Updated 6/3/2024

“The key to investing is not assessing how much an industry will affect society, or how much it will grow, but rather determining the competitive advantage of any given company and, above all, the durability of that advantage.”

Warren Buffett

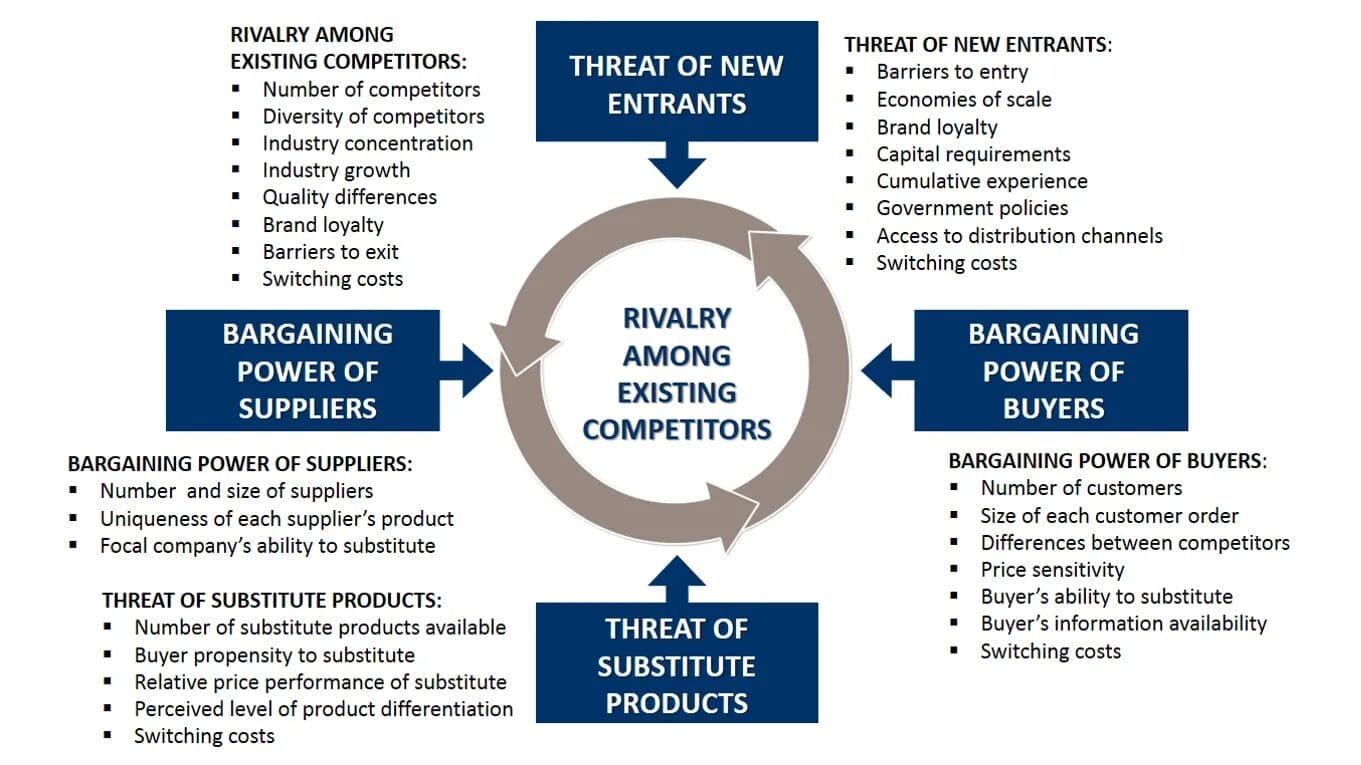

Investing in companies whose competitive landscape we don’t understand offers some challenges; we need to understand the company and industry to become good investigators. Porter’s five forces provide the keys to understanding a company and its competitive advantages or lack thereof.

We can examine many companies using Porter’s five forces to determine their competitive advantage or “moat.” Porter provides us with five different topics, giving us a wide scope to analyze a company.

Using these forces, we can analyze different companies using those templates as examples, especially when we begin to study a new company or industry. As we will learn, rivalry doesn’t only come from competitors but other forces as well.

In today’s post, we will learn:

- The Importance of Porter’s Five Forces

- Breaking Down Porter’s Five Forces – A Quick Guide

- Porter’s Five Forces Example: Dominos Pizza

- Examples of Porter’s Five Forces Questions

Okay, let’s dive in and learn more about Porter’s five forces examples.

The Importance of Porter’s Five Forces

One of the best ways to analyze company competition remains using Porter’s Five Forces model.

Harvard Business School’s Michael Porter created the model in 1979. Porter named it “Five Forces,” which examines five specific factors to determine whether a company can remain profitable relative to others in the industry.

The collective power of the Five Forces determines a sector’s profitability and its attractiveness to potential entrants.

For example, if the forces offer fierce competition (i.e., airlines), almost no one will earn attractive returns. But if the competition remains milder, the possibility of better returns exists, i.e., soft drinks.

“Understanding the competitive forces and their underlying causes reveals the roots of an industry’s current profitability while providing a framework for anticipating and influencing competition (and profitability). A healthy industry structure should be as much a competitive concern to strategists as their company’s position.”

Michael Porter, Harvard Business Review article

Breaking Down Porter’s Five Forces – A Quick Guide

Porter envisioned understanding the competitive forces in play and the overall industry structure as crucial to effective decision-making, along with developing strong competitive strategies for the future of any company.

Understanding these forces gives us a better overall understanding of the company and its industry.

One of Buffett’s many superpowers is his ability to assess the competitive landscape and pick the “winners” for a particular industry.

We need to look no further than his portfolio, which contains many “moat” type companies:

- Apple

- American Express

- Moody’s

- Coca-Cola

Explore Porter’s Five Forces to determine what forces shape industry competition.

- Threat of new entrants

- Threat of substitutes

- Bargaining power of customers

- Bargaining power of suppliers

- Competitive rivalry

Breaking down Porter’s Five Forces gives us the following:

Threat of New Entrants

The above factor determines how easily a competitor can enter the market. As more companies enter a market, existing companies face the pressure of losing customers or potential profits.

The threat to entrants remains high if companies can easily enter a market, barriers remain low because costs remain low, or the technology is unprotected or not patented.

For example, the payment space exploded recently because it is easy to create an app that allows different payment abilities, such as trading stocks, transferring money, or buying products. The ease of use led to many competitors joining the space quickly because of the low cost and ease of creating code to solve a problem.

Some common barriers to entry to consider:

- High costs of entry

- Customer loyalty to existing brands

- Complex technology

- Government regulations

- Economies of scale

- Large capital requirements

Threat of Substitutes

This factor determines how easily customers can switch between competing products or services. If products or services can fill a customer’s needs, those products become interchangeable.

Companies can lose market share when products or services become interchangeable. It can worsen profits as companies compete on price, and everyone starts the race to the bottom.

Another risk is if the product or service becomes so easily replicable, they risk the customer doing it themselves.

Switching costs become related to this force; for example, if a customer has no friction when changing between services, such as Netflix or Hulu, nothing prevents them from switching as they need.

Some potential threats to a company include:

- The number of substitute products or services

- The quality of substitute products or services

- The price of substitutes

- Competitions profits

- The competitor’s aggressiveness

- Likelihood of switching products and services

Bargaining power of customers

This force determines how price changes affect customers’ buying decisions and their ability to lower prices. For example, when fewer customers are in play, buyers have greater power, but the amount of substitute products remains high.

All of this could cause prices to fall and profits to shrink.

Buyers have less power overall when they buy in smaller amounts and have fewer substitute choices.

Conditions affecting this force include:

- Number of customers

- Quantity of purchases

- Substitutes available

- Buyers’ price sensitivity

Bargaining Power of Suppliers

This factor considers how many suppliers a company has access to, plus how easily suppliers can increase prices or reduce product quality.

The larger the pool of suppliers a company can choose from, the easier it is to switch to lower-cost suppliers or find higher-quality products. If a company has fewer suppliers, it could face higher prices or lower-quality products because of the supplier’s power position.

Items to consider that can affect a supplier’s power over a company:

- Number of suppliers

- Supplier size

- Company’s ability to find alternatives

- The uniqueness of the supplier’s product

- Switching costs between suppliers

Competitive Rivalry

The competitive rivalry force examines how fierce the industry competition is and compares the quality of the competition’s products and services.

Competition can remain high when an industry has many companies of similar size and power. For example, the auto industry has many companies of similar size, including Ford, Honda, GM, and Tesla.

In this scenario, customers’ switching costs remain low, which leads to aggressive advertising and marketing campaigns and lower prices to attract customers. All of these strategies can lead to lower profits in the long term.

Some items that could affect competitive rivalry include:

- Customer loyalty to brands

- Number of competitors

- Industry growth

- Differences in products

For the next sections, we will use the above framework to work through several companies, such as Domino and Apple, to give us examples of how this analysis could work.

Porter’s Five Forces Example: Domino Pizza

Dominos Pizza (DPZ) is a leading international fast-food chain with an established, strong position in the global fast-food industry and a market presence in over 85 countries.

Domino’s currently has a market price of $385 and a market cap of $13.8 billion. In the last fiscal year ending January 2022, the company had sales of $4.33 billion, an increase of 5.8% from the previous year.

The company holds the number two spot relative to other pizza operators, Yum Brands (Pizza Hut) at $34.2 billion and Papa John’s at $3.1 billion.

Let’s examine the Five Forces for Domino’s Pizza.

Threat of New Entrants:

The threat of new entrants reflects how new market players might disrupt existing market operators. If the fast-food industry continues to see low profits and barriers to entry, those factors will attract more businesses, leading to higher threats of new entrants.

Below are a few factors that help Dominos reduce the threat of new entrants.

- Entry into the fast-food sector requires substantial capital resources for investment. Competitors can mitigate some force by offering product differentiation or creating a unique experience.

- Domino’s Pizza will face lower threats if an existing regulatory framework imposes strict, time-consuming regulations on new market entrants, discouraging many from entering the market.

- The threat will remain low if brand loyalty remains high and customer psychological switching costs remain high. If Dominos continues to excel at customer service and grow brand loyalty, it reduces the threat.

- If entrants face struggles establishing distribution channels, which remains one of Domino’s superpowers, Dominos will see lower threats. Dominos does a superb job creating long-term contracts with distributors, widening access to different markets.

The Threat of Substitute Products

The pizza industry’s wide array of substitute products makes the competitive climate challenging for Domino and other pizza players. The high substitute threat illustrates how customers can use alternative products to feed their fast food needs and pizza substitutes.

Some threats Dominos faces:

- Cheaper products

- Switching costs

- Quality increases or decreases

Here are some ways Dominos can combat these threats:

- Dominos can combat the threat of quality substitutes by focusing marketing and advertising on their excellent ingredients compared to competitors. Emphasizing the better ingredients illustrates the supremacy of its products.

- Dominos can provide evidence of a better customer experience by utilizing mobile apps to simplify the ordering and paying process. They can also offer different combination meals to heighten their buck’s sense of greater bang.

- Dominos can increase brand loyalty by offering different incentives to become members of a loyalty program and special deals. They can also encourage local stores to embrace regular guests by acknowledging them and offering special deals.

Bargaining Power of Buyers

Bargaining power illustrates customers’ pressure on a business to gain high-quality products and excellent customer service for affordable prices.

This force impacts Domino’s directly by lowering profits and creating higher industry competition. Domino’s has better growth outlooks and higher profit margins when the force is lower.

Domino’s can fight this power by diversifying its customer base and growing the same base. It can achieve these goals by introducing new products, targeting new market areas, and adopting strategies around product diversification.

For example, marketing and advertising offer helpful strategies for promoting new products.

Building loyalty via a better customer experience using technologies such as better mobile apps, driverless delivery, and a better online experience will reduce the customer buying power.

If Domino’s adopts these strategies, it can strengthen its position in the fast-food market.

Bargaining Power of Suppliers

The bargaining power of suppliers for Dominos exists in their ability to limit product supply, reduce quality, or increase prices. When suppliers have a strong footing, it impacts Domino’s profits while increasing its competition, thus impacting Domino’s growth prospects.

Dominos can offset some of the power of suppliers by:

- They can build an efficient distribution chain with multiple options for suppliers.

- Dominos can experiment with substituting different materials so that if the prices of one product rise, they can pivot to another material.

- Dominos can develop dedicated suppliers whose company’s livelihood depends on Dominos. A lesson Dominos could learn from Costco, Walmart, and Nike is the growth of third-party suppliers whose business survival depends on each respective company. For example, by creating third-party suppliers, Walmart reduced supplier bargaining power.

Rivalry Among Existing Companies

The fast-food and pizza industry contains many strong players with local and international connections. Many competitors in both industries can negatively affect Domino’s market share. For example, Pizza Hut remains a top competitor to Domino’s. Another top competitor, Papa John’s, has grown in scope and size, putting pressure on Domino’s to improve its delivery and execution.

Dominos can continue to compete by:

- Strengthening the differentiation between it and competitors by focusing on the needs and expectations of customers. It can increase differentiation by using its technological advantages and customer loyalty programs.

- Dominos can also increase switching costs by further embracing loyalty programs.

- They can spend additional money on R&D to identify new customer segments to continue growth.

- Dominos can also partner with competitors, which can sometimes be mutually beneficial.

Examples of Porter’s Five Questions to Ask

Below is a framework of questions you can ask when analyzing a company using the Porter Five Forces framework. These questions remain a starting point to help get you started.

- Competitive Rivalry

- How many competitors does the company have?

- Who are they? Have they established brands?

- How does the quality of the products and services compare to the company you analyze?

- Bargaining power of suppliers

- How many potential suppliers does the company have?

- How many suppliers do they use for its key products or services?

- What unique product or service do they offer?

- What kind of switching costs exist?

- Bargaining power of buyers

- How many buyers does the company have?

- How big are the orders?

- What kind of switching costs exist?

- Do the buyers dictate terms to the company?

- Threat of new entrants

- How easily can new entrants gain access to the sector?

- How capital-intensive is the industry?

- How quickly can competitors enter the fray and compete?

- Threat of substitutes

- How often do customers switch products or services?

- What kinds of switching costs exist?

- What technological disruptions exist?

The above questions give you a great starting point, as well as the Domino example we worked through.

Investor Takeaway

By analyzing Domino Pizza using Porter’s Five Forces model, we can see a complete picture of the company, industry, and what drives profitability.

Using these exercises gives us a good sense of how a company operates, what risks exist, and how it navigates its industry or sector.

By walking through different companies using Porter’s Five Forces examples, we can better understand both companies and the sectors they operate within. Part of the knowledge we gain can help us make better investment decisions and avoid potential value traps.

Part of the challenge of investing is understanding business models and how they make money, such as investing and knowledge compounding.

And with that, we will wrap up our discussion regarding Porter’s Five Forces examples.

Thank you for reading today’s post. I hope you find something of value. If I can be of any further assistance, please don’t hesitate to let me know.

Until next time, take care and be safe out there,

Dave

Dave Ahern

Dave, a self-taught investor, empowers investors to start investing by demystifying the stock market.

Related posts:

- The Importance of Pricing Power in a Company “The single most important decision in evaluating a business is pricing power. If you’ve got the power to raise prices without losing business to a...

- 8 Steps to Decoding Investment Moats “In business, I look for economic castles protected by unbreachable ‘moats.'” ~ Warren Buffett, 2007 Shareholder Letter Finding companies with competitive advantages or moats are...

- 7 Powers Decoded: Strategies for Sustainable Business Success from Hamilton Helmer Understanding the underlying strategies that propel companies toward long-term success is paramount in the dynamic investment sphere. 7 Powers: The Foundations of Business Strategy by...

- A Deep Dive into the Inner Workings of Compounding Machines: Understanding Their Competitive Advantage A Deep Dive into the Inner Workings of Compounding Machines: Understanding Their Competitive Advantage As an investor, you always seek ways to maximize your returns...