Updated: 5/22/2023

Invested capital is one of the main components of the popular Return on Invested Capital, or ROIC, metric.

There are two main ways to calculate Invested Capital:

- Operating Approach

- Financing Approach

I will show you the EXACT line items to use for each approach. Unbelievably, you can’t find this information anywhere on the internet.

In this post, we will discuss:

- The Invested Capital Formulas: Operating and Financing

- How to Calculate Invested Capital [Operating Approach]

- How to Calculate Invested Capital [Financing Approach]

- Line-by-Line: $MSFT Invested Capital [Operating Approach]

- Line-by-Line: $MSFT Invested Capital [Financing Approach]

- Invested Capital Q&A: Financing Approach

It turns out that ROIC and Invested Capital is one of the most disagreed upon metrics in finance…

The Invested Capital Formulas: Operating and Financing

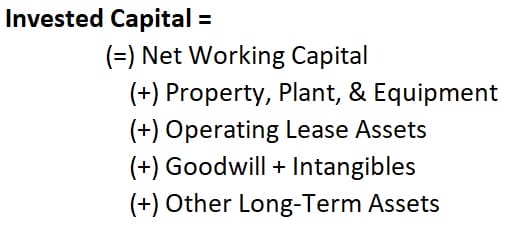

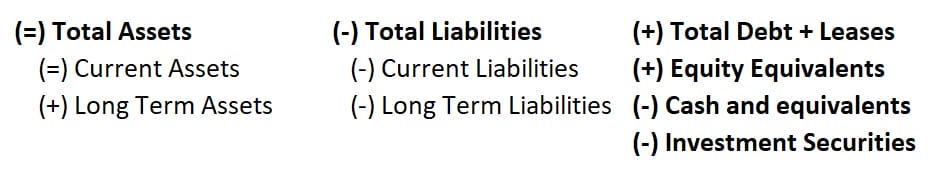

In the Operating Approach to calculating Invested Capital, investors will look mostly at the Assets side of the Balance Sheet.

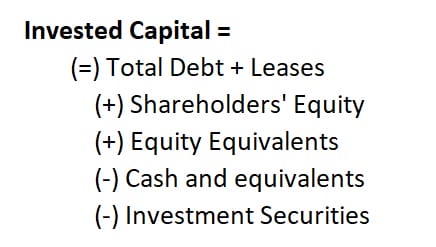

In the Financing Approach, investors will look mostly at the Liabilities side.

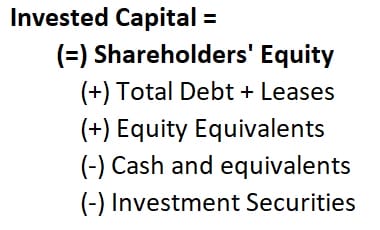

Invested Capital (Operating)

Invested Capital (Financing)

We can use several resources online to validate these formulas.

Then, we will go through each component, line-by-line, and use them to calculate Invested Capital for Microsoft ($MSFT), Apple ($AAPL), Google ($GOOG), Amazon ($AMZN), and ($TSLA).

How to Calculate Invested Capital [Operating Approach]

Michael Mauboussin of Morgan Stanley is a very highly respected thought leader in finance and Return on Invested Capital. He most recently updated his work on ROIC on October 6, 2022 with Dan Callahan, CFA, to account for intangibles and other common issues.

In Mauboussin’s latest report, he outlines the Operating Approach for calculating Invested Capital in the following way:

Invested Capital

=

Current assets – Non-interest-bearing current liabilities + Net PPE +

Acquired intangibles + Goodwill + Other

Note that in his example in the paper, Microsoft, Mauboussin includes Operating Lease Assets as part of “Other” and also adjusts Cash and Equivalents to only include cash needed to run the operations.

How to Calculate Invested Capital [Financing Approach]

The Corporate Financial Institute is a popular organization in finance training and certification. They have a great website with free articles about financials, models, and accounting.

In their knowledge resources article on Invested Capital, CFI writes the following formula for the Financing Approach:

Invested Capital

=

Total Debt & Leases + Total Equity & Equity Equivalents

+ Non-Operating Cash & Investments

This is pretty similar to other displayed formulas online, though CFI does not apply the formula on a real-life company for an example.

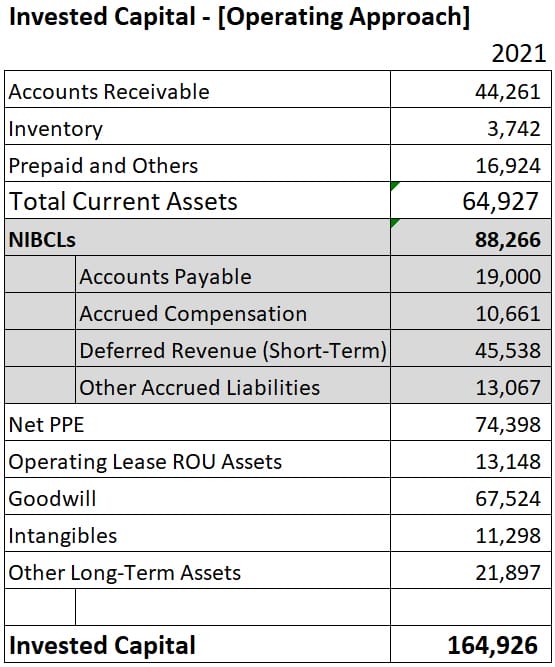

Line-by-Line: $MSFT Invested Capital [Operating Approach]

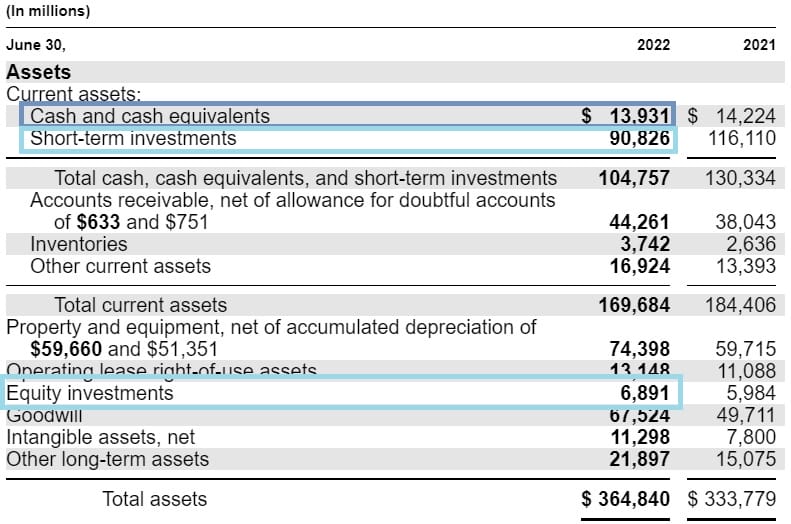

Next I will use a version of our ROIC Calculator Spreadsheet on Microsoft’s latest financials. You can follow along at home by using the 2022 10-K for Microsoft filed on 07/28/2022.

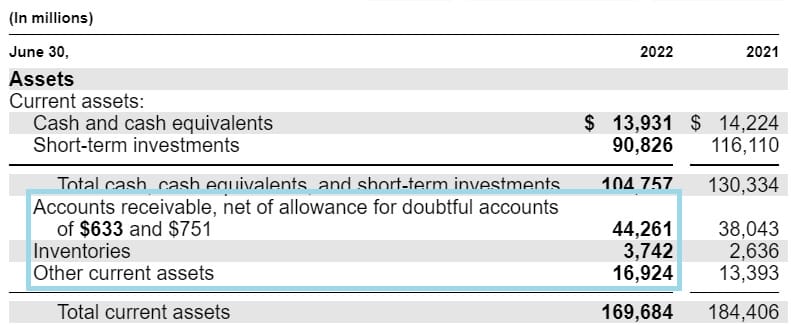

We first want to calculate Total Current Assets excluding cash and equivalents and tax-related assets.

In this case, Accounts Receivable, Inventory, and Other current assets are all segregated from the Current Assets on Microsoft’s 10-k.

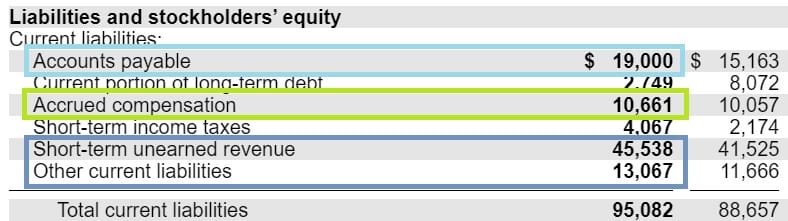

Next we want NIBCLs, or Non-Interest Bearing Current Liabilities. These should exclude the current liabilities associated with debt and any tax-related liabilities.

Keep in mind that Deferred Revenue and unearned revenue are essentially the same thing. The key here is that you want short-term deferred revenue/unearned revenue; that which the company has collected cash for but will book as revenue in the next 12 months or less.

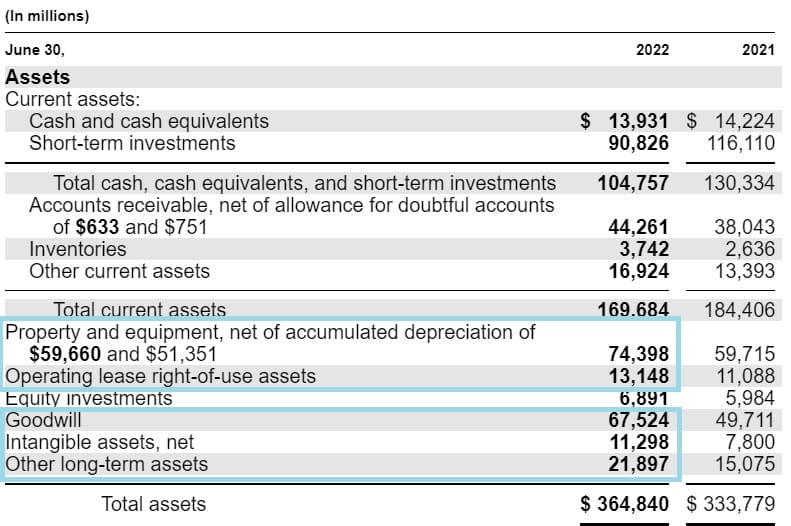

Next, we want the Long Term Assets which are necessary to operate the business.

This means that again, tax-related assets are excluded because they don’t relate to the actual operations of the business.

We also don’t want any investment securities, like Microsoft’s Equity investments here. Those are more of a store of wealth than a long term asset used to generate (operating) cash flows in the business.

You don’t necessarily have to remember every line-item that is used, since we’ve calculated them for you.

In summary, here are the balance sheet line-items to care about:

- Current Assets

- Accounts receivable

- Inventory

- Prepaid and others

- NIBCLs: Non-interest bearing current liabilities

- Accounts Payable

- Accrued Compensation

- Deferred Revenue (Short-Term)

- Other Accrued Liabilities

- Long Term Assets

- Net Property, Plant, & Equipment

- Operating Lease ROU Assets

- Goodwill

- Intangibles

- Other Long-Term Assets

The Invested Capital formula, at this point and with these line-items, is simply:

Using the line items above:

Current Assets – NIBCLs + Long Term Assets

Invested Capital Q&A: Operating Approach

Q: Why are Operating Lease ROU Assets Included?

These are included to keep ROIC consistent whether a company decides to “buy or rent” a new property.

When a company opens new stores and purchases them instead of leases them, that cash gets deducted through Capital Expenditures. If a company were to open a new store and lease it, that cash gets deducted from Cash From Operations (often through working capital).

When expanding through purchase, the cash spent on capital expenditures converts to a long term asset (Plant, Property, and Equipment). It is depreciated over time.

With the now required Operating Lease ROU Assets on the balance sheet, companies expanding through leasing the property now also see an increase to long term assets (Operating Lease ROU). It is “depreciated” through lease expense on the Income Statement.

Q: Why are NIBCLs included; if they reduce Invested Capital, which pushes up ROIC, shouldn’t less be better?

It’s true that the more NIBCLs a company has, the better their ROIC.

But short term (current) liabilities are created from expenses in the Income Statement. Take Accounts Payable as an example. A company that expenses a cost but has not paid cash for it yet, will deduct the cost from revenues in the Income Statement but keep cash the same on the Balance Sheet. Instead of subtracting cash, it adds the (Current Liability) Accounts Payable.

So though NIBCLs reduce Invested Capital and push up ROIC, they also reduce Operating Income, which reduces NOPAT for ROIC and pushes down ROIC. It generally balances out.

The same logic can be applied to other NIBCLs like short-term deferred revenue and accrued compensation.

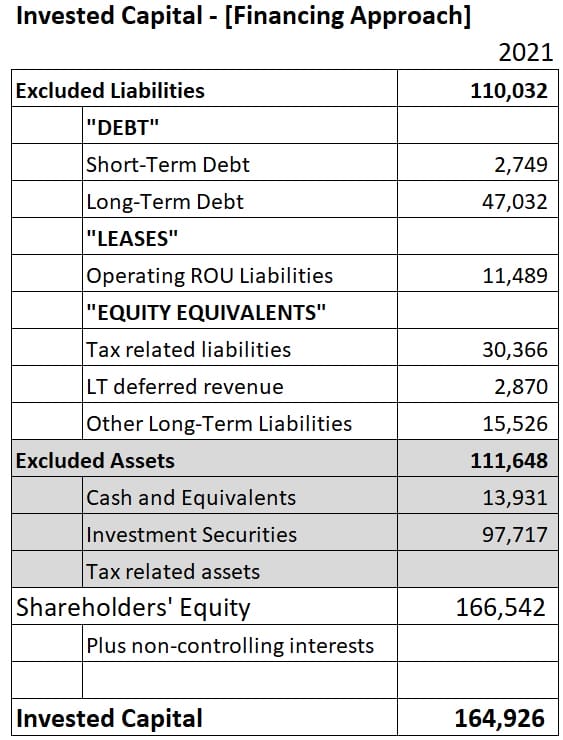

Line-by-Line: $MSFT Invested Capital [Financing Approach]

Next I will use another version of our ROIC Calculator Spreadsheet, this time using the Financing Approach to calculating Invested Capital.

Here things seem a bit more complex, because EVERYONE is thinking about it the WRONG way.

Calculating Invested Capital using Financing is not so much about looking at how a company is financed, such as through debt, but rather what the formula is excluding.

In simplest terms, it starts at Shareholders’ Equity and excludes special items. More on that later.

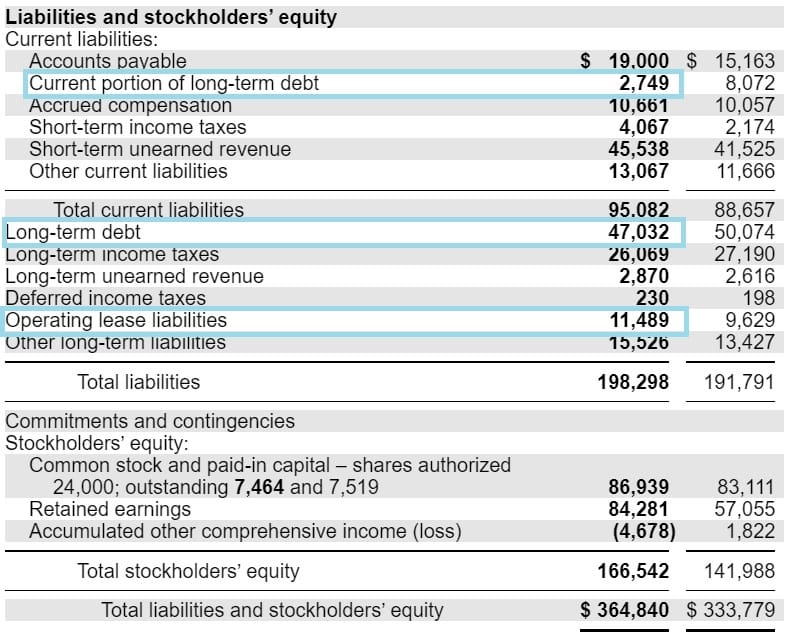

Starting on the Liabilities side of the Balance Sheet, take any line items that refer to Debt and Leases and input them into the spreadsheet, under the Excluded Liabilities tab.

These figures get added back to Shareholders’ Equity, which effectively excludes them.

Next, we take all Equity Equivalents.

Mauboussin defined this nicely in his paper by describing them as other long-term liabilities which “include deferred taxes, underfunded pension funds, and unearned revenue.”

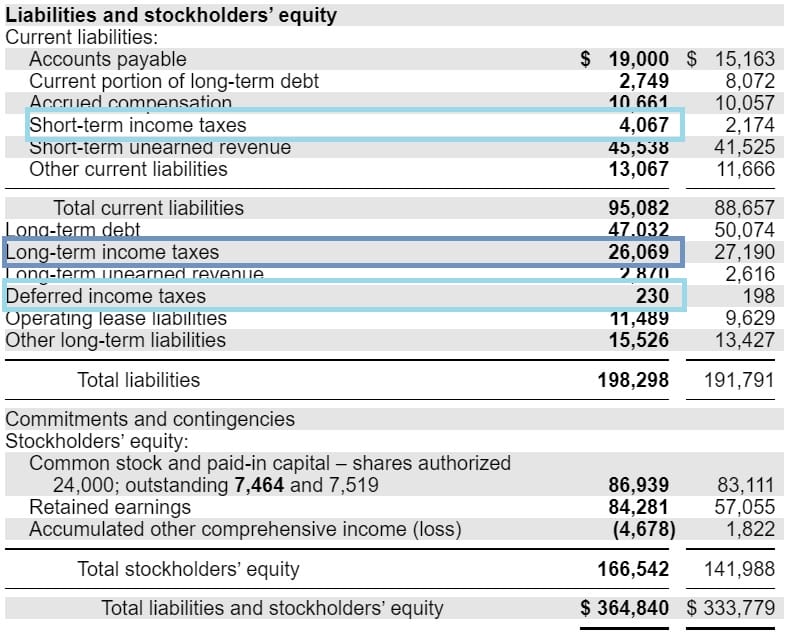

First, let’s focus on the tax-related liabilities first. Where my thinking differs from Mauboussin’s slightly is that I believe Short-term taxes (under Current Liabilities) should be included as one of Equity Equivalents. This, because ROIC uses NOPAT, which starts from EBIT (and is before taxes).

I could be misinterpreting Mauboussin, but his example on Microsoft suggests he includes Short-term tax payables in the Invested Capital formula.

So we will input all Tax related liabilities, to be added to Shareholders’ Equity and thus effectively excluded from Invested Capital.

Adding all three of these line items, we get 4,067 + 26,069 + 230 = $30,366.

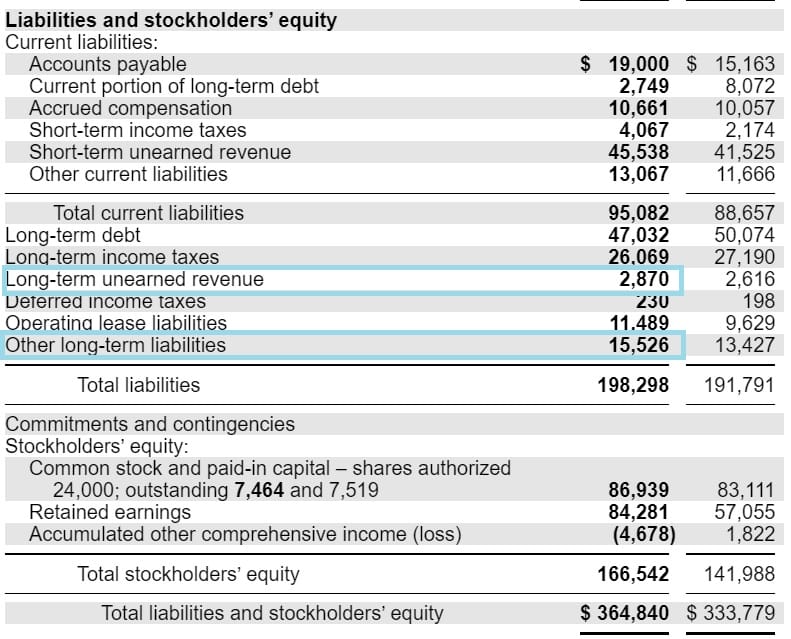

Now for the other two Equity Equivalents, which include the long term deferred revenue and other long-term liabilities:

Going back to the assets side, we want to exclude assets such as Cash and equivalents, Investment Securities, and any tax-related assets. We do this by subtracting these from Shareholders’ Equity, which effectively excludes them from the Invested Capital formula.

Cash and cash equivalents was $13,931 million.

Microsoft has two types of securities on its balance sheet, Short-term investments and Equity investments. We will sum these to get $97,717 for the Investment Securities line item.

Finally, we take the company’s shareholders’ equity for the year, which was $166,542.

Adding Excluded Liabilities and Subtracting Excluded Assets to Shareholders’ Equity, we get an Invested Capital of $164,926, which matches the $164,926 calculated for Invested Capital using the Operating Approach.

In summary, use the following line-items to calculate Invested Capital with the Financing Approach:

- Excluded Liabilities

- “DEBT”

- Short-Term Debt

- Long-Term Debt

- “LEASES”

- Operating ROU Liabilities

- “EQUITY EQUIVALENTS”

- Tax related liabilities

- LT deferred revenue

- Other Long-Term Liabilities

- “DEBT”

- Excluded Assets

- Cash and Equivalents

- Investment Securities

- Tax related assets

- Shareholders’ Equity

- Plus non-controlling interests, if any

Once you’ve determined these line items, the Invested Capital formula, with these line-items is:

Using the line items above:

Shareholders’ Equity + Excluded Liabilities – Excluded Assets

Invested Capital Q&A: Financing Approach

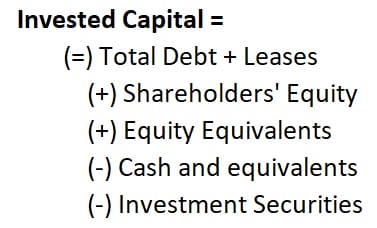

Q: Why did you present the Financing Approach this way?

I used the words “excluded” a lot, because I’m trying to make a point.

The way that calculating Invested Capital with the Financing Approach is being taught today completely misrepresents what an investor is really calculating. Like I said, it’s not what you are calculating, but rather what you are not.

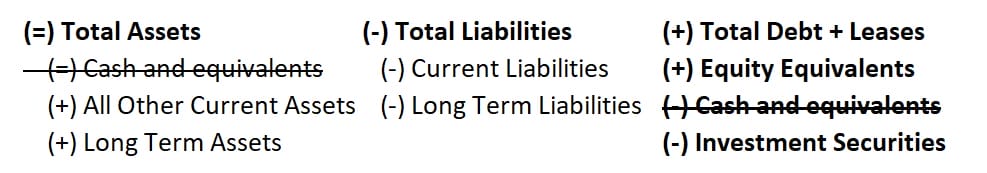

I understand how the formula is taught today. Let’s start there and then make some adjustments.

The Invested Capital formula is thought mostly as you see on the left. I propose thinking of it as starting with Shareholders’ Equity first. It’s the same formula, just rearranged slightly.

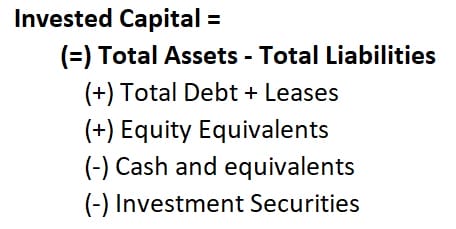

Ok, now think about what Shareholders’ Equity means. It’s really just Total Assets minus Total Liabilities.

Shareholders’ Equity = Total Assets – Total Liabilities

If we can all agree on that as the case, then you can write the formula to be like this:

Which you can then rewrite as this:

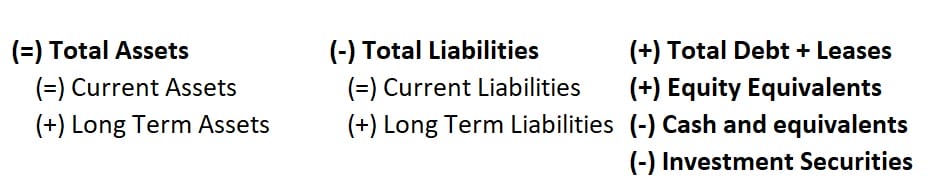

I’ve just re-written the formula to describe what is inside Total Assets and Total Liabilities. Both have current (assets or liabilities) and long term (assets or liabilities).

Or more correctly, to assign the correct minus signs underneath Total Liabilities:

Now for the fun part.

What is really inside of something like Current Assets? Well you have things like Accounts Payable and Cash+equivalents. We could further describe Current Assets as Cash and Equivalents plus All Other Current Assets, like so:

Notice what happens now inside the formula. Cash and equivalents cancels out, because it is a minus sign in the Invested Capital formula, and we’re subtracting it from a component of Shareholders’ Equity.

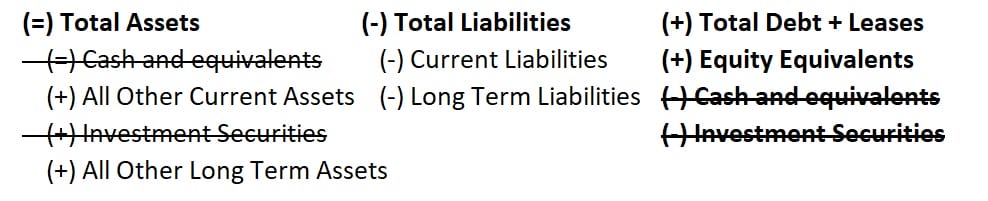

We can also do the same with Investment Securities, knowing it is a part of Long Term Assets (and maybe also other current assets, depending on the company):

We’ve really given ourselves a formula to look at all of the Total Assets excluding Cash and equivalents and securities.

That makes sense.

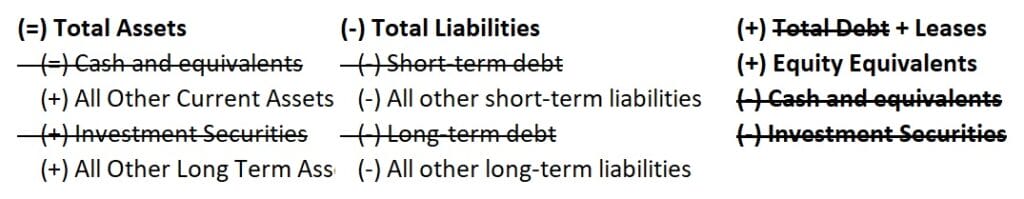

What people lose is that IT’S THE EXACT SAME THING on the Liabilities side (with Total Debt + Leases and Equity Equivalents).

Look what happens when we further describe Current Liabilities and Long Term Liabilities by thinking of the debt line items inside.

Because Total Debt + Leases is added to Shareholders’ Equity for Invested Capital, it cancels out (or excludes) the Debt line-items for the company which are automatically embedded in Shareholders’ Equity.

So it is not that the Financing approach wants to look at a company’s financing and how much debt they have taken out; it’s about excluding the debt from the formula, as well as the leases, equity equivalents, cash and equivalents, and investment securities.

Investor Takeaway: The Bottom Line

I hope you can use these formulas in your search for companies that compound capital at a superior rate.

ROIC and Invested Capital are interesting metrics, especially because everyone seems to calculate it differently. A quick search will return many different ROIC estimates for any given company.

Maybe this post can one day change the way Invested Capital is thought about.

If you’d like to “check your work,” here’s the Invested Capital formula applied to a few other companies, by Fiscal Year:

- Apple ($AAPL): Invested Capital = $50,618 million for FY21

- Alphabet ($GOOG): Invested Capital = $124,374 million for FY21

- Amazon ($AMZN): Invested Capital = $182,234 million for FY21

- Tesla ($TSLA): Invested Capital = $26,308 million for FY21

There are many great resources out there about ROIC. I couldn’t possibly list them all. I would recommend checking those out as well, especially the ones I referenced for this post:

- Counterpoint Global Insights: Return on Invested Capital

- Corporate Finance Institute: Invested Capital

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- ROIC vs ROCE: When to Use One Over the Other [Pros & Cons] Updated 8/25/2023 ROIC (Return on Invested Capital) and ROCE (Return on Capital Employed) are formulas describing how efficiently a company invests its capital. The difference...

- How to Calculate Invested Capital for ROIC (the right way) Do you know how to calculate Invested Capital the right way? Did you know there are two different equations for the same Invested Capital formula,...

- ROIC Analysis: Value Destruction From Growth and Other Pitfalls Something that might shock the average investor is that growth can actually lead to value destruction for a company, depending on how a company is...

- WACC vs. ROIC: Is Shareholder Value Being Created or Destroyed? Measuring a business’s economic moat is a challenge, but a comparison using several metrics allows us to get an economic moat idea. That comparison is...