Similar, but in the complete opposite of my most recent blog about Phillip Fisher’s 15 Points to Look for in a Common Stock, Fisher also outlines a list of 10 “do nots” when it comes to an investor’s checklist between Chapters 8 & 9 in his extremely popular book, Common Stocks and Uncommon Profits.

I’ve gone through the two chapters and highlighted the key takeaways below. I highly encourage you that when you read this, try to apply it to your personal life and think about if you have ever done, or currently do, any of these things and try to reflect on how you can get out of these bad habits.

1 – Don’t Buy into Promotional Companies

If I was to say to describe a company as “no profit, growing sales, unproven track record, promising future”, would you know what company I was talking about?

Odds are, we can all think of at least one, if not many, of these so-called promotional companies that are all speculation and really haven’t proven anything at this point.

Fisher recommends staying away from these companies at all costs because you’re really only buying into a blueprint of the future. Nobody really knows what future challenges the company might encounter because everything is just too new.

When I was reading this section, I kept thinking about how sometimes the Shark Tank investors will not invest because things are just too unproven and early, and they’ll literally say, “it’s too early for me so I’m out”.

I view this as a very similar type of situation.

Another potential red flag that Fisher brings up is a lot of these promotional companies will have one or two really strong employees that flourish in certain aspects of the business but are very weak in others, and those strong personalities can be hesitant to relinquish control and will ultimately be a detriment to the company.

This is a major part that Fisher recommends leaving the investing in these promotional companies to groups or companies that have experience in investing in smaller companies because these promotional companies also need advice to get to their path to profitably. In other words – stay out!

2 – Don’t Ignore a Good Stock Just Because it is Traded “Over the Counter”

Fisher really goes pretty in depth on this topic and says that in today’s world, there is a major benefit to buying “over the counter” stocks to help increase your liquidity that you might not otherwise be able to realize.

He says that major changes have been made that bring a lot of credibility to the over the counter stocks, such as the SEC implementing procedures to prohibit market manipulation, and that today’s corporation is quite simply designed more as a long-term investment rather than to be traded in and out of.

In summary, Fisher really boils it down to two key take ways for this chapter:

- Be very sure that you have picked the right security

- Be sure you’ve selected an able and conscientious broker

3 – Don’t Buy a Stock Just because you Like the “Tone” of its Annual Report

When reading a company’s annual report, the “tone” of it is more likely to align with the philosophies, policies and goals of the company rather than reflecting on the actual performance of the company, and likely not including any sort of financial data to back it up.

More often than not, the tone is the company putting their best foot forward to reaffirm investor goodwill and generate more excitement about the company, but you need to beware as you’re likely only getting the most optimistic view of the business.

Fisher compares buying a stock based off the tone of the annual report to buying a product because you like their billboard advertising.

It’s flashy!

Don’t allow yourself to buy something that seems “flashy” on a whim – you need to do your research and confirm your opinions on that company. Impulse investing will likely never end up working out.

4 – Don’t Assume a High Price at which a Stock may be Selling in Relation to Its Earnings is Necessarily an Indication that Further Growth in Those Earnings has Largely Been Already Discounted in the Price

Fisher goes really in depth with an example about a couple of different companies here…one of which is priced at a P/E that is double the Dow Jones Industrial Average (DJIA) and the company issues a statement that earnings are expected to double, while the other is also priced at a P/E double the DJIA and will experience earnings jump due to continued innovation and new market growth.

It seems obvious, but the company with the continued innovation and the new market growth is the company that you would want to invest in, right?

He goes on to say that many people will discount the future earnings assuming that a company won’t continue their strong performance but if you view a company as having such a strong P/E because of the leadership and innovation of the company, sometimes those types of companies can be the biggest bargains as all as their P/E continues to climb.

5 – Don’t Quibble Over Eighths and Quarters

I think Andrew and Dave talk about this on the podcast a good amount, and I know that I do as well, but this point can really be summarized by saying the term “opportunity cost”.

Opportunity cost is simply the cost of not taking advantage of an opportunity.

So, in this point in the chapter, Fisher talks about how you shouldn’t worry about a stock dropping .5%, or you waiting to buy a stock that’s currently priced at $100 but you want it to be at $99.50.

If you like the company and the value is strong, buy it, because that $100 stock might never actually come down to $99.50.

Odds are that it will, simply based off the day-to-day fluctuations in the market, but sometimes it won’t, and the cost of you not buying 100 shares of that $100 stock will be $5000 if it gets to $150/share, $10,000 if it gets to $200/share, so on and so forth, all because you wanted to save $.50/share for a GRAND TOTAL of $50.

Obviously, this doesn’t mean to buy stocks that aren’t deemed a strong buy in your evaluations because the value isn’t quite there, but maybe keep an eye on them for when they start to get closer to the value that you had in mind and then pull the trigger on them.

At the end of the day, worrying over these extremely small fractions of percentages is not only worthless, but it can be extremely stressful, so don’t put yourself through it.

Just purchase the stock, if you think the value is there, and move forward with only evaluating it on an as-needed basis.

6 – Don’t Overstress Diversification

While diversification is extremely important, Fisher really hammers home the idea that you should never invest in a stock that you’re not knowledgeable about and you should have time to be able to stay up-to-date on the happenings of the company and the industry.

He says how there’s many different ways to be diversified, such as by the market cap, industry, cyclicality, amount of total portfolio invested in each company, and many other ways – but the #1 important factor is to know your investment.

Not knowing what you’re investing in is riskier than not being diversified.

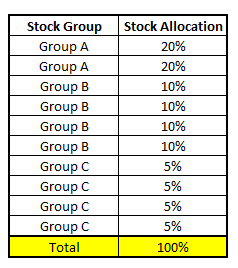

Fisher really breaks it down to three different types of companies (mainly regarding market cap) and how you should try to model your portfolio from an allocation perspective.

Group A

This consists of companies like IBM, Dow, Du Pont, etc. These are very stable companies that don’t have nearly as much inherent risk of going to 0 like some of the upcoming stocks that we will talk about might have.

In this grouping, each company should have no more than a total allocation percentage of 20%, which then results in you having at least five of each company like this if this is the type of company you want to focus on.

Group B

These companies are slightly riskier than those companies in Group A.

These companies are more so considered mid-range stocks and Fisher recommends that you should have two Group B stocks for every stock in Group A. If your portfolio was only made up of stocks from Group B, you should aim to have no more than 10% allocated to each stock for a minimum of 10 total stocks.

Group C

These stocks are extremely risky, and I would consider these to be in the $2 – $10 million earnings/year range type of company.

Never invest in these companies unless you’re completely fine with the stock going completely to 0.

At a minimum, you should have 20 stocks in this range if only made up of Group C companies for a maximum allocation of 5% to each company.

A potential individual stock portfolio could look like the chart below:

Important to note that while this is below the 20 stocks that Andrew recommends, this is a sample portfolio strictly to show the different types of allocations and percentages with the various stock groups.

Also, if you’re not knowledgeable on more than 10 attractive, investable stocks, then you shouldn’t invest in them for the sole purpose of diversification.

7 – Don’t be Afraid of Buying on a War Scare

Through the 20th century, every time that the US has been in a war, the stock market has always experienced a very strong drop and then followed by a much stronger rebound, oftentimes immediately rebounding to values much higher than the stock market before the war, or war scares, even occurred.

When there starts to be word of war scares, many people will oftentimes sell their stocks for the fear that if the US is defeated then the American dollar will likely become completely useless.

While this is potentially true, the US never has been defeated and has a very strong military, so it will likely come down to your personal risk preference of what you want to do if and when these fears come about.

Fisher talks about how when a country goes into war, it sparks a ton of government spending that wasn’t previously there.

All of this extra money in the economy will cause inflation to spike and make your dollar worth even less, so when you sell your stock positions to keep your money in cash, it becomes less valuable each day during a war crisis and even after while that extra money is still in circulation.

Fisher says that when fears of a war start to become popular, you should dollar-cost-average any extra money into the market on the way down and then once the war actually starts you should up your contributions into the market.

He goes on to say that it’s not necessarily even about the opportunity to make money during a war, but about protecting your value of your money because keeping it in cash will become less valuable for the inflation reasons I’ve already mentioned.

Personally, I think Fisher is completely right, but it really does come down to risk. I will go with the history and bet that the market will rebound strongly after a war or war fears, just as it has done every time in the US to this point.

8 – Don’t Forget Your Gilbert & Sullivan

Fisher really hammers home the importance here of looking at the future rather than the past.

The past financials are really good to help you establish a baseline for some things that might happen, such as showing cyclicality of a company or maybe defining some of the anticipated revenues of a business during downturns, but it’s certainly not to be used as an end all, be all for the path forward.

The important thing is that if you’re going to use past financial data to formulate your opinion and analysis of a company going forward, and you should, then you need to also understand all of the background.

For instance, don’t simply look at the last 5 years and see that EPS has jumped so you need to buy that stock now.

Maybe that’s because of share buybacks? Maybe it was due to a product innovation that is no longer the top innovator in the product category?

Past financials are extremely important, but they’re primarily good for showing where you have been.

That being said, using these past financials can show you a track that the company might be going down and some things to look out for, both for good and for bad.

The key is to do your homework and stay focused on the future!

9 – Don’t Fail to Consider Time as Well as Price in Buying a True Growth Stock

Fisher outlines an example here where you might determine the value of a stock to be $20 but it is currently priced at $32.

You want to wait for it to come down some, but you think it can go much higher so you’re facing a dilemma – do you try to buy it now in fear that it immediately goes back down to $20 or do you hold off and not buy and risk the chance that it goes up considerably like you think it eventually will?

That, my friends, is a very hard question to answer.

I personally think its personal preference, and this is where I would bring dollar-cost averaging into play, but Fisher recommends a different strategy – buying on a specific date rather than a value.

He says that you can plan to buy X amount of time in advance and buy the stock at that day. That can help alleviate some of your concerns about what the stock might do and help hedge your bets in a sense, so you’re not caught up in a potential lose-lose situation when buying based off value only.

10 – Don’t Follow the Crowd

Fisher compared this in a sense to chasing clothing fads – if you’re always chasing the fad, then you’re never actually in fashion, are you? You’re always a little bit behind.

He urges us to bring out our inner devil’s advocate inside of ourselves and really try to take the contrarian view of the stock market.

Try to zig when others are zagging, just like Tobias Carlisle told us to do.

If you’re always looking to buy stocks that have a ‘buy’ rating from analysts, you’ve likely already missed out on the value of that stock.

That’s why Andrew and Dave really try to hammer home that you should look for value when you’re looking to invest in a stock and not buy into something that everyone is talking about on the news because that’s likely going to have an inflated price.

All in all, this was one of my favorite chapter(s) to ready so far in this book.

I think that Fisher does an amazing job of really telling you some major pitfalls, and explaining why they’re pitfalls, and identifying how you can get out of them. I highly recommend you take his words to heart.

In the end of it all, they could be what keeps you from making an investing mistake in the future that you’re currently making already!

Related posts:

- An Outline of the Phil Fisher Investment Philosophy Shared in His Book Phil Fisher, author of Common Stocks and Uncommon Profits, has now taken a shift in the most recent chapter of his book to focus on...

- Top Philip Fisher Quotes on a Matured Investing Strategy If you’ve been following along with some of my blog posts on the extremely popular book, ‘Common Stocks and Uncommon Profits’ by Phillip Fisher, then...

- Famous Growth Investor on Why Conservative Investors Sleep Well Phil Fisher, author of Common Stocks and Uncommon Profits, has been one to always talk about the power of how conservative investors sleep well, and...

- Stock Buying Checklist: Essential Part of Evaluating Stocks (Example Checklist) The stock buying checklist is one of the essential tools to any investor, in my opinion, and to most, an underutilized tool. Using a checklist...