The Purchase Managers Index (PMI) is a great economics tool for investors to wrap their heads around as it can be watched as a leading indicator of changes in the economy. The changes in PMI data can indicate many things including changes in GDP, inflation, and employment which can all be used when making investment decisions and asset allocations.

PMI data is normally collected directly from company management in a series of questionnaires, so it is coming directly from the forefront of the production process. PMI surveys originated in the manufacturing sector but have expanded to cover the service sector due to its growing importance in the economy.

This article will take a look at the current PMI data to get a sense of where consumer inflation might be heading in our high inflation environment of 2022. As will be seen, the latest PMI figures continue to show a reduction in the pricing pressure coming through both the manufacturing and servicing sectors. This should offer some support for the hoped-for peak of the interest rate hike cycle towards the beginning of 2023.

Purchase Manager Index is a Leading Indicator

As the PMI is looking at trends further up the value chain from the end consumer, it can provide a leading indicator to economic growth as well as price pressures at the manufacturer level that will eventually make their way down to the consumer inflation figures. Companies are constantly forecasting sales for future quarters to help prepare inventory and employment levels, so going right to the source provides a leading indicator for the economy based on what management is seeing and expects.

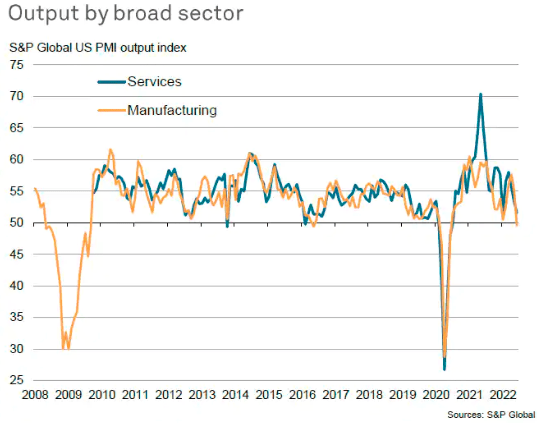

The index is read with 50 being the baseline; a PMI reading over 50 would indicate expansion while a reading below 50 would signal contraction. As well as looking at overall expansion and contraction compared to the 50 baseline, trends upwards or downwards in the PMI readings should be monitored (against a 3-month moving average for example) to spot when monthly changes become significant.

A PMI is normally done as a survey sent to executives at major companies that are representative of the industry and geographic area in focus. These surveys originated in the manufacturing sector but now take place in the service sector as well due to the growing importance of the service sector in today’s economy. PMI surveys focus on areas such as inventories, supply deliveries, employment, and of course prices.

What is a Diffusion Index?

This PMI is a type of Diffusion Index which is commonly used in finance and economics to distinguish growth and momentum. With a mid-point of 50, a diffusion index is built by assigning 0 for negative growth, 50 for steady state, and 100 for growth depending on if the metric for the current period is above or below the previous period reading. This averages out to a Diffusion Index which captures the overall trend in prices, hiring, or inventories to name a few data points that could be tracked.

Various PMI Suppliers across the Globe

Due to the differing styles and focus of questionnaires along with different geographic or industry selections, there are many purchase manager indices across the globe and also within countries.

The major U.S. PMI provider is the Institute for Supply Management (ISM) which is a non-profit organization, but other for-profit entities also provide their own purchase manager indices. The notable for-profit player would be S&P Global which now owns the popular IHS Markit index provider which complies data on more than 40 economies globally.

Different providers of purchase manager indexes range from non-profit industry groups and universities to large for-profit global entities. Interestingly enough as I research this article, I learned my former alma mater up in Canada, Ivey Business School at Western University, now makes the Ivey PMI for the Canadian economy.

What are the Current PMI readings for July 2022?

Given all the various providers of PMI data, it is good practice for investors to look at multiple data points. Investors can also focus on geographies across the globe as well as manufacturing or servicing index readings. Which specific PMI would concern an individual investor all comes down to their portfolio allocation. But that being said, let’s discuss a couple of big ones that might be of interest.

Having fallen from a high of 64.7 in May 2021 to 52.8 in the latest July 2022 reading, the U.S. ISM Manufacturing PMI seems to be normalizing as COVID supply chain woes subside. Likewise, the JP Morgan Manufacturing PMI reached its lowest in a year and a half in July 2022 as can be seen below. On the Service sector side, the ISM’s non-manufacturing PMI for July came in at 56.7, which is higher than June’s 55.3 but that reading last month was its two-year low.

All of these recent PMI figures are still above the 50 mid-point which indicates expansion from the purchase managers in the economy. However, the decline from recent highs shows that some calm should be coming to the inflation and tight labor market.

Take Away for Investors

PMI data provides a great leading indicator to changes in GDP growth and consumer prices. Investors should pay attention to this data to get an idea of general economic growth as well as inflation and employment data that may be coming through the supply chain. Getting a forward-looking sense of these economic data points can give investors the opportunity to position their asset allocation accordingly.

Related posts:

- Types of Inflation: Demand-Pull vs. Cost-Push Inflation With inflation now running over 4% in the U.S. and other developed countries, investors are wondering how to classify the seriousness of the situation. As...

- Quotes about Inflation from Famous Investors – What We Can Learn The most successful investors in the stock market probably know a thing or two about inflation. Of the many great quotes about inflation from these...

- Common Indicators of Rising Interest Rates and Its Impact on the Economy How can you tell when interest rates might rise and what the impact would be on our lives? You can use simple tools to answer...

- How Fed Economic Stimulus Works and Its Effect on the Economy The Central Bank of America is the Federal Reserve, responsible for deciding how much money is in the economy. To most people, that means that...