Updated 3/30/2023

Did you know the majority of financial assets for most companies comprise marketable securities? Did you also know companies such as Microsoft, Amazon, Google, and Berkshire Hathaway hold over 25% of their assets as marketable securities?

It’s true; you can look it up.

Or you can read the rest of this post and learn more about another segment concerning these marketable securities, held to maturity securities.

Like held to maturity, securities are not exciting, sexy ideas, but many companies use these securities to hedge against inflation or juice their returns on assets.

Not every investment idea a company dreams up will return 20% to the company. And in many cases, the company might produce so much cash flow they struggle to deploy it in a way to return lots of value to shareholders.

Instead of dumping all that cash in a savings account and earning pennies, many companies utilize marketable securities to earn better returns.

In today’s post, we will learn:

- What are Held to Maturity Securities?

- Can You Sell Held to Maturity Securities?

- Some Pros and Cons of Held-to-Maturity Securities

- Examples of Held-to-Maturity Securities

- Investor Takeaways

Okay, let’s dive in and learn more about held-to-maturity securities.

What Are Held to Maturity Securities?

Held-to-maturity securities are investments purchased by a company meant to own until maturity. For example, Amazon might purchase a bond they intend to hold until the maturity of that bond.

There are different accounting treatments for held-to-maturity investments compared to their cousins:

- Available for sale securities

- Held for trading securities

Bonds, CDs, and other debt vehicles remain the most common forms of held-to-maturity securities. Bonds and debt vehicles have stated or fixed payment schedules and fixed maturities. And companies typically purchase them and hold them to maturity.

However, stocks do not have a stated maturity; they buy and sell based on the investor’s decisions. Visa and Mastercard have no expiration date on your investment.

Companies have a few categories to align their investments for accounting purposes. Depending on the company’s goals and desires, they can define them as available for sale or hold for trading.

These different classifications are treated differently on the company’s balance sheets. Also treated differently are the respective gains or losses of these investments.

Held-to-maturity securities are typically reported as noncurrent assets and are not considered part of their working capital.

Companies amortize the held-for-maturity securities on the balance sheet. It is an accounting practice that allows for adjustments of the assets throughout the asset’s life for those unfamiliar with amortization.

Earned interest income lists as a separate line item on the income statement. But changes in the stock price of the investment don’t change on the balance sheet.

Held-to-maturity securities only report as current assets if the security has a one-year or less maturity.

Securities with maturities of longer than a year will list on the balance sheet at an amortized cost. All of this includes the initial acquisition cost and any additional costs.

Both are available for sale and held for trading securities listed on the balance sheet at fair value, while held-to-maturity securities list at amortized value.

Also, any temporary price changes in a held for maturity securities do not appear in financial documents.

Okay, now that we have a basic understanding of held-to-maturity securities, let’s look at some accounting guidelines

Can You Sell Held to Maturity Securities?

Suppose a company decides to invest in bonds or other debt securities; then it has the choice of holding it until it matures or selling it at a premium when the interest rates decline.

Many banks or insurance companies hold these securities to hedge against inflation and have a solid, secured return over a set period.

With the return fixed on the balance sheet under the amortization rules, any price fluctuations don’t affect the balance sheet’s value, unlike available-for-sale or equity securities, which will fluctuate with the market.

Any earned income from held-to-maturity securities flows from the balance sheet to the income statement via the net investment income line item.

A danger of selling held-to-maturity securities for companies to consider is the potential auditors might prohibit companies from using the category in the future.

Some one-time exceptions allow these sales, but accountants look down on the arrangement. One of the advantages of companies using this accounting treatment is its stability with price-fixing.

Now, a one-time opportunity allows companies to reclassify their held-to-maturity securities.

But if a company chooses to liquidate its held-to-maturity securities, it risks “tainting” its marketable security portfolio.

Suppose FASB, the accounting council, determines the company is acting the rules by declassifying its held-to-maturity securities. They may determine the portfolio must change to available-for-sale securities.

We have exemptions, such as nonrecurring events, for which the past pandemic offers as a perfect example. In that case, the company can liquidate its held-to-maturity securities without penalties.

Okay, let’s examine some pros and cons of held-to-maturity securities.

Some Pros and Cons of Held-to-Maturity Securities

Like any investment, there are advantages and disadvantages to buying held-to-maturity securities.

In this section, we will cover some of those ups and downs.

Let’s discuss some pros involved in investing in held-to-maturity securities.

The first benefit of held-to-maturity securities is they generally remain low-risk investments. They have locked returns if the bond issuer doesn’t default on the loan.

The predictability of those returns allows the company to plan for the future.

The second benefit is the low volatility associated with the market. Since the held-to-maturity securities list on the balance sheet at a fixed price, the market’s ups and downs will not affect those securities’ value.

Since bonds have a fixed coupon rate and maturity date, fixing that bond’s price on the balance sheet smooths out those long-term returns. Remember that the interest earned from the coupons post on the income statement as a part of the net investment income.

The third pro for held-to-maturity securities is the diversification they offer companies. Investors can plan their portfolios around the returns from held-to-maturity securities.

The low-beta securities offer diversification away from the volatility associated with equities or other available-for-sale securities.

Most held-to-maturity securities are debt instruments, particularly bonds that offer lower beta or volatility investing in stocks. When a company holds a longer maturity Treasury bond or corporate bond, the return is known, allowing it to step out more and invest in riskier investments.

Some of these choices will depend on the business’s nature and its investment portfolio goals.

Some businesses, such as property-casualty insurance firms, use available-for-sale securities because the shorter nature of those insurance premiums lends itself to turning over quicker.

A life insurer might hold longer-term securities to match the longer nature of life insurance premiums, as life insurers refer to long-tail insurers and property-casualty insurers are short-term.

There are two main cons to holding to-maturity securities:

- Limited liquidity

- Limited upside potential

When a company invests in held-to-maturity security, it is tying up those funds in an investment that limits its ability to use them for another reason.

A few situations allow the company to liquidate or sell its held-to-maturity securities. But for the most part, those funds are there until maturity. And if a situation comes up that affords another better opportunity, these particular funds are not available.

If the company does a poor job of planning, it could limit itself by investing in these securities and accounting for them as a held-to-maturity security. Of course, they can and do invest in bonds, but many companies list them as available for sale securities, which gives them more flexibility.

The second con of holding securities to maturity is the risk of default. While Treasuries have never defaulted, there are occasions when corporate bonds default.

If a company invests in riskier bonds, it could set itself up for the risk of default.

And one of the pros of holding securities to maturity is securing stable income and decreased volatility.

The final con is the loss of higher gains in the case of better opportunities. When a company ties up its monies held to maturity securities, it opens itself to the cost of lost opportunities.

Remember that held-to-maturity securities returns are a done deal. And they don’t allow the company to exploit favorable market conditions.

Examples of Held-to-Maturity Securities

A great example is the Treasury 10-year note, backed by the U.S. government’s full faith and one of the safest investments anyone can make.

The 10-year bond pays a fixed-rate return. For example, the current 10-year rate is 3.57%, and the 30-year rate is 3.78%.

Depending on what kind of maturity you are looking for, companies have different rates from which to choose. But along with those kinds of rates, we also have corporate rates to choose from.

The credit rating of those individual bonds offers slightly better returns, with approximately the same risk level.

For example, Microsoft offered a recent bond of 3.30%, which will mature in 2029, and Microsoft is one of the few companies with a AAA rating, higher than the U.S. government.

Let’s say that Apple wants to invest in a bond offering listing at $1,000 for a 10-year bond and to hold it until maturity. If the bond pays a coupon of 3.30%, then each year, Apple will receive that 3.30%, and ten years later, Apple will receive its $1,000 back from the bond’s face value.

Whether interest rates rise or fall, Apple will receive 3.30% each year over the next ten years or 3.30% in interest income.

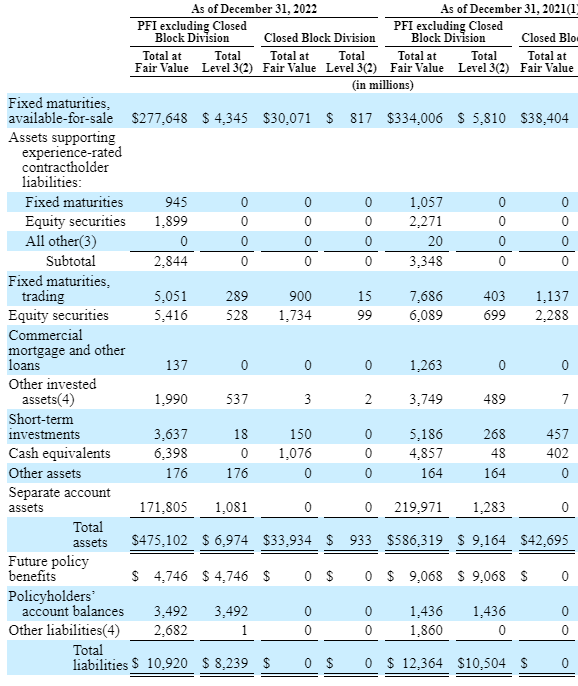

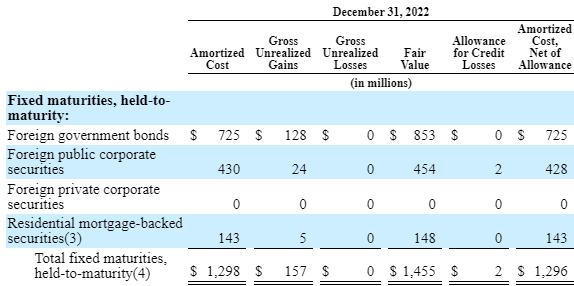

As we investigate the above screenshot, Prudential uses foreign government bonds and other corporate securities at amortized costs.

Prudential purchased those securities at a fixed cost of $1,298 million, which has grown to a fair value of $1,455 million.

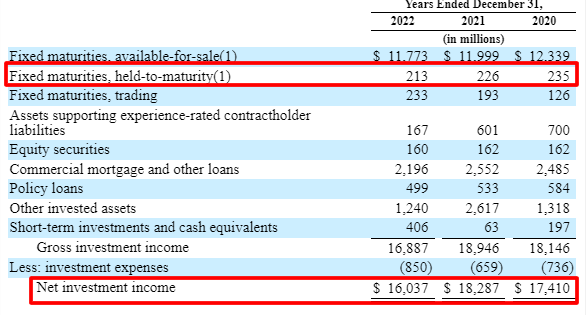

And if we look next at the net investment income, a line item listing on the income statement. The net investment income combines interest income, dividends, and other income.

The above screenshot shows that Prudential earned $213 million from its held-to-maturity securities, 1.3% of its net investment income.

Granted, the percentage is not much in the grand scheme of things, but the investment does allow the company to risk a small portion of its investment portfolio to equity securities.

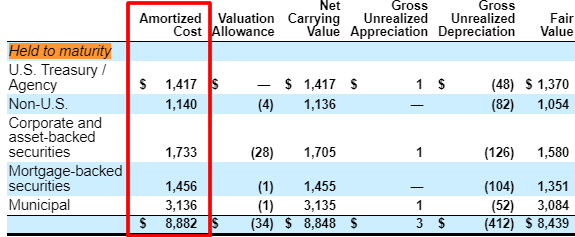

Looking at another insurer, Chubb (CB), we see a different breakdown of the held-to-maturity securities.

Looking at Chubb’s investment notes allows us to see the breakdown of its investment portfolio.

The above screenshot from Chubb’s held-to-maturity section shows that the company holds many securities in various vehicles.

- U.S Treasuries

- Municipals

- Corporate bonds

- Mortgage-backed securities

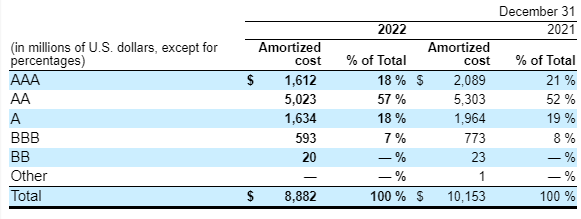

Another little nugget from the Investment note sections of Chubb’s latest 10-q noted above for our investigation.

The chart notates the breakdown of its held-to-maturity securities bond credit ratings. The great part of the little breakout is most of the portfolio is in strong credit-rated bonds. All of which lends itself to stability, albeit lower returns.

Investor Takeaways

Held-to-maturity securities are part of the bundle, including all marketable securities. Each bucket has a part to play in the performance of the company.

Available-for-sale securities typically hold a larger portion of most companies’ investment portfolios, with equity positions a smaller portion, with the exceptions of large equity portfolios such as Berkshire Hathaway and Markel.

Most companies use their investment portfolios as a means of capturing returns while they wait for better opportunities. Therefore, most of their investments are short-term in nature.

But there are cases where a company might want to hedge against inflation or stabilize its equity portfolio with safer, long-term investments.

Which is where the held-to-maturity classification comes into play. Using the accounting definition to apply to long-term investments, the company can avoid market volatility and plan on fixed returns from a portion of its portfolio.

As investors, we need to understand the classification because it concerns the returns a company earns on its assets. But the investments also limit a company’s liquidity, and if management is not planning ahead, it could tie up funds at lower returns.

That lack of liquidity could hurt the company in the long run as it may miss out on better investment opportunities.

One of the reasons for a complete understanding of each line item of a financial document and its ramifications is to help us understand what management is thinking and how it impacts the company.

With that, we will wrap up our discussion on held-to-maturity securities.

As always, thank you for taking the time to read today’s post, and I hope you find something of value on your investing journey.

If I can further assist, please don’t hesitate to reach out.

Until next time, take care and be safe out there,

Dave

Related posts:

- Types of For Sale Securities and Their Accounting Treatment (AFS/HTM/HFT) Have you wondered what all those assets on an insurance company’s balance sheet were? Or why do companies carry such a large balance of marketable...

- Types of For Sale Securities and Their Accounting Treatment (AFS/HTM/HFT) Updated 12/19/2023 Have you wondered what all those assets on an insurance company’s balance sheet were? Or why do companies carry such a large mix...

- Marketable Securities In-Depth Guide: What They Are, Valuation, and Impact Updated 3/30/2023 Have you ever seen that line item on the balance sheet listed as marketable securities and wondered what they were? I know I...

- Held for Trading HFT/AFS Securities – Company Investment Portfolios [Guide] Updated 3/30/2023 Ever wonder why Warren Buffett buys all those stocks and what the goal is behind them? Also, why does he mention valuing Berkshire...