As I mentioned in my Trading Options for Beginners post, I’ve been dabbling with quick day trades with options, and using a protective call or protective put to shield against a reversal.

I took the protective call one step further by pyramiding this protection and giving myself exposure to upside potential after already exiting my day trade positions.

Let’s go over the protective call and why it can be so useful for mitigating risk, and then I’ll show you an example of how I used it in a pyramiding fashion.

Basics of a Protective Put or Call

Basically, if you’re day trading options, one strategy is to take a decent sized position and just try to flip it for a quick 5 or 10% gain. Well, you can also buy an OTM call for around 5 or 10% of the put for protection. That way if the stock screams higher, making your put worthless, then you can get some of the gains from your protective call. If the stock screams drastically higher, you could make more profit from the protection call then you would’ve even made from 5-10% gains from the original put.

Let me show you how I did this successfully, though I’ll admit that I was very lucky that I was betting on the stock to go down and it did.

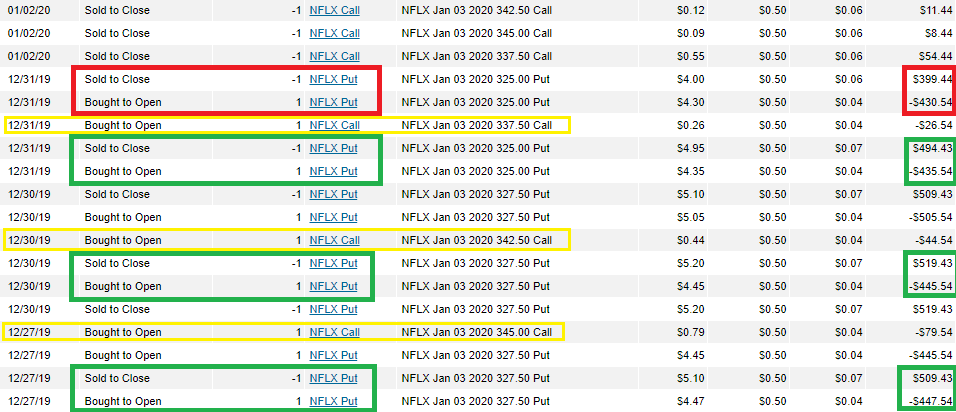

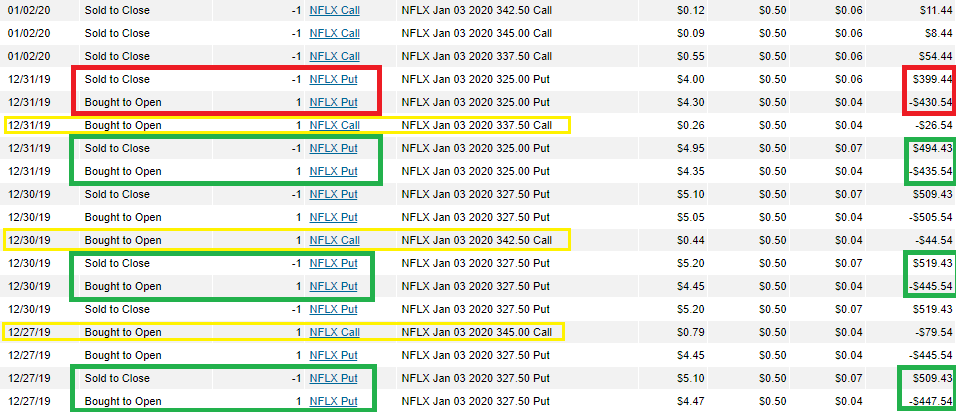

You can see that I was spending around $400 – $500 on Netflix (NFLX) puts, and trying to get a $40 – $50 profit on my trades in order to quickly score 5 – 10% gains.

Once I had my first winning trade, I reinvested the profits into a protective call. But notice just how far OTM that call was. When I bought that first 345.00 Call, NFLX was trading at around $330. So I spent $79.54, or a little more than half of my first two winning trades, to get protection that if NFLX soared to above $345 (or about +4.5%), I’d fully recover the $445.54 I lose from the put expiring worthless.

The risk in a strategy like a protective call or protective put is that either, (1) you spend too much money on protection making your profits not worth it, or (2) the stock falls in between your put or call and your protection and you get hosed anyway.

In my case, if NFLX would’ve closed in between $327.50 – $345.00 on the date of expiration Jan 3, then I’d probably had lost most, if not all, of the $445.54 I spent on the 327.50 put, and same story with the $79.54 I spent on the 345.00 call.

Quick tip: That’s why if you’re buying options, which I really don’t recommend except for fun, it’s important to get in and get out as quickly as you can.

With a protective put or call that’s far OTM, which is required if you want to not spend as much on premium for it, it’s probably unlikely that the stock will ever cross ITM for that option because it would need such a big move.

Not only does time decay get you when buying and flipping options, but the stock can also move very fast against you.

Quick tip: So if you have a profit, take it, and move on.

Or, as I’ve heard said that really exemplifies the reality of options elequently, “take the profit and live to fight another day”.

Pyramiding Your Protection

One way to further limit your downside risk when daytrading options is to pyramid your protective puts or calls. It’s not really something I’ve seen covered much, but I think it can be the closest thing to “free Wall Street bets” as you can get.

Here’s what I mean by this.

Say you’re day trading NFLX puts like I was doing (for fun). So, you’re in at $445, out at $510, rinse and repeat. And, you have your protective call that you bought with half of the profits.

Well, you can keep that protective call and just leave it, and continue to trade the NFLX puts. So you just paid for the protection once, and get the benefits of it until it expires.

As you collect profits, you can continue to spend half of the profits on protective calls, and this will further protect your downside risk. I did it like this (take a closer look at the yellow highlights again):

Understand that if you’re right on a trade then you’ll need to keep buying more protection lower and lower as the stock goes down. For example you’re buying NFLX puts because you think the trend is down, and you make profits becasue it does go down, well then to attain the same protection you’ll need to buy protective calls with lower strike prices as the stock price is also falling lower.

How this can be like a “free Wall Street bet” is that you can keep these calls until expiration and potentially profit on a reversal once you’re done trying to scalp for your put profits.

I did this in this example. I was out of my puts by December 31st, 2019, because I thought that the stock would go higher during the first few days of the New Year, as NFLX has done in the past. Well, because I had kept my protective calls the whole time, I had these that could pop if the stock popped much higher.

The stock didn’t pop a crazy amount, just around +1-2%, but I was still able to pocket a profit on the last protective call option I bought (the 337.50 Call), selling at $54.44 after buying at $26.54.

The first two protective calls I took major losses on, but that was okay because I bought those with profits so it was essentially “free”. Any gains on them would’ve been a bonus, because they were bought primarily for protection.

Related posts:

- How Options Time Decay Destroys the Prices of Calls and Puts Options time decay can be one of the most insidious forces to lose you money as you buy call and put options. As I mentioned...

- Taking Worst Case Scenarios of Selling Covered Calls – It’s Not That Bad! While I am new to the options game myself, I have learned quickly that options are like stocks, but on steroids. In this article I’m...

- Selling Covered Puts for Great Premiums: It Doesn’t Have to Be Risky Getting down to the basics of selling covered puts really helps the options trader conceptualize the risks and reward profile behind the trade. The big...

- 4 Popular “Theta Gang” Strategies to Collect Premium from Options What is theta gang? Simply put, these are options trading strategies that capitalize on the fact that the prices of options decay over time. Instead...