind of works out its way there are some similar characteristics.

There are patterns that we can learn from, and there are key lessons to be gleaned from stories of the past, and so I’ve written about some of those and would like to share about it, but I think it should be obvious.

We have declining revenue declining earnings and declining equity. Sure you might be able to get good cash about what you’re paying for the price of sales is fantastic still it’s like 0.02. So a ridiculous amount of revenue compared to how much you have to buy. But even with all those things, you have to consider the other three factors, and it’s a losing battle it’s even worse than the gamble, in my opinion, I would completely just stay away.

Dave: I would too, and another thing that I was looking at did just kind of put this in perspective a little bit. The market cap of Sears right now is 357 million and when you think about a company with the name recognition of Sears and how huge the company is and how long they’ve been around. That’s staggering to think about it and that borders into the small cap stock area, and that’s just staggering to think about.

When you look at the negative shareholder’s equity that Andrew was talking about you think about the assets versus the liquidity of the company and there just isn’t much there, and those are the kinds of things that really can make it a really scary proposition to get into a company like this.

And yes it may be tempting to buy something that’s a quote-unquote so cheap but as Andrew has talked about in his book with the Value Trap Indicator you know these are the kinds of things that can really suck you dry if you’re not careful, and that’s why looking at the financials and looking at the overall picture as opposed to just the price is so critical to a margin of safety and having a value of safety. And you know when we’re trying to invest one of the biggest things that we always try to look for is not losing money you know our good buddy Warren Buffett rule number one don’t lose money rule number two don’t forget rule number one, and that’s so critical.

We’ve talked about in the past when you lose money and trying to regain that money is it can be a very uphill battle for sure. Andrew was talking a little bit about some other I’m going to blank an alert other cautionary tales that he’s talked about in his book, and I was wondering if you’d be willing to share a few of those with us.

Andrew: yeah definitely so what was interesting about some of these as they had warning signs for years before they went bankrupt. If you pick up a copy of my book you read it you’ll start to see a theme a lot of these companies have negative earnings over and over and over again.

Even more obvious is when a company has negative earnings, and negative shareholders equity just like Sears does right now. Blockbuster you could there were probably millions of news articles out back then there were all these different types of research right and what’s funny about when you when you hear about companies in the media they’ll never dig into the numbers like we’re doing today.

They’ll never give you like a 5-year layout of just these simple numbers that are telling a big story about what’s going on. looking in the past it’s like okay well maybe with hindsight it seems like it was very obvious that you should stay away from Blockbuster I remember growing up as a kid and going to Blockbuster over the weekend and I’m picking out one or two movies and that was the entertainment for the weekend and then I remember being in high school when we had our first Netflix account, and I believe that flicks started out where you would get the CD mailed to you and then you would mail it back.

What was cool about that was unlimited so you would return one whenever you were finished, and then you get another one. That that’s what made this the subscription model appealing, and I remember just out of nowhere everybody in my high school seemed to have their own Netflix account and then obviously they went into the streaming thing and then that took off.

Before long you know Blockbuster completely disintegrated but you know I argue that even if I was even remotely aware of the stock market back, then I don’t think I would have known to stay away from Blockbuster unless I was also skilled and looking at the numbers.

Look at blockbuster for the VTI I did thirty bankruptcies of the 21st century kind of and I really dug deep into 12 of them and I featured these and they take up a big portion of the book and it’s just breaking down these numbers and looking at them and giving a chart round and showing the financials and then talking about that.

With blockbuster in 2010, they had negative 569 2009 negative 385 2008 negative 85 basically for four straight years you saw earnings decline. So it was positive in those seven, and then it went negative in no way further negative nine and then really negative oh 10 or 2010 shareholders’ equity same situation as Sears.

They went from 700650 200 negative 300 so completely declining and then net sales as well right 5550 350 and 40 it’s I mean are we not looking at Sears again like it’s kind of prophetic in a way.

Right and that I know if you would probably talk to other people they would probably say they don’t buy clothes from Sears much either so it might be one of those things that seem obvious when you look at the share price for Blockbuster before they went bankrupt. I thought that was interesting too you had in 2007 there around 4 and then 2008 they went up to like six or five depending on which quarter you’re looking at then down the like the two the three range and then down like a dollar and then bankrupt.

You can see like the warning signs were there for a very long time you didn’t have to jump ship right when things started to look a little sour but come on three years of negative earnings and you’re still sticking with the stock. Personally, I have a policy where if a stock has negative earnings I’m just not buying it at all and if I own the stock that gets to negative earnings, I’m selling it because again this is the number one thing that the business world can all agree on is profit.

No sense in staying in a company that’s failing at that big of a scale so investors in Blockbuster you can see there are still a lot of hope a lot of optimism and even though the share price did kind of rebound those three major metrics continue to decline and finally the company did go bankrupt.

And I think I don’t think it’s very coincidental that it was that last year that they finally had more liabilities and assets, and then that was 2010, and then they go bankrupt right after that annual report.

Something to keep in mind there was another one too that I wrote about in the book that had the same characteristics in the sense that I had negative earnings and negative shareholders equity and that was THQ that was like a gaming company.

They were in the gaming industry they had a couple of pretty good games I came out, but you know you would on paper it sounded nice. They had a monopoly on games based on like Nickelodeon and Pixar that that sounds profitable but the financials didn’t prove to be as profitable as everything though as all the investors hoped they would in the same token.

They had four years of negative earnings 2012 11 10 and 2009 all four years negative earnings they had like a little bit of a bump and shareholders’ equity from 2009 to 2010 but those last three years before bankruptcy shareholders equity was declining down and then on the revenue standpoint it stayed pretty flat. There’s a little bit of decline after2010, but sales were at least flat, so you can see again not every bankruptcy going to look the same.

But knowing that profits are going down means that you can’t buy if you have negative earnings how are you going to buy more assets right and if you if you’re trying to maintain a certain level of revenue and sales you’ll probably pileup more liabilities.

Those are the kinds of things that can make your total equity get lower when I’m looking at a stock I always want shareholders equity that’s increasing earnings other increasing. Those are all things that are compounding positively they’re creating more cash, and that’s being able to be reinvested into more cash and create more sales and profits which can create more cash.

It’s all positive reinforcing. Unfortunately the same thing can happen on the downside, and then you see it with stocks like this and the warning signs are kind of there and a company like this THQ I think the difference between THQ and Blockbuster was that Blockbusters business model deteriorated at such an extreme level that everything crumbled at the same time. whereas THQ at least they were able to maintain appearances by keeping revenue flat so there was some demand that they were obviously throwing money into the furnace by accumulating all these liabilities selling off assets just to stay afloat and it finally caught up with them after four years of negative earnings and again just one year of negative shareholders equity.

I think it blows my mind again that Sears has been able to last this long with that many year of negative equity but at the same token like their negative equity isn’t extremely bad yet if that makes sense like we’re talking about like a negative 3.8 billion. When they still have what 19 billion in sales 22 billion in sales, so I don’t know like who knows like when the final nail in the coffin gets hit.

But I just I don’t see our cover story, and even if-if there is it’s not worth the risk and not going to be a profitable strategy. If you’re going to be picking stocks like this and even if you’re trying to stay diversified and picking a group of stocks like this with declining everything. It’s just not a good policy to have, and unfortunately it’s not hammered down enough, and obviously, it’s a sobering its kind of making me depressed even talking about it maybe that’s why it’s not catching on. But hopefully, by listening to this, you can tell that like these aren’t super complicated topics.

It’s not a super complicated metric these are just a couple of basic things that we can kind of put two and two together and if there was more awareness about this and in the financial industry I think it would definitely save a lot of investors a lot of money and a lot of heartaches and you know by limiting losses you’re only pushing up your upside and pushing up your gains and pushing up your performance.

It is really worthwhile to be able to understand this and to look at it because like we’ve said and like it should be obvious buy low sell high works really well a lot of buys low and super deep discounts and you talk about margin of safety and you focus on the margin a lot of those can really explode for you and profits and gains. But you have to be super careful and super picky and making sure that the safety parts there as well.

Dave: yeah those are all amazing points and that is the advice that you really need to listen to and follow through with there’s a difference between being in a company that’s beaten down or the industry is beaten down to a company that is in its death throes and those examples that answer Illustrated of blockbuster and THQ are great examples of companies that were very much exhibiting signs of financial distress and you know they were putting the SOS out there for you to read it.

It’s just a matter of whether people were paying attention to or not and not to beat on Tesla but that is really why Andrew and I are really down on the company but the product yeah product is great, but everything that we were just talking about that what they fall into negative everything and that can be such a dangerous investment to get into. I understand the hope is very strong and belief is very strong but when you look at the black and white numbers those things can make it very obvious to you that this is not a place that you want to be, and that’s why I Andrew and I wanted to talk about some of these things tonight was to help illustrate the caution that you need to have when you’re investing.

Being aware of any sort of risks that you could be taking because we do take risk you’re taking a risk with the money that you’ve earned you worked hard to get that money and when you put it in the stock market you want it to work for you and when you make a choice to invest in a company like Tesla or Blockbuster it’s a big risk. It’s a very big risk, and you have to ask yourself what is the return that I’m hoping for by making this investment, and that’s where I think it comes down to for me.

All right so I think that’s going to go ahead and wrap it up for us tonight. I hope you enjoyed our conversation about some cautionary tales, we’re not trying to be bummers or downers but we just want to talk about some of the things you need to be a little bit more aware of and without any further ado you guys go out and find some great intrinsic value and invest with a margin of safety emphasis on the safety. You have a great week, and we will talk to you guys next week

Related posts:

- IFB132: Warren Buffett on Investing in Business Vs Pricing Announcer: 00:00 You’re tuned in to the Investing for Beginners podcast. Finally, step by step premium investment guidance for beginners, led by Andrew Sather and...

- IFB22: Finding Investment Ideas with a Reliable Stock Screener Welcome to session 22 of the Investing for Beginners podcast. In today’s session we are going to discuss how Andrew and I like to use...

- IFB36: Should You Buy Tesla Stock in this Bull Market? Welcome to Investing for Beginners podcast this is episode 36, I’m David Ahern, and Andrew Sather’s here as well. Tonight we’re going to talk...

- IFB158: Stock Picking for Dummies Announcer (00:00): You’re tuned in to the Investing for Beginners podcast. Finally, step by step premium investment guidance for beginners led by Andrew Sather and...