Do you know how to calculate Invested Capital the right way? Did you know there are two different equations for the same Invested Capital formula, and they mean two different things?

I’ve seen the words Invested Capital tossed around lightly many times online, and while the intentions are good, the execution is not.

When Invested Capital is being referenced, it could mean two things:

- Operating Invested Capital

- Invested Capital for equity holders (investors)

As investors who are trying to use ROIC to find good investments, you might think that we’d want to use #2. But that’s not the case– if you’re trying to use ROIC to find a great business model.

ROIC is often used to help identify businesses who have a very high cash flowing, or efficient, core business. In other words, great operations.

Because like Warren Buffett once said,

“I try to invest in businesses that are so wonderful that an idiot can run them. Because sooner or later, one will.”

–Warren Buffett

We have to understand that there are several distinct parts of a great business:

- Great capital allocations (CEO)

- Great financing decisions (CFO)

- Great operations (COO)

Let’s dive into all 3, because they are each critical but distinct. Each is important to understanding how to calculate Invested Capital properly, and instinctively know which is best to use.

This works really well for evaluating businesses as stock picks, by the way.

#1 – Great Capital Allocating (CEO)

This is where Warren Buffett made his bread and butter. Remember that a company can do 5 things with its cash flows:

- Pay a dividend

- Buyback shares

- Reinvest in the business

- Payoff debt

- Make an acquisition

A company who has a CEO who is good at the above will probably grow very efficiently, which is where you get into the WACC vs ROIC discussions.

WACC vs ROIC

If a business has a higher WACC than ROIC, it will destroy itself over time. If its ROIC is higher than its WACC, then it will create value over time.

Take an extreme example of a company with a WACC of 10% and ROIC on new projects at 2%. Well, if a CEO continues to borrow money at 10% to reinvest it in a new project to make 2%, that’s going to fail in enough due time.

But notice the careful choice of words here. That’s an ROIC on a new project, which implies operating ROIC and not ROIC like is often quoted among investors.

Here’s another example.

Say that the CEO can earn a 2% ROI on the company’s profits by making an expensive acquisition. Well, compare the WACC to the ROI, and obviously borrowing at 10% (or issuing shares) to make an ROI of 2% still doesn’t make sense.

It doesn’t matter whether we’re talking about ROI or ROIC; it’s not the name of those metrics that are important, but what you’re using them to measure and why!!

#2—Great Financing Decisions (CFO)

I like the examples I made above, because we can simply apply them again to make this point. Understand that the CFO can make a similar capital allocation as the CEO, but only in his own financial realm, in general.

So a CFO might make a decision on whether to refinance a loan, at a lower cost of debt, and this can create a positive ROI.

Similar to evaluating how a management allocates company profits, an investor might use Invested Capital and ROIC for finance-related decisions. But again, this might be calculated with ROIC; but it does not mean the same thing as great ROIC of an effective core business.

#3 – Great Operations (COO)

Here’s where ROIC comes into play in finding a great core, or operating, business.

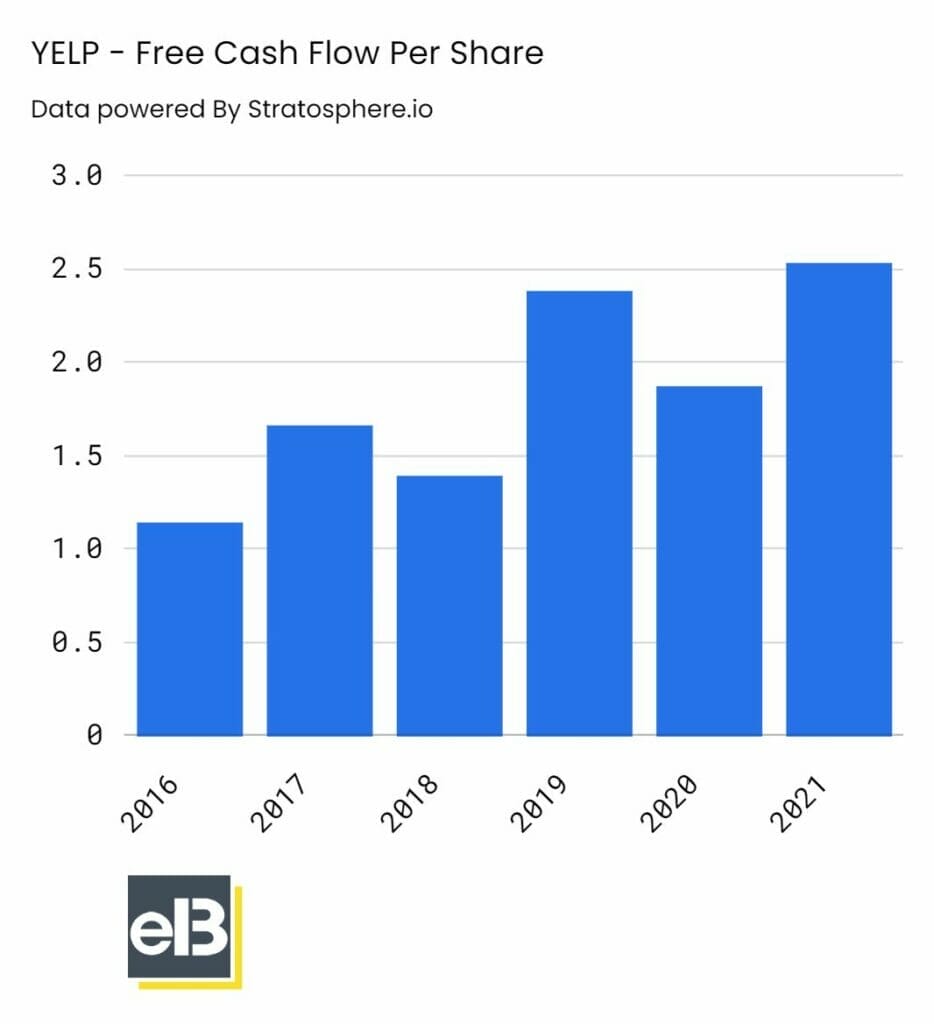

Example: Yelp has been a cash flow generating machine. As a software company with a large, established base of users (creating the network effect), it takes little cash to run the business. Here’s their latest Free Cash Flow Per Share over the last 6 years, from stratosphere.io:

But, the stock has been crushed:

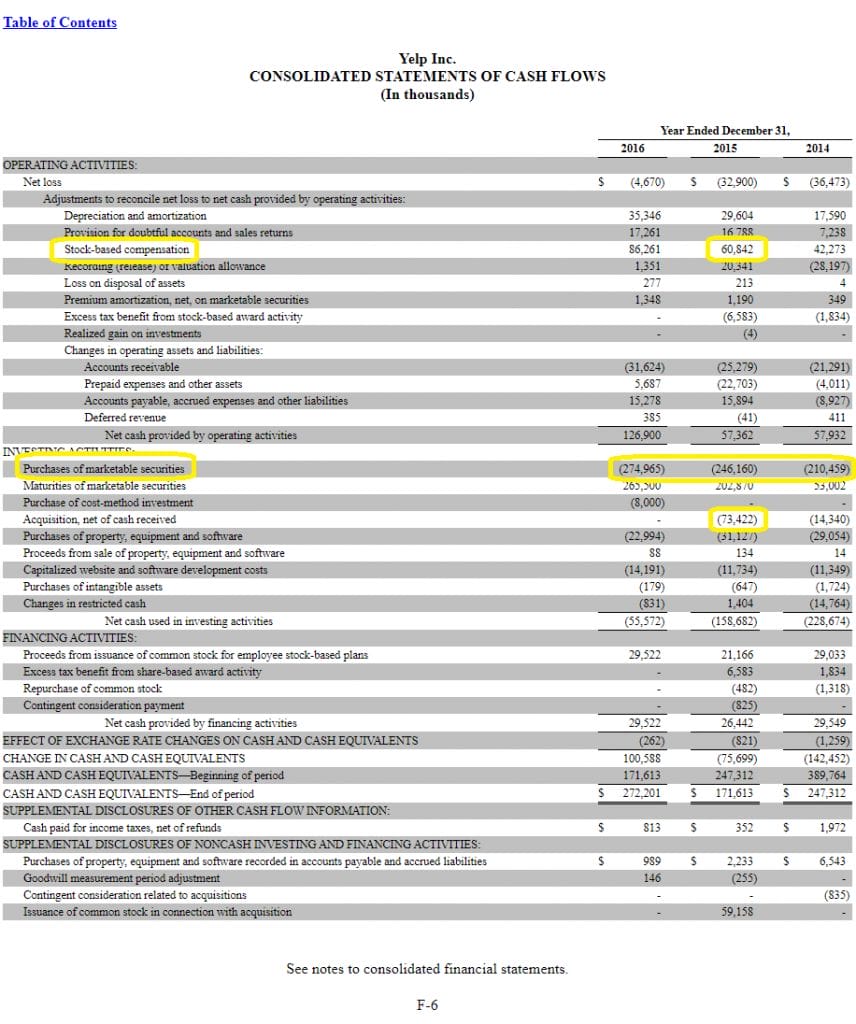

Let’s sniff out what went on in their cash flow statement in those years leading up to the poor (flat) price performance.

Well for one, they bought (and sold) a ton of marketable securities, at least $200 million worth per year. Who are these guys, day traders?

Stock compensation seems pretty high, which shouldn’t have been a problem as long as shareholders are happy, right? Oh.

They started to make a splash with acquisitions, but how did all of this free cash flow turn into earnings (and returns) for shareholders?

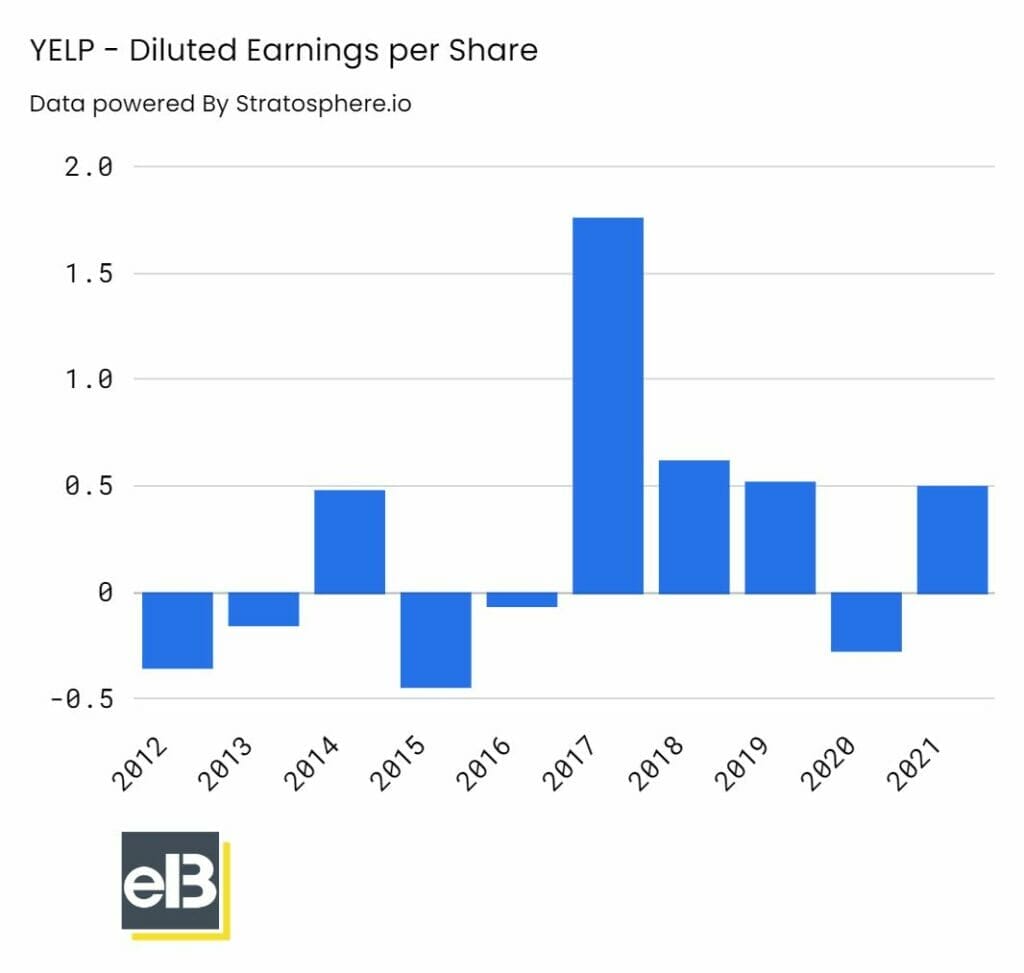

Oh.

That’s far from a nice, slow and steady growth trend that investors like to see.

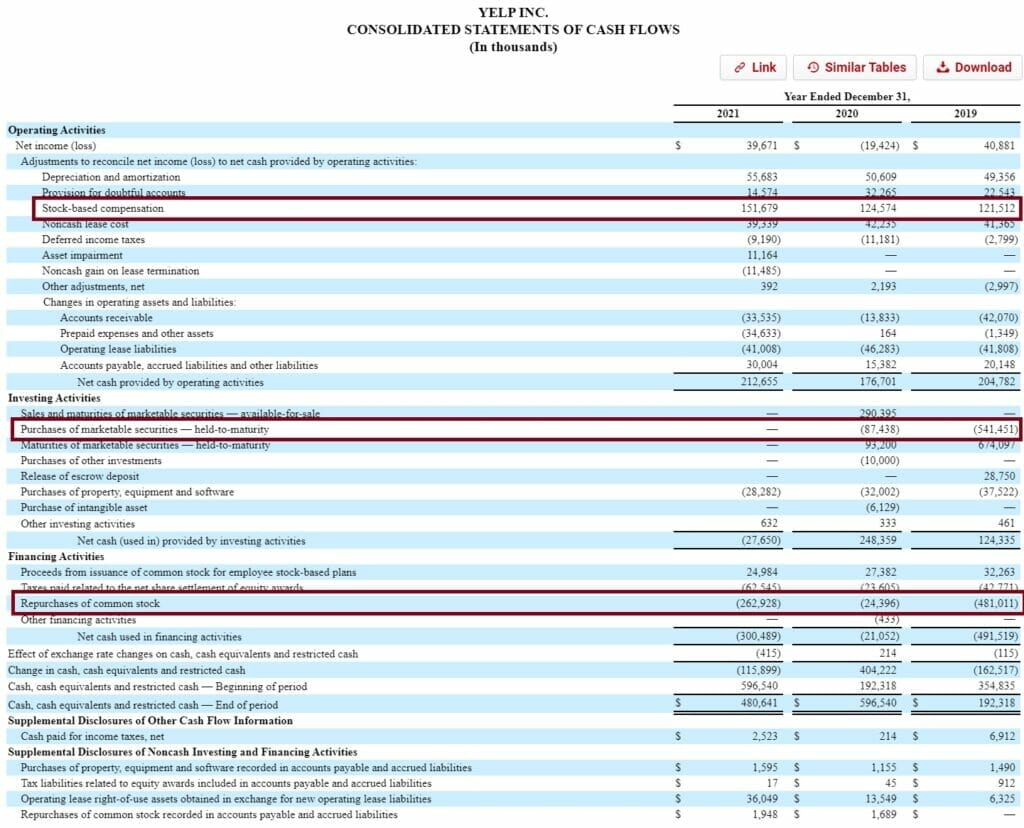

How about a look at what they’ve been doing lately?

Interestingly, they’re buying back a massive amount of shares, and still buying a significant amount of marketable securities, but aren’t paying a dividend. We’ll see how that plays out.

Yelp and Invested Capital / ROIC

Depending on which ROIC measurement you use for this company, you can make their business look really attractive, or really not.

From the calculation by quickfs.net, which seems to be taking an ROIC from the equity perspective, the ROIC has been mediocre (oftentimes below 5%).

However, looking at just its core operating business tells a different story. The company has 90%+ gross margins, we’d see a huge ROIC which signals: excellent business, questionable management.

So let’s calculate Invested Capital for operating ROIC as explained by McKinsey and Company in Valuation: Measuring and Managing the Value of Companies.

“To analyze a company, we begin by reorganizing its accounting statements to estimate ROIC, free cash flow, and economic profit. We do this reorganization so that ROIC and economic profit reflect more of an economic than accounting view of the company. For example, we need to distinguish operating from non-operating assets. We need to determine how various reserves and provisions affect operating capital and operating profits.”

That might seem like a lot to take in, but every single word has immense meaning.

Read it over and over again if you can.

Basically, we want operating results because the balance sheet gets clogged with lots of extra stuff. For example, various tax items have nothing to do with the core business. A company can delay paying taxes, or get tax credits from previous losses, and those become deferred tax assets or liabilities.

Operating invested capital = operating working capital + net PPE + net other (long term) assets

To get to operating working capital, you basically want take current assets and subtract current liabilities (excluding any debt). Similar with net other assets, take other assets and subtract other long-term liabilities but not long term debt.

Remember not to include assets like deferred tax or goodwill; they aren’t core to the operating portion of the business. The exception to the rule would be if a company’s growth strategy is mainly derived from M&A, in that case include goodwill; see this great report by Michael Mauboussin for more on that.

I highly recommend you get one of these valuation textbooks like McKinsey’s and work out an example with a piece of paper and pen for yourself. See if you can calculate Invested Capital for the operating part of the business without any help. Only then can you say you understand it (trust me, it took a lot of hair pulling for me to get it right, but maybe I explained it simply enough for you).

And then try it out on other businesses, calculating Invested Capital but only from the operating side. Let’s go back to Yelp and do that now.

How to Calculate (Operating) Invested Capital for Yelp

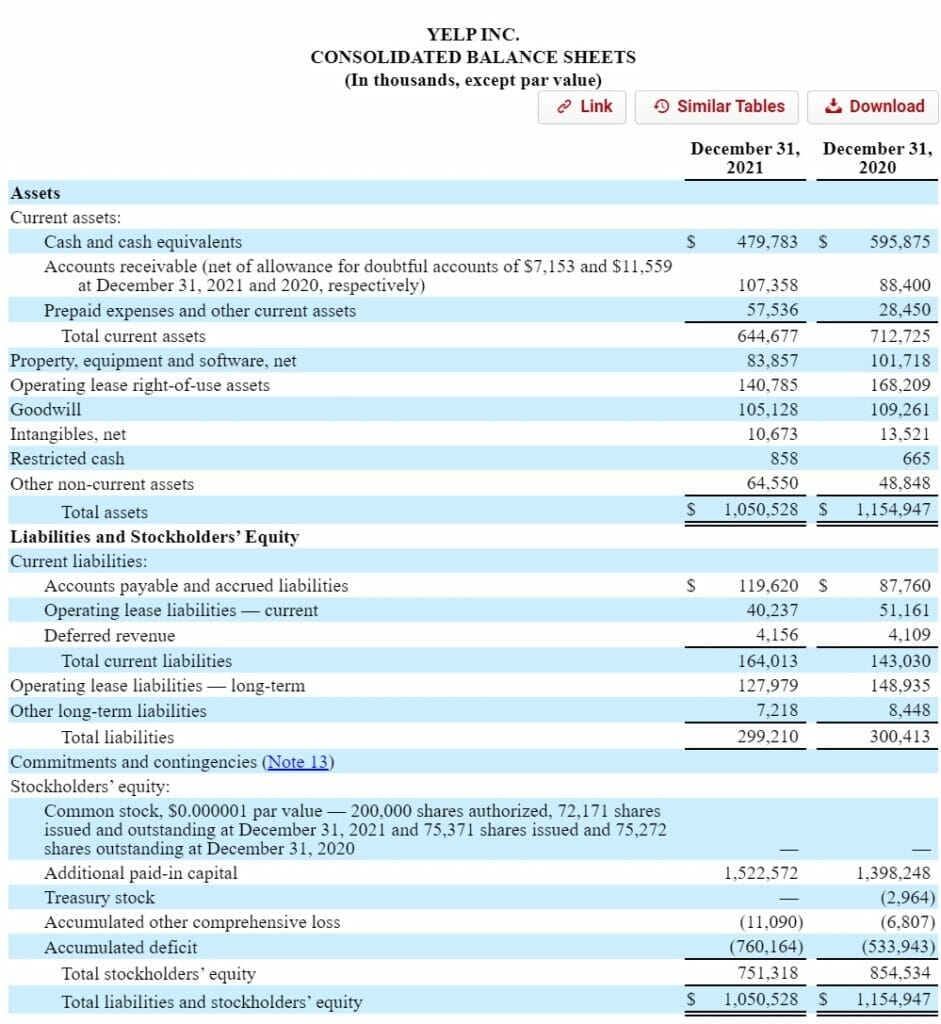

I’ll explain how to calculate Invested Capital using a screenshot of $YELP’s balance sheet, with each line item needed explained in the bullets below.

For the assets, we will be considering the following:

- Current assets

- Accounts receivable = $107,358

- Other current assets = $57,536

- PPE (net)

- Property, equipment and software, net = $83,857

- Long term (other) assets

- Goodwill = $105,128

- Intangibles, net = $10,673

- Other non-current assets = $64,550

Assets summed for operating Invested Capital = $429,102

Remember, assets such as marketable securities do not get included in Invested Capital for this calculation since they aren’t needed to run the business.

Use common sense with these things, and don’t think of it like a strict formula (like cooking with a recipe at home).

Now for the liabilities we will subtract, which will be liabilities needed for the operating of the core business, and other long term liabilities for the core business:

- Current liabilities

- Accounts payable and accrued liabilities = $119,620

- Deferred revenue = $4,156

- Long term (other) liabilities

- Other long-term liabilities = $7,218

Liabilities summed for operating Invested Capital = $130,994

So, Invested Capital = $429,102 – $130,994 = $298,108

In general, if the operating ROIC is much higher than the ROIC for equity owners (see this great post by Cameron Smith on calculating company level ROIC), this could be a signal that management is wasting a lot of valuable cash flows away.

Investor Takeaway

Here’s the funny thing about businesses and the stock market.

Each company can provide a superior ROI for investors through any of the 3 ways– great capital allocation, great financial decisions, or great operations. And a company could do poorly in one of those 3 ways, and still make out to be a fantastic business.

What we need to make sure is that we understand the context behind metrics like ROIC and Invested Capital.

“When a management with a reputation for brilliance tackles a business with a reputation for bad economics, it is the reputation of the business that remains intact.”

–Warren Buffett

Do they mean ROIC in the sense that the company creates great earnings from superior capital allocation (like Warren Buffett)?

Or do they mean ROIC in the sense that the company’s core business just churns out cash flows (like Chipotle)?

That’s why you need to know that there are two ways to define Invested Capital and two ways to calculate Invested Capital.

Ignoring poor capital allocation on a company with a great core operating business can work out disastrously. It can lead to large wasting of cash flows. At the same time, the best capital allocator in the world can’t grow a business with a broken business model. So a great operating business is paramount too.

If you need more help calculating ROIC, and want a spreadsheet that does it for you, check out our product The Little Package of Valuation.

Andrew Sather

Andrew has always believed that average investors have so much potential to build wealth, through the power of patience, a long-term mindset, and compound interest.

Related posts:

- WACC vs. ROIC: Is Shareholder Value Being Created or Destroyed? Measuring a business’s economic moat is a challenge, but a comparison using several metrics allows us to get an economic moat idea. That comparison is...

- ROIC vs ROCE: When to Use One Over the Other [Pros & Cons] Updated 8/25/2023 ROIC (Return on Invested Capital) and ROCE (Return on Capital Employed) are formulas describing how efficiently a company invests its capital. The difference...

- Invested Capital Formula: The Exact Balance Sheet Line Items to Use Updated: 5/22/2023 Invested capital is one of the main components of the popular Return on Invested Capital, or ROIC, metric. There are two main ways...

- ROIC Analysis: Value Destruction From Growth and Other Pitfalls Something that might shock the average investor is that growth can actually lead to value destruction for a company, depending on how a company is...