Table of Contents [Click to Skip Ahead]

- Intro to Options

- The Two Most Basic Options Contracts

- The Options Killer: Time (Theta)

- How to Create a Safe Income Stream from Options

- How to Calculate Potential Profit and Loss on Any Call or Put

- Other Strategies and Important Risk Management

- The Martyrs of Options Trading and Their Losses

I like to warn beginners that options trading is like “the stock market on steroids”. One day of watching options prices and you’ll see that it’s true.

Those small 1-2% moves made in the stock market each day can mean huge returns for options traders. The premium to be made in volatile stocks that are hated by the market can be huge too, dwarfing the income received by your average dividend.

But, the options market is rife with risks. With some of these types of trades, your capital is likely to go to zero, and/or… your account will blow up in a big way (as Warren Buffett says, like picking up pennies in front of a steam roller).

I’m not here to try and convince you about options trading one way or the other.

What I will try here is this.

To present to you an overview of the options market, in the simplest way that I can.

I won’t bore you with second degree algebra, confusing charts, or complex unexplained jargon.

What we’ll boil down to is the basics. You should know what the basics of options are after this post. You should understand many of the risks that come with trading options. You should get a grasp of some ideas to trade profitably– and hopefully– consistently.

Take this information here, and have at it.

But please…

- BE CAREFUL.

- Try to ALWAYS keep your emotions in check.

- Absolutely RESIST the urge to be greedy.

Start small, with some play money, and especially with money you can afford to lose.

Please don’t trade options on margin, and especially don’t write naked calls. And finally, when it comes to investing big bucks into options, know EXACTLY what system you will use. And follow it.

I believe options are incredibly powerful, and dangerous.

So please, take these warnings to heart. Try to really pay attention to the details of this post. Bookmark it even, and re-read it time and again to keep your approach straight and really understand what you’re doing.

Intro to Options

Alright, so just how great can options be?

Well… imagine putting $50 into an options contract. Say that the stock for that options contract jumps 10% in a day. Your gain on that $50 could be $130, or even $1,453!!

But it’s not all rainbows and flowers. To get a return like that, you’d have to take quite a risk. So much in fact, that if the stock doesn’t jump significantly, your $50 would turn to zero.

This is just one example of an options trade you could make.

I’ll present several more, but know this: options contracts generally give you more flexibility and greater variety on your risk/reward profile than stocks do.

What’s nice about that options trade above (which is an example of a call option), is that the risk for that particular trade is limited to the price paid for the contract. In other words, just that small $50 is at risk, and yet it can make such a huge profit.

Now, I don’t endorse buying a call option in that way– that’s more akin to gambling. But it is a lot of fun, and I’ll indulge myself every once in a while.

What I do love on an options trade, is one that pays me as time goes on, such as is the case with selling a cash covered put option.

We’ll dive into that one later, but it becomes especially attractive when combined with good knowledge about the underlying stock for that options trade, especially when the downside means buying a stock that you already love.

The Two Most Basic Options Contracts

What I’ve just introduced here is the call option and the put option. When you hear about options, it’s going to be based on either a call or a put.

Traders get fancy and combine all sorts of different calls, puts, strikes, expirations, blah, blah, blah– but at the end of the day everything boils down to a call or a put.

What’s confusing about the call and put option is that you can either buy a contract, or sell a new one.

There’s benefits and downsides to doing either. Let’s break down what each means for the beginner.

Call option: Holding a call option allows you to purchase 100 shares of a stock at a set price.

- For example, let’s say you buy a $12 call option for $50 (on a stock we’ll call Pet Food Stock). What this means is that you have the option to buy Pet Food Stock at $12 (100 shares remember), but you don’t have to.

- Say that the Pet Food stock is trading at $11 now, and then it jumps to $14. Using your call option, you could buy 100 shares of the Pet Food stock at $12 even though the stock is currently at $14. You could, then, buy and then sell those 100 shares for a nice $200 profit. Those shares are called away from the call option seller, and given to the call option buyer (you), and that’s called exercising a call option.

- With these simple numbers, you took a $50 investment and turned it into $150 ($200 in profit minus the $50 paid originally), for a HUGE return on investment: +200% on a stock that only moved +16%.

- Let’s say that you bought this same $12 call option, but the Pet Food stock dropped to $11 and stayed there for the life of your call option contract.

- Well, you wouldn’t want to buy 100 shares at $12 when the stock is at $11 (that’s an instant $100 loss), and so you instead would let the call option expire worthless… meaning you don’t exercise the option but you lose the money you paid for that call option ($50 remember).

Notice that I said the life of the options contract.

Every option, whether a put or a call, has an expiration date on it. You can’t just effectively trade large amounts of shares for little money with no other strings attached… at that rate you’d be just trading on margin and paying interest.

So in a way, trading options is sort of like buying stocks on margin, but instead of paying interest, you’re paying a premium to buy the option contract ($50 in our call option example above). And instead of paying this interest perpetually, you’re paying it just once– and only have the right (or option) to trade those large amount of shares in a limited timeframe.

The timeline or expiration date on options is a critical feature of options, and has such a big impact on how an options contract eventually is priced. I’ll go over this more later, but it’s an essential characteristic to understand in options trading. (See: Time Decay)

Put option: Holding a put option allows you to essentially sell short 100 shares at a set price.

I know, I know… all of the buying/ selling terms can get confusing. Don’t think of buying a put option as selling a stock, but think of it as just the opposite of a call option.

With a put option, you have the right to have an investor buy your shares at a specified price. Where with a call you make money if the stock goes up, with a put you make money if the stock goes down. As a put option buyer, you have the right to put your shares to the put option seller at an agreed upon price.

It’s not as straight forward as a call option, and I find it easier to digest it with an example.

- Say you bought a $12 put option on Pet Food Stock for $50. Let’s say the stock drops to $11 again. In a scenario like this, you could exercise your put option– in which case an investor who sold the put contract to you would be obligated to buy 100 shares from you for $12.

- Since Pet Food trades at $11 right now, you can simply buy 100 shares at $11, and sell 100 shares to the investor for $12 from the put, and pocket $100 profit.

- Like with the call option, you’d subtract the premium (what you paid for the put) of $50 to calculate your total ROI, or a 100% return ($100 profit minus $50 premium equals $50 ROI on $50 invested).

- Also like the call option, each put option contract has an expiration date that greatly influences the total cost of the option contract.

Now you might be thinking… what if I don’t have enough money to buy 100 shares to exercise a put option?

Therin lies the beauty and speculative danger of the options market.

Instead of just exercising the option, you can trade the option, and buy and sell options just like you would stocks. And since these contracts generally track the attached stock and its price movements, you can make and lose alot of money in a very quick time, and even on very small (stock market) movements.

Hence, “the stock market on steroids”.

The Options Killer: Time (Theta)

You might be thinking at this point, why not just always buy options instead of stocks?

Well like I alluded to earlier, all options contracts have a deadline to them– and profits on buying calls and puts will depend on the stock moving in the way you want and also in the time you’d like it to.

Unlike stocks, where you could essentially wait forever and not lose money unless you sell or the company goes bankrupt– with an option you lose it all if it expires worthless by the time the deadline is up. And as time passes, and the deadline gets closer and closer, the price of both a call or put option tends to fall, leading to losses even if the stock stays flat.

In the options world, this is known as time decay or theta.

This phenomenon is much worse in options that are not profitable to exercise (this is referred to as “out of the money”), but time decay happens on “in the money” puts and calls too.

Going back to our Pet Food stock $12 call option example, our $12 call option would be in the money (or ITM) if the stock was at $13 and out of the money (OTM) if the stock was anything below $12. For a $12 put, the put would be in the money with the stock at $11 and out of the money for when the stock is over $12.

Let’s say that the $12 call option that we bought at $50 has an expiration date of 1 month. After 3 weeks that same call option might only be worth around $20 or $25, even if the stock were to stay flat the whole time.

So if you’re going to be a buyer of options, you need the stocks to move quickly. Volatility is the options buyer’s best friend.

But it’s not all bad news.

Notice I said options buyer. Well, we can be a seller too, and profit from the time decay of options to score some really nice premiums. When this coincides with your other investment beliefs (such as really believing in the long term health of a certain stock), you can really juice up your returns and get paid handsomely to wait or hold.

First, let’s review a couple more key terms when it comes to the basics of options.

Strike price and premium:

This is the agreed upon price for a contract to be exercised. In the Pet Food Stock example, the strike price for the $12 call option is $12. The premium is $50, or the cost of the contract.

Price Per Contract:

I find it easy to talk about options examples in real money terms (like $50), because that’s the real price you’ll pay on a $0.50 contract for example. Options contracts are quoted at a price, such as $0.50, but because the contract gives you the option to buy 100 shares, you must multiply the options price by 100 to get your real cost.

So again, a $0.50 put option really costs you $50 just to buy 1 contract. A call option priced at $1.75 would cost $175 for 1 contract, etc, etc.

How to Create a Safe Income Stream from Options

This is where I get really excited about options, and has been the only way I’ve personally traded options profitably so far. These returns have been very consistent, and pretty safe.

Now, I don’t know about you… but I’ve never been able to figure out which way a stock or the stock market moves on any given day.

That makes it very hard to trade options, since– remember, you need to get the stock price move right and the timing right.

But if time decay is the biggest killer of options pricing, then time decay is the option seller’s biggest ally and source of consistent profits.

Here’s what I find more reliable with the stock market:

- Over the long term, businesses will compound their profits leading to higher stock prices

- The stock market is sometimes extremely emotional and creates mispricings

- Some companies are much safer than others simply because they have low debt

- I’m okay patiently holding stocks that get beaten down but are great businesses

That last point is key.

What we have to understand is that stock ownership is just ownership in a business. And options contracts are contracts to buy or sell stock, meaning contracts to invest in a business.

This is lost on options trading, all over the place.

It’s not just numbers on a screen. Any monkey can guess, flip a coin, on if a stock is going up or down.

What an intelligent investor can do is find good businesses, based on their metrics, and have the wisdom and patience to hold these stocks.

And when these stocks are hated, they oftentimes have much higher options premiums due to added volatility– and this can be a fantastic way to profit if you have the guts to see an investment through over its times of turmoil.

Now, let’s talk about options and profits so you know how selling options works.

Calculating Options Profits from Premiums

Remember back to our call and put options basics. Buying a call option gives us a right to 100 shares. So our profit potential is unlimited. The higher the stock goes the higher our profits.

For a put option, it’s similar… but a stock can’t go below zero. So our profit on a put is capped, but you can still make over 10x or even 100x on your money if the stock crashes drastically.

The price to pay for that leveraged, huge upside is the premium– which gets eaten away by time decay.

In order to get on the other side of that trade, we have to be willing to both cap our upside and expose our downside to potentially unlimited losses.

Why would anyone want to do that?

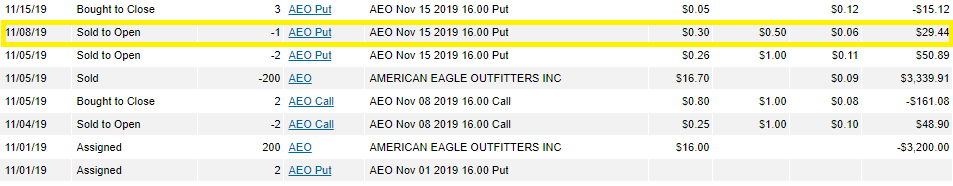

Well, these premiums can be very profitable. I’ve included a screenshot from my personal option selling to use as an example.

For this trade, I “risked” $1600 ($16 x 100) to earn $29.44 in 9 days, which represents around a 73% annual return.

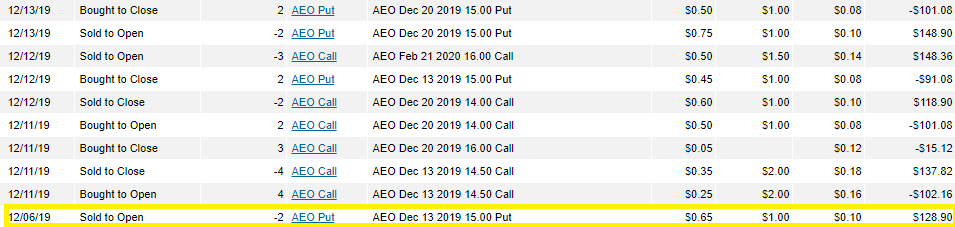

And around quarterly earnings time, the premiums tend to juice up.

In this trade about a week before earnings, I sold 2 puts for $0.65 each, risking $1500 on each put for around a 173% annual return if the puts expire worthless:

Now, you might still be thinking…

That’s not worth unlimited risk…

But when you consider what the risks here are really involved, it’s really just the same as owning a stock outright. I wrote a post breaking down how selling a covered put works, with what the real risks really entail and how you can profit greatly if you’re confident in the company.

How to Calculate Potential Profit and Loss on Any Call or Put

Now that I’ve given you the bare bones overview of options, and recommended a basic principle that I really like, let me give you the ability to branch out your wings a bit and learn more about the practicality of this stuff yourself.

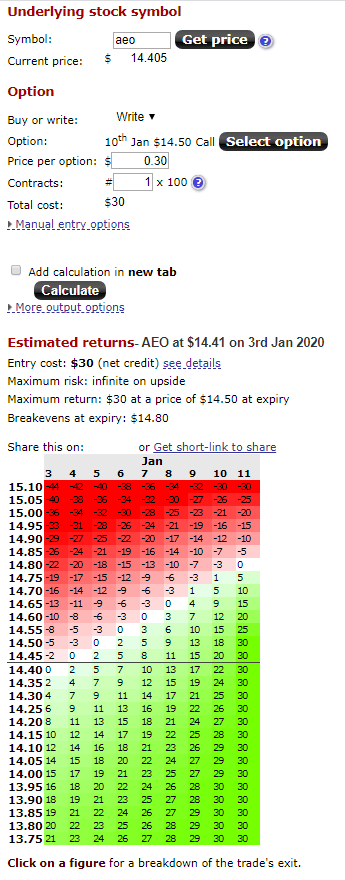

A website that I really enjoyed using when I was first getting into options is called Options Profit Calculator.

This will show you a great visual on how time decay really kills the profits on OTM (out of the money) options, and show you how much you need the stock to move to make profits.

You simply enter the ticker symbol of the stock you’d like to trade options on (not all stocks do, so make sure that’s the case).

From there, you can click through to the different options contracts: expiration date, strike price, and of course, call or put. It will show you a quote on where the option has recently traded at (usually delayed by a few hours) and give you a visual on potential profit. These profit calculations will vary depending on how much you pay for the option, which you can also adjust on the site too. You can pick whether you’re selling an option, or buying an option, and what the downside risk is on any trade.

Here’s an example of an options profit chart from the site on the type of put option I like to sell (a near the money or at the money (ATM) put option that is within a week or two to expiration):

There’s a few other relevant options terms to learn here, which will help you navigate their website.

Write: A term that’s interchangeable with selling an option. So you’d write a naked put or sell a naked put, it’s the same thing.

Long/short: More interchangeable terms with buying or selling an option. Buying a call option is also called a long call, while selling an option like a put can be called short naked put.

ATM: At the money. It’s an option that’s just barely in the money (profitable to exercise whether a put or a call).

Spreads, strangles, etc: A lot of the confusing jargon is just really other options strategies where you’re combining multiple options trades to manipulate the potential risks and rewards. So let’s talk about that next.

Other Strategies and Important Risk Management

Another way to play options that I have experience with is just simple day trading.

Like I mentioned before, options can swing wildly during the day even as the stock market is moving at its normal pace.

An enterprising options trader can try to take advantage of these swings for some quick and heavy profits.

I wish I had the secret to this kind of options trading for you, but let me warn you it’s an extremely difficult way to trade consistently and profitably.

It’s easy to buy an option on a stock that’s being very volatile for the day and sell it for a small profit as the stock moves up and down. In fact you should be able to do this quite easily. The problem is that the stock could stop bouncing up and down and just trend in the direction opposite of your put or call, in which case you get wiped out. And so all of those little profits you made from the volatility of the options get erased and then some with just one bad trade.

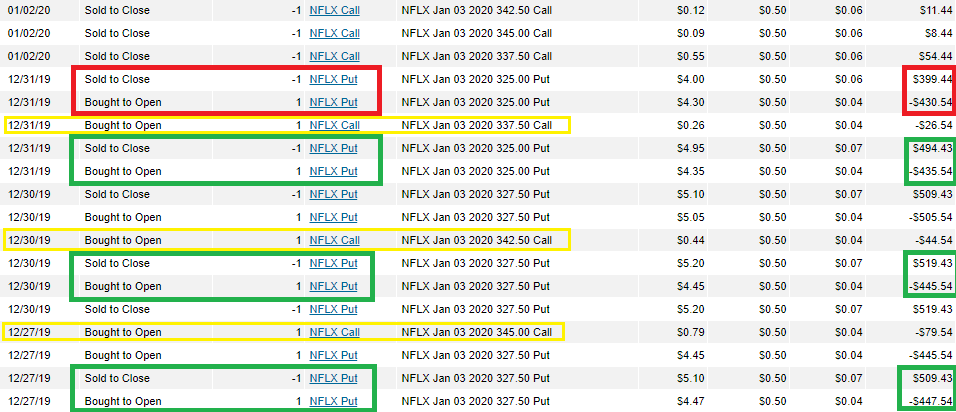

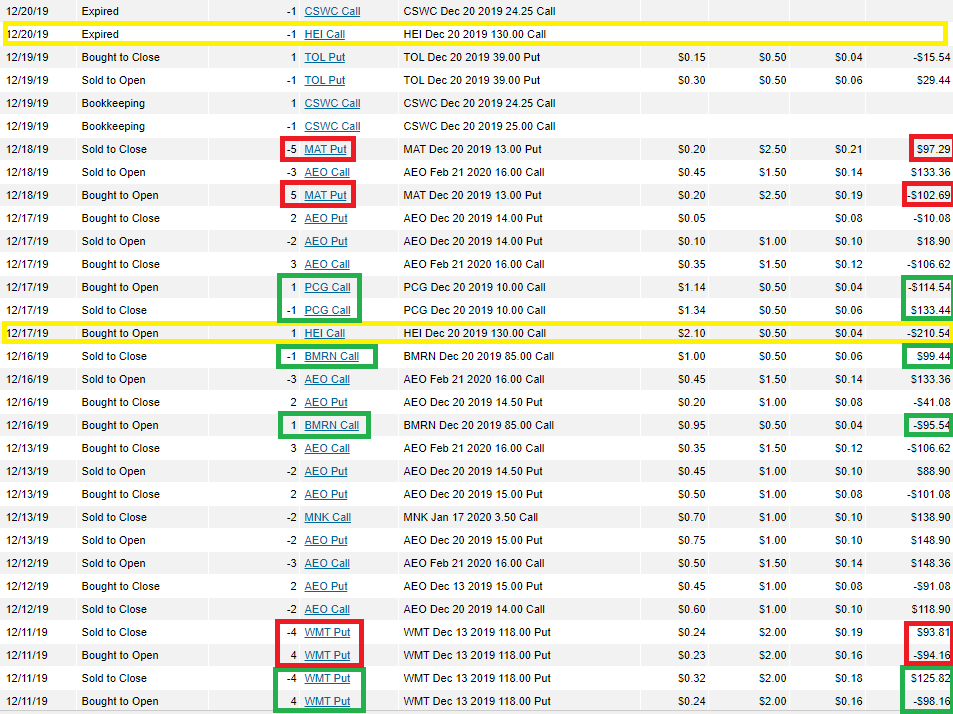

Here’s from my own account again, a perfect example of how easy it is to win and then get wiped out.

Click to zoom.

Notice how I had quick day trading gains and then lost $210 on a HEI Call that expired worthless.During the first 15 minutes of the stock market being open (9:30am EST, also when the options market opens), there can be HUGE swings in the options prices especially if a stock is moving more than it usually does.

I’ve closed trades where I bought an option and sold it minutes later and they’ve been quite profitable (10, 15, 20%).

But, there’s always someone left holding the bag during this time, and it really is impossible to know when a trend will stop, reverse, or continue. That’s when you can get wiped out, like I did with my HEI call as shown above.

That’s another reason why mitigating risk is so important when trading options.

One idea that I’ve started using, and when I’m playing with options like this, is to add a protective put or a protective call.

Here’s a detailed post I wrote about protective calls and puts, and an example of the results I had trying this strategy out:

Look, I think this example is an extreme case of luck and timing.

I don’t think it’s possible for me to reliably duplicate this and score ~33% returns whenever I want (which is what I essentially did after this week of NFLX trading, a total Profit/Loss of $165.05 risking around $500 each time).

And, if I really didn’t get lucky with the timing and held my 325.00 Put position that I paid $430.54 for through January 2nd (rather than closing it on 12/31/19 like I did), I would’ve lost probably at least half of the $430.54 and wiped out the whole week’s of gains.

So I don’t think what I did is a consistently reliable strategy for buying options.

And that huge risk profile is why I don’t buy options with my serious money, only with my play money. I much rather prefer the risk profile of selling options, and am okay “betting” bigger on that.

At the end of the day, take what you find useful in this entire post, and find what works for your Personal Risk Tolerance.

This is another example of how you can trade options, and the protective put or call is just one example of risk management (and hedging) you can use with options… and that’s what can make the flexibility of options so great.

The Martyrs of Options Trading and Their Losses

I’d be remiss if I created a huge options for beginners guide and didn’t mention the thriving options trading community on Reddit called Wall Street Bets.

Wall Street Bets is a forum filled with dirty locker room talk, insults, and general mockery and humor– but in it are valuable lessons of people doing incredibly stupid things with options.

I credit a lot about what I learned about options from this community, and I frequent the site as a place for great entertainment and the occasional gold nugget of information or education.

Where Wall Street Bets is best suited for the purposes of this guide is to show you just how dangerous options can be if you take extreme risks with your trades. Here’s a user who went down -$306k (-60.27%) buying calls, another who bought calls in the bull market of 2019 and still lost -$18k (-85.19%) of his account, and of course the infamous u/ControltheNarrative, who turned $4k into $1 million in leverage through a Robinhood glitch and lost over $40,000 in seconds.

Take heed of these warnings, and understand that “the stock market on steroids” can lead to a death spiral of losses if you aren’t careful.

So that does it.

I hope I’ve properly presented the opportunities and risks behind getting started with options trading, and that you have a good sense of the basics.

If I’ve scared you out of it, then good. Options trading is not for the faint of heart.

If you have a topic that you’d like me to cover next, please include it in the comments below. If you’re unsure about something I wrote, please leave a comment below. You can quickly login through your Twitter, Facebook, or Google account to write a comment.

Above all, I hope you really understand that there are businesses behind these options contracts and the stock market.

Businesses are built and run to grow, and as investors we can join along for the ride. A strategy like value investing can be a much safer approach to investing your money, and be extremely more stress free than this type of trading.

When it comes to serious investing, I think even the most active options traders will tell you that their retirement funds and life savings are mostly invested in boring stocks for the long term.

So learn about the basics of investing, the basics of personal finance, and the basics of business and stock market fundamentals if you haven’t already.

Once that’s all lined up, and you’re ready to make some aggressive moves with money you don’t necessarily need, then let’s really play the fun and lucrative game of options.

Leave comments below.

The world is our oyster.

Related posts:

- Stocks Vs Options: What Beginners Need to Know If you haven’t already, you’ll quickly discover the sexy, fast moving counterpart to stocks — options. It’s hard not to stumble upon these shiny derivatives....

- What is High IV in Options and How Does it Affect Returns? As you have learned from previous posts, trading options is buying the ability to buy or sell a stock at a certain strike price. A...

- Taking Worst Case Scenarios of Selling Covered Calls – It’s Not That Bad! While I am new to the options game myself, I have learned quickly that options are like stocks, but on steroids. In this article I’m...

- How Options Time Decay Destroys the Prices of Calls and Puts Options time decay can be one of the most insidious forces to lose you money as you buy call and put options. As I mentioned...